Here is a look at the market’s continuing strong performance this year (the S&P 500 is up 16.6%). REITS are one sector that’s been particularly strong (XLRE is up 19.1%) as the Fed’s new found dovish low interest rate posture helps REITs which generally rely on borrowing to grow. On the other hand, healthcare is one sector that has lagged (XLV is up only 4.2%) as this diverse sector faces varying specific pressures. Sabra Healthcare (SBRA) is a big dividend REIT that faces its own company-specific pressures as well as the headwinds of being a healthcare related company and the tailwinds of being a REIT. This week’s Blue Harbinger Weekly reviews the market’s performance, the performance of our portfolio holdings, and briefly reviews a few specific names, one of which is our opinion on Sabra Healthcare’s tempting 9.2% dividend yield.

To some extend spurred by the Fed’s low interest rate posture, growth stocks (particularly large cap growth stocks) continue to dominate their value counterparts, as shown in this next table.

Also interesting (and perhaps not surprising), US markets continue to outpace other countries and regions (especially Brazil, but not necessarily China).

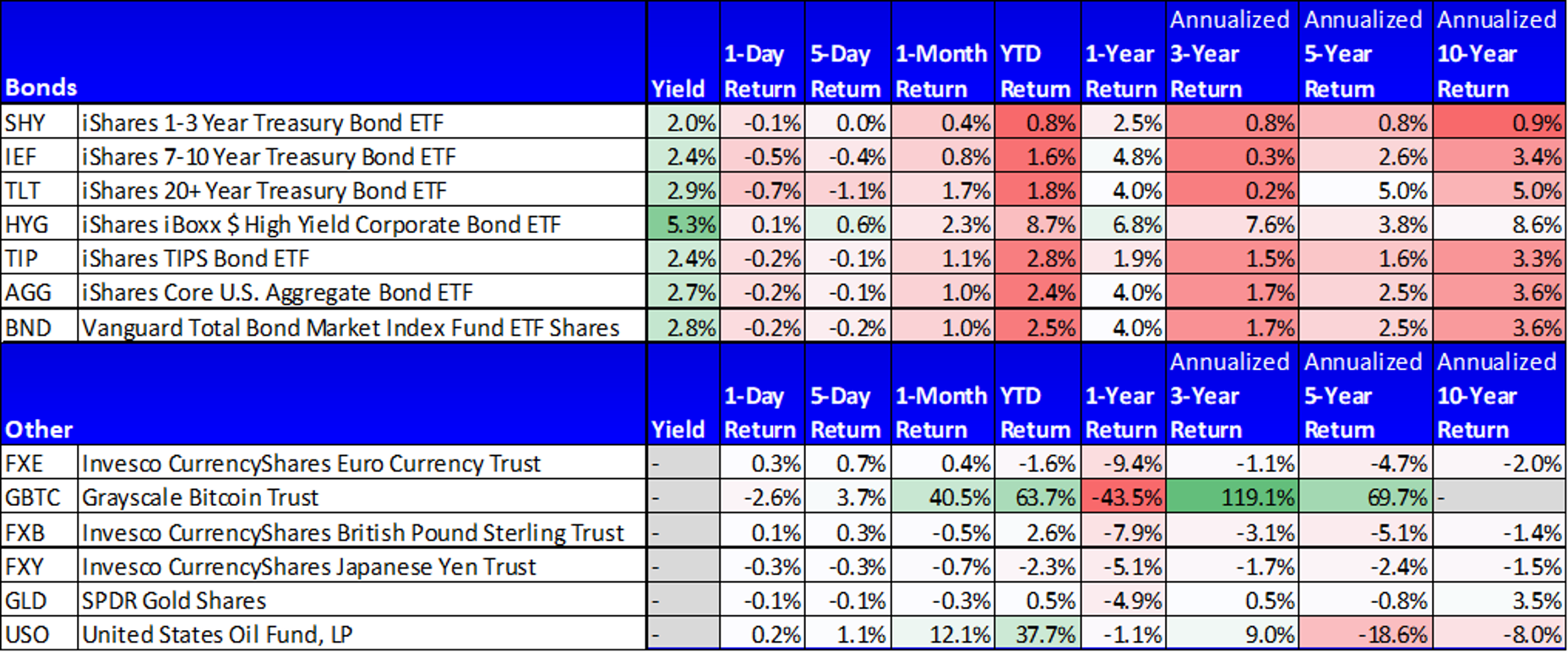

This next table shows that bonds have still been delivering low yields (although generally higher than most equity dividend yields), yet bonds have delivered essentially zero absolute returns (remember, the total return column is price return plus interest payments, sans interest—prices haven’t really moved much this year as compared to equities especially).

Bitcoin and oil have been huge gainers this year, but realistically their prices are not predictable (ignore anyone that tells you otherwise). Your chances for long-term success are much better with individual stocks.

