The market continues to reach new all-time highs, and our investment portfolios do too. However, a handful of popular big dividend paying equities have gotten particularly less expensive in recent weeks. This week’s Weekly provides a brief update on all four of them, and whether we believe they are worth investing or avoiding altogether.

Before getting into the details of the four opportunities, it’s worth reviewing overall market sector performance this year, because each of these opportunities are impacted by it. For example. Two of the ideas in this report are Real Estate Investment Trusts (or REITS) which have recently experienced a bit of a sell of after experiencing very strong performance this year. And Energy Transfer sits in the Energy Sector, the worst performing major market sector so far this year.

Here is a chart and table to give you some perspective on recent sector performance.

Stock-Specific Opportunities:

Ventas (VTR), Yield 5.4%:

Ventas is a big dividend health care REIT that we warned investors about two quarters ago. Specifically, in this report, we explained how the company is adjusting its strategy around changing market conditions, and it has ALMOST (but not yet) turned the corner. Since that time, Ventas has continued to face challenges, and after its most recent earnings announcement, the shares sold off hard (as you can see in our earlier chart. In our view, Ventas will eventually turn the corner thanks to a solid strategy and a continuing demographic wave. We have been avoiding owning shares of Ventas (we’ve continued to own another healthcare REIT, Welltower (WELL), but at this new lower valuation, we believe Ventas is worth considering. Depending on your personal investment goals, we’d not be opposed to picking up a few shares of Ventas at these levels.

Energy Transfer (ET), Yield 10.5%:

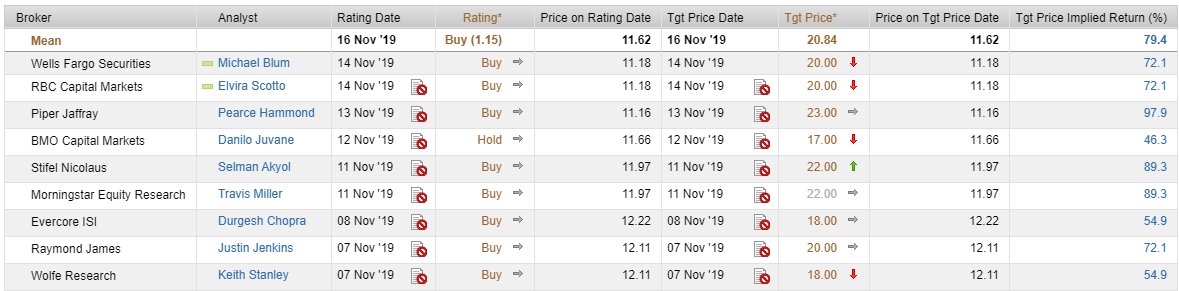

We recently wrote in detail about Energy Tranfser in this report, and we continue to like the shares (in fact we own Energy Transfer). The shares have been dragged down by a struggling Energy Sector and, more recently, by news of an FBI investigation about how the company has pushed through environmental approvals. We continue to be very confident in this high dividend yield, and the shares ability to rebound higher. And for a little perspective, Wall Street analysts covering the shares continue to be extremely bullish following the latest batch of news (they think the shares have the ability to nearly double), something we consider very positive in this case.

The saying is “buy low” (e.g. “buy when there is blood in the streets”), and Energy Transfer is currently offering a very attractive buying opportunity, in our view.

New Residential (NRZ), Yield: 13.2%:

We continue to like (and own) shares of this big-dividend mortgage REIT. The two big risks we see for NRZ are mortgage pre-payment speeds and limited market growth opportunities. Regarding pre-payment speeds, they speed up when interest rates fall, and the Fed’s latest bout of interest rate messaging adjustments has created some volatility in the share price of NRZ. We realize there could be further share price volatility ahead, and consider the volatility to be a buying opportunity creator, instead of a call for fear. And regarding “limited market opportunities,” we believe the amazing growth that NRZ experienced over the last decade has been a result of the company’s expansion into mortgage servicing rights assets across all 50 US states; and now that expansion has slowed, so too have NRZ’s growth opportunities. As a result, management has increased its investments in more traditional mortgage related securities, which still offer very attractive high yields, albeit with a different volatility and risk profile. We continue to own these shares. You can read our previous NRZ reports here.

Oxford Square (OXSQ), Yield: 17.9%:

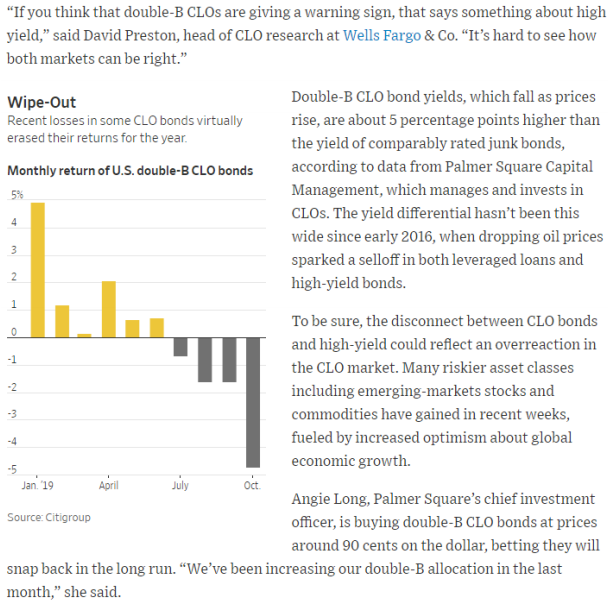

Oxford Square is a business development company (BDC) that invests in bank loans and debt and equity tranches of CLO vehicles. It offers a big yield and the shares have recently sold off. The sell-off is related to volatility in the CLO market (see the Wall Street Journal article we’ve pasted below for more details), and we are currently in the process of putting together a detailed report on OXSQ. We do currently own shares, and we suspect the sell-off is an attractive buying opportunity, but we’ll have a lot more to say about this one seen (hopefully within the next week, or sooner), once we’ve completed our latest detailed analysis of OXSQ.

Conclusion:

Regarding the four big-dividend investment ideas described in this article, of course your decision to invest (or not invest) depends on your personal goals. All four of them have recently sold off sharply, thereby mathematically increasing the yield to new investors. We continue to own New Residential, Energy Transfer and Oxford Square within our diversified Income Equity portfolio, and we’re taking a closer look at Ventas as well as preparing a detailed report on Oxford Square (to be released within the next week). All of our investment portfolios continue to grow their track records of outstanding long-term performance and high income. Disciplined, prudently-diversified, goal-focused, long-term investing has proven to be a winning strategy over and over again through out history.