This week’s Blue Harbinger Weekly highlights the performance of various market sectors and styles, including the sharp sell-off in REITs and healthcare. We also share the weekly performance of the individual holdings within our Income Equity and Disciplined Growth strategies, including a brief review of a couple big movers. Finally, we share our opinion on the attractiveness of big dividend REIT Medical Properties Trust (5.8% yield), which unexpectedly sold-off more than 8% just last week.

For starters, here is a look at the performance of major market sectors and styles.

Notably, the 5-day return for the Dow was +1.7% while healthcare sold of -5.2% and REITs were down -2.7%; this is a fairly large dispersion for a single week. Healthcare has been a laggard all year, however REITs were arguably overdue for some relative weakness. Before we get into some specifics on a particular healthcare REIT (Medical Properties Trust, (MPT), here is a look at the performance of the holdings within our Income Equity and Disciplined Growth portfolios.

Notably, Walt Disney (DIS) is up 13.6% in the last 5 trading days (as we noted last week, this Friday was a holiday). Disney’s gains are the result of the market’s positive reaction to the announcement of its new streaming service. Also worth noting, Union Pacific posted a health gain for the week (+6.0%) following a positive earnings announcement. As a reminder, Union Pacific has access to strategic west coast railroad ports that make it highly valuable for international trade. We continue to believe UNP has significant long-term upside.

And with regards to the sell-off in the healthcare and REIT sectors, here is a look at the recent performance of healthcare REITs, in particular (below). We’ve chosen to highlight this group because of the sell-off in the two sectors and because of the interesting high yields they offer.

All but one of the healthcare REITs was down over the last 5 trading days, and Medical Properties Trust was the worst performer of the group. What’s interesting, there seems to have been no company-specific news causing MPW to sell off. Arguably, the movement in interest rates caused MPW to sell-off as algorithmic trading intensified, per this speculative article.

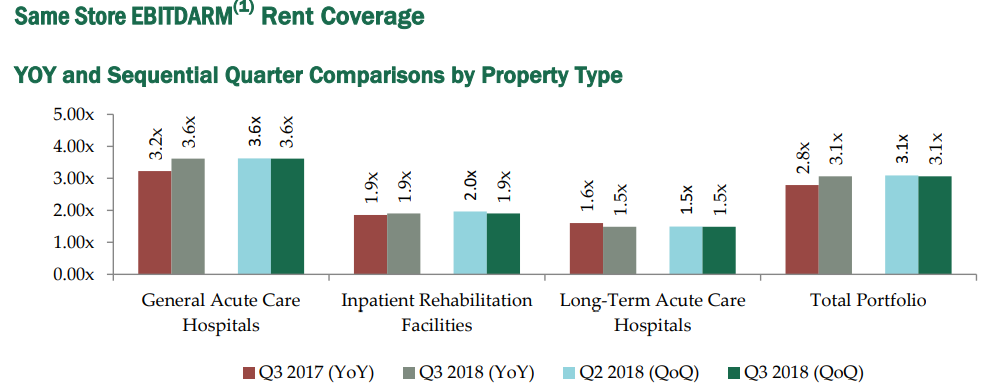

However, the fundamentals of Medical Properties Trust remain strong. If you don’t know, Medical Properties Trust is a self-advised real estate investment trust, which engages in investing and owning net-leased healthcare facilities. It focuses on funding hospitals and other facilities where patients must be admitted by doctors.

And per the 14 Wall Street analysts covering MPW, it’s undervalued (see chart below).

It’s unusual for a healthy-rated big-dividend REIT to sell-off this much in such a short-time period on no big news, and the sell-off could be nothing more than a noisy buying opportunity. For example, the shares remain reasonably valued on various valuation multiples, as shown in the following table.

And the business has been relatively steady with Funds from Operations (“FFO”) expected to keep growing, as shown in the following two graphics.

Nonetheless, the shares have sold-off, which makes them interesting. If the sell-off was, in fact, driven by machine-based algorithmic trading, we could see a sharp rebound in the upcoming trading sessions. The business remains relatively healthy, especially as compared to other big-dividend REITS. REITs have been strong this year (as shown in our earlier table), but if you’ve been waiting for even a small pullback (like the one we just saw) this could be a decent opportunity to do some buying. Also worth mentioning, perennial powerhouse healthcare names, Welltower (WELL) and Ventas (VTR) have also shown some weakness this year (after a very powerful full year prior), and this too could be a decent opportunity to add more shares (see earlier table for the performance of WELL and VTR).

Conclusion:

The market is up over the last 5 trading sessions, but REITs and Healthcare stocks are down. At Blue Harbinger, we like to own attractive businesses, and we like to buy them at attractive prices. And the sell-off we’ve experienced in healthcare REITs has created a little wiggle room for buying if you have extra money on the sidelines that you’ve been looking to put to work. We’re certainly not suggesting anyone “bet the farm” on healthcare REITs after the last week, but we are suggesting that being opportunistic can increase profitability, so long as you stay disciplined and focused on your long-term investing goals and plans.