REITs, BDCs, CEFs, MLPs, big-dividend stocks and dividend growth stocks can all be appealing to income-focused investors, but where are the best opportunities for 2022? In this report, we take a closer look at income-investment performance, valuations and go-forward opportunities.

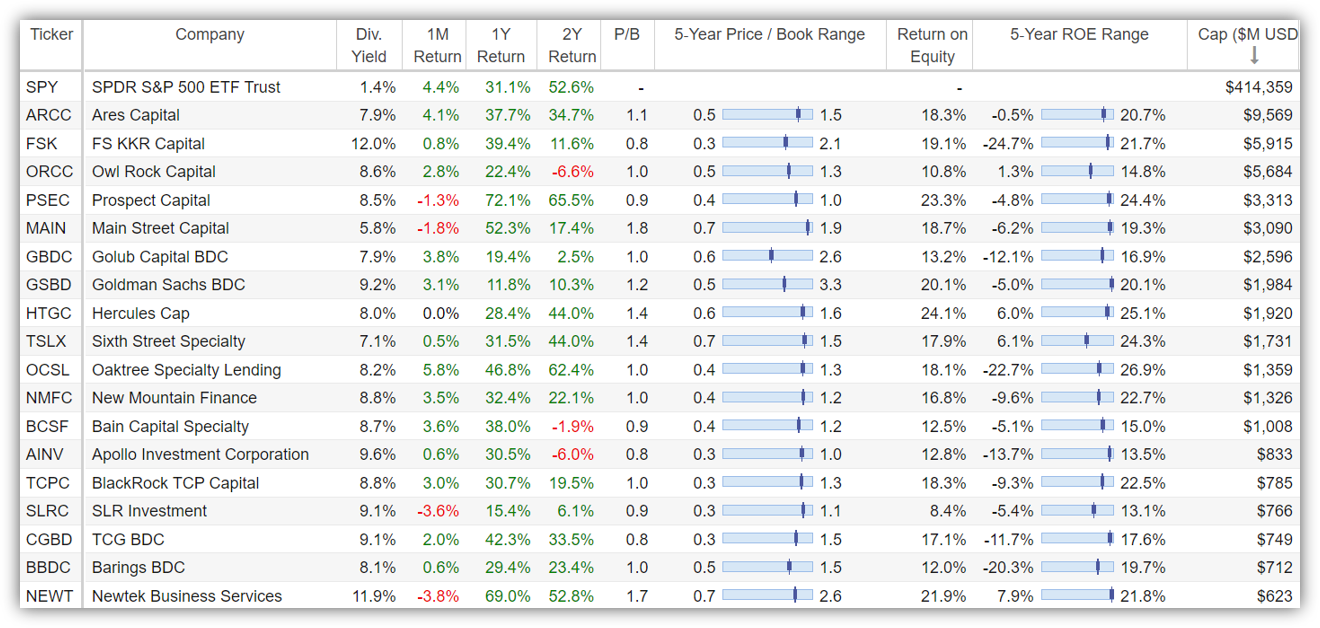

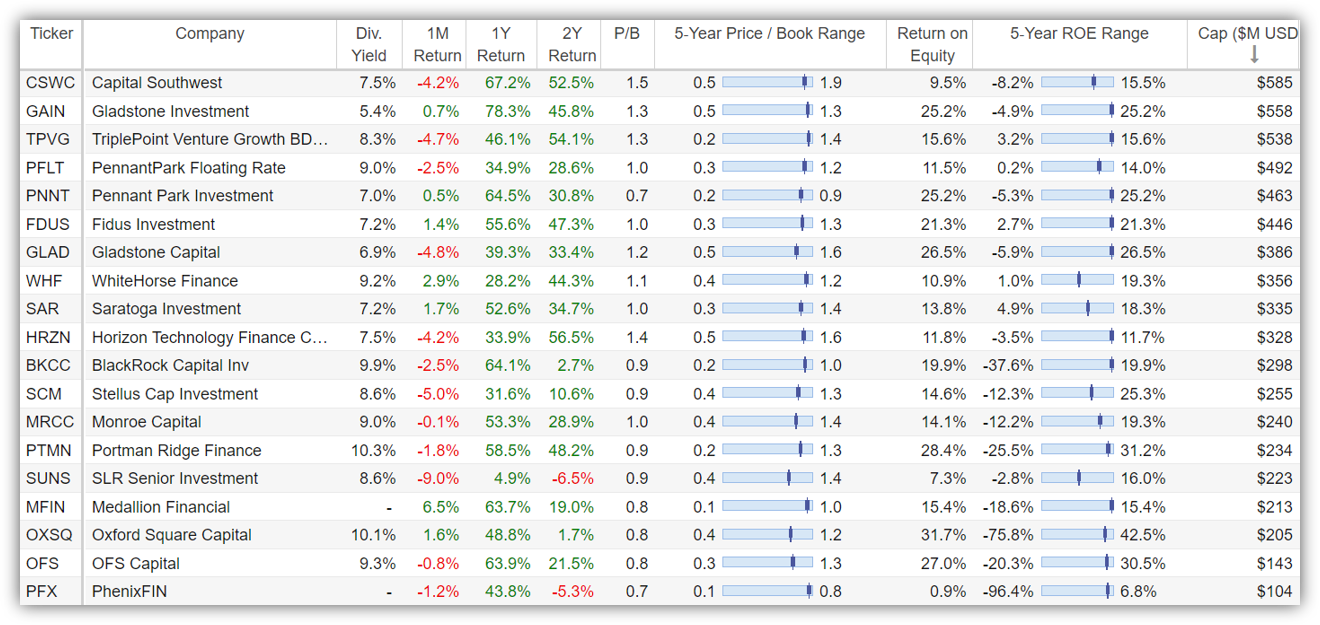

Business Development Companies (BDCs)

Let’s start off with BDCs. If you don’t know, BDCs (or Business Development Companies) basically provide financing (mostly loans, but sometimes equity) to small and mid-sized companies. BDCs where created by Congress in the early 1980s as a way to support smaller business (there are tax benefits—no corporate income tax if they pay out most dividends), and they are often an income-investor favorite.

As you can see in the table above, BDCs have posted very strong 1-year performance, many of them significantly beating the S&P 500’s strong gains. However, the 2-year performance numbers are not as impressive because BDCs got hit hard when the pandemic broke out (most of the 2-year gains have come within the last 1-year).

The reason BDCs got hit hard by the pandemic is because they make loans to smaller and riskier companies (that’s why the yields are high) and many of these businesses struggled mightily during the pandemic.

From a valuation standpoint, BDCs are reasonably priced (as you can see in the 5-year price-to-book value column above). Generally, BDCs can be considered attractive when they trade at a discount to book value, but some of the most popular BDCs almost always trade at premiums (Main Street Capital comes to mind).

In our view, based on current valuations and where we are at in the cycle, BDCs remain attractive as a group. We continue to selectively own several BDCs as you can see in our Income Equity portfolio (such as ARCC, MAIN, OCSL, TPVG and ORCC). We like them all at this point in the cycle because the businesses are well run, the ROEs are healthy and the dividends look strong on a go-forward basis.

