It was a terrible week for top growth stocks. Specifically, the high sales growth stocks that have performed so extremely well over the last year, performed absolutely terribly over the last week. We would never advocate for blindly buying or selling all growth stocks in general, but we do believe there are plenty of individual high growth stocks that are currently attractive and worth investing in, especially after this week’s turmoil. And in this report, we countdown our top 10 high growth stocks that just sold off, starting with #10 and finishing with our #1 top idea.

Market Overview:

Before getting into the countdown, it is worth reviewing some high level data to provide a backdrop for our rankings.

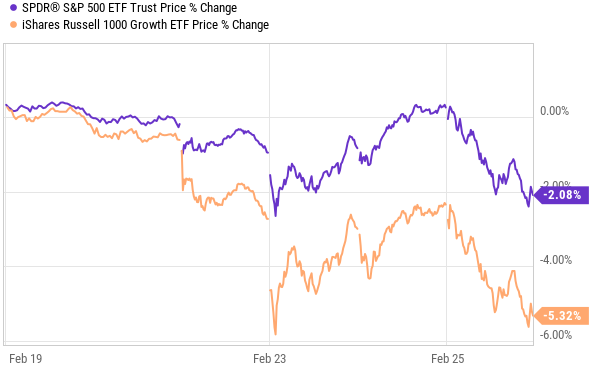

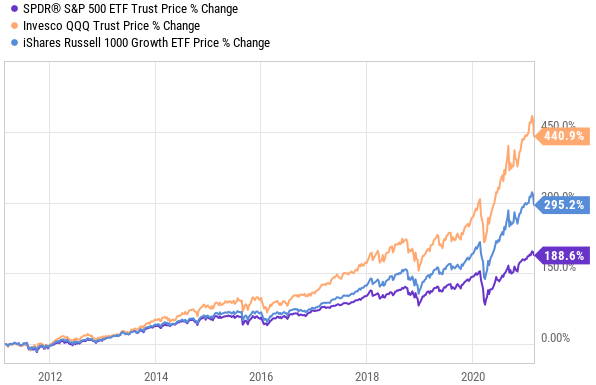

First, here is a look at the performance of the S&P 500 as well as the Russell 1000 large cap Growth index and the tech-heavy Nasdaq 100. Clearly overall performance has been very strong since the depths of the initial pandemic selloff in early 2020. And the strong performance has been even more pronounced for “growth-ier” stocks.

Next, here is a look at the performance of the S&P 500 versus its P/E ratio. While performance continues to be strong, valuations (as measured by price-to-earnings) are relatively expensive (an indication to some investors that the market is expensive).

