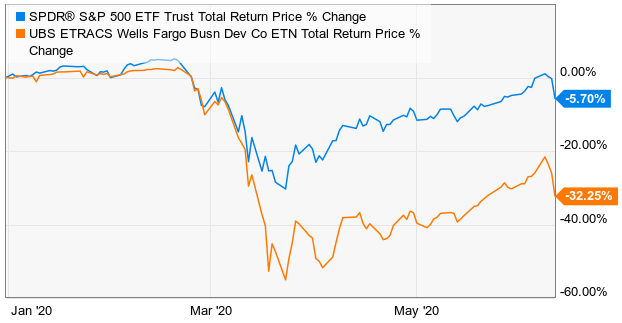

Business Development Companies (“BDCs”) can be an important part of an income-focused investment portfolio. And the latest market nosedive gives investors another attractive bite at the BDC apple. However, not all BDCs are created equally. Specifically, some will thrive in the current environment, while others will struggle mightily. This article provides an overview of the current BDC landscape, explains why some are in much better shape than others, and then shares 7 top high-income BDCs that we believe are worth considering for investment, especially after yesterday's big market sell off.

What is a BDC?

If you don’t know, BDCs provide capital (usually loans, sometimes equity capital) to smaller middle market businesses (i.e. companies with annual revenues usually between ~$10 million and ~$500 million). These may not sound like small businesses to you (they’re certainly not “mom and pops,” nor are they trillion dollar tech companies), but they are mainly smaller private businesses, and many of them have been hit particularly hard by the coronavirus lock downs.

BDCs were originally created by an act of Congress in the early 1980’s as a way to help small businesses succeed. This is why they don’t pay corporate taxes on income (as long as they distribute it in the form of dividends).

The Current BDC Environment

However, it’s important for investors to keep in mind that BDCs are inherently risky (this is why they’re able to pay such high dividends—they take on more risk). Specifically, BDCs often provide the loans to small businesses that are too risky for ordinary banks to take on (particularly after the more stringent lending requirements that were put in place by regulators following the financial crisis of ‘08-’09). And for perspective, this Wall Street Journal article explains how the slow economic recovery could be especially challenging for BDCs in particular.

Importantly, there are ongoing efforts by Congress to provide additional financial support to smaller businesses, such as those BDCs work with. For example, just this week the Fed expanded its main street lending program to allow both smaller and bigger loans. Further, Senator Pat Toomey recently suggested working directly with BDCs because they “could be effective conduits” for supporting small businesses. The point is that small business (the ones BDCs lend to) are going to face enormous ongoing challenges in the quarters ahead, and that means BDCs will too.

What We Look for in a BDC

Further, not all BDCs are created equally. In fact, some of them are extremely different from each other in terms of the types of financing they provide and industries they lend to. For us, we prefer BDCs with strong balance sheets, that are well-diversified, with exposure to industries that are less impacted by coronavirus risks, and that have primarily senior secured debt investments (which are safer) instead of subordinated unsecured debt.

