As we wrote about previously (for example here), part of the reason the market has been so ugly in recent weeks is because of illiquidity in the bond markets. However, with the fed now promising to basically throw in the kitchen sink in their effort to unclog the bond market (by buying a lot of Agency Mortgage Backed Securities (MBS), in particular), it’s worth taking a closer look at the Mortgage REITs that hold a lot of Agency MBS.

In this article we focus on one in particular…

Annaly Capital Management (NLY), Yield: 17.6%

Recommendation: “OPPORTUNISTIC BUY”

Recommendation Summary: Annaly is trading at a wide discount to its book value, however the Fed is taking strong actions that will directly benefit Annaly, such as buying Agency MBS (Annaly’s main investment) in the repo market, as well as very likely providing bridge loans that will smooth the sudden liquidity drop off that will be created by the lack of coupon payments due to the Fed’s Agency MBS actions. Annaly will likely weather the current storm with some bruises, and the shares will return closer to book value (i.e. NLY shares have approximately +30% upside). This is an opportunistic investment (3-12 months), and not a long-term buy-and-hold. The shares are not going as high as they were two months ago, but they should rise significantly in the weeks and months ahead as the dust clears

About Annaly:

Annaly is a mortgage real estate investment trust (mREIT) that invests primarily in residential mortgage backed securities (RMBS) but also in credits such as direct lending. The company went public in 1997. The company’s key segments are as follows:

Annaly Agency Group (93% of portfolio): Invests in agency backed RMBS

Annaly Residential Credit Group (3%): Invests in non-agency RMBS

Annaly Commercial Real Estate Group (2%): Invests in commercial mortgage loans, debt and equity investments

Annaly Middle Market Lending Group (2%): Direct credit investments in PE backed middle market companies

Annaly’s Business Model: Safety and Leverage

The majority of the asset backed securities that Annaly buys are backed by US government sponsored enterprises (or GSEs) such as Fannie Mae and Freddie Mac or Ginnie Mae. That means these bonds have very limited default risk for all practical purposes. The extremely low risk nature of the bond leads to low unlevered returns, as well as the opportunity to use leverage (or borrowed money) to magnify those returns.

Mortgage-REITs, such as Annaly, run leverage of nearly 7-9 times equity to magnify the returns of the Agency MBS that they own. In order to raise debt, the companies (including Annaly) use the repo channel pledging Agency MBS as collateral. Typically, repo market is extremely liquid, however it has not been lately (and that’s why the Fed has stepped in, as mentioned earlier).

Causes of volatility and latest developments

Typically, agency MBSs trade at a premium however due to the lack of confidence and loan forbearance programs following coronavirus outbreak, a sell-off took place in these normally reliable government backed securities. Around mid-March, agency MBS securities saw a sell-off which led to margin calls in the repo market which led to further selling of MBS securities as levered mREITs were forced to sell more. This is when Fed announced they would step in to provide liquidity to the market and restore order. In particular, the Fed announced “Consistent with this directive, the Desk has updated its plans regarding purchases of Treasury securities and agency MBS during the week of March 23, 2020. Specifically, the Desk plans to conduct operations totaling approximately $75 billion of Treasury securities and approximately $50 billion of agency MBS each business day this week, subject to reasonable prices. The Desk will begin agency CMBS purchases this week.”

And as you can see in the table below (from the New York Fed’s website), the Fed has moved to an open ended “whatever it takes” stance to support the agency backed market:

The Fed Is Taking Strong Actions:

The fed also has announced plans to inject money into the repo market as well as using other tools that amount to a figure larger than its current balance sheet.

Per the Financial Times, Ginnie Mae announced on Friday (3/27) that “it would cover the difference between what servicers owe and the funds they have on hand, although the agency stressed that the programme was temporary and should only be used as a last resort.”

And as per another Financial Times article, Treasury Secretary Steven Mnuchin has put in place a task force consisting of The Federal Reserve and the SEC heads to find ways to provide liquidity to mortgage servicers as they face a cash crunch when the large scale forbearance program is implemented.

For a little perspective, as per the Mortgage Banking Association, if 25% of eligible borrowers apply to defer payments, mortgage servicers will face $12B a month shortfall. It is important to note here that even in the normal course of business, any defaults are made whole by government backed agencies in the case of agency MBS, however that happens with a delay so the issue is really the sudden backlog and the resulting lack of liquidity. In this case, a bridge loan by the federal government will help smooth this process and will lead to no missed coupon payments on the underlying bonds. Given the approach of the federal government and Fed, there is little doubt that a formula in this regard will be worked out over the next few days. Worth noting, prior to his current role, US Treasury Secretary Mnuchin bought Indy Mac, a large mortgage originator that failed during 2008 crisis and sold it to CIT group in 2015 so he is very familiar with this industry.

How has NLY performed historically?

The chart below shows the historical dividends paid by Annaly. Clearly the performance has been mixed, therefore we view the current opportunity as an “opportunistic buy” and not a long-term buy and hold.

