This article shares our Top 10 compelling mREITs and Bond CEFs. They trade at significant discounts to their book values and are being supported, to varying degrees, by the actions of the US Fed. The Fed is pumping an unlimited amount of liquidity into the system by buying the types of bonds these compelling mREITs and CEFs own.

The COVID-19 pandemic has been devastating to lives and markets. An approximate resolution date is unknown, and the full extent of market damage is yet to be determined. The market “fear index” (VIX) remains dramatically elevated—an indication that investors expect continued high volatility. We write this article from the perspective that this too (the coronavirus pandemic) shall pass (eventually), and that it is much easier (and systemically important) for monetary policies to support some of the underlying assets (e.g. Agency MBS) of the mREITs and Bonds CEFs we review in this article than supporting non-publicly-traded business loans (such as those held by high yield BDCs (BDCS) for example). Every investor gets to make their own investment decisions (in accordance with their own needs and objectives), we hope to share some helpful information and ideas, and we agree with famous value investor, Seth Klarman, when he explains:

“Paying Less is Less Risky: Risk comes from the price you paid… It isn’t uncertainty or volatility. When there is great uncertainty and it drives prices down, you buy with less risk.”

Helicopter Fed:

(image: FX Trader Magazine)

Helicopter money (first coined by Milton Friedman in 1969) is “a proposed unconventional monetary policy, sometimes suggested as an alternative to quantitative easing (QE) when the economy is in a liquidity trap (when interest rates near zero and the economy remains in recession).” And along these lines, to backstop the financial system, the US Fed has recently been buying massive amounts of bonds and has pledged to do so in unlimited quantities and across essentially all security types. More specifically, the Fed has recently been buying Agency Mortgage Backed Securities (Agency MBS) and now even corporate bonds (and potentially even below investment grade bonds), exactly the types of securities that make up significant portions of the balance sheets of the mREITs and CEFs we will review momentarily.

Importantly, the recent distress in the bond markets (for example, see the credit spread charts below) has been caused by the coronavirus, exacerbated by low oil prices and magnified by a drying up of liquidity. Regarding liquidity, as bond owners have attempted to unload their positions, they’ve been unable to find enough buyers, thereby leading to lower (in some cases “fire sale”) prices. The Fed has been working to pump liquidity back in the system by being increasingly active in the repo market and announcing its unlimited buying power in an attempt to restore confidence (and liquidity) to the market. However, anecdotally, the fact that so much bond trading volume occurs out of New York, a city that’s been shut down by the pandemic, price-discovery and liquidity has remained extraordinarily challenging (especially considering many bond traders simply cannot trade from home (because they don’t have the systems and technological security in place). When liquidity returns to normal, it results in a significant gap up for bond prices.

Also worth mentioning, the Fed has most recently opted to NOT provide liquidity to mortgage services, which is an important piece of information when we get into specific mREIT opportunities later in this report.

Credit Spreads

As you can see in the following chart, the credit spread (the difference in yield versus treasuries) has been elevated for Agency (blue line) and non-Agency MBS (green line) due to stress in the markets.

(source: FactSet)

Interestingly, the spread has returned closer to normal levels for Agency MBS, but not so much for all MBS (including non-Agency MBS), again an indication of perceived risk due to stress in the markets. And for perspective, here is the same chart going back to 2005 so it includes the credit market stress of late 2015 to early 2016, as well as the financial crisis (2008-2009).

(source: FactSet)

Again, the current difference in spreads between Agency MBS and non-Agency MBS will be important when we get into specific investment opportunities in this report.

