Big Banks have changed a lot since the great financial crisis, but in a lot of ways they have remained the same. They’re now subject to dramatically more stringent regulatory rules (e.g., “too big to fail”), but their profitability (and long-term value) is still derived largely based on the same basic metrics (e.g., book value and net interest margins plus fees). And despite media stories obsessed with which tech companies have the biggest market caps, big banks continue to generate among the biggest piles of net income. In this report, we review one big bank in particular, describing why the shares are undervalued, the 3.4% dividend yield is attractive, the current market opportunity, a review of the risks, and concluding with our opinion on who might want to consider investing.

Overview: Citigroup (C), Yield: 3.4%

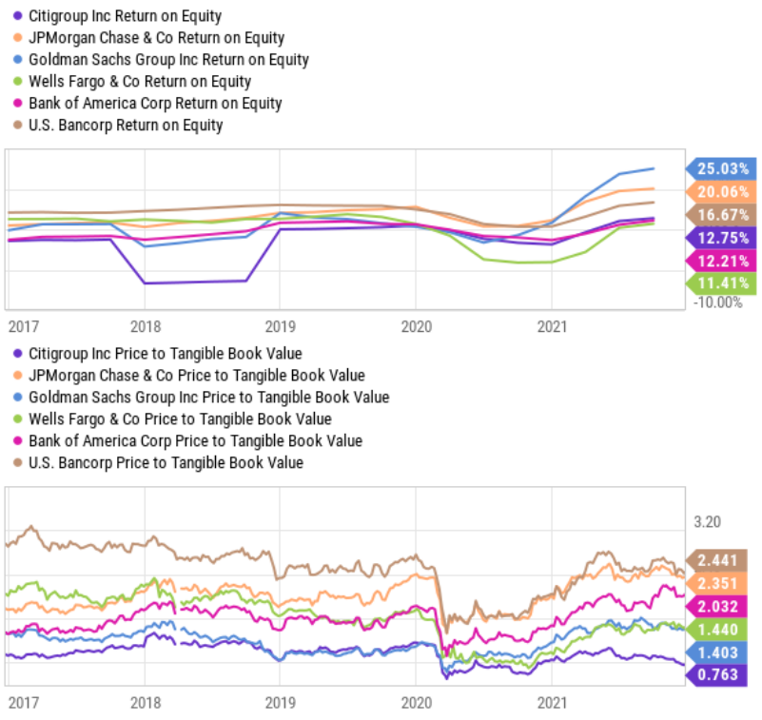

Citigroup has long been considered the ugliest of big banks because it got stuck with many of the worst assets following the financial crisis. And the shares still trade at the lowest price-to-book value of the big banks, plus it doesn’t have the same premier brand name (demanding higher institutional banking fees) as a JP Morgan (JPM) or a Goldman Sachs (GS). For starters, here is a look at the price-to-book values and return on equity for the big banks.

As you can see in the chart above, Citigroup trades at the lowest valuation. Yet despite this low valuation, Citigroup still generates loads of net income. As you can see in this next chart, big banks don’t have the biggest market caps in the world, but they do generate among the highest profits (net income).

And considering inflation is on the rise and interest rates are likely headed higher, big banks could be about to rise across the board.

How Citigroup Makes Money

From a high level, and like other big banks, Citigroup makes money from net interest margin (i.e., the difference between the rate Citigroup borrows money at and the rate Citigroup lends money at) and fees.

source: Investor Presentation

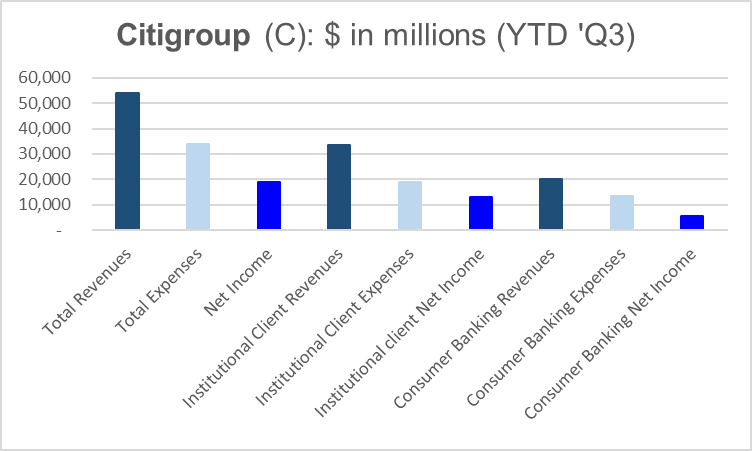

To be more specific, Citigroup breaks down its business into two main groups: Institutional Clients and Consumer Banking. And you can see to breakdown of revenue, expenses and net income from these two groups, below.