For example, the dividend declined during 2006 as CPRs (which measure the prepayment rate) went up to a record 42% as homeowners scrambled to refinance at lower interest rates (which is detrimental to mREITS). Similarly, prepayment rates spiked in 2012 as homeowners again went on refinancing spree to take advantage of lower rates. Having said that, please note that the company has a counter-cyclical element to it as evidenced by record increases in dividend payment during the last crisis.

Essentially, as the fed lowers rates during a crisis (as it just did), the cost of funds in the repo market declines immediately (and that is reflected in cost of funds for Annaly) due to the short duration of the liabilities. On the other hand, the assets (agency MBS) have a larger duration (as some have a fixed coupon component). This results in expansion of net-interest-margins during recessions however overtime higher prepayment activity will lead to pressure on profit-and-loss and dividends (once the dust settles).

Is NAV shrinkage the direct result of dividend payments?

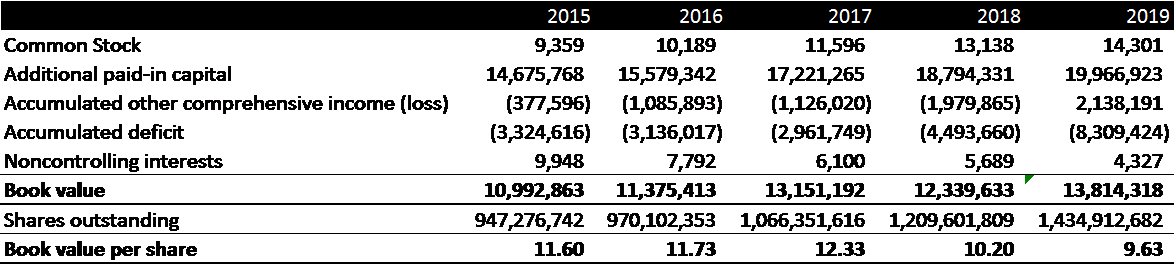

No. Dividends are a part of the cause, but the majority of the NAV (net asset value) shrinkage has to do with mark to market, as well as realized losses on interest rate swaps that the company gets into to hedge interest rate risk. The accumulated deficit number in the table below includes a net loss which in the most recent year (2019) had unrealized losses on interest rate swaps of 1.2B and realized loss of 1.4B on termination or maturity of interest rate swaps. Typically, when interest rates fall, swaps which are there to protect against interest rate increases, fall in value. Please note that when interest rates fall, the mark to market fair value of the RMBS in the portfolio goes higher. This is reflected in the “accumulated other comprehensive income (loss)” item and forms part of the book value calculation. 2019 saw a significant mark to market benefit in this line. Please note that while some of these losses and gains are mark-to-market and not realized, they still impact the book value and therefore the company’s leverage levels and ability to borrow.

Will Annaly’s marked-to-market losses become realized losses?

Given the average years to maturity of swaps was 4.23 years at the end of 2019, a large portion of mark to market losses on the entire notional $74B swaps hedges is not going to be realized as a majority of the positions will not be closed in the near future. Having said that, the company did have a 1.4B of realized losses in 2019 as it likely repositioned the portfolio given the change in Fed stance. In the past years, realized losses were limited.

Is this sector likely to bounce back quickly?

The company had an emergency update call with investors on March 16th. This was the worst time to be in this segment and management commented that their book value was down 7-8% from February month-end as of March 11th. Management also mentioned that even with the prevailing MBS values and repo rates, they still expect this business to generate mid to lower upper teens levered returns going forward. The book value as of March 11th was around $8.62-$8.71. At current stock price of $5.73, that amounts to around a 34% discount to its updated book value. Please note that prior to the current turmoil the stock was trading at nearly 1 times its book. Lastly, the company has nearly $6B in unencumbered assets that the company could use as buffer for raising liquidity.

Additionally, below you can see a chart from Bloomberg that has spreads on agency backed mortgage backed securities back to pre-February levels after massive fed interventions.

Overall, Fed intervention has clearly improved the scenario and the company was solvent and reasonably positioned during the mid-march stress period which tells us that it is probably in a stronger position now given some stabilization in the credit market.

While any immediate recovery will be a function of calm in funding and agency MBS markets, increased prepayment activity driven by low interest rates will have a negative impact from Q2 onwards. The company expects the conditional prepayment rate (CPR) to increase to 25% in Q2 vs 12.7% in Q4.

Conclusion:

March has been a difficult month for mortgage REITs but it is important to note that: (1) Agency MBS has a sovereign guarantee, and (2) The Fed and Treasury have taken a “whatever it takes” approach, and after stepping in to stabilize trading and funding in the repo channel, they are highly likely to provide bridge liquidity to mortgage servicers. Even as spreads have narrowed again in Agency MBS, Annaly is trading at a discount of greater than 30% to its reduced book value. The company survived 2001 and 2008, and in fact it increased its dividend during both those times due the inherent counter cyclicality in the business. We rate Annaly as an “Opportunistic Buy” (not a buy-and-hold) and believe the shares have significant price appreciation potential in the short to mid-term.