If you count the recently declared ordinary and supplemental dividends, popular Business Development Company (“BDC”) Gladstone Investment Corp (GAIN) yields approximately 9.0%. And this is tempting to a lot of investors considering it pays monthly, the price is still down, and it appears to be in a strong liquidity position. However, GAIN’s portfolio of middle market companies is at risk of being negatively impacted by the coronavirus—more so than other BDCs. In this report, we analyze Gladstone’s business model, the coronavirus impacts, valuation, dividend safety and additional risks. We conclude with our opinion about investing.

(Note: For reference, here is a PDF version of this report).

Overview:

Gladstone was founded in 2005 and is headquartered in McLean, Virginia. Its current portfolio totals $566 million, and is invested in 28 companies across 14 industries. Gladstone provides debt financing and equity capital to mature, lower middle market companies with an EBITDA of $3 to $20 million and $20 to $100 million in revenue.

Source: Gladstone Investment Corporation

The company is primarily focused on buyouts (~over 70% of the investment portfolio is made up of control transactions) and thus it provides a substantial portion of the debt and equity to facilitate the buyouts it participates in. It aims to maintain 75% investment in debt securities and 25% in equity securities per buyout transaction with equity (typically preferred) providing capital gain and debt providing consistent interest income. The company also invests in second lien debt along with first lien debt. The weighted average yield on debt investments stands at 11.4%.

GAIN is managed externally by Gladstone Management Corporation (which earns fees in return for advisory services), and administration services are provided by Gladstone Administration, LLC. Both companies are affiliates of Gladstone Investment Corporation.

What Is A Business Development Company (BDC)?

A business development company is a closed-end investment company that invests in privately owned, lower middle-market and middle-market companies, providing them capital to grow or recapitalize.

What Are the Advantages of Investing via a BDC?

High dividend yields, as BDCs are required to distribute 90% of their profits to shareholders as per governing law.

Being a regulated investment company, a BDC is not required to pay corporate income tax on profits.

They offer diversification as the portfolio consists of companies belonging to varied industries.

Experienced Investment management teams.

Fair amount of liquidity and transparency as BDCs are traded on public exchanges, unlike venture capital funds which are privately placed.

As they are traded on stock exchanges, periods of volatility can lead to shares of BDCs trading at attractive discounts to NAV.

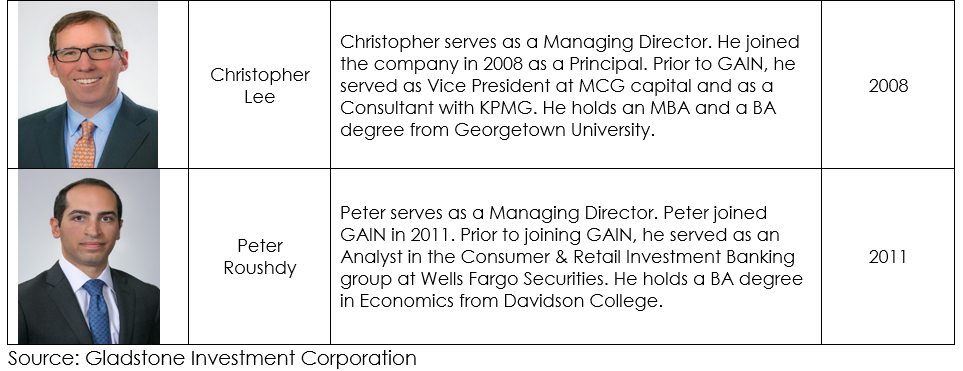

Seasoned Investment Team

The senior investment team has been investing together at GAIN for over 10 years. Notably, they did successfully steer the business through the great financial crisis in 2008/09.

Concentrated portfolio and higher exposure to junior tranches make the company’s cash flows more volatile

GAIN runs a concentrated book with only 28 portfolio companies which provides a low level of diversification, especially as compared to other BDCs. Solvency issues for one or two top positions can have a disproportionate impact on the company. GAIN’s largest portfolio company accounts for 8% of the total portfolio, and the top 5 companies account for 36.5% of the total investment portfolio. These are particularly concentrated risks as compared to other BDCs. The average investment size per portfolio company stands at $21.8 million. Below are the top five holdings:

Source: Gladstone Investment Corporation

Below is the industry classification of the total portfolio investment at fair value:

Source: Gladstone Investment Corporation

The company typically invests around 25% of its book in equity and is the lead investor in the buyouts it participates in. The company also has a large exposure to second lien debt. Combined, the company’s exposure to common, preferred equity and second lien debt account for half of the company’s portfolio. Higher exposure to junior categories of capital in middle market companies clearly increases the level of risk in the current downturn.

Dividends maintained for now but earnings risk not trivial

Gladstone’s stock decline so far resembles that of most BDCs. For example, after falling more that 50%, it recovered somewhat but is still down 14% versus its share price at the end of January.