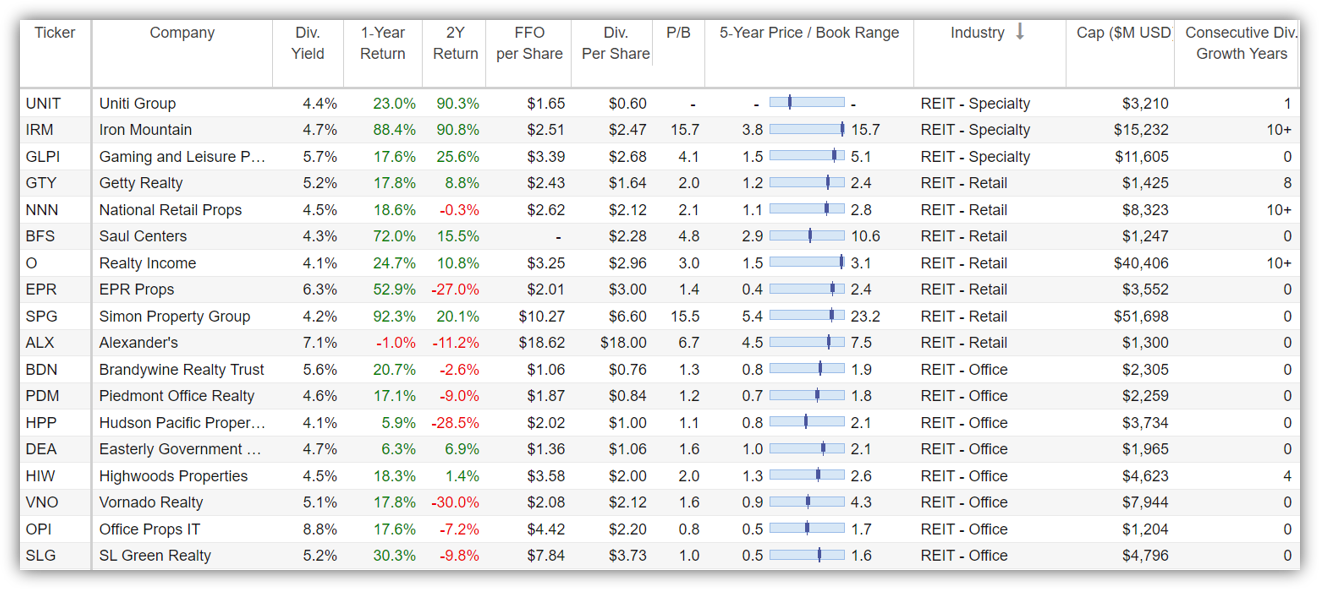

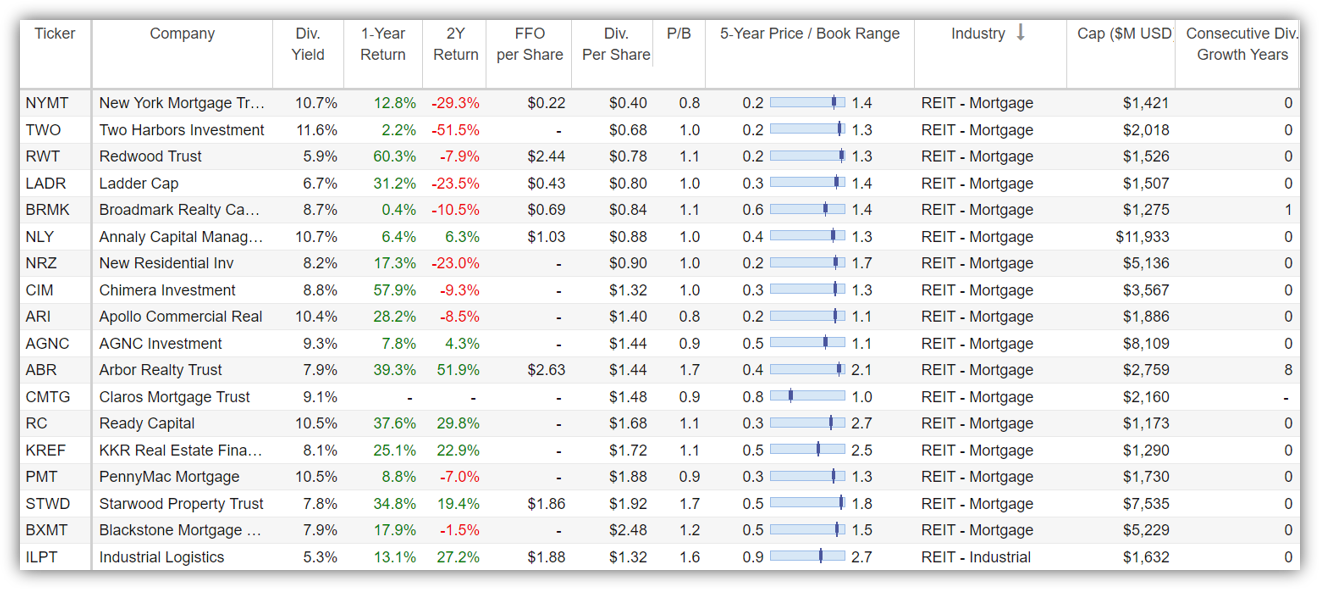

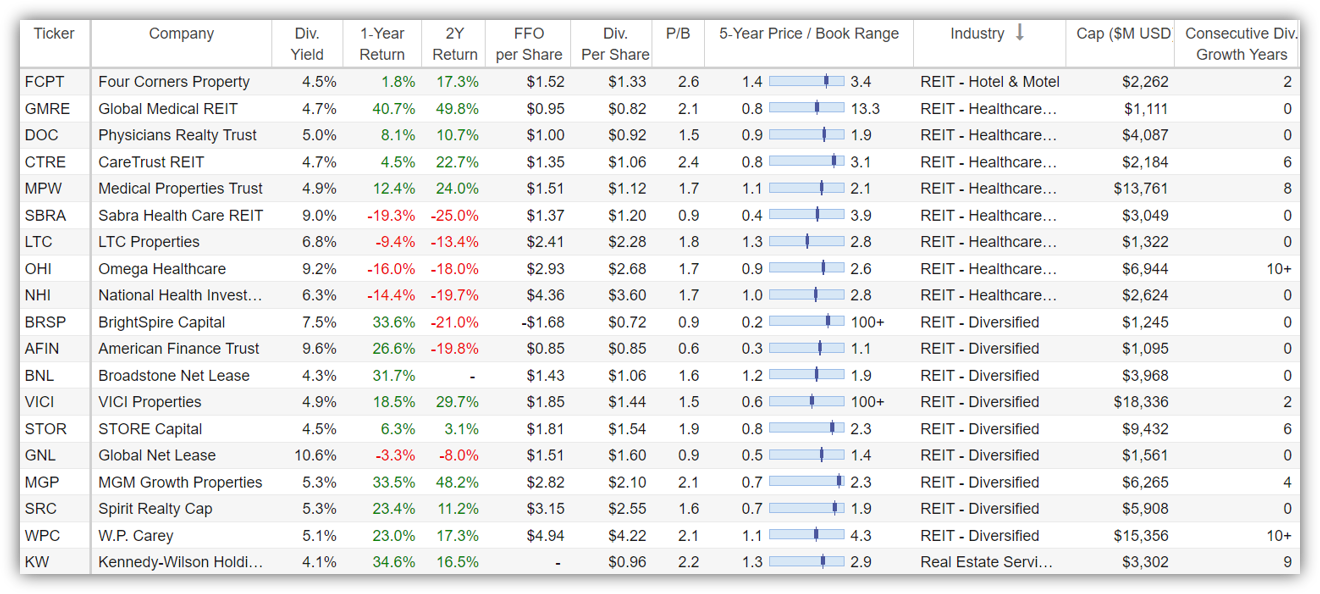

Real Estate Investment Trusts (REITs)

REITs are another popular income investment because they also can avoid taxation at the corporate level by paying out big dividends to investors. It’s been a mixed bag for REIT performance over the last 1-year based largely on industry (for example, industrial REITs have done well).

We currently own (and like) WPC, AGNC and NLY, O and SPG (from the list) as well as Digital Realty (DLR) and Prologis (PLD) (not included on the list because their yields are lower but quite attractive).

Regarding mortgage REITs (AGNC and NLY) we like them because the price-to-book valuables are quite reasonable (and they offer very big yields). Regarding industrial REITs—they have been strong, and we expect them to continue to be strong as they are often an important part of the supply chain (whether in person or online supplies). PLD is a premier industrial REIT that we continue to own. We also own office REIT KRC (Kilroy) as we expect some post-covid comeback in office properties, and KRC’s are newer and attractively located.

