All Blue Harbinger strategies delivered positive returns and outperformed the S&P 500 in May, thereby continuing their growing long-term track records of outperformance. This report provides details on performance and holdings, and provides updates on our biggest movers over the last month. We also provide a dashboard on market sector dynamics, that we believe is worth considering.

To get right to it, here are our updated strategy performance charts...

Income Equity:

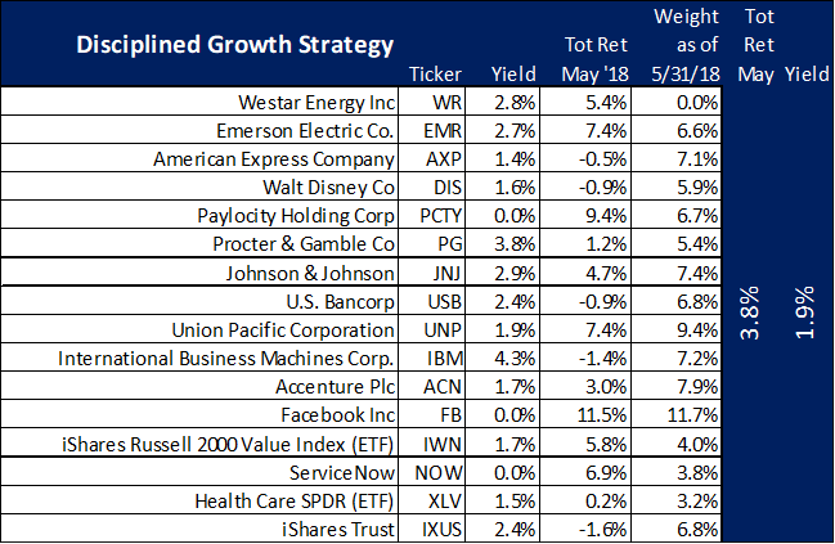

Disciplined Growth:

Balanced Portfolio:

And here are the updates on our biggest movers over the last month...

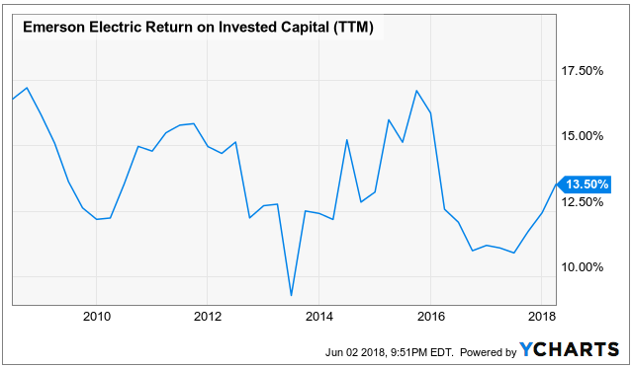

Emerson Electric (EMR), Yield: 2.7%

St. Louis Missouri headquartered Industrial equipment company Emerson Electric posted strong gains during the month, delivering a total return of 7.4%. The shares were up significantly more following an expectations-beating earnings announcement to start May, but gave back some gains following the announced acquisition of Aventics (producer of smart pneumatics technologies that power machine and factory automation applications).

This is a company that continues to deliver high returns on its invested capital (see below), as there are high switching costs for customers which give Emerson some healthy pricing power.

Paylocity (PCTY)

This cloud-based payroll processing and HR company (targeting small-to-mid sized businesses) continues to generate strong growth, and it has a lot of room to run. The company announced that it handily beat quarterly earnings estimates (again) this month, and sales keep growing:

What’s particularly attractive about this company is that customers tend not to leave Paylocity because they don’t want to disrupt their payroll and human resources functions. We believe this is a company with significantly more growth on its short- and long-term horizons. Further, once Paylocity stops focusing so heavily on sales, margins will rise significantly, and this will essentially become a cash cow business.

Facebook (FB):

After a brief hiccup in its price following fear of CEO Mark Zuckerberg discussing privacy concerns in front of Congress, the shares have resumed their upward trend (did you buy the dip?) and they have significantly more upside ahead as mobile advertisement revenue is a truly enormous opportunity that customers are willing to pay up for because of its effectiveness.