Given the company’s concentrated book, as well as higher exposure to junior traches of the capital structure, there is bound to be some impact on the company’s income prospects over the next few quarters.

“As far as interest income, obviously, we - to the extent - any of the companies we might need to help them a little bit with either some adjustment on their interest income, we'll do that as well. So overall, some potential decline in income, yes, one might expect that just because of the circumstance…..given our liquidity situation, and where we are, again, we're going to do whatever we need to do to help the portfolio companies.“ - David Dullum, President, Q4 2020 call

Having said that, the company so far has seen minimal disruption in terms of the need for liquidity support to portfolio companies or delay in interest payments.

“So far, we've not had to provide much support either through additional investment or some accommodation on interest obligations that they may have to us, in other words, the debt securities.” - David Dullum, President, Q4 2020 call

Finally, David Gladstone, CEO, on the latest call cautioned analysts by highlighting the futility of forecasts right now “So I feel for you trying to make a projection.”

We reviewed the company’s portfolio holdings to get a better sense of the impact of COVID-19 on its business. While most companies in the portfolio will see an impact, the companies listed below which account for over 30% of the portfolio value are likely to see a direct, disproportionate impact over the next few quarters. That is not a small direct exposure and we believe earnings risk over the next 12 months in not trivial.

Source: Gladstone Investment Corporation, Blue Harbinger Research

We believe that there is a good chance that several of these portfolio companies will ask GAIN for interest deferrals over the next two quarters. While the company has not tinkered with the dividends for now, we believe that it is just a matter of time.

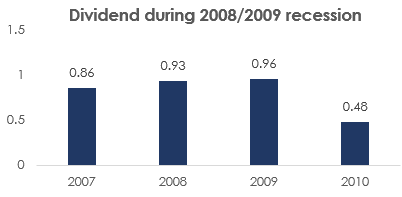

Despite near term risk, business is positioned better now than it was in the 2008 recession

Gladstone delivered disappointing performance for shareholders during the global financial crisis with a dividend cut of 44% due to a decline in investment income from 2007 to 2010. The majority of the decline was the result of the company’s forced exit from the syndicated loans market at a haircut given drying up of funding. The exit resulted in a decline in the company’s earnings base and dividends.

However, over time GAIN has improved its business strategy and balance sheet position. The company stopped investing in low yield syndicated loans and moved its focus entirely to providing debt and equity in buyout situations in lower middle market companies with positive cashflows.

Since FY 2011, the company’s performance has been stable with a consistently rising dividend per share. On equity side, the company has delivered a strong average buyout exit cash‐on‐cash equity return of 4.4x. Supplemental dividends to account for capital gains have also amplified shareholder returns.

Conservative balance sheet & adequate liquidity

As of March 31, 2020, Gladstone had total borrowings of $54.3 million and mandatorily redeemable preferred stock outstanding of $129.2 million. GAIN’s leverage remains at just 36% of total assets and therefore even in a difficult macro environment we do not expect the company to face distress.

Also, there is no significant near-term maturity and the company has $137.6 million available under credit facilities, thereby enabling Gladstone to provide sufficient liquidity to portfolio companies, as well as tap new investment opportunities at favorable terms. This strong financial position may enable GAIN to support the current dividend level even if NII per share declines temporarily. However, GAIN may actually choose NOT to use internal accruals to support dividend payment as the company prioritizes conserving cash and supporting portfolio companies in trouble.

Attractive dividend yield however not adequately compensating for heightened COVID-19 risk

The company has announced that it will be maintaining its $0.07 monthly dividend as well as paying out a $0.09 supplemental dividend in June 2020. Assuming no cuts, these announcements translate into a 9% annualized dividend yield at current prices as compared to historical yield of ~8.5%. Additionally, the stock is trading at price-to-NAV of ~1.0 compared to an average price-to-NAV of ~0.85. Given the portfolio concentration, as well as macro weakness, we would have liked to see a sizeable discount to historical valuation.

Additional Risks:

Prolonged impact of COVID-19: If coronavirus-lockdowns last longer than expected, the company’s earnings and potential dividend cuts could be quite pronounced.

Highly concentrated portfolio: Due to the limited number of portfolio companies and high dependence on company-specific performance, downside risk during a recession is significantly higher than is the case is at a well-diversified BDC.

Conclusion

Given the uncertainties associated with future earnings, the risk of future dividend cuts, and a lack of “valuation discount” relative to its own trading history, we believe the current risk-reward of GAIN is subpar and investors should not allow the big monthly dividend payments to distract them from the underlying fundamentals. We believe management will likely be able to navigate the business through the current challenging economic environment, but there will also likely be significant coronavirus damage in the process (over the next two quarters, and potentially beyond). If you own shares, and have enjoyed the rapid rebound off the initial coronavirus lows—congrats. However, now may NOT be the best time to add to your position.