Some investors might overlook the attractive industrial REIT we review in this report because its current dividend yield is only 1.6%. However, this dividend has been growing faster than peers (and we expect this to continue), and the yield is lower than peers because the share price has also been growing significantly faster than peers (and we expect this to continue too). In this report, we review the REIT’s attractive business model (including ongoing market opportunities), its financials, valuation and risks; we conclude with our strong opinion on investing.

Overview: Prologis (PLD)

Prologis operates as an industrial Real-Estate Investment Trust (REIT) engaged primarily in leasing industrial and logistics properties for business-to-business commerce and retail/online fulfillment. Prologis continues to benefit from a large secular trend (i.e. the rising adoption of online commerce—especially post the pandemic). Further, a strategic shift in supply chain dynamics (with an increased focus on resiliency rather than just effectiveness or “Just in time” delivery of products) has also been a positive catalyst.

About the Business:

Incorporated in 2011, Prologis, Inc. is the second-largest public Real-Estate Investment Trust (REIT) and the largest industrial REIT worldwide. The company is engaged mainly in developing and renting logistics and industrial properties. The company’s significant presence in this market is evident from the fact that about $2.2T of goods flow through its distribution centers on a yearly basis. This represents 3.5% of total GDP for the 19 countries it operates in and about 2.5% of the global GDP.

Prologis logistics properties are primarily leased by companies in high growth areas such as e-commerce. As of September 2021, the company owned (both directly as well as via its co-investment ventures) 4,675 buildings comprising 994M square feet or 92M square meters in 19 countries. In addition to developing and renting out its logistics properties, the company is also actively engaged in managing several co-investment ventures. These include private real estate investment funds and publicly traded REITs such as Japanese REIT Nippon Prologis REIT and Mexican FIBRA Prologis.

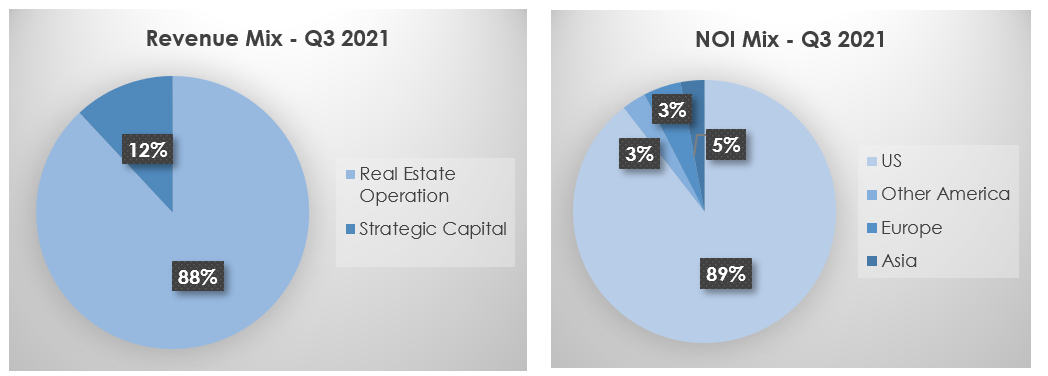

Prologis derives revenue primarily from its two operating segments, namely Real Estate Operations and Strategic Capital. In the Real Estate Operations segment, Prologis is mainly engaged in developing and leasing its logistics and industrial properties to a diverse set of tenants under long-term contracts. In Strategic Capital, Prologis earns stable income from managing assets of its several co-investment ventures. In addition to earning management fees, the company also generates additional income by providing leasing, construction, development, acquisition, and disposition services. Additionally, Prologis is also entitled to earn promote revenue, which is the sponsor’s share of the REIT’s profit from this segment.

Real Estate Operations remained company’s primary segment and contributed 88% of total revenue and 90% of total Net Operating Income (NOI) in Q3 2021, whereas Strategic Capital represented 12% of total top-line and 10% of total NOI in the quarter. Based on NOI by geography, the Prologis derived 89% of total NOI from the US followed by Europe which accounted for 5%. Additionally, 92% of the company’s total assets are located in the US.