PIMCO Bond CEFs:

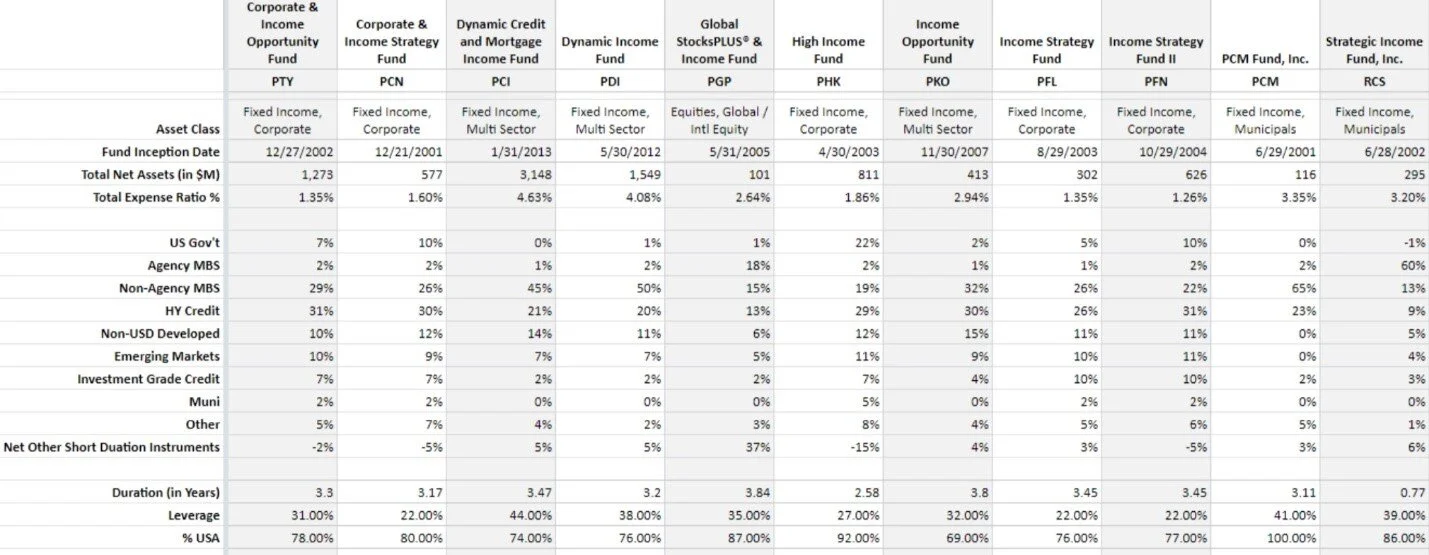

Here is a recent chart showing popular PIMCO Bond Closed-End Funds (“CEFs”) and their allocations to Agency and non-Agency MBS, as well as other investment types.

(source: Alpha Gen Capital)

Notice the varying allocations of these funds to both Agency MBS and non-Agency MBS (among other asset types). This is important as it relates to the Net Asset Values (NAVs) of the funds and the various discounts to NAV (which has recently been driven a lot by fearful sellers). Also, critically important, it is our view that as the Fed pumps liquidity into the market, it will flow not only into the asset classes they’re buying, but it’ll help liquidity flow into other assets classes, thereby increasingly liquidity and bond prices across the board (according to this article, it is to “grease the wheels of the credit market,” and “to avoid the type of credit crunch seen after the collapse of the financial system in 2008.” Further, the Fed has taken a whatever-it-takes stance, they’ve been expanding their purchases into other asset types (including corporate bonds), and even former Fed chair Janet Yellen thinks it could make sense for the Fed to even eventually expand into even stock purchases to help support the market if warranted. This is reassuring to some investors and terrifying to others, but it demonstrates the Fed’s whatever-it-takes approach.

Mortgage REITs (mREITs):

Many popular, big dividend, mREITs also invest heavily in Agency MBS and non-Agency MBS. One of the critical differences here is that mREITs generally only report NAV (or book value) quarterly instead of daily like the Bond CEFs. For this reason, there is a lot less transparency. Another big difference is that Bond CEFs (such as the examples above) generally own mostly publicly traded assets, so there is daily price transparency to their underlying assets, whereas many mortgage REIT assets are often not publicly traded and not nearly as liquid. For example, the mortgage servicing rights (MSRs) of New Residential (NRZ), which we warned investors about just a few short months ago (before this whole mess began).