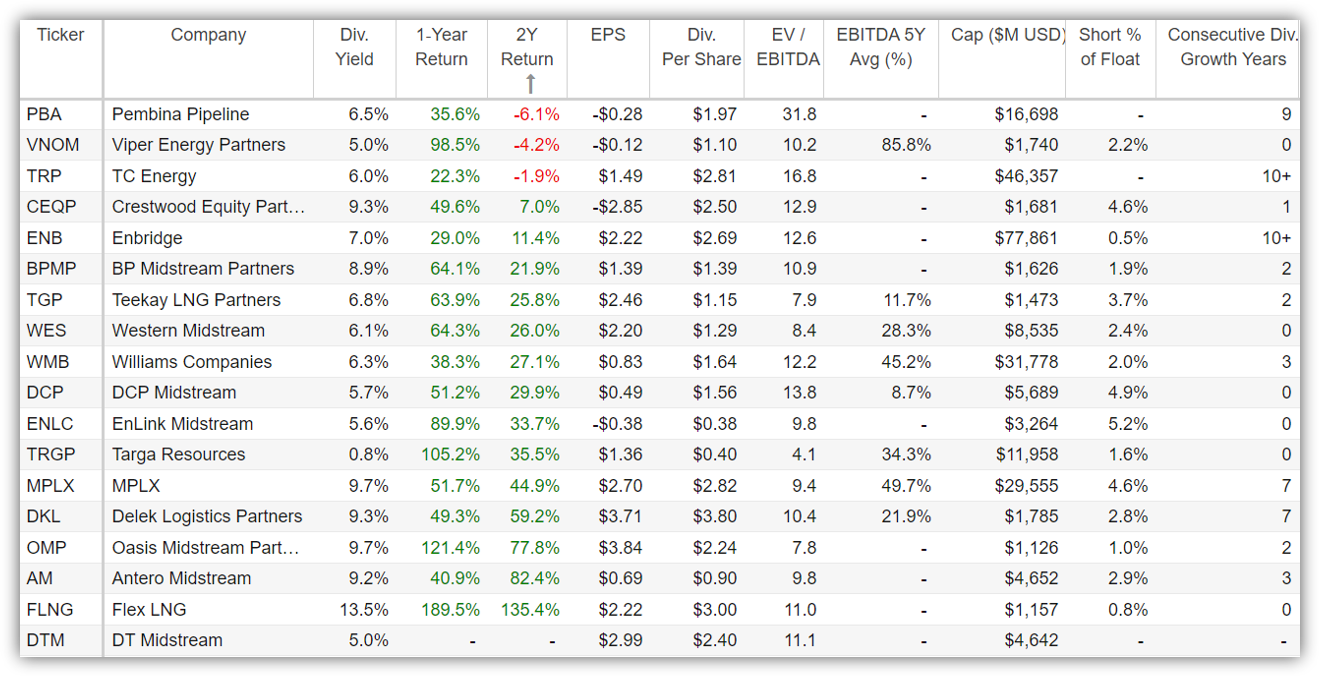

Midstream Companies

Anything related to energy has had a challenging decade due mainly to volatile energy prices, and due to social pressures to use alternative (non-fossil fuel) energy sources. However, traditional energy is not going away for decades (or longer) and prices have shown strength (and could show more strength as inflation rises).

We continue to own EPD and XOM within our Income Equity portfolio, with no intention of selling.