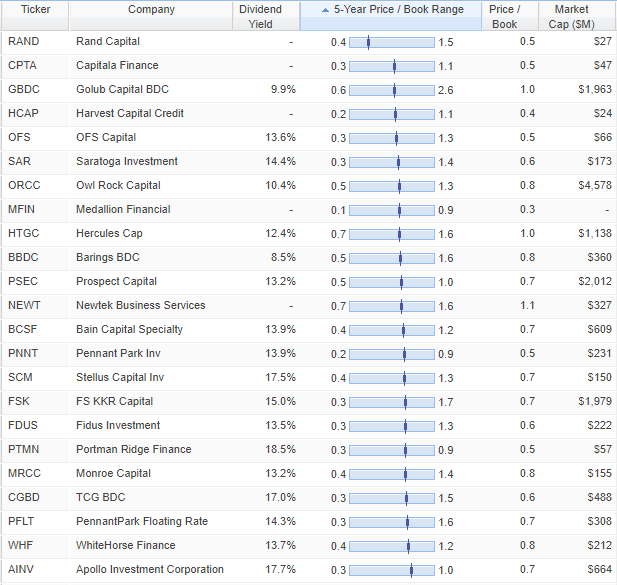

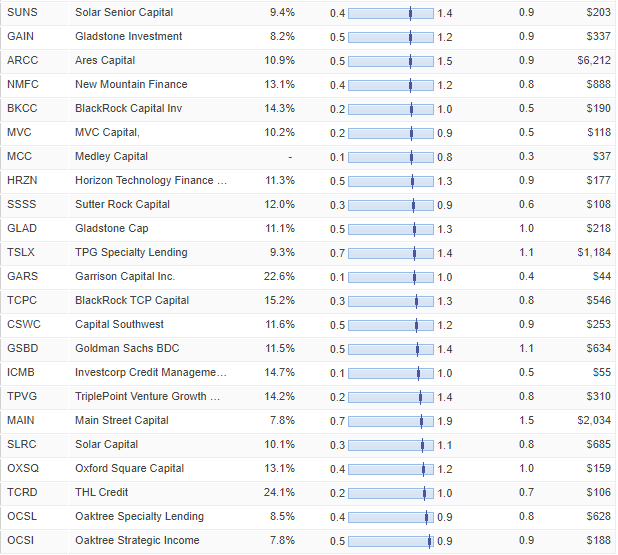

Some investors may argue that now is a great time to simply buy the cheapest BDCs on a price-to-book value basis (P/B is a common BDC valuation metric), but we disagree (especially considering current market conditions). For example, book values are generally reported only quarterly, and many of them have changed dramatically since the last batch of quarterly reports were released (we cover attractive specific examples later in this report). Further still, some BDCs should trade at higher valuations considering the differing qualities of their businesses.

(data source: StockRover, 11-Jun-20)

In fact, not all BDCs are going to survive this mess, and some that do survive will do so barely and with significant long-term damage to their book values and to individual BDC investors’ pocket books. Rather (and in addition to the types of BDCs we like as described above) we like BDCs that have enough financial strength and liquidity to be opportunistic buyers in the distressed market that exists now (and will likely continue to exist for at least the next few quarters) instead of the BDCs that are financially weak and will be forced to sell their assets at fire sale prices just to barely stay in business.

Obviously, no one knows what will happen in the market tomorrow, and it’s easy to make generic statements like “there will be big winners and losers in the BDC space,” but in this article we share our detailed analysis of a variety of BDCs and our thoughtful opinions on which are among the most attractive to consider right now for investment in your prudently diversified long-term income-focused investment portfolios. After all, it can be quite lucrative to pick up shares of attractive businesses at significantly discounted prices.

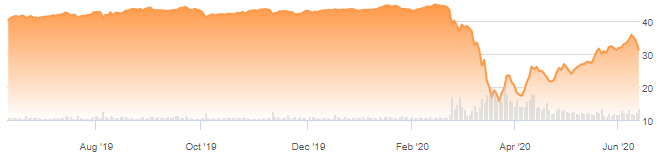

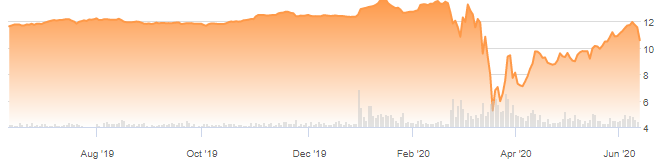

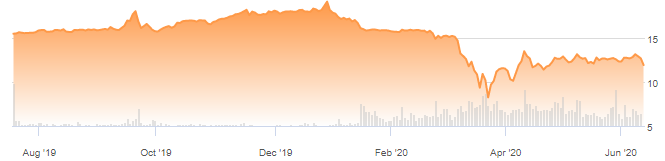

1. Main Street Capital (MAIN), Yield: 7.8%

Many income-focused investors had grown to love Main Street Capital over the years for its big, steady, monthly dividends payments, but when the coronavirus hit—the share price took a tumble. Further, the company suspended its beloved “supplemental” dividend as a precautionary measure (the ordinary dividend is still intact).