These are important distinctions (i.e. NAV transparency and liquidity) when we compare the price discounts of mREITs to Bond CEFs. Even though they can own some of the exact same assets, it’s not exactly apples-to-apples, yet the comparisons can be meaningful, as we will explain later in this report.

For a little more perspective, here is a look at the recent performance of many mREITs (and it has been absolutely ugly).

10. PIMCO Strategic Income Fund (RCS), Yield: 15.7%

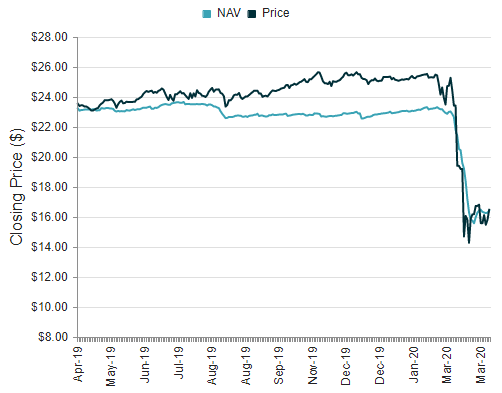

Reverting back to bond CEFs for a moment, PIMCO’s RCS is particularly interesting (and in many regards attractive), especially considering its relatively large allocation to Agency MBS (as you can see in our earlier CEF table, it was recently as high as 60% for Agency MBS). Remember, the Fed has been purchasing massive amounts of Agency MBS in an effort to pump liquidity back into the system (recall, as the current pandemic crisis spread throughout the credit markets, buyers disappeared, and sellers drove the price lower). You can get some perspective to the market’s aversion to Agency MBS in our earlier Agency MBS credit spread chart. And one place this fearful selling was particularly apparent was in PIMCO’s Strategic Income Fund.

As you can see in the following chart, both the price and NAV of RCS plummeted as fears related to the coronavirus pandemic ramped.

(source: CEF Connect)

Very important to note, RCS normally trades at a wide premium to NAV (as you can see in the chart above), but that premium shrunk as selling pressure intensified.

Part of the issue with RCS (and basically all PIMCO bond CEFs) is the use of leverage (or borrowed money) to magnify returns. There is some concern that these funds will receive margin calls to keep leverage levels under mandated limits and that the funds will be forced to sell assets at ugly fire sale prices to meet margin calls. However, unlike the mREITs we’ll cover in a moment, PIMCO is a well-seasoned pro in utilizing the repo market, which provides short-term cash but doesn’t necessarily impact leverage ratios, and it’s a place where the Fed has been increasingly active in recent weeks to help support liquidity in the credit markets. Plus, these bond CEFs don’t use nearly as much leverage as many mREITs (more on this in a moment).

Importantly, as we mentioned early, we believe the Fed’s whatever-it-takes approach, to pump liquidity into the system, will flow beyond only the asset types it has been heavily buying (e.g. Agency MBS and treasuries), and into essentially all of the asset classes this fund invests in. We believe RCS will benefit in three ways. Specifically, as liquidity flows into the system—bond prices (and RCS’s NAV) will rise, as the coronavirus eventually abates—bond price (and RCS’s NAV) will rise further, and thirdly, as fear subsides—this fund will again trade at a larger premium to NAV, thereby providing further price appreciation for investors. Not to mention, it’ll continue to pay a large monthly yield to investors. We’ll discuss bond CEF risks in more detail later in this report, but RCS currently presents an attractive opportunity for income-focused investors.

9. PIMCO Dynamic Income Fund (PDI), Yield: 12.1%

Another attractive PIMCO fund (that we wrote about back on March 20th) is the Dynamic Income Fund. In that article, we explained that we like the fund for many of the same reasons we like RCS.