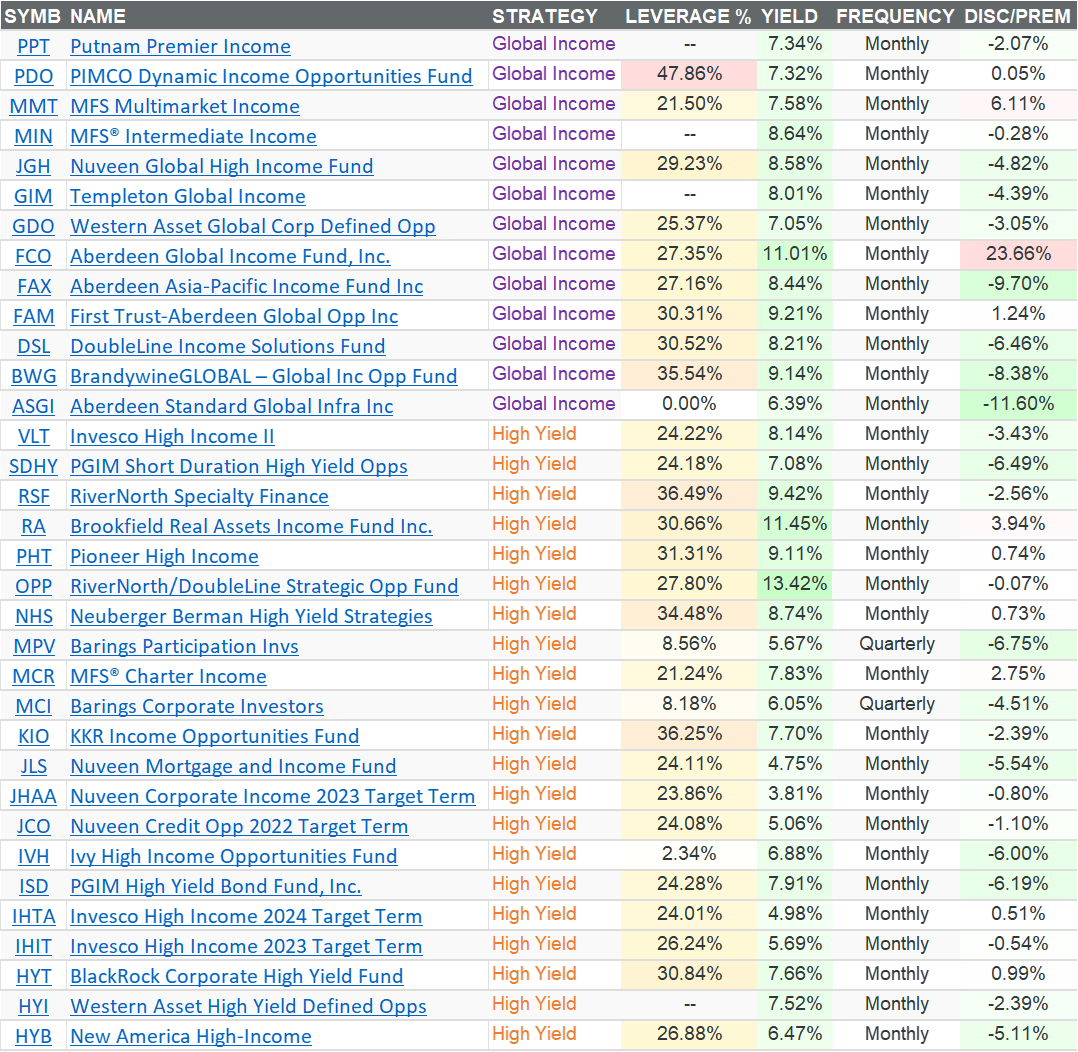

