This 8.3% yield fixed income closed-end fund (“CEF”) is currently trading at a relatively attractive price, and it is worth considering if you’d like to own some “non-stock-market” exposure within your investment portfolio; specifically, it can help diversify away risks as well as keep your monthly income high.

BlackRock Multi Sector Income Trust (BIT), Yield: 8.3%

The primary objective of the BlackRock Multi-Sector Income Trust is to seek high current income, and its secondary objective is capital appreciation. This particular CEF seeks to achieve its investment objectives by investing at least 80% of its assets in loan and debt instruments and other investments with similar economic characteristics. And for perspective, here is a look at the current holdings broken down by type and credit rating.

And before we get into the specifics of BIT, it’s worthwhile to briefly consider some of the benefits of investing in a closed-end fund, in general

What Are the Advantages of Investing via a CEF?

For starters, CEF’s often offer high yields (more on the “nuts and bolts” of BIT’s distribution payments later), which can be very attractive if you’re seeking income. Another advantage is that CEFs offer some instant diversification; they hold a basket of securities (even if they are concentrated in a specific asset class or style) which is less risky that holding only one or two stocks. They also offer active management teams. And very importantly, CEF’s can trade at very attractive prices considering they’re often bought and sold at significant discounts to the value of the securities they hold (we’ll get more into BIT’s specific discount later in this report).

Why Is BIT Attractive Now?

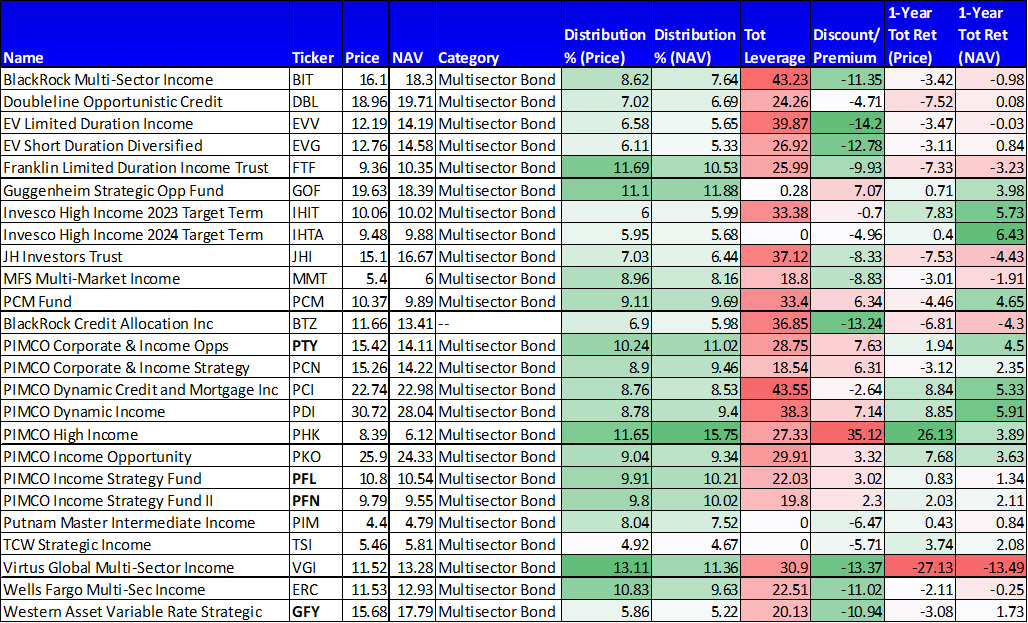

For starters, BIT stands out among many other fixed income CEFs because of its attractive yield (it pays monthly) and its discounted price. Specifically, here is a look at a variety of fixed income CEFs compared to each other on various metrics.