(source: CEF Connect)

Specifically, even though PDI holds only a small amount of Agency MBS, we believe the Fed’s actions will improve credit markets almost across the board, and PDI will continue to benefit. More specifically, PDI’s price will keep increasing as liquidity is pumped into the system by the Fed, PDI will benefit as the coronavirus pandemic will eventually be brought under control, and PDI will benefit as fear eventually recedes and it reverts to trading at a larger premium to NAV. PDI pays monthly, and it continues to present an attractive investment opportunity if you are an income-focused investor. Not only will it keep paying big monthly income distributions, but we expect its share price to rise significantly in the quarterly ahead.

8. AGNC Investment Corp (AGNC), Yield: 16.8%

AGNC is an internally-managed mortgage REIT that invests predominately in Agency MBS. And again, this is one of the main markets the Fed is working to support. Agency securities are issued by government-sponsored entities (e.g. Fannie Mae, Freddie Mac and the Federal Home Loan Bank), and they are the highest credit quality debt instruments after treasuries. Here is a snapshot of AGNC’s investment portfolio from the most recent quarterly earnings presentation, and as you can see, AGNC owns predominately Agency MBS.

In our opinion, AGNC is in a much stronger position that other mREITs, and one reason is because it owns primarily government Agency MBS (which is safer than non-Agency MBS).

However, we have a lot less transparency into what AGNC currently owns (compared to the bond CEFs we just reviewed) because the AGNC generally only reports its book value quarterly (not daily). But due to the current market situation, AGNC CEO Gary Kain recently revealed on April 1st, he estimates his firm book value at $12.35-$13.25 (down from $18.69 at the end of the last quarter). The shares recently traded at $11.20, representing a 12.5% discount to the estimated book value, but a 40% discount to last quarter. Given the transparency around what AGNC holds (mostly Agency MBS), and the assumption that Agency MBS spreads will continue to decline (and prices rise) as the pandemic eventually recedes, these shares could have significant upside price appreciation potential from here. Historically, the shares trade close to book value. In our view, AGNC currently presents an attractive opportunity if you are an income-focused investor that also likes price appreciation. We believe the book value and price both go significantly higher from here.

7. New York Mortgage Trust (NYMT)

If you have owned NYMT this year, you’ve experienced some serious pain as the shares have fallen from over $6 to under $2. The firm reported it was hit with margin calls and was forced to relinquish some assets at fire sale prices. As a result, the shares are not going back anywhere near $6 anytime soon, however we do suspect they are going dramatically higher. NYMT recently estimated its book value (as of March 31st) to be roughly $3.87 per share, which is almost 100% higher than its current market price. For reference, here is a look at the firm’s holdings as of the last reported quarter (year-end), which include a significant allocation to Agency MBS.

This REIT is down, but appears not to be out. If you are looking for some income and powerful price appreciation potential, consider holding your nose and buying NYMT.

There are Risks:

Of course, there are significant risks to investing in these mREITs and bond CEFs. For one, they all use leverage (borrowed money) which can magnify the returns in the good times, but also magnify losses in the bad times. It wasn’t that long ago that we went through the Financial Crisis of 2008-2009, and one of the outcomes was that big banks were no longer allowed to use as much risky leverage as they once did. However, mortgage REITs picked right up where the banks left off. The mREITs are generally more risky than the bond CEFs because they use dramatically more leverage, they tend to be less diversified, and their assets are often more unique and less liquid. This is why the mREIT sell off has been more dramatic (in many cases) than the bond CEF sell off. However, now some mREITs have dramatically more upside, although many bond CEFs (such as those highlighted in this article) have significant upside too.

Another risk is that the market environment gets even worse than it already is. No one knows the final extent of the coronavirus damage to the economy except that it will be enormous. Further, there is no guarantee that the Fed’s helicopter money approach will be successful. As mentioned, to some investors, the Fed’s whatever-it-takes attitude is more frightening than reassuring. However, from our standpoint, we are not betting against the Fed.