source: YCharts, as of 2/25/2021

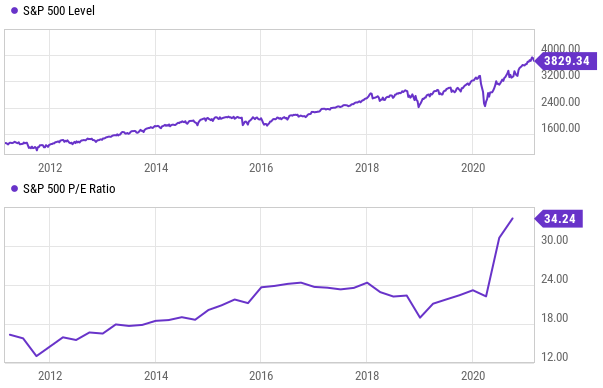

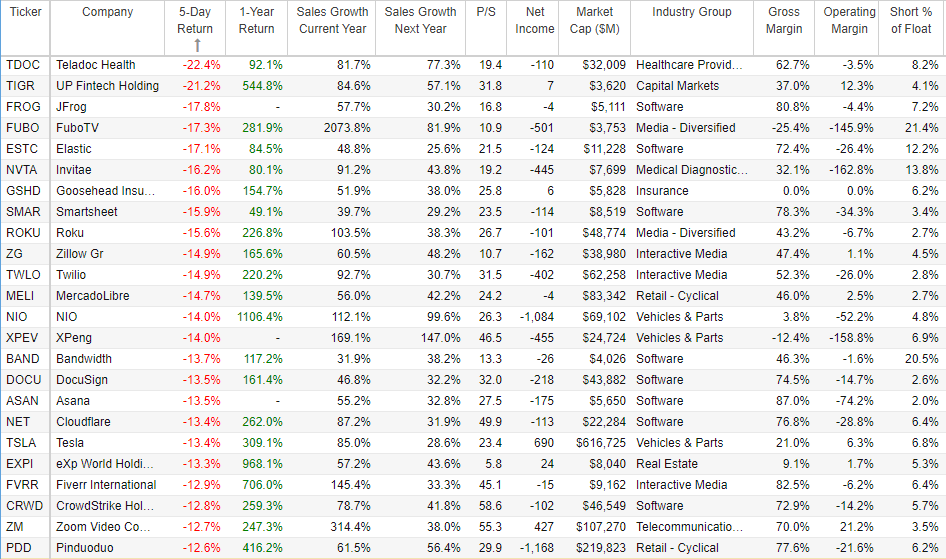

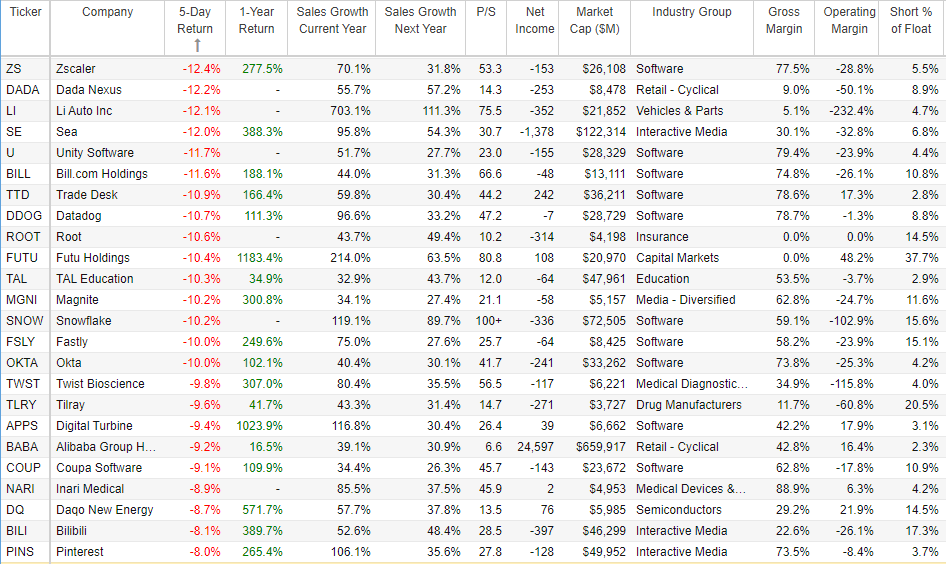

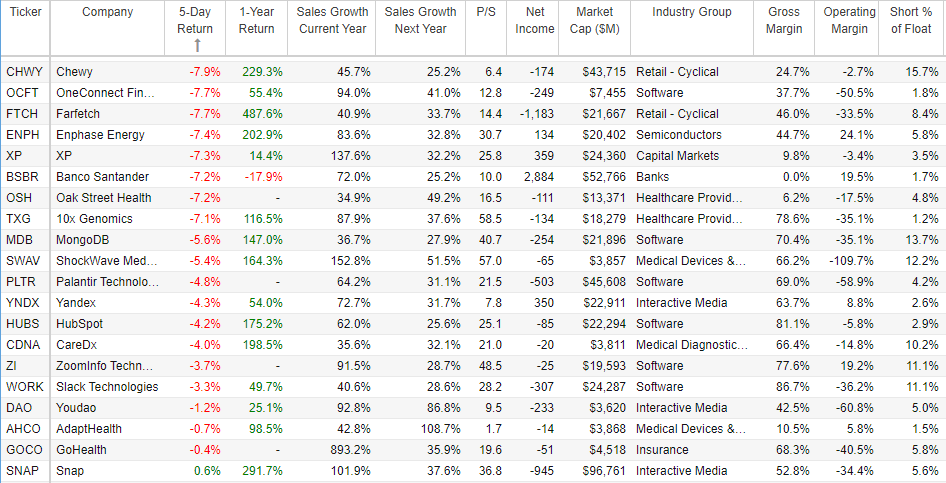

However, not all stocks are created equally, and it would be a great disservice to value everything on P/E ratio alone. For example, top growth stocks often have very little earnings (by design) because they are spending heavily on growth (which is often the right thing to do to take advantage of market opportunities and to maximize long-term value). Rather, price-to-sales ratio can be a more prudent valuation metric in these growth stock cases. To put this in perspective, here is a look at the recent performance and price to sales ratios of top growth stocks with the highest revenue growth trajectories. You’ll notice the amazing 1-year performance numbers, but also the terrible 5-day results.

