We’ve written about the attractiveness of healthy dividend REIT Simon Property Group (SPG) in the past, most recently here. But we’re highlighting it again now because the valuation and income available are increasingly very attractive. The narrative that the Internet will kill all brick-and-mortar stores is way overblown in Simon’s case, so we are sharing this very attractive options trade opportunity.

Overview:

If you don’t know Simon Property Group, Inc. (SPG) operates as a self-administered and self-managed real estate investment trust. It owns, develops and manages retail real estate properties which primarily consist of regional malls, premium outlets and mills. Simon Property Group specializes in the ownership, development, management, leasing, acquisition and expansion of income-producing retail real estate assets.

The Negative Narrative Is Way Overblown

There is a narrative going around that online shopping will kill all brick and mortar retail stores, thereby destroying Simon’s business (because they rent brick and mortar retail space at their malls). And while we do believe this narrative is appropriate for some shopping mall REITs (mainly the B-class malls), it’s simply not true for A-Class mall owner, Simon Property Group.

For some perspective, here are a couple quotes/highlights from Simon’s CEO during the most recent quarterly earnings conference call at the end of July whereby it was announced that FFO (funds from operations) was in line with expectations and revenue came in higher than expected:

“Adjusting for the prior year for a non-cash investment gain… and the impact of external leasing cost, our FFO growth rate was 4.9% per share. We continue to grow our cash flow and report solid key operating metrics.”

“So to conclude, we produced another good quarter of results and operating metrics. There's no company in our industry that has the reach and impact on the communities that we have. And we continue to focus on the long-term, we'll continue to invest in our product and generate the kind of returns that will grow our earnings, cash flow, and dividends.”

And here is a look at some improving operating (credit) metrics for the business:

Further still, Wall Street analysts recognize the shares are oversold, per their aggregate buy rating and significant upside price targets as shown in the following graphic:

The Trade:

Sell Put Options on New Residential (SPG), with a strike price of $140 (+6.0% out of the money), and expiration date of September 20, 2019, and for a premium of $1.30 (this comes out to approximately 11% of extra income on an annualized basis, ($1.30/$140 x 12 months). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of SPG, at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’re happy to own SPG, especially if it falls to a purchase price of only $140 per share).

Your Opportunity:

We believe this is an attractive trade to place today and potentially tomorrow as long as the price of SPG doesn't move dramatically before then, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) of approximately 10%, or greater.

Important Trade Considerations:

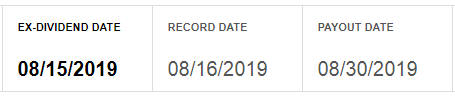

Two important considerations when selling put options are dividends and earnings announcements because they can both impact the price and thereby impact your trade. And in SPG’s case, they are largely non-issues. Specifically, SPG isn’t expected to announce again until October 3rd (after this put option expires). And second, SPG just went ex-dividend on Friday, so the next dividend isn’t for another full quarter, and thereby the dividend will not impact this trade.

Conclusion:

Simon Property Group shares have sold off significantly due to an overblown negative narrative about brick-and-mortar stores versus the internet. However, in our view, the market has overreacted, and the shares are way too cheap (and Wall Street analysts covering the stock agree with us). We already own shares of SPG, but if you don’t (or if you want to own more shares) you might consider placing the income-generating options trade in this article because it generates significant income for you up front (that you get to keep no matter what) and it gives you the possibility of purchasing shares of this healthy dividend REIT at an even lower price if they get put to you before expiration. As a general rule, we like to keep our position sizes below 5% of our total portfolio (or 10% in rare instances), so consider how big your position size will be if the shares get put to you. And as a specific view, we believe SPG’s shares are significantly undervalued right now (and we want to own them for the long-term). Things could get worse before they get better, but in the months and years ahead, we believe SPG’s share price is going higher, perhaps significantly higher.