Book value declines and distribution reductions are coming. For the Bond CEFs, we can already see the book value (or NAV) reductions on a daily basis. However, we don’t have full transparency into the mREITs, and things could be far worse than investors realize. However, based on the preliminary book value estimates, many mREITs have sold off too far, and now offer significant price appreciation potential (although some will not return to pre-coronavirus levels anytime soon as a result of distressed fire sale prices to meet leverage margin calls). Further, there will be more dividend and distribution reductions, however this is par for the course, and many of the yields will remain attractive even after being reduced considering the significantly lower (attractive) prices.

Regarding bond CEFs, a lot of them are extremely attractive right now, although they come with their own risks. Perhaps the most frustrating is the high management fees they can charge. Also, it’s important for investors to understand that these are mostly income vehicles, and not necessarily long-term price appreciators, although the current panic fear-driven low prices have created the potential for rare and attractive price appreciation in the quarters ahead.

Fed actions are another risk. Some mREITs (particularly service providers) have been anticipating stimulus for their industry that may never come. For example, Colony Capital (CLNY) recently gave up on its hope for Commercial MBS relief from the Fed. Further, the Fed’s ever-expanding asset purchases will impact different mREITs and Bond CEFs differently. Although we believe once liquidity starts flowing in the asset classes the Fed is buying, almost all credit market asset classes will benefit.

6. New Residential (NRZ)

At the end of December, we warned investors about the risks of New Residential, and encouraged them to stay diversified (i.e. don’t dump your whole nest egg into NRZ).

We just didn’t expect the market to turn so ugly, so quickly. And since that article, NRZ’s share price has plummeted, and the quarterly dividend has been slashed to $0.05 from its previous $0.50.

(source: Seeking Alpha)

And considering the damage that’s already been done (NRZ has been forced to sell assets at fire sales prices), we don’t expect the shares to return to their pre-COVID-19-crisis levels anytime in the near future, but we do expect them to go much higher from here.

In our view, NRZ is currently an “Opportunistic Buy” as a short to medium-term opportunistic play. Our expectation is based on the most recent price to book value estimates. The firm generally trades at around 1x book value, however the price was recently around $5 while management estimates the book value to be approximately $11.75 per share (down from $16.21 at the start of the year). Management states they are in book value protection mode, and considering the market has shown some recovery strength recently (i.e. good for book value), we believe these shares will rise closer to book value in the coming quarters.

We are encouraged to see NRZ management buying their own shares, but NRZ is not out of the woods yet. There was some consideration that the Fed may provide a liquidity facility for mortgage servicers considering they still have to come up with interim cash flow while the CARES Act is essentially forbearing mortgage payments for homeowners. But considering servicers are not too big to fail, the Fed has opted against such a facility and is allowing liquidity to work its way through the markets and then leaving servicers to fend for themselves. However, considering the ongoing liquidity efforts of NRZ (e.g. selling assets and cash on hand) and the seemingly strengthening market conditions, we expect NRZ to pull through and for the shares to rise towards book value in the coming months, assuming market conditions do not take a more dramatic turn for the worse. NRZ shares aren’t reverting back to pre-pandemic levels anytime soon, but we do expect them to go dramatically higher from here in the quarters ahead (and there is some expectation for the dividend to steadily be raised as the liquidity crunch eventually recedes).

5. BlackRock Credit Allocation (BTZ), Yield: 8.4%

This bond CEF invests across investment grade and below investment grade assets (as you can see in the holdings breakdown graphic below.

(source: BlackRock)

We like it because it pays a big monthly distribution, it’s managed by a trustworthy company (BlackRock), the management fee is relatively low (recently only 0.62%), and it trades at a very attractive price and discount to NAV as you can see in the chart below

(source: CEF Connect)

BTZ shares have been caught up in the credit market fear and liquidity crunch, which have driven the NAV lower and the price much lower (it recently trades at an 8% discount to NAV). We expect that as the Fed continue to pump liquidity into the credit markets, it will flow through to the types of bonds BTZ owns, and the price will rise. Worth Mentioning, this fund does use leverage (borrowed money), generally in the range of 30% to 35%. However, BlackRock gets the leverage at a lower cost than most individual investors, and they also have the discipline in place to manage it well (for example they can efficiently access the repo market when need be). We view BTZ as an attractive long-term investment, trading at an attractively discounted price.