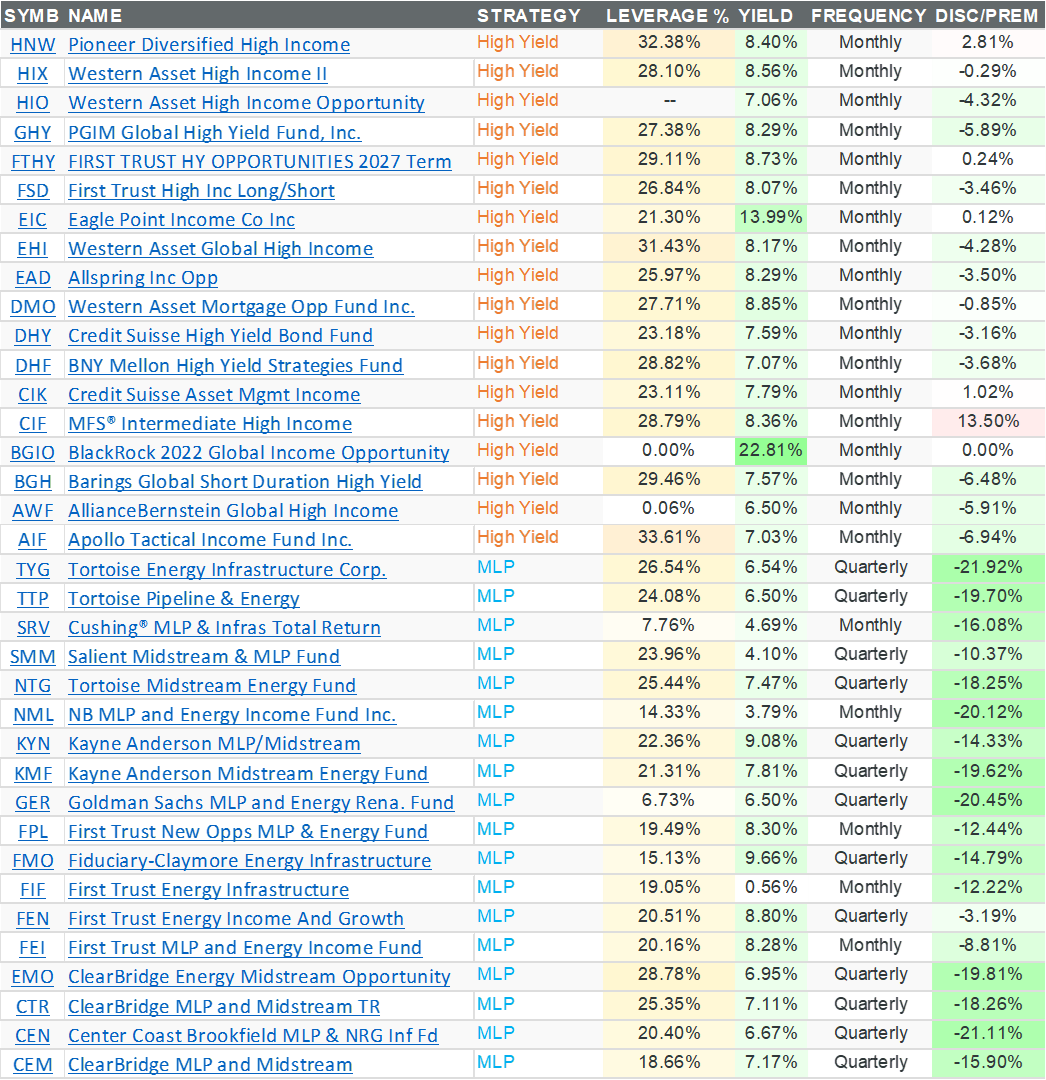

Closed-End Funds (CEFs)

