Energy (XLE) is the worst performing sector this year, gaining only 8.0%, versus an amazing 31.0% for the S&P 500 (SPY), and an even more amazing 49.5% for Tech stocks (XLK). Some investors prefer to stick with the hot-hand and choose to ride the momentum of only the hottest zero-dividend aggressive-growth stocks. On the other hand, we tend to be more contrarian in nature, especially when there are big safe dividends involved. And those big safe dividends become even sweeter when there is significant share price appreciation potential. This report ranks our Top 10 Big Safe Energy Sector Dividends. Without further ado, here is the list.

10. Royal Dutch Shell (RDS.B), Yield: 6.3%

Royal Dutch Shell is one of the big integrated oil companies that has been impacted by lower energy prices, as well as the overly pessimistic narrative that fossil fuels are on their last dying leg.

In reality, the world is extremely unlikely to transition dramatically to alternate sources of energy for decades. For example, the International Energy Agency (“IEA”) estimates approximately $21 trillion of oil and natural gas investment will be needed by 2040. For example, the chart below indicates that oil & natural gas demand will continue to remain robust even in 2040. RDS’s oil business continues to be a cash cow and will remain so in the future as global demand persists.

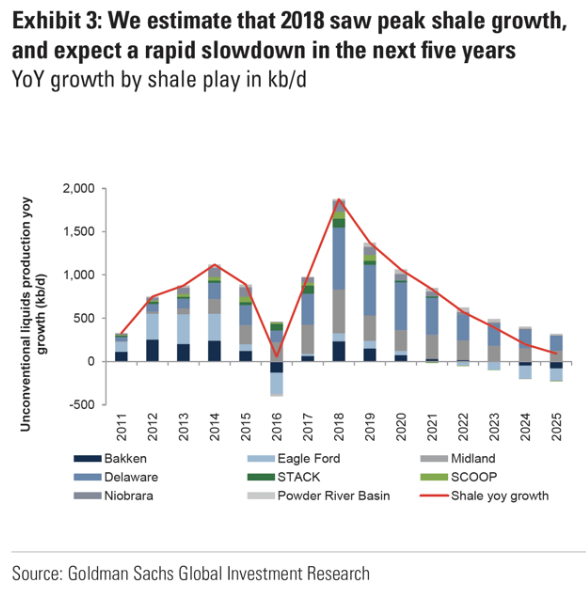

Further, some analysts expect a dramatic slowdown in shale production, which was a major driver of energy price declines, and could therefore provide more strength to prices going forward—a good thing for Royal Dutch Shell and its industry.

And for our full detailed report on RDS, we’re sharing one from a couple months ago that is still very relevant today, and has lots of good information about RDS, such as the important difference between the A shares (RDS.A) and the B shares (RDS.B).

9. Vermilion Energy (VET), Yield: 12.7%

Many investors are quite attracted to Vermilian for its huge dividend (which is paid monthly) as well as its significantly discounted price.

In our view, Vermilian is quite attractive and worth considering, as long as you recognize there are some risks to the business, which we have detailed in our full VET report (linked below). Nonetheless, we believe the shares offer an attractive balance between risks and rewards, and they have significant upside price appreciation potential. You can access our full Vermilion report here:

8. BP PLC, (BP), Yield: 6.5%

Similar to RDS at number 10, BP is a large cap integrated energy company with a juicy dividend and a discounted share price.

We believe the dividend is very safe, and so are the safety standards in place at the company (especially after the Deepwater Horizon incident). We did a deep dive on BP’s business, and you can access that report here:

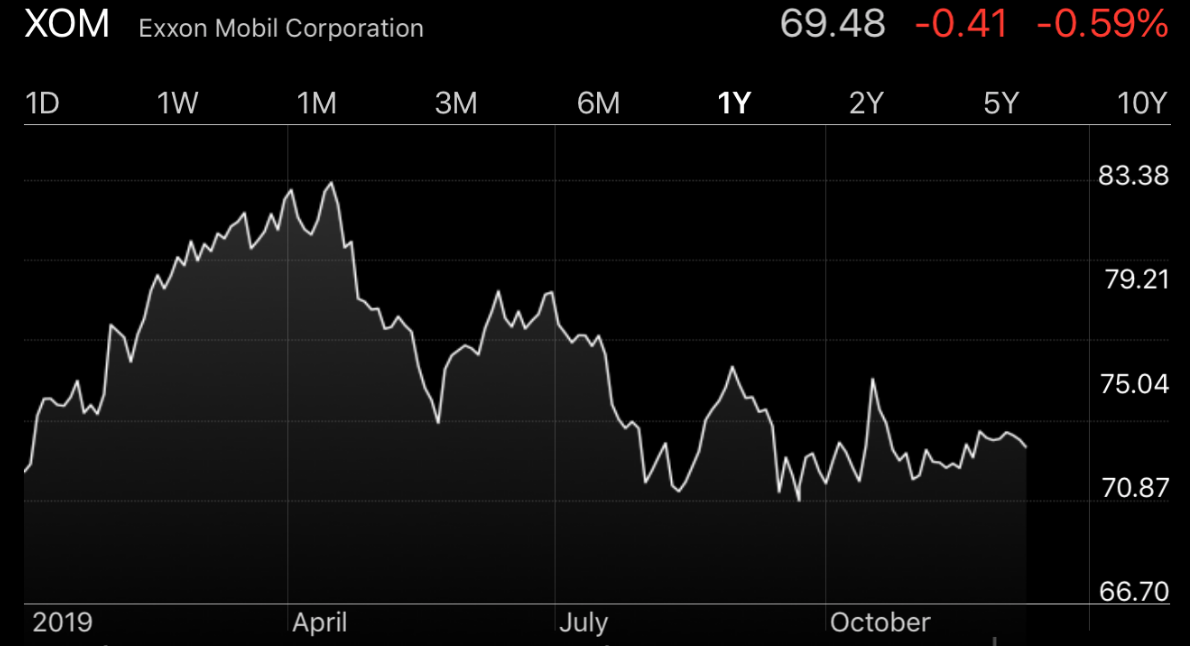

7. Exxon Mobil (XOM), Yield: 5.0%

Even though Exxon Mobil offers a lower dividend yield than its large cap integrated energy peers (such as RDS and BP) we ranked it as more attractive on this list because the dividend yield is still very big (it’s actually near a 30 year high), the dividend is very safe, and the shares have very significant price appreciation potential in the years ahead as management continues to execute on its attractive “high grading” strategy.

You can read our full write-up on Exxon Mobil here:

6. Tsakos Energy Navigation—Preferred Series-E (TNP.PE), Yield: 9.9%

We’re going with a lessor known preferred stock with a huge dividend yield and a discounted price for our number 6 pick.

Tsakos operates a fleet of 68 marine transportation vessels for crude oil, LNG and other petroleum products, and serves oil companies worldwide on long, medium and short term charters. The dividend on these Tsakos preferred shares is cumulative, and preferred stock is higher than common stock in the capital structure. We also think the shares haven’t risen enough following the sharp rise in shipping rates in early October and a recent charter extension for one of its LNG carriers. You can read our full write-up on Tsakos here:

5a. Phillips 66 (PSX), Yield: 3.3%

Do not be turned off by the relatively small dividend yield here because realistically a 3.3% dividend yield is NOT small, and in the case of PSX—the dividend continues to grow significantly and steadily.

This business is unique and it does not get the credit (or valuation multiple) it deserves for its very attractive midstream business. We expect these shares and the dividend to go significantly higher over time.

5b. Teekay Offshore Preferred B (TOO.PB), Yield: 9.7%

The price of these preferred shares rebounded extremely hard in late September following some additional clarity from institutional investor Brookfield Business Partners (BPU). Basically Teekay agreed to be acquired by Brookfield, and this dramatically improved Teekay’s financial wherewithal. However the shares still trade at an attractively discounted price and offer a huge yield (and we continue to own them).

We owned these shares and benefited from the big rebound earlier this year, and you can view our fearless report from immediately before the big rebound here:

4. Williams Companies (WMB), Yield: 6.4%

We’ve owned this one since it was Williams Partners (WPZ) (technically WPZ was acquired), but we continue to believe the WMB entity is very attractive for its improved business model and steady distributions to income-focused investors. Specifically, after a challenging period involving financial and operational reorganization, the company has emerged financially stronger and set to grow its distribution.

More specifically, WMB is well positioned to grow its EBITDA, cash flows and distribution while maintaining its credit metrics. We currently own shares of WMB, and you can read our recent full report here:

3. Adams Natural Resources Fund (PEO), Yield: +6.0%

The Adams Natural Resources Fund (PEO) is an attractive closed-end fund that’s been paying dividends (technically “distributions”) for over 80 years. However, it won’t show up on many of the energy sectors screens investors often run because it’s a “CEF.” Furthering PEO’s “under-the-radar” status, many financial websites list its yield as lower than 6% because they incorrectly omit this fund’s large Q4 distribution.

We currently own shares of PEO, they trade at an attractive discount to NAV (as CEFs often can), and we wrote in great detail about this attractive fund recently. You can read that full report here:

2. NuStar Energy—Preferred Series C (NS.PC), Yield: 9.0%

These preferred stock shares (NS.PC) are attractive. Nustar is one the largest independent terminal and pipeline operators in the US, owning ~9,850 miles of pipeline and has a storage capacity of 61.5 million barrels.

The business is growing at an attractive pace, it has laid the foundation for expansion, all the while working to reduce leverage. You can read our full report on Nustar here:

1. Energy Transfer (ET), Yield: 9.4%

Energy Transfer, LP (ET) is a stable, cash flow generator that operates energy oriented transportation, storage and midstream assets in major production basins in the United States. Specifically, Energy Transfer offers investors an attractive, stable income vehicle in the energy sector.

As a midstream company, the majority of the its cash flows are based on fee and tariffs tied to volumes rather than prices which leads to cash flow stability despite swings in oil and gas prices. The company is set to improve its balance sheet and cash flows which will help reduce the company’s valuation gap relative to its peers. ET’s 9.4% yield is highly appealing given improving fundamentals and the defensive nature of its cash flows. You can read our full Energy Transfer report here:

Conclusion:

The saying is to “buy when there is blood in the streets,” and energy stocks have been under performing the rest of the market by a wide margin. And what makes many of them so attractive is that despite the poor share price performance, the businesses and dividends are healthy and growing. Further, fossil fuel use isn’t just going to disappear overnight (i.e. we’re still going to be using a lot of oil and gas for many many years). Given the attractive dividends and attractive valuations, we believe the names on this list are very attractive and worth considering for a spot in your prudently-diversified, long-term, income-focused investment portfolios.