Sometimes investors just want big monthly income payments without all the worries and risks associated with the stock market. This article covers a Closed-End Fund (“CEF”) that offers an attractive 9.1% yield (paid monthly) by investing in an actively managed portfolio of fixed income securities (bonds). Not only does this fund pay monthly, but it’s never reduced its monthly payments in its 6-year history, and it actually just raised them. Further, it trades at a compelling 6.3% discount to its net asset value. It has other attractive qualities too, such as a conservative amount of leverage, and an attractive management team. This article reviews the risks and rewards, and concludes with our opinion about investing.

BlackRock Multi-Sector Income Trust (BIT), Yield: 9.1%

The primary objective of the BlackRock Multi-Sector Income Trust (BIT) is to seek high current income, with a secondary objective of capital appreciation. It’s a CEF, and if you don’t know, according to Investopedia, a Closed-End Fund (“CEF”) is a “portfolio of pooled assets that raises a fixed amount of capital through an initial public offering (IPO) and then lists shares for trade on a stock exchange.” CEF’s are unique versus other funds, such as Exchange Traded Funds (“ETFs”), because CEF market prices are driven in large part by supply and demand, and can therefore trade at significant discounts or premiums relative to the value of their underlying holdings, as we will cover later in this report (hint: BIT trades at an attractively discounted price). For more information on CEF’s (and how to pick a good one) check out our report: How to Pick a Good CEF.

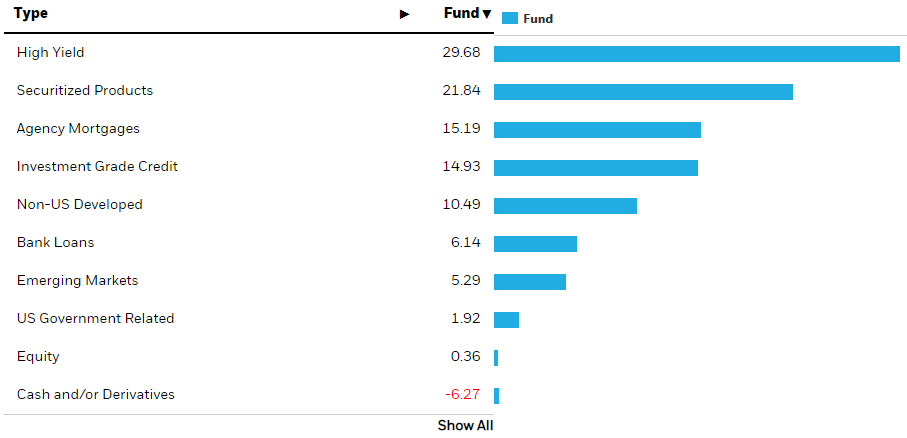

To give you a little more perspective on BIT, here is a breakdown of its current holdings by sector, credit quality and top positions.

(image source: BlackRock website)

As you can see in the above graphics, the fund is well diversified across sectors, ratings and issuers. You may have some concern about the use “High Yield” and some lower credit quality securities within the fund. However, this is only part of the fund’s holdings (it’s diversified), and we’ll have more to say about the credit quality in the “Risks” section of this report.

Leverage

Worth noting, this fund does use some leverage (borrowed money), and we view this as prudent and attractive. According to Morningstar, the fund’s leverage ratio recently sat at 37.5%, which is well within the normal range for a fixed income Closed-End fund. Further, we view BIT’s leverage as attractive because it magnifies the income and total return delivered to you, by this fund, by approximately 37.5%, all else equal. And even though this does introduce some extra risk (that the market could move against you), we’re comfortable with this amount of leverage for these types of fixed income securities, especially considering the fund is able to borrow at lower “institutional” rates than the average investor, and because the fund is professionally managed by the disciplined team at BlackRock.

Discount to NAV

Another attractive quality of this fund is that it currently trades at a discount to the net asset value of its underlying holdings. Per data from CEF Connect, the discount recently sat at 6.38%, which is a bit larger than normal over the last 3- and 6-month periods.

(image source: CEF Connect)

We view this discount as attractive because it means you’re buying the underlying holdings on sale. You’re getting all the income you’d get if you paid full price, you’re just getting it at a discount. And similar to the leverage we discussed previously, the discount to NAV is another attractive characteristic that can magnify the income this fund is able to pay to you.

Additional Attractive Qualities of BIT:

We also like BIT for several additional reasons. For example, we like that the fund is professionally managed by BlackRock. BlackRock is a large organization with many closed-end funds (and many investments of other types too), and this helps ensure the fund has the resources and infrastructure to be successful. For perspective, this fund has over $650 million of net assets, which means it has plenty of scale to succeed and thrive, especially as compared to some smaller funds. Further, BlackRock has a reputation for reasonable fees, and BIT is no exception. BIT’s management fee is 1.31%, which is not unattractive for a fund of this type. Note, the total fee rises to 2.90% when you include the additional costs of borrowing, and we view this as reasonable considering the attractiveness of the fund (total expense ratios can go significantly higher for other similar types of CEFs).

Strong History of Distributions

We also like this fund for its strong history of healthy monthly distributions to investors. The fund’s distributions have historically been comprised of entirely income (no return of capital or capital gain distributions), and the distributions have never been reduced. In fact, the monthly income payments to investors was just increased, as you can see in the following chart.

Risks:

Of course, there are risk factors that should be considered when investing in this fund. For starters, a significant portion of BIT’s underlying assets are invested in high yield bonds, and high yield bonds can add some volatility to returns. Specifically, when the market gets “jittery” high yield credit spreads (as measured by the orange bar in the following chart) can widen, and the price of this fund can decline (temporarily), as you can see in the following chart.

As the above chart shows, when credit spreads widen BIT can sell off. However, spreads are currently slightly elevated, relative to recent history, and we view this as creating an attractive entry point/buying opportunity.

Another risk factor is simply that the fund’s discounted price versus NAV could get larger (i.e. the discount could get bigger). In this case, the price of the shares could go lower. However, given the strong history of steady income payments, we view any discount widening as an increasingly attractive buying opportunity, as investors can keep collecting the high income payments (the fund’s primary objective) while waiting for some likely capital appreciation (the fund’s secondary objective).

Conclusion:

If you are looking for high monthly income that is not totally dependent on the whims of the stock market, then the BlackRock Multi-Sector Income Trust (BIT) is worth considering. Not only does it pay big healthy monthly income, but it is well-managed, and trades at an attractive price. We are currently long shares of BIT in our Blue Harbinger Alternative Fixed Income portfolio.