source: data from Citigroup’s Q3 investor presentation

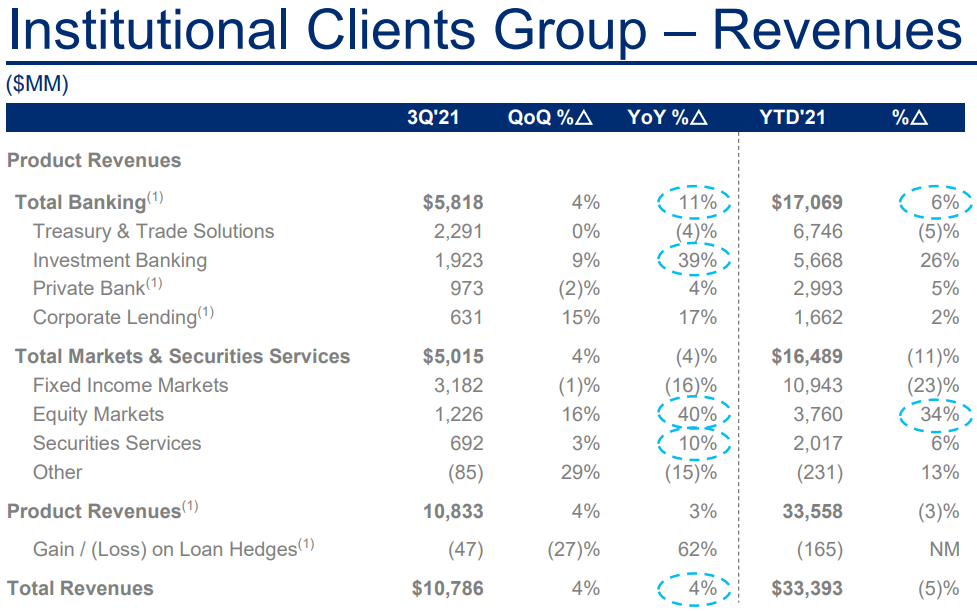

To give you a little more color, as you can see in the tables below, Citigroup’s Institutional Clients Goup generates revenues from Banking, Securities Services and Products.

And on the Consumer Banking side (using just North America as an example), revenues come from Branded Cards, Retail Services and Retail Banking.

What Differentiates Citigroup:

Versus other big banks, Citigroup is different for three main reasons. One, it has a larger international presence. Two, it doesn’t have the same strong brand name in the US to command price premiums like other big banks (Citi is still a strong US brand, and very strong outside the US). Three, its balance sheet assets, management and strategy are considered riskier as compared to other big banks (thus contributing to the lower price-to-book value).

Why Now is a Good Time to Invest:

In addition to its attractively low valuation (more on valuation in a later section of this report), Citigroup currently presents an attractive investment opportunity for a variety of reasons. For starters, interest rates are expected to rise. Rising rates (combined with rising inflation and a strong US economy) will increase the bank’s net interest margins and increase its profitability. Second, because of its large (and growing) non-US operations, Citigroup has relatively more growth potential than peers. And third, Citigroup has more room for improvement than pees. For example, the current valuation is low for a variety of reasons, including the market’s perception of Citi’s assets being more risky (despite passing regulatory stress tests) and being more disorganized (they are under strict regulatory supervision following a series of hundreds of millions of dollars of wire transfers incorrectly sent to the wrong recipients). Citigroup also recently brought in a new CEO, Jane Fraser, in February of 2021, and she intends to continue to right the ship.

Dividend Safety and Growth:

Citigroup has been able to pay dividend for 10 years in a row, and that dividend has been increased 5 times. Also, the company has been ocassionally buying back shares—an indication that the company views their stock as undervalued (and a good way to return cash to investors—because they own a higher share of future net income).

In fact, Citi returned $4.0 billion to shareholders in Q3 (through dividends and share repurchases). This represents a 92% payout ratio. Important to note however, Citigroup announced it will pause share repurchases in Q4 (as a result of a new capital rule related to derivatives). In reality, this is a good thing because it makes the bank safer, and the shares are still attractively undervalued for investors.

Valuation:

From a valuation standpoint, we have already seen (in an earlier chart) that Citigroup trades at an attractively low price-to-book as compared to peers. Generally speaking, anything below 1.0 is considered a discount and attractive.

Importantly, it makes sense to adjust Citi’s’ book value to “tangible” book value (in order to subtract out goodwill and intangible assets). At the end of Q3, tangible book value per share was $79.07 and the shares currently trade at $60.64—a discount of nearly 25% (this is attractive).

Admittedly, just prior to the great financial crisis (in late 2007), big banks started trading at lower price-to-book values and that was a waring of the devastation that was to come. However, this time around, banks are under strict regulatory requirements (Citi continues to pass stress tests and has a return on Tangible common equity (tangible book value) of 11.0%—this is very attractive—especially considering the banks use significantly less leverage and less risky assets than they did prior to the ‘08-’09 financial crisis (as per regulatory requirements).

Despite the markets negative perception of Citigroup, we view the shares as significantly undervalued and attractive.

Risks:

Bank Regulation: One of the biggest risks for Citigroup is simply bank regulation and reserve requirements. Such oversight has become dramatically more strict over the last decade, and any new rules or changes could adversely impact the company’s ability to grow profits.

The Economy: Another big risk is the economy. Bank performance is closely tied to the economy. An economic slowdown could negatively impact the bank.

Monetary policy is also a risk. The US federal reserve is expected to raise rates (which would ultimately improve net interest margins and profitability), but monetary policy can change, and it can also backfire (for example, raising rates too much and too quickly could hurt the economy and hurt Citigroup).

Complexity: Citigroup is a very large and complex organization with diverse cultures across its many units and geographies. This makes the bank difficult to manage and a daunting task for new CEO, Jane Fraser. Additionally, because its brand doesn’t necessary demand the same level of price premiums with institutional clients (as JP Morgan or Goldman Sachs), Citigroup may have a permanently lower return on equity than some peers (this is largely already baked into the price, and Citi’s ROE is still strong on an absolute basis).

Underperformance: Lastly, there is no guarantee that the book value or share price will rise. Citigroup has a history of disappointing shareholders. And while this remains a risk, it also creates an attractive contrarian opportunity as the company continues to improve.

Conclusion:

If you are a contrarian income-focused investor, there is a lot to like about Citigroup, including its solid dividend, low price-to-book value, the increasingly healthy business, its strong non-US operations, the strong economy and interest rates that are expected to rise. Citigroup has been a chronic underperformer for years, and in our view—this positions the stock well for contrarians. If you are a disciplined long-term investor, Citigroup is worth considering for a spot in your portfolio.