Source: Company’s 10-Q

E-commerce: Dominant theme across logistics real-estate operations

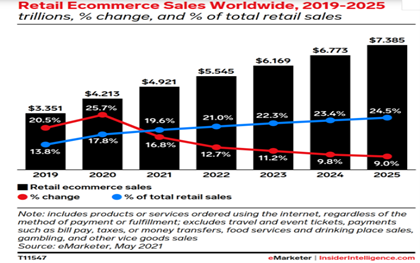

The performance of modern industrial REITs (such as Prologis) is largely correlated with growth in e-commerce, considering the high intensity usage of e-fulfillment space by online commerce operating businesses. In fact, as per the company’s estimates, for comparably sized retailers, an online-only business needs three times the logistics footprint of a traditional brick and mortar business due to the associated complexity with regards to the management of inventory. Additionally, considering the value of an online retailer is largely tied to the time it takes to deliver products, demand for modern and “last touch” warehouses and logistics facilities or those that are situated in proximity to large suburban areas is also on the rise. E-commerce sales as a percentage of total retail sales grew dramatically between 2019 and 2020, rising from 13.8% in FY 2019 to 17.8% in FY 2020 due to pandemic related tailwinds and the upward trajectory is expected to continue going forward as well.

Source: Company’s Estimates, eMarketer

Well-placed to leverage e-commerce tailwind through its diverse customer base and differentiated assets

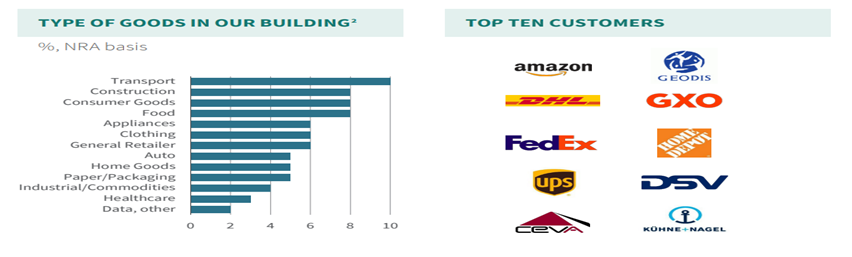

Prologis caters to a wide variety of customers ranging from e-commerce giants such as Amazon (AMZN) to industry specific online retailers such as Home Depot (HD) as well as companies like DHL, FedEx (FDX), and many others. The company has about 5,500 customers. Amazon remained its major tenant contributing 4.4% of net effective rent and leased almost 31M square feet of space from Prologis in Q3 2021. As such, Prologis is well-placed to leverage e-commerce tailwinds as online commerce businesses will look for partners that can provide them with large product reach. Moreover, the company’s customers are well diversified as evidenced by just 13.7% and 20.3% of net effective rent contributed by the top 10 and 25 customers, respectively.

Source: Q3 2021 Fact Sheet

Another differentiating feature (that sets Prologis apart from other industrial REITs, and positions it well to leverage the e-commerce mega trend) is its increased focus on building and acquiring high quality assets that are both technologically advanced and geographically well suited for long-term investment. The company’s logistics properties cover all densely populated and well-connected areas. For example, assets in Southern California, New Jersey/New York, San Francisco Bay Area, Chicago, Lehigh Valley which are the most high demand areas for setting up warehouses due to their geographical connectivity representing ~43% of total gross asset book value.

Over 97% of the company’s assets based in the US were occupied in Q3 2021 whereas 98% were leased. International geographies also exhibit a positive trend with about 98% of total assets already occupied and leased in Q3 2021.

