With the S&P 500 recently hitting new all time highs, some investors fear we are overheating. One way to take a little risk off the table is by investing in attractive big-dividend REITs, which tend to rise and fall less with the overall market, but keep paying those big dividends throughout if you select them right. Despite, some analysts arguments that even REITs are overheating, many of them remain a much safer bet (with much higher income) compared to the overall market. This article addresses REIT valuation concerns, as well as overall market concerns in light of the Fed’s changing interest rate posture and where we seem to be (very late) in the current economic cycle. We conclude with our Top 10 Big-Dividend REITs worth considering.

We’re Arguably Very Late in the Economic Cycle

Aside from the S&P 500 hitting new all time highs this week, part of the reason many investors are nervous is because the current economic expansion has been going on for a very long time. In fact, the current expansion (which started back in ‘09, financial crisis) is one of the longest expansion cycles in recent history, per the following chart.

The Fed’s Interest Rate “About Face” Makes Investors Nervous

And what’s further, the Fed’s recent “about face” on interest rates has some investors nervous. Specifically, as the following CME FedWatch chart shows, over the last year the Federal Reserve has changed its posture from expecting interest rate increases to expecting interest rate deceases. And this has left many investors wondering, is the Fed worried about the economy? What do they know?

Further, changing interest rate expectations can most certainly impact REIT prices, both positively and negatively, and differently depending on the industry and REIT specifics. For example, on one hand, rising rates can be negative for REITs because they rely on borrowing (and/or issuing more shares) to fund growth, and when rates rise both can become more expensive. Specifically, higher rates can mean higher borrowing costs, and it can also mean a lower share price (less money received for issuing new shares) because, to some extent, REITs can act as a bond-proxy meaning if rates rise then REIT prices may fall to make the yield higher so their rates are competitive with newly higher bond rates/yields, relative to their risk.

On the other hand, rising rates can be a good sign for REITs, some REIT sectors more than others, because if rates are rising it means the economy is likely stronger, and the REITs underlying businesses are likely stronger too. However, now that expectations have moved from higher expected rates to lower expected rates, it adds to uncertainty and fear in the market. We’ll have more to say about interest rates impact on REITs later in this report.

Strong REIT Performance Makes Some Investors Nervous

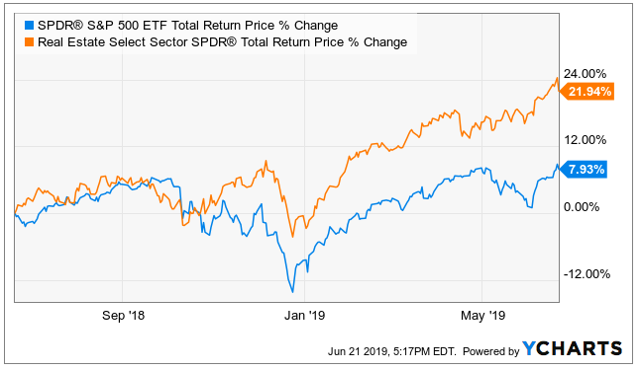

REITs have been performing very well this year, and over the last full year, especially as compared to the rest of the market, as shown in the following chart.

…They Argue REIT Valuations May Be Getting Frothy

This next chart shows that REIT valuation multiples are higher than they were a year ago.

And on an individual basis, some REITs seem particularly expensive, especially when you consider that retail REIT valuations are still pulling down the overall sector average. What’s worse, cap rates are very low lately, suggesting there are not a lot of attractive REIT investment opportunities out there right now.

…But REIT Management Teams Seem Ready

With low cap rates, many REIT management teams seem to be waiting for the next downturn, perhaps so they can take advantage of distress instead of becoming a victim of it. For example, this next chart suggests REITs have a lot of dry powder considering coverage ratios are high and debt ratios are low.

REITs are a “Flight to Quality” Asset

And let’s not forget that REITs are often considered a “flight to quality” investment because many investors believe they’re safer than other market sectors thanks to their lower volatility, lower betas, and bigger dividend payments. REITs can be a bit of a hedge when the market sells off, again thanks to their lower betas and higher dividends.

How We’re “Playing” The Current REIT Environment:

Given the current dynamics and uncertainty of the REIT market, we have a few suggestions on how to play it (and we’ll share info on specific REITs we own later in this report). But for starters, don’t try to make bets on where interest rates are going; that’s very hard to do (it’s a bit of a fool’s errand, actually), and you’re much better off just selecting attractive REITs at good prices and then holding them for the long-term, as part of a prudently diversified portfolio. Second, be opportunistic, but only on the margin. That means stick to your long-term investment strategy, but if distress does come, be ready to take advantage. And finally, some quality REITs are already being thrown out with the bathwater thanks to a powerful false narrative (more on this one later), and other REITs are simply powerful attractive blue chips practically regardless of market conditions.