And while the above table does show several of BIT’s attractive qualities, it does not explicitly show how its price is more reasonable than other CEF on the basis on their respective historical discounts/premiums. Specifically, a lot of popular CEF’s are very expensive right now because they’ve rebounded very hard since the distress of Q4 when credit spreads were widening significantly. Whereas BIT remains reasonably valued. BIT also has a variety of additional attractive characteristics, as described in the following paragraphs.

Big Healthy Monthly Distributions (Pure Income):

One of the attractive qualities of BIT is that its big monthly distributions are very healthy in the sense that they’ve historically been all income, and not capital gains or return of capital, as shown in the following chart.

This healthy distribution composition is actually rare among bond CEFs, considering many of BIT’s peers are regularly distributing capital gains (both short and long-term) as well as returning capital (i.e. giviving you back your own money as part of the distribution) just to maintain the yield.

BIT’s Current Discount to NAV Is Attractive

As we mentioned earlier, one of the attractive qualities about CEFs is that they can trade at a significant discount to the value of the assets they hold. This creates the potential for price gains if the discount spread narrows, but even if a CEFs discount never disappears (even if it trades at a discount to NAV forever), it affords investors a chance to buy yield (income) at discounted prices (i.e. below the market rate).

Here is a look at BIT’s current and historical discount to net asset value (below), and unlike many of its peers, BIT is not trading at an unusually expensive price relative to its own history as are many of its peers as we mentioned earlier. BIT’s valuation is reasonable.

Leverage (Borrowed Money):

Depending on the strategy, many CEFs borrow money (i.e. use leverage). This can be particularly attractive in the good times because it can magnify returns. However, it can also be a risk because it can magnify losses when the market goes down. As we saw in our earlier table, BIT’s leverages is reasonable relative to peers and relative to the amount of risk involved with the type of securities it holds.

Also, keep in mind the leverage is not free (there is an interest charge to borrowing money). And this cost may rise as interest rates keep rising. The good news is there are regulatory limits to the amount of leverage CEFs can use. For example, most bond CEFs keep leverage around 40% at the max and equity funds keep it around 30% (BIT is currently just over 40%). Some investors prefer leverage while others prefer none. Also, funds that use leverage get it at low institutional rates (i.e. rates lower than the average Joe can get in his personal account).

Expense Ratios and Management Fees:

Expense ratios and management fees are another important consideration for CEF investors. If you are simply looking for exposure to the a mix of fixed income securities, a bond ETF may do the trick. However, that ETF lacks the active management team, the high yield, the potential for a big discount to NAVs (ETFs are open-end funds, therefore there are mechanisms to directly eliminate discounts and premiums), and ETFs generally don’t use leverage (there are some exceptions). Keep in mind if a CEF does use leverage (borrowed money) those costs are often rolled up into the total expense ratio. In the case of BIT, the total expense ratio is 2.9% per year, but that includes the cost of the leverage (borrowed money) that the fund uses. This seems like a high fee—but it’s not that high when you consider 50% or more is simply the cost of borrowing.

Risks:

We’d be remiss not to explicitly mention risks to the fund. For example, it’s a bond fund, and based on its holdings—the price is sensitive to both interest rates and credit spreads. Specifically, as interest rates rise, the price of the underlying holdings of BIT will fall, all else equal. BIT’s duration is 2.97—not that high—meaning relatively lower interest rate exposure). Further, if the market re-enters a risk-off mode (like we did in Q4) credit spreads will widen and the price of BIT will fall, all else equal. Further still, the leverage can make things particularly good in the good times and particularly bad in the bad times (note: markets generally go up in the long-term, so the conservative leverage will likely work significantly to your advantage). Further still, management fees will be a drag on performance (however, in exchange for the management fee, you do get an attractive actively managed investment). And also, the discount to NAV can get wider at times, and often does. These are all things you should keep in mind if you’re going to invest in this closed-end fund.

Conclusion:

If you are looking for high monthly income payments from a bond fund, BIT is worth considering. It has a variety of attractive qualities as described in this article, and it can also help you diversify away some of the stock market risk within your overall investment portfolio.