Additionally, Prologis has also been actively building what it calls “last touch” delivery sites. These sites are usually located in densely populated areas where end-customers are reachable in less than an hour. Availability of these locations provides e-commerce businesses with increased sales and higher end-customer retention. In fact, research from MH&L found that 87% of online shoppers emphasize shipping speed as an important decision for a repeat purchase from the same e-commerce brand.

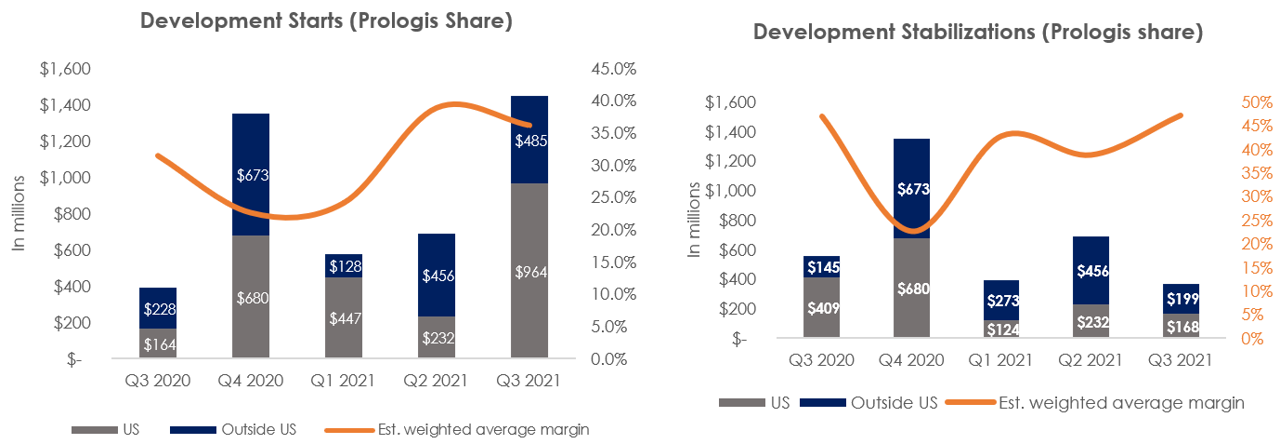

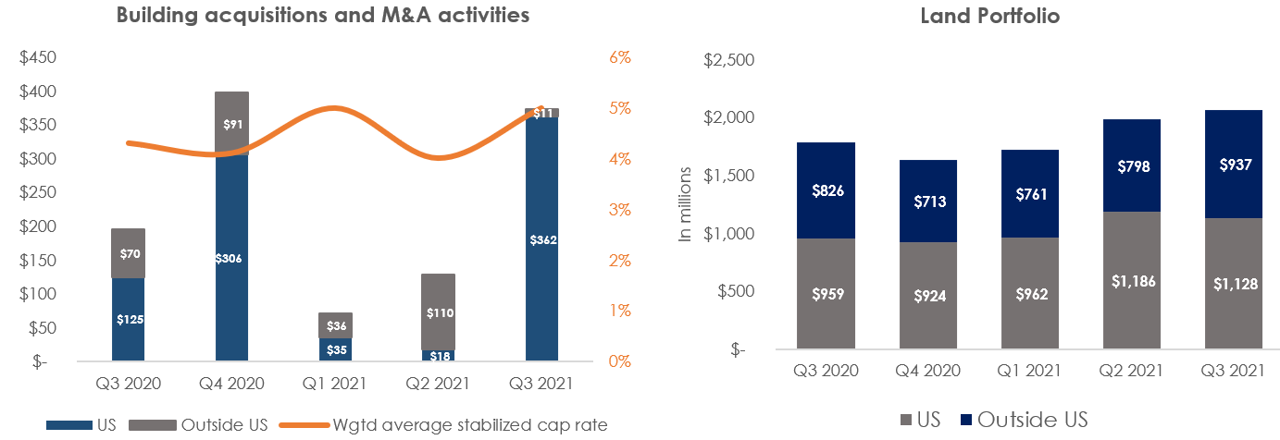

Capitalizing on growth opportunities through development and acquisition activities

