Welcome to all new members. We've made a couple small updates to the data in our Portfolio Tracker tool, and we wanted to take a moment to highlight them. We'll also use this update to share a few quick highlights about our current portfolio holdings.

Portfolio Tracker Tool:

For starters, here is the link to the updated Portfolio Tracker tool (you can also access the tool using the link on the main members landing page). If you launch the tool, you will see our current portfolio holdings (including real time pricing and recommendations) on the first tab.

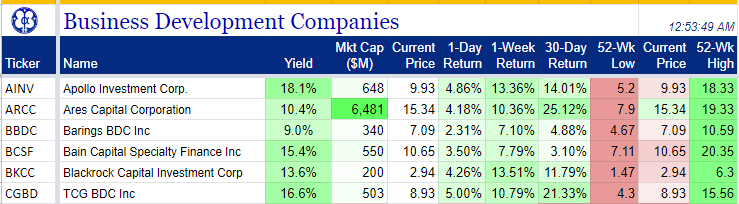

Tabs 2 and 3 include more data on performance and risk management. And the last 5 tabs include real time pricing separated by categories including BDCs, REITs, Energy, Shipping and S&P 500 stocks with dividend yields of at least 4.0%

It is these last 5 tabs that we have updated. First, we added the market capitalization for each security (this data updates in real time). Second, we updated the dividend information on the last 5 tabs based on the latest information from Stock Rover (Stock Rover and Google Finance are the main data sources for the tool). Please understand that the dividend amounts are being updated much more frequently lately due to the economic impacts of the coronavirus pandemic, and you should be sure to always double check another data source (such as Seeking Alpha, CNBC, yahoo Finance, etc) before making any buy or sell decisions. Our goal in creating these tabs is just to give you a real time tracking tool to help you make your own investment decisions.

Portfolio Holdings Highlights:

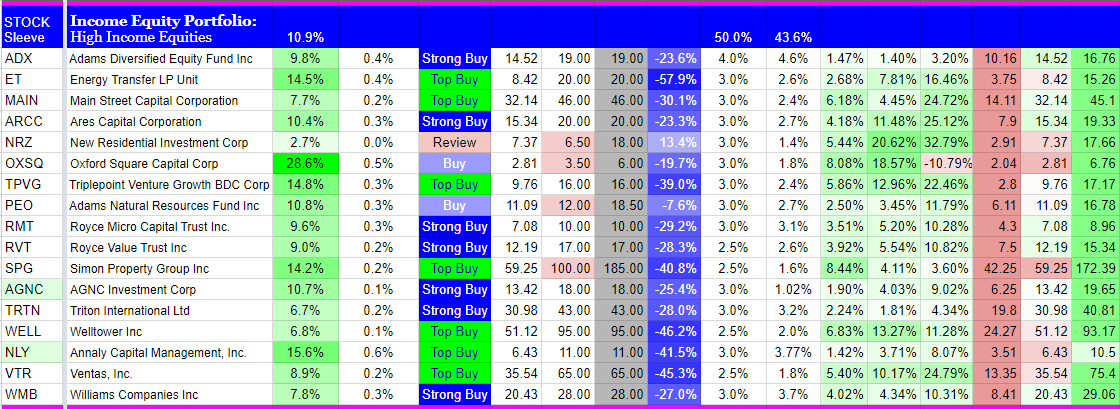

Worth mentioning, if you look on the Master Portfolio tab of the Tracking Tool, you'll see that almost all of our holdings are up significantly over the last month and especially the last week. This is especially true for the "High Income Equity" sleeve of our Income Equity Portfolio. High Income Equities were among the hardest hit by the pandemic, but as more states begin their phased re-openings, "high income equities" are just getting started in terms of a rebound. Of course there will be volatility, but we believe these stocks have considerable upside from here. You can see our specific recommendations for each position we own (i.e. Top Buy, Strong Buy, Buy, Hold and Review). These ratings also update in real time as the market moves based on the "Buy Under" prices we have set. From time to time, we update the "Buy Under" prices too based on our research, but we leave the original "Buy Under" prices in the spreadsheet for your reference.

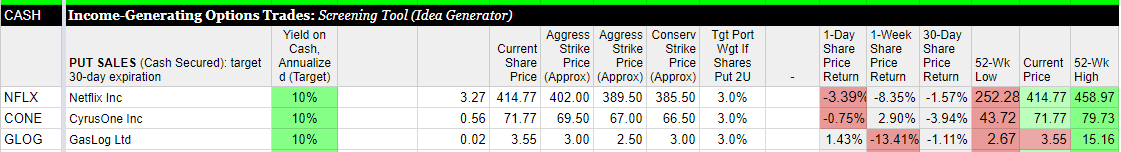

Also worth mentioning, from time to time we do share "income-generating options trades" with members, and that is the reason behind the green and black option trade sections on the master sheet.

Specifically, based on market prices, and our views on the securities we like, the option trade section of the Master Portfolio tab automatically suggests a few potential options trade ideas (i.e. selling income-generating put options or selling covered call options). However these are just model-driven suggestions, and we always roll up our sleeves to review the latest fundamental and technicals before suggesting any income-generating options trades via a formal report. Also worth mentioning, we highlight a few "Income Via Growth" stocks at the bottom on the Master Portfolio Tab. Some investors like to generate some of their income through long-term growth stocks (i.e. selling some of their winners) and that is the reason behind the growth stock suggestions. Those ideas are generally updated once per month, within a few business days of month-end.

High Level Market Thoughts

Obviously the market has been challenging this year, and dividend stocks have been hit particularly hard. This raises two very important points. First, as long-term investors, we encourage people to stay disciplined--and stick to their long-term plans (and goals). For example, if you panicked and sold all your high-income equities at the end of March--then you have missed out on the powerful rebound that has been occurring and has more room to run. Secondly, if you have money to invest right now, high income securities remain particularly attractive, and we work hard to highlight attractive opportunities for you to consider for your own investment portfolio.

Please feel free to reach out with any questions, comments, concerns, recommendations or ideas. The comments section of each article is a great place to give and share information. Lastly, and importantly: disciplined long-term investing has proven to be a winning strategy over and over again throughout history. Know your goals as an investor, and stick to your plan. Be smart, don't make "unforced errors." We'll continue to share attractive investment opportunities with you as they arise, and for you to consider.

Stay safe during this ongoing pandemic.