4. Wells Fargo Income Opportunity (EAD), Yield: 11.5%

EAD is an attractive monthly-pay Closed-End fund that is well-managed and trades at a compelling price and a highly compelling discount to NAV, especially as the Fed continues with its whatever-it-takes approach to support the credit markets (and yes—the fed is even buying corporate bonds now).

(source: CEF Connect)

As you can see in the above chart, not only has the price fallen sharply as the market has panicked (we believe it’ll revert back to near normal in the quarters ahead), but it also trades at a larger than normal (and quite attractive) discount to its NAV thereby adding to the attractiveness of this buy. The fund holds mostly corporate bonds (most of them BB rated or above) and the fed is working hard to support this market. This is an attractive long-term buying opportunity.

3. Annaly Capital (NLY), Yield: 22.5%

We recently wrote about Annaly in great detail here. And the thesis is basically that this mREIT holds almost all (93%) Agency MBS, which is relatively quite safe and being directly supported by the Fed. However, the shares sold off extremely hard as it was lumped in with other riskier mREITs. On a price to Book Value basis, Annaly trades at a huge discount. Just this week it reported that it expects only a 21% to 23% decline in first quarter book value, yet the shares have declined by approximately 50%, and it now trades at a 23% discount to NAV. Annaly historically trades at about 1x book value. Also important to highlight, the company has had no collateral or margining issues throughout this crisis thanks to the strength of its assets.

These shares have at least 23% upside as the discount to NAV dissipates in the quarters ahead, and probably more as the book value rises in the quarters ahead as the market stress of the coronavirus also dissipates thanks to the Fed and the strength and resiliency of the US economy. Again, Annaly holds almost entirely Agency MBS.

2. PIMCO Dynamic Credit Income (PCI), Yield: 12.7%

We wrote about our #2 and #1 ideas in a joint article a couple weeks ago (access those joint articles here and here). They’re both bond CEFs, and the shares of both have increased significantly since those articles, but also have significantly more upside in the quarters ahead as long-term investments (not to mention they both pay big monthly income distributions to investors). The PIMCO PCI as an income-investor favorite, but it’s been hard for some investors to click the buy button because it generally trades at a significant premium to NAV. However, that premium has recently dissipated and the share price is attractively (temporarily low), in our view.

(source: CEF Connect)

Even though this fund doesn’t directly hold a lot of Agency MBS, it does hold some securities the Fed will buy, plus that liquidity will flow through and benefit essentially all of the fund’s holdings. In fact, we like that it doesn’t have a huge allocation to Agency MBS because if it did then a lot of the buying opportunity would likely have already disappeared as the fed has worked to dramatically reduce that credit spread as we saw earlier in this report. In a nutshell, we believe the NAV will rebound dramatically, the price will revert to a premium, and the fund will keep paying big monthly income. It’s an attractive long-term buy.

1. BlackRock Multi-Sector Income (BIT), Yield:11.8%

The story with the BlackRock BIT is essentially the same as the PCI story (the NAV will rise, the discount will shrink, and the fund will keep paying investors big monthly income). However, we ranked BIT higher because the discount to NAV is bigger and the management fee is lower. Some investors don’t mind paying more of a premium for PIMCO funds, but we think BIT currently offers a slightly better opportunity. Be sure to read our two previous recent reports on BIT here and here.

(source: CEF Connect)

Conclusion:

The economic impacts of the coronavirus could drive us into “GDII” (Great Depression Two). But we doubt it. We believe the specific investment opportunities described in this report are attractive for their income and significant price appreciation potential. We understand that things could get worse before they get better, however we’re not betting against the Fed’s helicopter money or the resiliency of the US and global economy. Bond CEFs and mREITs have significant price appreciation potential ahead, however they are still only one part of our total investment portfolio. Disciplined, prudently diversified, long-term investing has proven to be a winning strategy over and over again throughout history. It will this time too.