Despite achieving significant scale already, Pologis is actively engaged in developing, redeveloping, and acquiring new properties to fuel its growth. In Q3 2021, the company recorded $1.5B in total development starts with about 60% of the construction activity being built to suit. These sites are expected to create $523M in estimated value. Additionally, the company benefited from $368M in Total Expected Investment (TEI) in assets that moved to development stabilization (i.e., properties that have achieved over 90% occupancy or have been operational for a year). These properties are expected to create $173M in value with an estimated weighted average margin of 47.2%. Additionally, the company’s owned and managed land portfolio now supports 180M square feet consisting of 109M square feet of land portfolio, 21M square feet of covered land, and 51M square feet of optioned land. This gives Prologis over $21B of future built-out potential providing the company with notable growth and value creation opportunities in the coming years.

Core FFO supported by robust real-estate operations

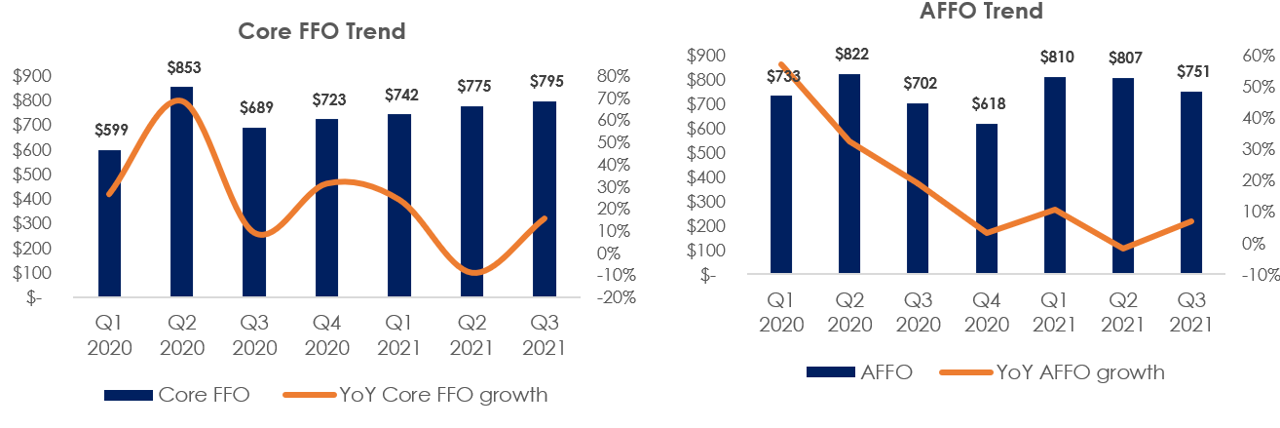

In Q3 2021, Prologis reported $795M in Core FFO as compared to $689M in Q3 2020. On a per-share basis, Core FFO per common share, diluted increased 16% YoY from $0.9 in Q3 2020 to $1.04 in Q3 2021. Adjusted Core FFO (AFFO) also improved 7% YoY from $702M in Q3 2020 to $751M in Q3 2021. The increase in Core FFO and AFFO were largely driven by 6% YoY growth in Real Estate Operations revenue from $984M in Q3 2020 to $1B in Q3 2021. Real Estate Operations growth was mainly supported by 27.9% rent change on rollovers and 6.7% YoY acceleration in cash same-store NOI that increased from $594M in Q3 2020 to $634M in Q3 2021.

Given the sharp rise in demand for logistics warehouses to support e-commerce growth, the company is expected to have a strong year. It now expects Core FFO per common share diluted to be in the $4.11 to $4.13 range which is 1.5% more than previously stated guidance at mid-point.