In our view, Main Street currently trades at an attractive valuation with a lot of risk already baked into the share price (and this week’s latest price drop provides a little extra margin of safety).

In particular, Main Street was well positioned going into this mess with a diversified portfolio and a conservative balance sheet. And if the company gets through this crisis (as it has gotten through previous crises), the shares have significant price appreciation potential to go along with their big monthly dividend payments to investors. For example, you can read our previous full report on Main Street here.

Nonetheless, we understand and appreciate that some investors fear another more dramatic leg lower for the market, and for Main Street in particular (considering the threat of another big wave of coronavirus outbreaks, and the negative impacts the first wave is still going to have on existing investments). As such, we shared and attractive income generating options trade idea with Blue Harbinger subscribers yesterday (i.e. we sold put options with a $25 strike price that expire in July for a big dose of upfront income ($50/contract), and the chance to own the shares at $25, if they get put to us). Regardless, for long-term investors, we believe Main Street is an attractive income-investment at its current price.

2. Horizon Technology Finance (HRZN), Yield: 11.1%

Horizon Technology Finance Corp. is a business development company that pays a big monthly dividend and offers an attractive combination of growth and income (and the shares were down over 8% on yesterday, as most all BDC’s sold off extremely heavily). Horizon generates its high income by investing in a non-traditional high-income area of the market, development-stage companies.

We like Horizon because it entered this crisis sitting on significant attractive dry powder relative to its portfolio size and has started to deploy increasing amounts of cash on new investments. The increased investment activity will lead to growth in interest income as well as dividends. The stock trades at a dividend yield of over 11% (paid monthly) which is highly attractive considering its prospects of income and dividend growth in the future. Further, its exposure to non-traditional high-income sectors of the market (expansion and late-stage ventures in technology and life sciences industries) can unlock valuable results for long-term income-focused investors. If you are looking for an attractive high-income portfolio-diversifier, Horizon is worth considering for a spot in your long-term income-focused investment portfolio. You can read our previous report on Horizon here.

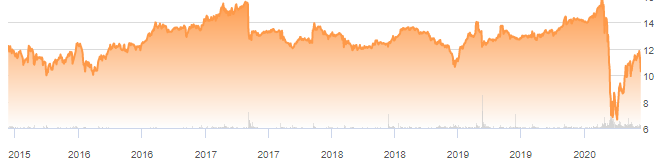

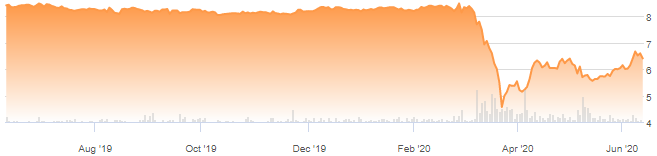

3. Hercules Capital (HTGC), Yield: 12.3%

Hercules Capital has been severely impacted by the current crisis, and its share price has plunged (it was down 7.6% yesterday).

However, Hercules sector exposures and balance sheet position suggest it may have a much easier time weathering this storm compared to other BDCs. For example, Hercules' high exposure to drug discovery and software sectors makes it less susceptible to portfolio distress in this downturn. And considering its strong liquidity position, no near-term debt maturities, high coverage ratios, and only a modest impact, relatively speaking, expected on earnings due to healthcare and tech focus, we believe both the equity and debt of Hercules are attractive and worth considering. For your reference, here is a helpful Hercules report to consider.

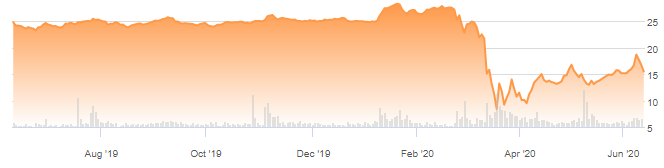

4. Saratoga Investment (SAR), Yield: 14.2%

Our thesis on Saratoga is basically that it will survive this pandemic recession, and come out healthy on the other side because it was healthy going into the pandemic and it is wisely and proactively preserving cash temporarily. It may seem unfortunate, but we believe it is wise that Saratoga has decided to temporarily defer its dividend payments (to conserve short-term cash). Many of SAR’s peer BDCs will stubbornly stick to their dividends, and could end up doing irreparable damage to their balance sheets (i.e. their share prices will lose far more than the value of the dividends). Again, no one likes a temporary dividend deferment, but the long-term total return potential (future dividends plus price appreciation) is attractive.

