The coronavirus is impacting everyone’s lives far beyond just the stock market (which has been ugly). And we hope that everyone is staying safe in this new “social distancing” reality. As for the stock market, if you’ve had your investment portfolio strategy in place before this mess, then stick to it. Disciplined long-term investing has been a winning strategy throughout history, and it will this time too. If you have been sitting on extra cash that you’ve been meaning to invest—hold your nose and buy.

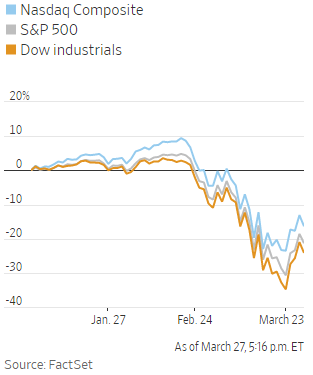

Despite this past week’s gains, the market has been ugly. We don’t need to give you detailed horror stories on what is happening to many popular investments (simply open your brokerage account, and you understand). However, this too shall pass (eventually), the market will again set new record highs, and all the skill in the world still can’t correctly pick the exact timing of when the market will bottom (market timing is a fool’s errand). However, we will share a few popular (and often overused) quotes from famous investors.

Be Greedy when others are fearful. -Warren Buffett

Volatility is not risk. – Seth Klarman.

Buy when there is blood in the streets. -Baron Rothschild.

If you are a long-term investor (i.e. you have at least a 5 to 10-year investment horizon, and hopefully longer), now is the time to hold your nose and buy. We have continued to share attractive buying opportunities throughout this market turmoil, but it is important to remind investors that “a rising tide raises all ships.” If you put together a disciplined portfolio of investments—it’s going to go higher over the long-term, and perhaps much sooner than later. During extraordinary times like this, your investment portfolio’s “beta” exposure matters much more than “alpha” simply because beta is a measure of your overall exposure to market movements, and if you have any beta at all then your portfolio is going to go higher with the market. If you are not sure what we are talking about, consider this recent article from Barron’s:

If you are looking for sympathy with regards to how bad this sell off has been, you may take solace in knowing that even the classic 60/40 portfolio (60% stocks and 40% bonds) has had an unusually large sell off during this period of market turmoil.

What Does The Future Have In Store?

We know the unemployment rate is spiking, and the economy will experience a dramatic slowdown as states continue to shut down business with “shelter in place orders.” And we also know some businesses will be hit harder than others. For example, depressed share prices of some shopping mall REITs (such as Simon Property Group) suggest panicked investors believe the world has changed forever, as we recently described here:

However, other cloud-based businesses are expected to fare better considering they’re already prepared for “social distancing” operations. And their prices reflect some of this, as they’ve sold off less hard in some cases. For example, see our recent write up on ServiceNow (NOW) here:

The Bottom Line:

Our bottom-line takeaway for this week is twofold. First, it’s always important to pick good individual investments for your aggregate portfolio, and we try to help you with that regularly with the investment idea articles we share. However, the other main point is that your “beta” exposure matters too, especially in these volatile market conditions. Our hope is that you already had your disciplined long-term investment strategy in place prior to this current market turmoil, and that you are sticking to your long-term strategy instead of making panicked mistakes. And if you have been sitting on extra cash that you’ve earmarked for investment, don’t try to bottom tick this market (exact market timing is impossible). Instead, hold your nose and buy!