“Acute scarcity in our global markets is driving record rent and value growth. In the third quarter alone, rents grew 7.1% in our US markets, far exceeding our expectations. We are increasing our 2021 market rent forecast significantly to an all-time high of 19% for the US and 70% globally, both up approximately 700 basis points.” - Thomas S. Olinger, Chief Financial Officer

Robust balance sheet with stable credit rating

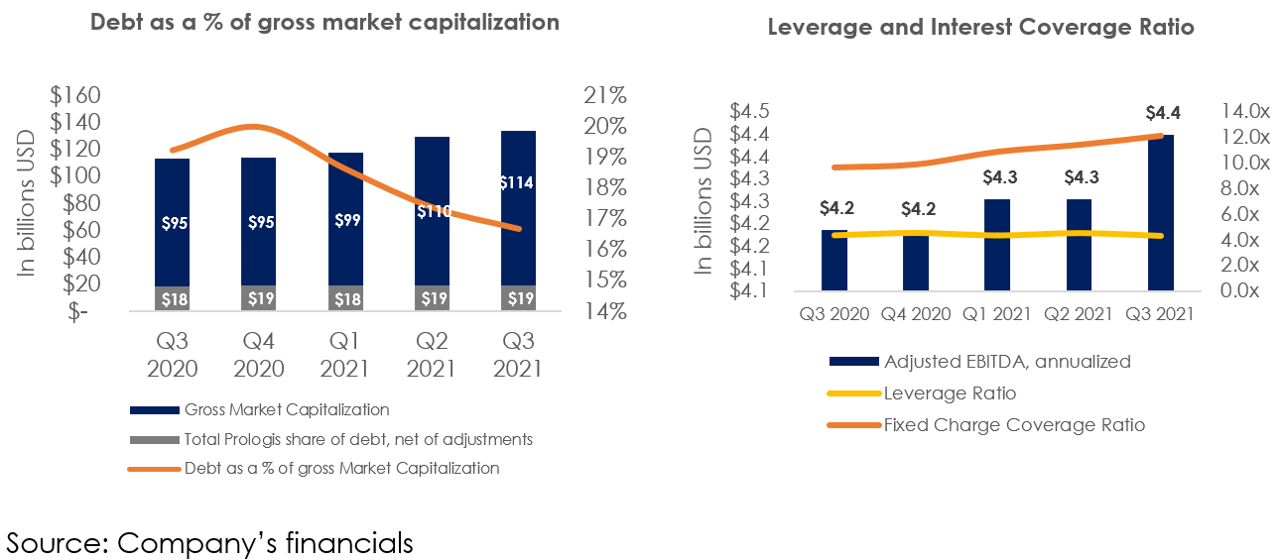

The company’s current consolidated liquidity stood at over $5B consisting of $4.9B in available credit facility and $585M in cash & cash equivalents as of September 2021. Total Prologis share of debt, net of adjustments was $19B in Q3 2021. Adjusted EBITDA was $4.4B on a TTM ended in Q3 2021. This leads to the company’s leverage ratio (i.e., debt to adjusted EBITDA) at 4.3x in Q3 2021 as compared to 4.5x in Q2 2021.

The company’s fixed charge coverage ratio or adjusted EBITDA to total Prologis share of fixed charges of 12.1x and debt to gross market capitalization ratio of 16.6% in Q3 2021 are both healthy indicators of the balance sheet. Additionally, Prologis has been rated A3 (outlook stable) and A- (outlook stable) by Moody and Standard & Poor in Q3 2021. The company’s strong balance sheet will allow it to be opportunistic and aggressive to tap attractive opportunities in growth markets.

