Consider buying these shares now to add some powerful long-term growth that is currently trading at an attractive price relative to its value. We'll explain why the shares are on sale, why they've got large long-term upside, and why if you can handle a tiny (but growing) 1.3% dividend-yield in your portfolio, they're worth considering... now.

Skyworks Solutions (SWKS)

Skyworks makes high-end chips mostly for smart devices, and the business generates high margins that most competitors cannot achieve because they don't have the sophistication of Skyworks.

The shares have sold-off because of:

- Normal Seasonality,

- An iPhone inventory correction, and

- US-China trade intervention related to business with ZTE.

However, over the long-term Skyworks will continue to benefit from its ability to service the increasing complexity of smart devices. We like the shares not only because Skyworks is a leader but also because the market cap (~$18.1 billion) is relatively small relative to the other leading chip makers which could eventually make Skyworks a buyout target as industry consolidation continues (because Skyworks would likely get acquired at a very healthy premium).

For perspective, here is a look at Skywork's recent performance relative to other chipmakers (and Apple, one of its big customer)...

The point is to show the shares haven't kept pace--however we believe they should have (based on the healthy business)--i.e. they're currently on sale.

Here is our update from Skywork's earnings announcement a few weeks ago, and more color on our views.

Metrics to consider...

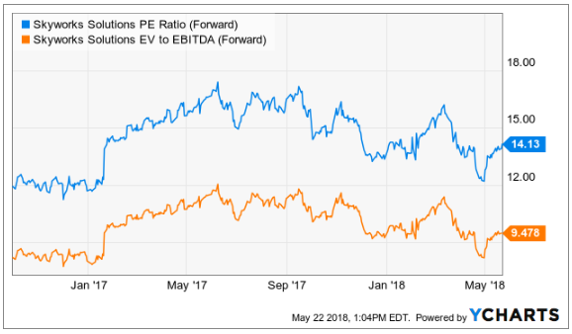

Stock Price: $99 Market Cap: $18.1B Fwd P/E: 14.1x Fwd P/S: 4.7x

ROE: 22.2% Dividend Yield: 1.3% EV/(Fwd) EBITDA: 9.48x

Earnings Update

(from May's announcement)...

Skyworks beat on EPS and Revenues...

- Q2 EPS of $1.64 beats by $0.04.

- Revenue of $913.4M (+7.2% Y/Y) beats by $2.44M.

But provided downside Q3 guidance...

- June quarter revenue from $875M to $900M (consensus: $931.61) which would represent a 1.5%-4% sequential decline and a 0%-3% year-over-year decline. Skyworks noted the loss of about $25 million-$30 million of lost revenue in the June quarter associated with the ZTE ban, mostly in the firm’s mobile business. Nonetheless, Skyworks foresees significant sequential growth in the September quarter and growth again in the December quarter, in line with traditional seasonal patterns.

- EPS from $1.59 to $1.60 (consensus: $1.65).

The lower guidance is likely the result of an inventory correction for Apple iPhones and a loss of China’s ZTE business due to US government intervention.

Other key metrics...

- Non-GAAP gross margin, 50.7%;

- Operating margin, 36.3%

- Cash and equivalents, $1.88B.

According to said Liam K. Griffin, president and chief executive officer of Skyworks:

“Skyworks delivered record top and bottom line results for the March quarter driven by global demand for our high performance connectivity engines…” “We demonstrated continued strength in our financial fundamentals as improvements in profitability directly translated into cash flow growth. At the same time, our solutions are enabling an expanding and diversified set of end markets spanning the Internet of Things, automotive, home security and factory automation. With the launch of Sky5™, Skyworks is well positioned to capitalize on the transformational applications ahead ─ powering 5G networks and facilitating instantaneous, reliable and secure wireless connectivity.”

However, according to Kris Sennesael, senior vice president and chief financial officer of Skyworks, there is softness among smartphone customers:

“Strong growth in our broad market portfolio is mitigating the near term softness at leading smartphone customers and the trade restrictions imposed by the U.S. government on a Chinese OEM,” said Kris Sennesael, senior vice president and chief financial officer of Skyworks. “Specifically, for the third fiscal quarter we expect revenue in the range of $875 to $900 million, with non-GAAP diluted earnings per share of $1.59. Further, based on new program ramps heading into the second half of the calendar year, we anticipate a resumption of sequential revenue growth in the September quarter with sustained momentum into the December period.”

Skyworks does traditionally experience a seasonal downturn in calendar Q1...

Valuation:

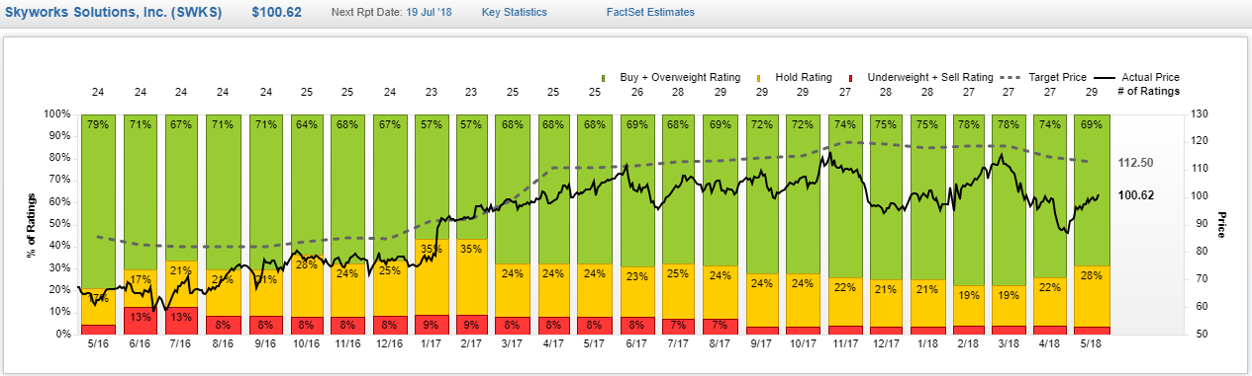

The Street continues to believe the shares have upside.

The Bottom Line:

Skyworks’ business remains healthy and the company is attractively priced relative to its long-term growth and value. Specifically, Skyworks should continue to benefit from its ability to service the increasing complexity of smart devices, but is experiencing a traditional seasonal sales slowdown, as well as negative impacts from an iPhone inventory correction, and US-China trade intervention with regards to ZTE (which we expect to be resolved amicably, eventually). In our view, the Street is way too short-term focused in its view of Skyworks (i.e. the shares have a lot of long-term upside). This isn't our traditional high-income stock, but if you like to add a little diversity and powerful long-term price appreciation potential, Skywork's 1.3% dividend yield is worth considering for a spot in your investment portfolio.

For reference, we wrote about Skyworks in more detail about 1 year ago in this article...

The shares haven't moved much since then (mainly due to the reasons described in this article), but Skyworks has increased its dividend, and the shares are even more attractive now, in our view.

Also, if you're looking for an alternative way to play these shares, consider this write-up on Skyworks from last June (it focuses on an income-generation options strategy).

You can view our current holdings here.