We also like that SAR has two Small Business Insurance Corp licenses, which will help it whether the storm better than peers. Further, the deferment may help preserve liquidity so SAR can be more opportunistic when other BDCs don’t have enough liquidity.

Similar to the income-generating options trade we described with Main Street earlier, a similar opportunity exists for SAR which we wrote about somewhat recently here.

5. Ares Capital (ARCC), Yield: 10.7%

Ares sticks out like a sore thumb within the BDC space because of its attractive big dividend and relatively lower risk as compared to other BDCs. Ares doesn’t have the highest yield in the BDC space, but it's one of the safest, most-well established and liquid BDCs, and the risk-reward trade-off makes it a highly compelling investment opportunity during this coronavirus sell-off. This week’s sell off gives another interesting entry point for investors, and you can read our previous Ares report here.

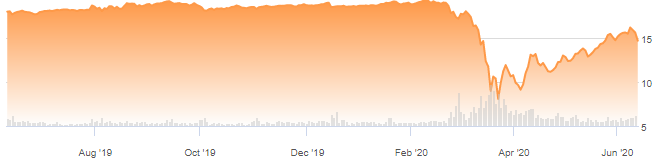

6. Owl Rock Capital (ORCC), Yield: 10.3%

Owl Rock will be impacted negatively by the coronavirus, and the full extent of those impacts is not yet know. However, the share price has declined dramatically and the valuation is particularly attractive relative to history and other BDCs. Further, Owl Rock is different than many other BDCs because it is in a strong liquidity position to weather coronavirus challenges, and will likely be in a strong position to take advantage of distressed market opportunities in the coming quarters (i.e. providing financing to companies at attractive rates that will be beneficial to ORCC shareholders). If you are a contrarian income-focused investor, Owl Rock’s big dividend is worth considering for a spot in your portfolio. You can read our detailed report on Owl Rock here.

7. Oaktree Strategic Income (OSCI), Yield: 7.9%

OSCI is a BDC managed at the firm (Oaktree) founded by famous debt investor, Howard Marx. This particular BDC invests primarily in high-yield, first lien, liquid, middle-market debt. And even though its share price has been hit hard by the COVID-19 pandemic (as most BDCs have been), OCSI has been positioning its portfolio and balance sheet conservatively for multiple years in anticipation of stressed market conditions (such as the current market environment), so it can not only weather the storm, but also so it has the financial wherewithal to be opportunistic when other BDCs cannot. This is also a big part of the reason OCSI recently proactively reduced its dividend—a good thing for new investors, in our view.

While most BDCs have been severely impacted as a result of elevated financial uncertainties in the credit markets, we believe that OCSI is less susceptible to the current downturn because of its well-diversified portfolio, the majority of its book being in first lien debt and its limited exposure to stressed sectors such as oil & gas production, travel, and leisure. The book value will likely be reported significantly higher at the end of this quarter, and the current valuation provides investors an attractive window of opportunity to capture a superior risk/reward. You can access our full report on OCSI here.

Takeaways:

BDC are risky, but they can also provide attractive high income if selected carefully. And within the current market environment, there are some particularly attractive opportunities, such as those described in this report. In particular, liquidity will be the name of the game during this time of distress. Specifically, BDCs need enough liquidity to support their existing portfolio companies. Further, those with extra liquidity will be able to take advantage of BDCs that are short on liquidity, by purchasing their attractive assets at highly discounted “fire sale” prices. No one knows where the market will be tomorrow, but a few quarters from now, many high-quality BDCs will likely be trading at significantly higher prices than they are today. You can view all of our current holdings here.