(image source: StockRover, as of 2/25/2021)

As the table above shows, many of these top growth stocks (with very strong 1-year price performance and very high expected revenue growth), look “beyond-absurd” on an operating margin basis (because it is negative for most of them), but are at least somewhat rational and comparable on a price-to-sales ratio basis. To conceptualize the price-to-sales valuation metric, it can be helpful to consider the ratio in relation to sales growth rates because a high sales growth rate can quickly bring a higher price-to-sale ratio considerably lower (to a more reasonable level) in a matter of quarters or years.

And it is critically important to note, unlike the “Tech Bubble” of the late 1990’s and early 2000, many top growth stocks today have very real revenues that are growing very rapidly and have very long runways for continued high growth. These are real businesses and the stocks can make you a lot of money if you select them right.

Top 10 High Growth Stocks, that Just Sold Off

With that backdrop in mind, and without further ado, here is our ranking of Top 10 high growth stocks on sale (after this past week’s dramatic sell off), starting with #10 and counting down to our #1 top idea.

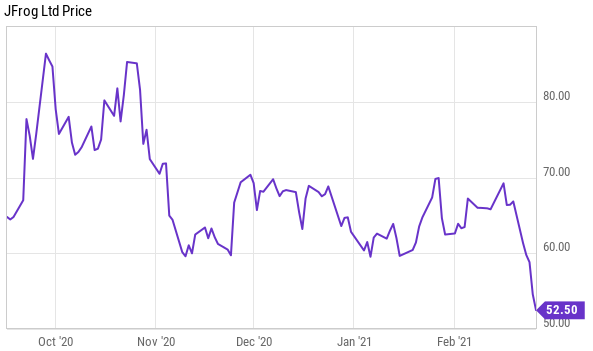

10. JFrog (FROG)

JFrog currently presents an attractive long-term opportunity for investors seeking significant capital appreciation. Not only have the shares of this attractive (newly public) business sold off hard as part of the recent marketwide sell off, but they’ve also sold off doubly hard as the final lockup period for shares held by insiders as part of the recent IPO just expired on February 22nd.

source: YCharts

If you don’t know, JFrog is a “dev ops” company that provides end-to-end software management solutions that allow users to release updates extremely fast. The company has an impressive high growth rate (see earlier table), product offerings and an expanding opportunity in a very large and nascent industry. The shares almost doubled after the September IPO, but have been regressing lower, and now trade back near the IPO price despite the fact that the company released solid earnings this month, whereby they beat revenue expectations and raised their future revenue outlook. If you are looking to purchase attractive long-term growth at an increasingly reasonable price—JFrog shares are worth considering on this recent pullback. You can access our recent JFrog reports here:

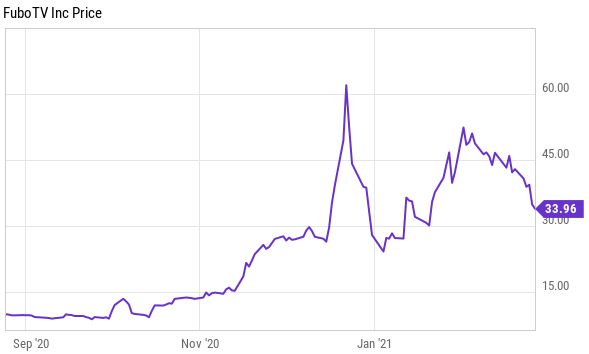

9. FuboTV (FUBO)

FuboTV is a “sports first” streaming platform with a very high growth trajectory and a large total addressable market (i.e. lots of room to run). It is benefiting from the the secular decline in traditional TV, the shift to connected TV advertising, and the potential growth in online sports wagering. And the share price has just pulled back dramatically.

source: YCharts

To be clear, FUBO is an attractive business, but it does face a variety of risks (such as execution risk and its current lack of profitability), and we expect the share price will continue to be very volatile. As such, we like these shares for an out-of-the-money put selling strategy. This is a strategy we write about often, and it entails generating attractive high upfront premium income (that you get to keep no matter what) in exchange for the obligation to purchase the shares at a much lower price (if they actually fall to that price before your options contract expires in the relatively near future). This is an attractive strategy based on current (high volatility) market conditions, and you can view a detailed example of a recent FUBO trade idea later in this report (see the “Income-Generating Options Trade” section).