Our Top 10 Big Dividend REITs…

REITs have big dividends compared to the overall market. For example, the S&P 500 yields under 2% currently, whereas the real estate sector ETF (XLRE) yields around 3.2%. For the purposes of this article, we’re defining “big dividend” as anything yielding more than the S&P 500, but many of the REITs on our list yield much more and are quite attractive if you’re an income-focused investor. Without further ado, here is our ranking of top 10 big-dividend REITs worth considering…

10. STAG Industrial (STAG), Yield: 4.6%

Stag is an industrial REIT that offers a big 4.6% dividend yield, paid monthly. And the actual dividend payment has been growing in recent years, and so has the price. Stag’s strategy of acquiring and operating single-tenant industrial properties is successful, and it has a lot more room for growth. We’d have ranked STAG higher on our list, except for its higher beta risk relative to other REITs (i.e. it’s likely moderately more sensitive to an economic slowdown than other REITs). Click the following link for our full write-up on STAG, including its strengths, dividend, valuation and finally our detailed opinion on STAG’s future prospects.

9. East Group Properties (EGP), Yield: 2.5%

We’d rank this one higher on our list if the yield wasn’t so low compared to other REITs (2.5% is still better than the S&P 500 though). Nonetheless, EastGroup Properties has been one of the best performers in the industrial REIT sector in recent years in terms of maximizing shareholder value (we’ve owned it since early 2016). And the company’s differentiated operating strategy and risk-adjusted targeted development program continues to pave the way for future growth. Our full article on EGP (see link below) analyzes its various strengths, examines its dividend yield and valuation (the dividend has been consistently increasing, but the yield is still only 2.5% because the price keeps increasing too, as it should) and concludes with our specific opinions about investing in EGP, particularly if you’re a long-term dividend growth investor.

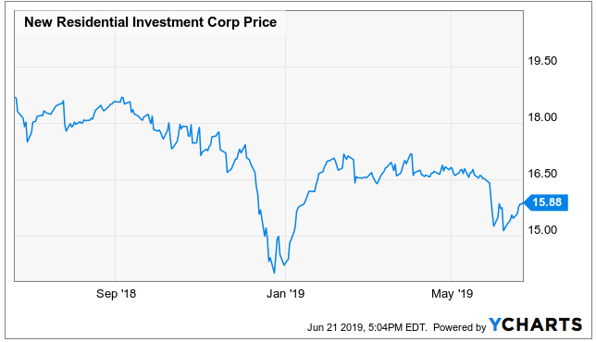

8. New Residential (NRZ), Yield: 13%

If you’re looking for a big dividend yield, New Residential is worth considering for a spot in your diversified income-focused investment portfolio. We’ve written about this one multiple times in the past (see link below), and we continue to own it. If you read through our last full write-up on NRZ (link below) be sure to consider the section that reviews the impacts of changing interest rates on NRZ’s business, as well as the slowing growth potential for mortgage servicing rights. NRZ is trading at an attractive price currently, however NRZ investors tend to get jittery when the market does, so there is the potential for even more attractive entry prices in the future. Again, we currently own NRZ.

7. Ventas (VTR), Yield: 4.9%

Ventas is a big-dividend healthcare REIT, and the shares are up in the last week as the market has appreciated news of a new Colony Capital refinancing deal. However, our strategy for investing in this one is different. Ventas is a little risky in our view because of its exposure to troubled operator Brookdale. Brookdale has been creating significant problems for multiple healthcare REITs, but if you subscribe to the mantra of “buying when there is blood in the streets” Ventas could soon be offering an even more attractive entry price. Specifically, if you are an income-focused investor, you might consider selling the July $67.50 strike price put options on Ventas to take advantage of the recent volatility (the options premium income available is higher when uncertainty is higher). In particular, you can collect around $0.75 in premium income now for selling the puts, and it gives you a shot at buying the shares at an even lower price if they fall below the strike price before expiration. Put selling is a differentiated income-focused strategy not dramatically dissimilar from selling insurance, however in this case the worst scenario is you end up buying an attractive REIT (Ventas) at a lower price if the shares get put to you before they expire. For more detailed information about our views on Ventas, please refer to our recent full Ventas write-up here:

6. Realty Income (O), Yield: 3.7%

This is another monthly dividend payer that’s made it onto our list, and it’s actually very popular among REIT investors thanks to its steadily growing dividends and price. In our view, Realty Income is one of those steady blue chip REITs with a very safe dividend over the long-term. In the near-term the shares could experience some volatility, but that volatility will be less than the overall market’s volatility thanks to the big steady dividend payments. And over the long-term, the dividend and the share price are eventually both going higher. You can read our recent full write-up on Realty Income here:

The Top 5 Big-Dividend REITs

Our Top 5 Big-Dividend REITs are reserved for members-only. They include a variety of attractive REITs yielding 5.0%, 5.6%, 5.3%, 4.6%, and 5.0%, respectively. They all offer relatively very safe income, and we expect them to increase in price and increase their dividends over the long-term. We currently own four of them (and we may soon own all five). Here is the list…