Not to mention Facebook’s growing war chest of cash.

Here is a look at FB recent history of bearing expectations.

Facebook continues to experiment with virtual reality which could eventually become a major new source of revenues.

Williams Partners (WPZ), Yield: 6.1%

WPZ had a great month of May gaining over 11% as it was announced that Williams Companies (WMB) will be acquiring the 26% of WPZ that it doesn’t already own, and they’ll being doing so at a premium. The transaction will simplify the corporate structure of the gas pipeline and infrastructure group. Based on a recent Morningstar report, the simplification transaction will further improve the organization’s cost of capital, deleverage the partnership, strengthen distribution coverage, and reduced the need for equity issuances over the next few years. Not to mention William’s continuing access and long-term contracts related to prime location pipeline and infrastructure.

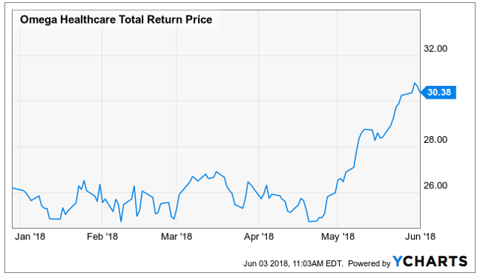

Omega Healthcare Investors (OHI), Yield: 8.5%

Omega announced expectation-beating quarterly earnings last month which helped reassure investors’ concerns about dividend coverage considering several of its struggling facility operators. Specifically, Omega announced Q1 FFO of $0.78 beating expectations by $0.04, and announced revenue of $220.2M (-5.0% Y/Y) beating street expectations by $5.35M.

Three positive and key considerations from Omega’s quarterly call are as follows:

- As part of our strategic positioning, in the first quarter of 2018, we disposed of $98 million in assets. And including assets held for sale, we’re evaluating over $250 million in additional asset sales in 2018. The revenue reduction related to our $98 million of first quarter assets disposed is $10 million, while the trailing 12 month cash flow in these assets is $4 million. The cash flow on these assets did not cover the underlying rent, yet we were able to achieve sale proceeds that equates to rent yields of approximately 10%.

- Our strong sales results today reflect the continued appetite for SNF assets by local market private buyers. We’ve made great progress addressing the operators; Orianna is in the middle of a controlled Chapter 11 Bankruptcy process; Signature is being resolved outside of bankruptcy; and Daybreak is paying current rent obligations timeline. Later in the call, Dan will provide more detail regarding portfolio workouts.

- Turning to our dividend and 2018 guidance. Our quarterly dividend of $0.66 per share reflects the payout ratio of 85% of adjusted FFO, and 96% of funds available for distribution

Omega is making good progress with its troubled operators, and the market is liking what it is seeing so far. You can read our previous longer write-up on Omega here:

We continue to own our shares.

Automatic Data Processing (ADP), Yield: 1.85%

ADP provides payroll processing and benefits administration to large companies, and it benefits significantly from a strong economy, particularly increases in employment. This is also a company that has increased its dividend every year for the last 40 years. This company has highly defensible economic moats considering once a customer sets up with ADP—the switching costs are too great. ADP revenue and profits continue to grow, a trend we expect to continue.

Skyworks (SWKS), Yield: 1.3%

Skyworks posted a strong price gain of nearly 14% in May, and this gain is long overdue, and we believe the price is still way too low relative to Skywork’s long-term value. We wrote in detail about Skyworks in this article:

And even though the stock just rallied, it is still considerably cheaper than it was, and it has significantly more upside, in our view.

Conclusion:

We believe all of the strategies continue to be positioned attractively for continued long-term gains, income, and profits. The global economy continues to strengthen and grow (particularly the US), and "growthier" sectors of the economy continue to be particularly attractive, in our view, though we are careful to include select attractive securities across most sectors to help ensure we can continue to post strong gains (and income) if/when market conditions do change. For reference, here is a look at how varying market groups have recently been performing: