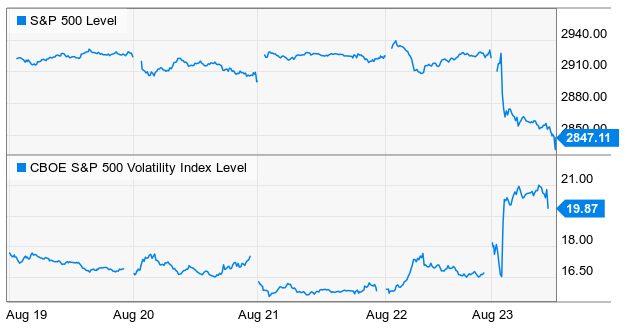

Trade War tensions escalated Friday. So did market volatility. The S&P 500 fell sharply. This week’s Weekly reviews a few of the biggest movers on our watch last week. Specifically, two stocks we own that were up big (despite the sell-off) and three names (including a couple big-dividend payers) that sold-off thereby creating attractive investment opportunities. We also review our two most recent income-generating options trade ideas—both of which we continue to believe are quite attractive now.

Trump’s “Trade War” With China:

For starters, regarding the “Trade War,” this too shall pass. And if you can’t sleep at night because of President Trump’s “Trade War” then perhaps you should consider less risky/volatile investments. For example, our Income Via Growth Portfolio has the most market volatility as measured by beta (and a lot of long-term high return horsepower too!), Income Equity is less volatile and offers roughly 3 times the yield of the S&P 500, and our Alternative Fixed Income strategy offers the highest yield and the least market volatility risk. All three are designed to help you cater your own investments prudently.

Watch List Movers:

Now, here is a look at some of the biggest movers (both up and down) on our watchlist over the last week:

We don’t currently own all of the names on this list (most are just opportunities that we watch), but two we do own that performed great last week despite the sell-off are Shopify and Paylocity. We’ve written in detail about both of these companies in the past, and they both have significantly more upside price appreciation potential ahead. They don’t pay big dividends, but it’s a good idea to diversify away from purely high dividend investments sometimes, especially depending on your goals, and we like both and own them in our Income Via Growth portfolio.

Regarding Netflix, that’s a stock that sold-off last week, and has sold-off significantly over the last year despite its rapidly growing business. It remains an industry leader despite all the growing competition in the streaming space. It’s undervalued and has a lot more upside ahead, in our view. We own it in our Income Via Growth portfolio.

Regarding big-dividend stocks, Industrial REIT Stag (STAG) and Energy company Enbridge (ENB) are two that are on our radar. Not only do they offer attractive dividends, and a lower price than a week ago following last week’s sell-off, but they also present very interesting income-generating option trading opportunities. Specifically, as regular readers know, we like to occasionally generate income by selling out-of-the-money put options on attractive businesses we wouldn’t mind owning, especially at a lower price.

The income available on these types of options trades usually increases when market volatility increases (like it did on Friday) and that’s why the opportunities are increasingly attractive. We generally like to place these income-generating options trades (selling out-of-the-money put options) on attractive high-income payers at around 5% to 10% out of the money and with around 1 to 2 months until the options expire. For more information, check out our two most recent income-generating options trade ideas below (by the way, we continue to view both of these options trade ideas as attractive as well!).

Also, we offered up two additional attractive high income investment opportunities over the last couple weeks. Both are big-dividend business development companies (BDCs):

Conclusion:

As always, don’t let last week’s sell-off frighten you into ditching your long-term goal-oriented investment strategy. Fear is generally the leading cause of bad trading mistakes and it’s also what keeps most investors from achieving their long-term goals. Further still, fear is what leads many investors to run to overpriced investment advisors that really are not acting in your best interest (they’re generally looking out for themselves). Most investors have what it takes (easily) to manage their own disciplined long-term goal-oriented investment portfolios (or at least a big chunk of them) with better results than an investment advisor, especially after the big fees that can be saved. In a saying often attributed to Ben Franklin: “a penny saved is a penny earned.” And let’s not forget, those pennies add up and compound in value over time.

The Bottom Line:

Last week’s volatility creates an opportunity to do a little trading and/or re-balancing around the edges (such as the ideas described in this article), but for goodness sake, don’t drown yourself in expensive fear-driven trading mistakes, and don’t lose sight of your long-term goals.