The coronavirus has created major challenges for some sectors more than others, and property REITs have been hit hard. Uncertainty has lead to fear, dramatically lower market prices, and high upfront premium income available in the options market. This report shares an attractive options trade on an compelling big-dividend REIT. We believe the this is an attractive trade to place today, and potentially into early next week, so long as the underlying stock price doesn’t move dramatically before then.

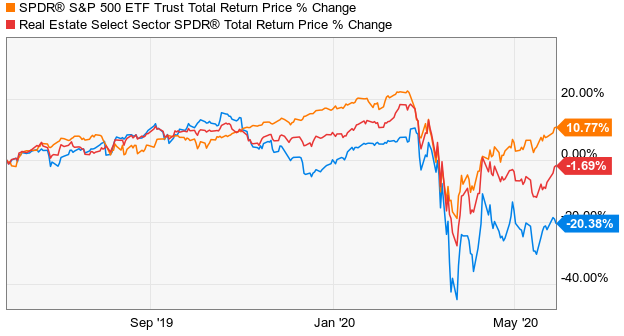

The blue line in the chart above is the 1-year total return of W.P. Carey (WPC).

The Trade: W.P. Carey REIT (WPC)

Sell Put Options on WP Carey (WPC) with a strike price of $55 (12% out of the money), and an expiration date of June 19, 2020, and for a premium of $0.70 (this comes out to over 15% of extra income on an annualized basis, ($0.70/$55 x (12 months, annualized). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of WPC at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own WPC, especially if it falls to a purchase price of $55 per share).

Note: If you want higher upfront income, and a higher chance of having the shares put to you, consider selling the $60 put instead.

Your Opportunity:

We believe this is an attractive trade to place today and potentially into early next week as long as the price of WPC doesn't move too dramatically before then, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) of approximately 10% to 12%, or greater.

Our Thesis:

Our thesis is basically that the world will eventually recover from the coronavirus (albeit with some new social norms) and WPC’s share price is trading too low based on shortsighted market views (mainly fear). And it is when fear (and volatility) is higher, that premium income on options trades rises.

We recently wrote in great detail about WP Carey, just as the coronavirus was starting to take hold around the world, and you can read that full detailed report HERE. Since that time, the shares have continued to trade dramatically lower based partially on real negative impacts, but also based on too much shortsighted fear.

WPC has a strong balance sheet (e.g. well laddered-future debt maturities and plenty of cash on hand), a well diversified portfolio of strong tenants, a strong management team, healthy (recently reaffirmed by S&P) credit ratings, and the quarterly dividend of $1.04 is well covered by adjusted FFO of $1.25. There will absolutely be a significant hit to FFO during the rest of 2020 (this is why management pulled guidance), but in our view WPC will survive, and eventually thrive

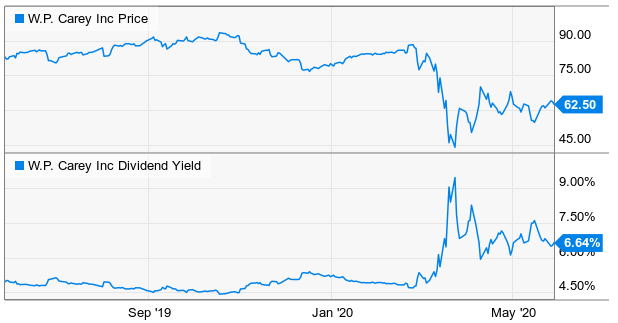

For your consideration, here is a recent chart of WPC’s price to adjusted-FFO ratio, and as you can see—a lot of negativity has already been priced in.

source: WPC and Yahoo Finance (Note: each quarterly AFFO number has been annualized).

We like this trade because WPC’s share price is down (especially relative to FFO) over the last three months, but also because it’s down over the last two days, which is helpful to the option premium income available.

According to WPC’s CEO Jason Fox (during this month’s quarterly earnings release presentation):

Based on the initial performance of our tenants and the conservative positioning of our balance sheet, we are confident we will continue to have sufficient liquidity and importantly flexibility as we navigate the challenging environment ahead.

Also worth mentioning, Fox also explained:'

From a capital allocation perspective we've historically seen some of our best opportunities during downturns and periods of market stress. We’re staying engaged with brokers and potential sellers. And we're very focused on new opportunities to come to market and how they're priced although the capital markets have been volatile.

Important Trade Considerations:

Please also keep in mind, options contracts trade in lots of 100, so to secure this trade with cash (in case the shares get put to you and you have to buy them) you’ll need to keep $55 times 100 on hand (the strike price times an options contract lot of 100). You’ll also need to be comfortable holding that many shares in your account from a position-sizing / risk management standpoint.

Two additional considerations when selling put options are dividends and earnings announcements because they can both impact the price and thereby impact your trade. In this particular case, they are both largely non-issues because WPC isn’t expected to announce earnings again until after this contract expires, and it won’r go ex-dividend again until the end of June (also after this contract expires). Had either of these events been scheduled for before this options contract expires, we’d need to be comfortable with the added risks (i.e. we’d need to receive more upfront premium income on the trade).

Conclusion:

WPC is a financial strong, well-managed, REIT that will weather the coronavirus pandemic far better than many of its smaller weaker peers. And WPC has come under too much selling pressure from shortsighted investors.

We currently own shares of WPC, but if you are uncertain about pulling the trigger on a normal buy order, you might consider this trade instead. It allows you to generate attractive upfront income that you get to keep no matter what. And this options trade also gives you a chance of picking up shares of this attractive long-term big-dividend REIT at an even lower price, if the shares fall even further than they already have, and they get put to you at $55. And at a price of $55, WPC is an extremely attractive long-term investment.