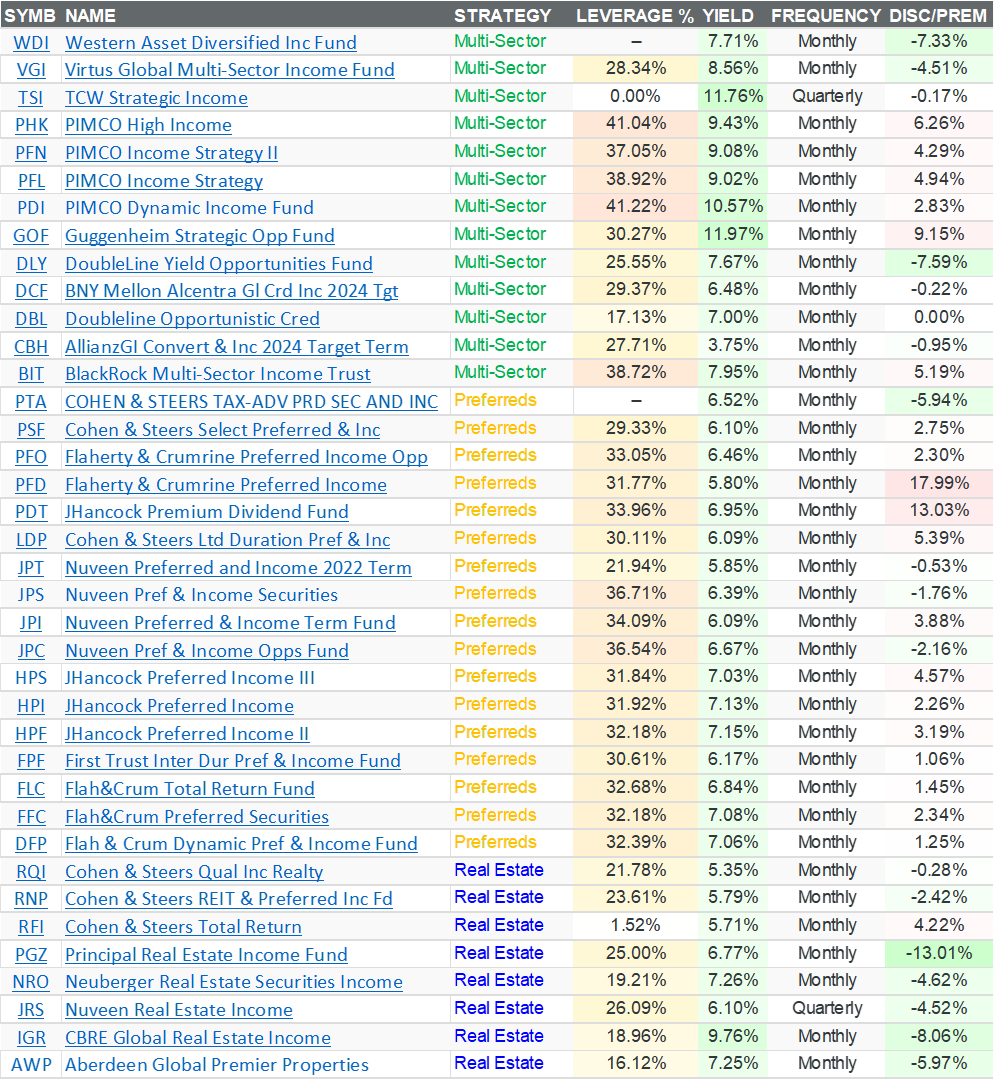

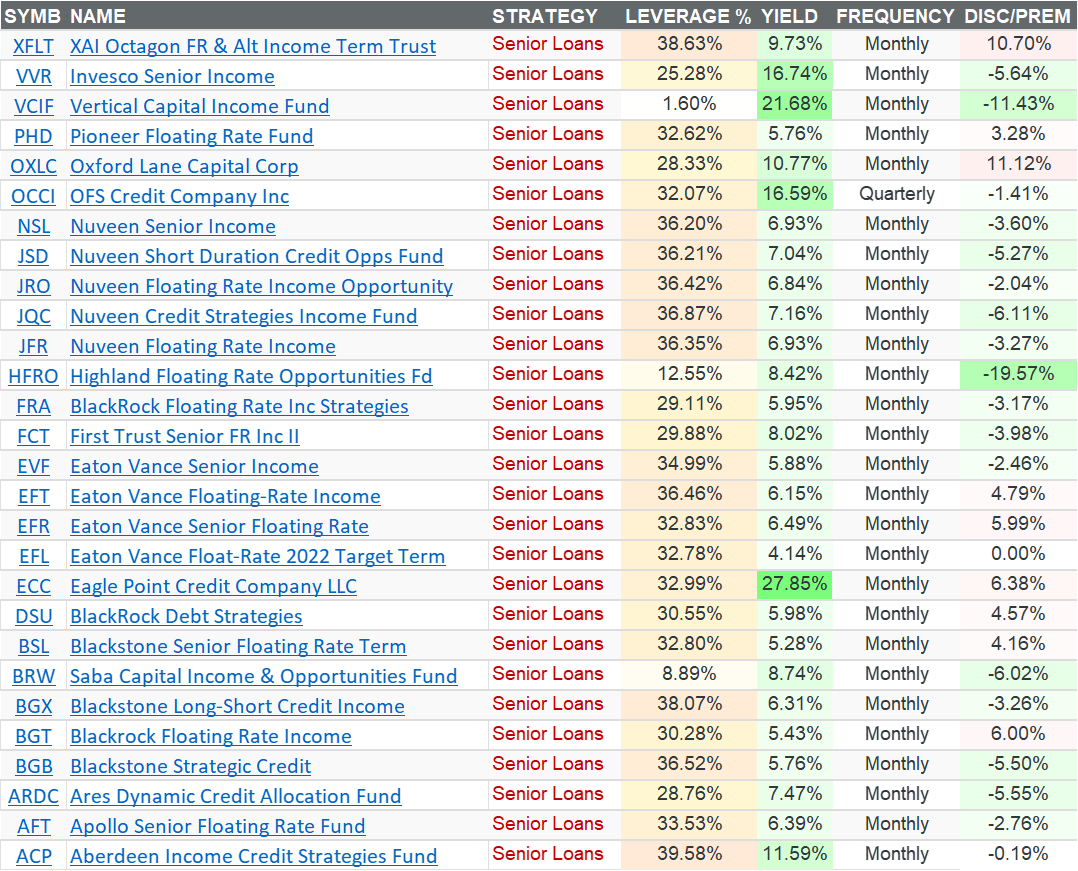

Closed-end funds are a widely diverse group (as you can see the different strategies in the table below). And they can trade at wide premiums and discounts to the net asset value of their underlying holdings.

One fund on this list that we do NOT own, but it still stands out, is the Goldman Sachs MLP CEF (GER) because it holds a lot of the popular/attractive MLPs listed in the previous section of this report, but GER trades at a huge discount to NAV (it’s like you are buying the underlying holdings at over a 20% discount). GER faced challenges and a merger in 2020, which led many investors to flee. In particular, the fund used to be highly leveraged (borrowed money to invest) but got in trouble when covid hit (as prices fell) and they sold a bunch of positions (and permanently reduced leverage) at exactly the wrong time.

The fund is less risky than it used to be (thanks to the low leverage) and the big discount to NAV is very tempting and hard to ignore, especially considering the big distribution yield.

We currently own a variety of CEFs including PIMCO’s ticker PDI (we used to own PCI, but that recently merged into PDI). And this one is currently trading at an unusually small premium to NAV for a PIMCO fund. It’s attractive. We also own BlackRock’s BIT, but this one now trades at an unusually large premium to NAV for this fund, and it could be time to consider reallocating to other CEFs. We own (and like) DoubleLines (DLY)—which currently trades at an attractive discount. We also own and Energy/Resources sector CEF by Adams Funds (PEO) and we like that one going forward too.

Our Bottom Line:

Attractive high-income opportunities continue to be available, such as those we have highlighted in this article. In our view, BDCs are attractive in general based on where we are in the market cycle. And so too are select REITs attractive (such as those highlighted in this article). In addition to owing BDC and REITs, there are attractive energy sector opportunities (including MLPs), and the CEF space (while very diverse) currently offers particularly attractive opportunities for income-focused investors.

Lastly, and most importantly, don’t lose sight of your own personal investment goals. We are bombarded by the media with investment ideas (most of them conflicting), and they are usually not right for you personally. Know your own personal investment goals and stick to your strategy. Disciplined, goal-focused, long-term investing is a winning strategy.

You can view all of our current portfolio holdings here.