Reasonably Valued, Strong Dividend

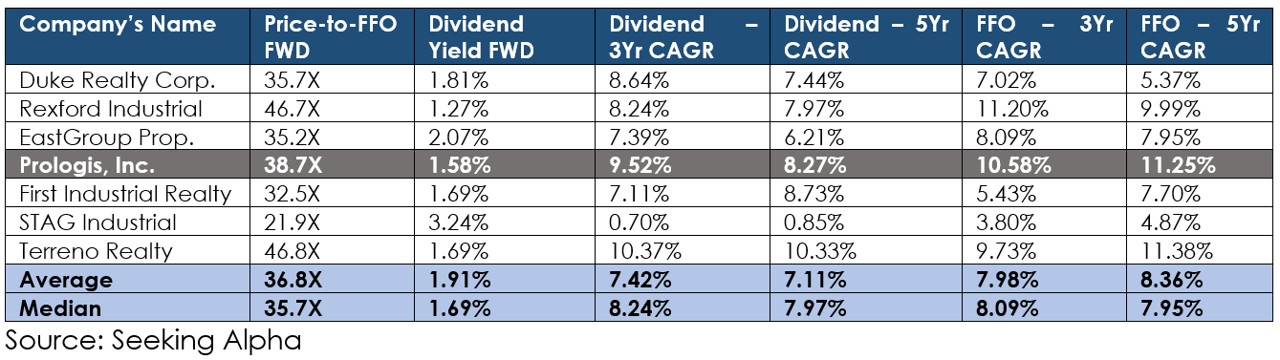

Prologis shares have risen over 60% since last year due to accelerated demand for company’s logistics sites as a result of pandemic led tailwinds. This has led it to trade at a Price to FFO ratio of 38.7x on a forward basis which is at a premium. Having said that, Prologis has a history of outperforming peers when it comes to dividend growth. In fact, on a 3- and 5-year basis, the company’s dividends have registered an impressive CAGR of 9.5% and 8.3% which is more than industry’s average of 7.4% and 7.1% respectively. Further, Prologis’ total dividends to core FFO ratio (of 61%) implies ample dividend cushion. And based on the current quarterly dividend rate of $0.63, PLD is trading at a forward dividend yield of 1.58%. While this is lower than the industry average, broader market dynamics including expected growth in new as well as rollover rents and the company’s quality assets justify the premium valuation.

Risks:

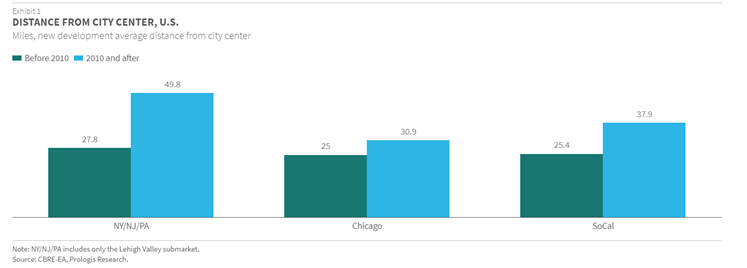

Supply of well-located industrial lands is decreasing: Availability of industrial locations in densely populated areas is decreasing as a result of conversion to other uses. In fact, prior to 2010, new developments average distance from city center was 25 miles for Chicago and 25.4 miles for Southern California. However, after 2020 this has increased to 30.9 miles for Chicago and 37.9 miles for Southern California. As such, the company has to pay above-average construction and design prices for its last touch delivery sites. To put the numbers into perspective, PLD paid almost double or $260 per square foot to build Georgetown Crossroads as compared to just $125 per square foot for a traditional remote warehouse. Having said that, the Prologis’ scale (as well as a quality balance sheet) provides it with the necessary ammunition to outperform peers when it comes to acquisition activity.

Conclusion

Don’t be fooled by Prologis’ relatively small dividend yield (1.6%). The dividend and the share price continue to growth faster than peers thereby providing attractive total returns. And as the largest industrial REIT globally, with a very healthy balance sheet, Prologis is well positioned to benefit from ongoing growth in e-commerce. In our view, Prologis continues to provide a superior investment opportunity in the fast-growing industrial REIT space. And if you are a long-term, dividend-growth investor, Prologis is worth considering for a spot in your prudently diversified portfolio.