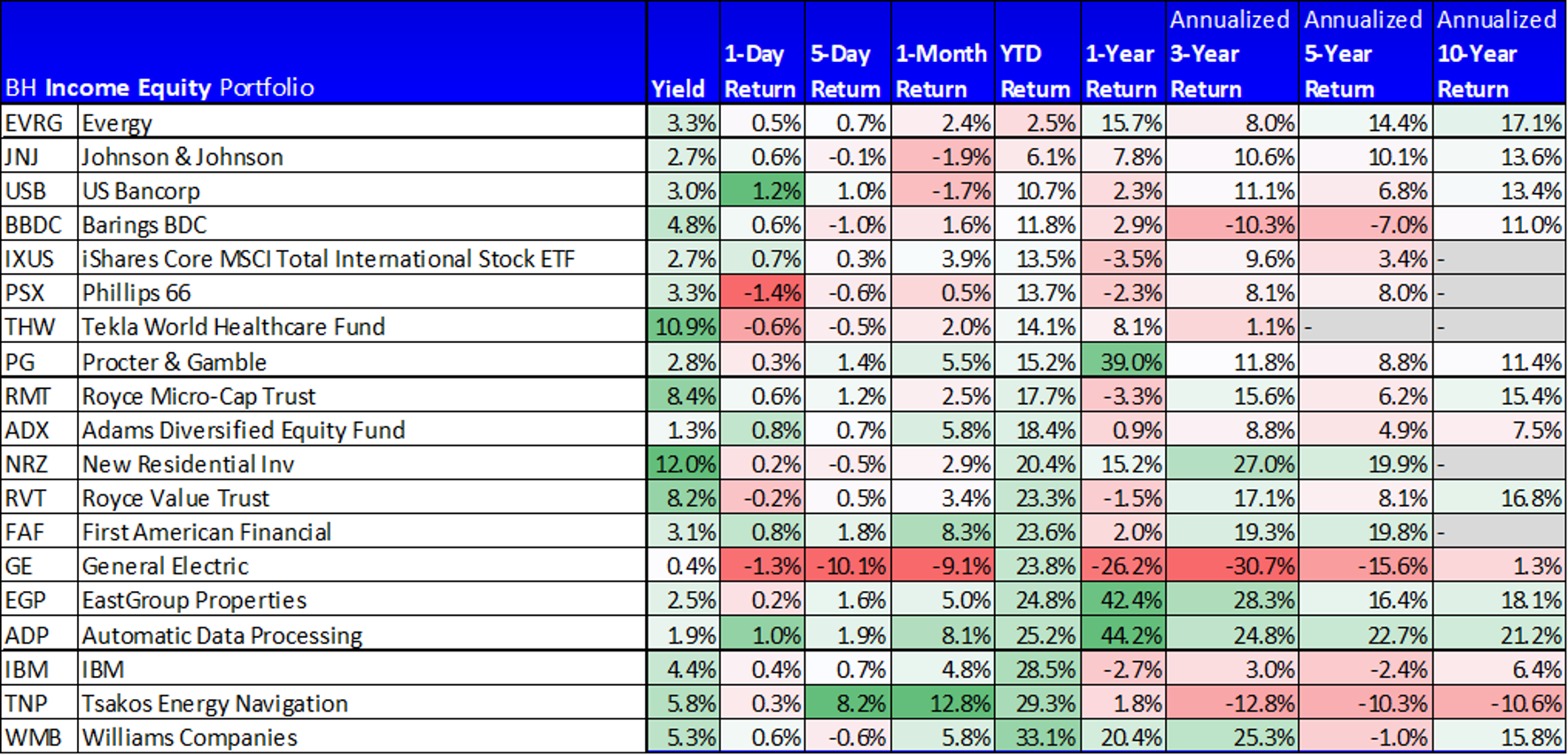

Here is a look at how the individual holdings did within our Income Equity and Disciplined Growth strategies over the last week.

One notable mover was Walt Disney (DIS) which gained 11.5% on Friday following news of the upcoming release of it’s new streaming service. Notice, Netflix sold off a little on the news. Nonetheless, we remain long-term bullish on both, but for different reasons (e.g. we expect Netflix to continue to grow much faster, and we expect Disney to keep paying an attractive dividend, and its price to keep growing, albeit at a slower rate than Netflix. Disney will likely be much less volatile too).

Sabra Healthcare (SBRA), Yield 9.2%

Sabra Healthcare is a healthcare REIT that focuses on skilled nursing facilities, senior living and specialty hospitals. And considering it trades at a multiple of only around 10 times 2019 funds from operations (“FFO”), the 9.2% dividend yield is tempting.

But before you dive headfirst into a new Sabra position, keep in mind a significant portion on its business is in “skilled nursing facilities” (“SNF”)—a space that has been very challenging as pressure on healthcare reimbursement rates has led to significant distress for SNF operators (i.e. the businesses that lease SNF space from Sabra).

In fact, this is a business with a below investment grade credit rating, which is a sign of more risk.

Wall Street analysts are in fact cautious on the shares, and forward guidance suggests slowing FFO in the quarters ahead.

From our perspective, we are waiting on this REIT (SBRA) to show some signs of improvement before we pull the trigger and buy shares. We like the valuation, the high yield, and the low interest rate environment. And we saw the shares of another SNF healthcare REIT (Omega Healthcare (OHI)) rise significantly higher in the quarters after it first showed improvement from its struggling operators. We think Sabra could experience a similar prolonged rally in its share price, but we’re waiting to see some signs of improvement before pulling the trigger. For now, Sabra is staying on our watch list, as we pay close attention to the shares in the weeks ahead (it next announces earnings on May 9th).

Conclusion:

The market has rallied significantly so far this year, and we’re quite happy with the gains we’ve seen in the value of our accounts (especially after the challenging Q4 last year). Given our strong economy, we expect more strength (and income) ahead. We stuck to our long-term investment plan in Q4 when the market was selling off, and that served us very well as we were invested to fully benefit from the rally so far this year. Similarly, we’re not taking any chips off the table at this time, even though the market has been so strong in 2019. Prudently diversified, goal-oriented, long-term investing helps you avoid silly short-term mistakes, and it is a well-proven strategy for long-term success.