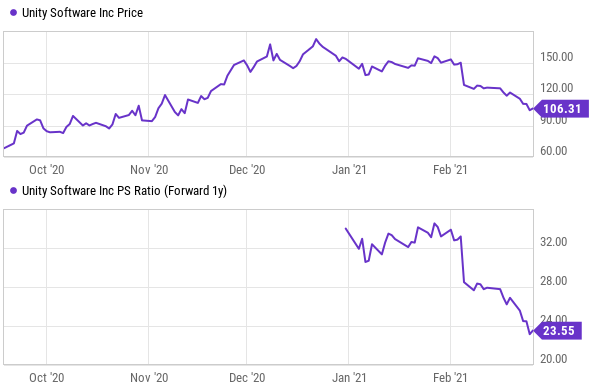

8. Unity Software (U)

Unity Software provides tools to videogame developers. The company completed its initial public offering in September, and the share price had been strong. However, the shares sold off significantly following the company’s recent earnings announcement at the start of this month. Specifically, Unity beat earnings (and revenue) expectations, but provided lower than expected forward guidance causing the market to react negatively.

source: YCharts, data as of 2/18/2021

Unity’s forward growth expectations still remain high (26.8% per StockRover) and the total addressable market is large (which means the company has a long runway for years of high growth ahead). The shares trade at around 26.25x forward sales (see chart above), and the recent selloff has created an attractive entry point in our view. If you are looking to buy high growth after a short-term pullback, Unity is worth considering. You can read our previous full write-up on Unity here:

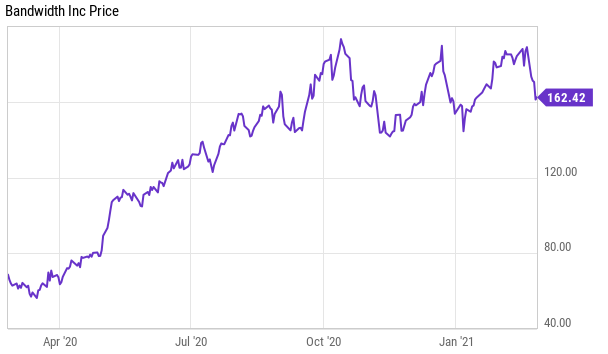

7. Bandwidth (BAND)

An attractive high-growth business trading at a compelling valuation, Bandwidth is a CPaaS (Communication Platform as a Service) solutions provider that offers a suite of software APIs (to support the mission-critical communications needs of a diverse and impressive set of enterprise-grade customers that includes the likes of Google (GOOGL), Microsoft (MSFT), Zoom (ZM), Arlo (ARLO), and RingCentral (RNG), to name a few). Not to mention Bandwidth’s owned IP network provides scalability, reliability, major cost savings and uniquely positions it for success.

Specifically, Bandwidth is well-positioned to take advantage of the large secular growth opportunities ahead. To get a better understanding of this business, members can read our previous full report and investment thesis here.

6. Palantir (PLTR)

Palantir is a data analytics software company that began trading publicly in September. However, the company was founded in 2003 and has already grown to an impressive $45 billion market cap based on its highly lucrative long-term contracts with government agencies as well as enterprises to help them manage their data efficiently and facilitate informed decision-making. We especially like the company’s high growth rate, large market opportunity and strong leadership team.

source: YCharts

And the share price is increasingly attractive considering it just recently announced quarterly results whereby it beat earnings and revenue expectations plus announced solid forward sales growth expectations. Further, Wall Street analysts have been raising their aggregate price target on the shares following the upbeat quarterly results. Nonetheless, the share price has continued to decline, and we believe this makes for a compelling entry price if you are a disciplined long-term investor. This one has a lot of long-term upside potential.

5. CloudFlare (NET)

Cloudflare (NET) is an attractive internet infrastructure and security company (i.e. a top growth stock) that has been increasing revenues very rapidly and has a very large total addressable market (for continued high growth in the long-term).

And while the shares of top growth stocks (like Cloudfare) are never going to be cheap, this week’s price pullback has created a small margin of safety thereby creating an increasingly tempting entry point for long-term investors. In the following report, we review Cloudfare’s business model, competitive strengths, financial position, and our opinion on investing (i.e. it’s attractive).

4. Oak Street Health (OSH)

Oak Street Health (OSH) is a recently public company (August 2020) that is on a tremendous growth trajectory as it delivers its highly differentiated, technology-enabled, value-based care model for Medicare. The continuing growth opportunities stem from the rapid shift of patients to value-based care and increasing patient consumerism.

source: YCharts, as of 2/18/2012

You can access our recent full report on Oak Street Health here:

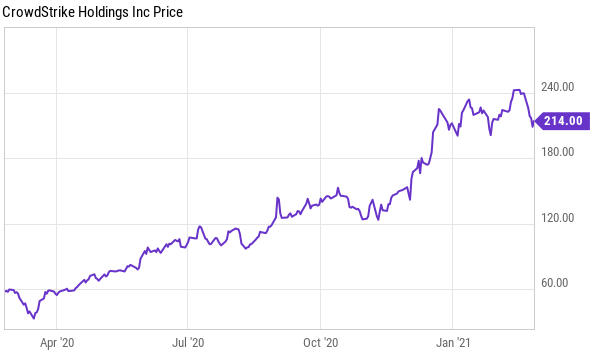

3. Crowdstrike (CRWD)

Crowdstrike is a cybersecurity business with a very high growth trajectory and a large total addressable market. And in the wake of never ending cyber breaches (such as the recent Solar Winds hack), cybersecurity is a must have for every enterprise.

