As market narratives continue to focus on “second wave” coronavirus risks, stocks are selling off hard. We’d been enjoying a strengthening rebound up until last week, and this week is starting off down again. However, some businesses will be impacted less than others. This report shares an attractive upfront income-generating options trade on a business that will weather the storm thanks to its critical nature, strong cash position, long-term leases and the fact that it may benefit as many of its peers struggle. We believe this is an attractive trade to place today and potentially over the next several trading sessions, as long as the underlying stock price doesn’t move too dramatically before then.

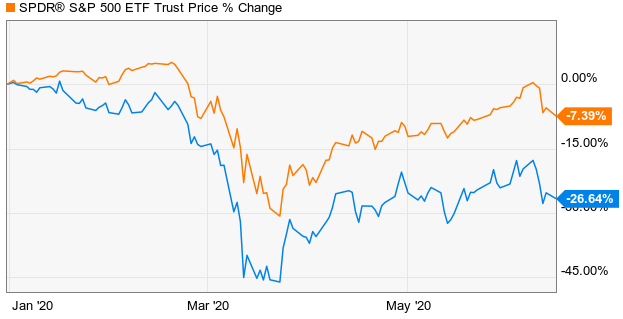

The blue line in the chart above is the year-to-date total return of intermodeal shipping company, Triton International (TRTN).

The Trade: Triton International (TRTN)

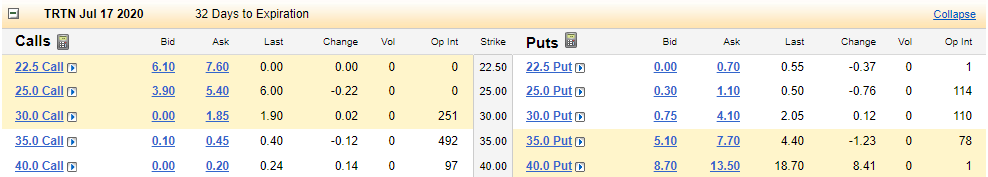

Sell Put Options on Triton International (TRTN) with a strike price of $25 (~15.2% out of the money), and an expiration date of July 17, 2020, and for a premium of $0.25 (this comes out to 12% of extra income on an annualized basis, ($0.25/$25 x (12 months, annualized). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of TRTN at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own TRTN, especially if it falls to a purchase price of $25 per share).

Your Opportunity:

We believe this is an attractive trade to place today and potentially into early next week as long as the price of TRTN doesn't move too dramatically before then, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) of approximately 12%, or greater.

Our Thesis:

Our thesis is basically that Triton’s share price is already attractively low as compared to strong cash position and long-term leases with customers. Further, despite the economic impacts of the coronavirus, international trade will still continue, and Triton is a critical part of the supply chain (it’s the biggest intermodal shipping container company). Even though Triton will face ongoing near-term challenges from the coronavirus, its share price already reflects a lot of potential damage, and if the shares were to fall to $25 and get put to us, that would be an extremely attractive price on a relatively very attractive big-dividend payer. We recently wrote in great detail about Triton, and you can access that full report here: Triton International.

Important Trade Considerations:

Please also keep in mind, options contracts trade in lots of 100, so to secure this trade with cash (in case the shares get put to you and you have to buy them) you’ll need to keep $25 times 100 on hand (the strike price times an options contract lot of 100). You’ll also need to be comfortable holding that many shares in your account from a position-sizing / risk management standpoint. Alternatively, if your account is approved for margin (borrowing) you don’t need to keep the cash on hand in case the shares get put to you, just know that if they do get put to you—you’ll buy them “on margin” and get charged the borrowing interest rate in your account (some investors are okay with this, others simply prefer to keep the cash on hand).

Two additional considerations when selling put options are dividends and earnings announcements because they can both impact the share price and thereby impact your trade. In this particular case, earnings is largely a non-issue because TRTN isn’t expected to announce earnings again late July (after this contract expires). And Triton won’t go ex-dividend again until after this contract expires. Had either of these expired before the options contract expires, we’d have to be comfortable that we were earning enough upfront premium income to account for these volatility risks.

Conclusion:

Triton is an important part of the global trading supply chain, and demand for its services simply will not dry up. Further, its share price has already declined significantly to account for pandemic economic risks. Further still, Triton is in a strong position financially (they’ve got plenty of cash), and Triton may also benefit as its peers face challenges (Triton is the biggest player in the space, and benefits from financial strength and customer trust, especially relative to its smaller peers).

We do not currently own shares of Triton International, but we do own the series A preferred shares of Triton (as described in the report we linked above). We continue to believe the preferred shares are attractive (they yield over 8%, the common shares yield over 7%) but the preferreds to do not have the attractive price appreciation potential of the common. In particular, it is the recent share price sell off and volatility for the common, that makes the upfront premium income so attractive on this trade (as fear and volatility increases, so does up front premium income in the options market.

If you are uncertain about pulling the trigger on a normal buy order, you might consider this trade instead. It allows you to generate attractive upfront premium income that you get to keep no matter what. And this options trade also gives you a chance of picking up shares of this attractive long-term high-dividend stock at an even lower price, if the shares fall even further than they already have, and they get put to you at $25. And at a price of $25, Triton is an extremely attractive long-term investment.