We especially like the subscription model of the service considering cybersecurity isn’t something a company can justify getting rid of. For some background information, you can read our previous write up on Crowdstrike here.

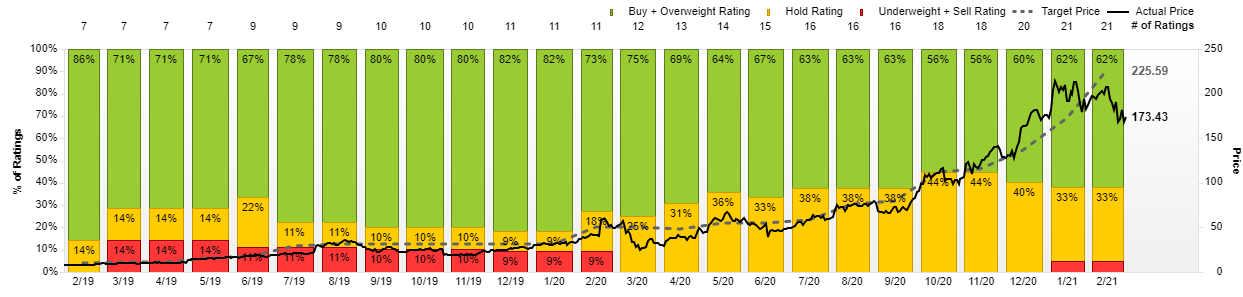

2. Enphase (ENPH)

Growth, growth and more growth. Enphase is simply attractive. The company designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally. Specifically, Enphase offers semiconductor-based microinverters, which convert energy at the individual solar module level, and combines with its proprietary networking and software technologies to provide energy monitoring and control services. It also offers AC battery storage systems; Envoy communications gateway; and Enlighten cloud-based monitoring service, as well as other accessories.

source: YCharts, data as of 2/18/2021

Enphase has estimated the serviceable addressable market (SAM) for its products going from $3.3 billion in 2019 to $12.5 billion in 2022. And it likely has significantly more growth beyond that. Analyst have been raising their price targets on this one rapidly (see the dotted line in the graphic below), but they still haven’t raised them nearly high enough relatively to the long-term growth potential.

This is an attractive company in an attractive industry at an attractive time. We are currently long shares of Enphase in our Disciplined Growth Portfolio.

We currently own shares of Square in our Blue Harbinger Disciplined Growth Portfolio, and believe the share price will increase dramatically in the quarters and years ahead.

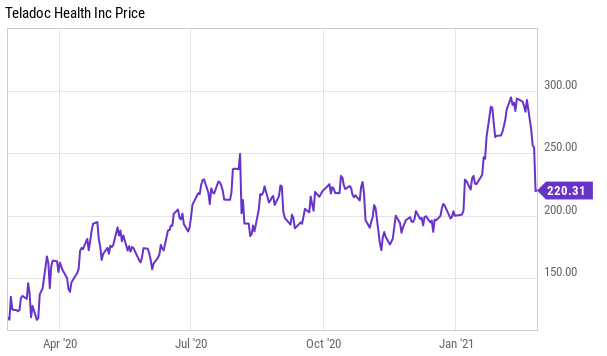

1. Teladoc (TDOC)

Telahealth companies Teladoc and Livongo were both on fire with growth when their merger was announced late last year, and the market’s love affair with these businesses slowed. And even though the valuation metrics fell, the high growth rate and large total addressable market did not.

Teladoc shares recently got their groove back and have posted strong gains so far this year, but still have significantly more upside as the high growth rate and relatively lower price-to-sales ratio makes it attractive. It’s also attractive because telahealth is a large growing market and TDOC is the leader. You can access our previous reports on Teladoc (and Livongo) here:

The Bottom Line:

This week’s sell off has created some increasingly attractive investment opportunities if you are a disciplined long-term growth-focused investor. We’re not saying things can’t get worse before they get better (they can), but in the long-term these are businesses that will likely all grow dramatically and carry their share prices much higher from here. The road may be bumpy, but if you can handle the ride (and growth stocks fit your goals), now is an increasingly compelling time to invest. Our Blue Harbinger Disciplined Growth Portfolio continues to put up strong market-beating returns, and you can view the current holdings here.