Investors continue to express concerns about the possible negative impacts of rising interest rates, as well as concerns about a possible market pullback. As a result, we're sharing this lower volatility investment opportunity with some "hedging" benefits against the risk of rising interest rates.

This is a guest article from Alpha Gen Capital. Alpha Gen runs a highly rated membership service (Yield Hunting: Alternative Income Opportunities) that focuses on attractive risk-return areas of the market. This particular article reviews a newly issued, high-yield (+7%), fixed-to-floating rate preferred stock. Alpha Gen recently initiated a position in this preferred stock; we've added it to our watch list.

What follows is Alpha Gen's write-up...

Summary

- Preferred stocks typically have perpetual maturities and are only retired at the behest of the issuer.

- Landmark is a unique MLP/REIT hybrid security with a very stable business model and barriers to entry.

- The common shares yield over 9% currently but a new preferred issue has a 7%+ yield plus upside from higher rates.

- We added the preferred security to our Strategic Income Portfolio. The preferred series C began trading on the Nasdaq this morning (April 20) under the ticker LMRKN.

Landmark Infrastructure Partners- (LMRK)

Short Summary: This is an interesting small cap speculative infrastructure REIT play that investors should consider investing from the preferred stock angle while waiting for a large margin of safety on the common.

We recently wrote on Ares Corp- (ARES) which was converting from a C-corp publicly traded limited partnership to a corporation. The switch was due to the recently passed tax reform bill that the Trump administration pushed. With the lower tax rate, there is an incentive to make that switch and we are likely to see many publicly traded LPs make a similar move.

LMRK is a niche MLP/REIT - and as such, issues a K-1 (dun dun dunnnnn). But hold on, we will detail some more moves that management has made in the last year to simplify their tax package including placing the partnership's assets into a REIT subsidiary.

They bill themselves as a "growth-oriented" real estate and infrastructure company formed to acquire and manage a portfolio of real property assets. These are interests in wireless communication, outdoor advertising, and land underneath solar panels and wind turbines. The assets are the core backbone of their tenants' operations and businesses.

The market cap is not large, at just ~$430 million. The shares trade with a beta of 0.52 to the S&P 500. The forward dividend yield is now at 9.05% based on a $1.47 annual payout.

Since inception, the shares have traded in a channel between $14 and $18.

On the most recent conference call in February, CEO Tim Brazy noted:

2017 was our third full year since our IPO, and we continue to make very significant progress growing the Partnership. This past year, we’ve achieved several milestones and continued our transition toward a more fully integrated real estate and infrastructure company. Since our initial public offering in November 2014, we've more than tripled the number of assets in our portfolio from approximately 700 at the IPO to more than 2,200 assets at the end of 2017. We’ve also increased our revenue by more than four times from approximately $13 million at the time of the IPO to over $50 million in 2017.

The company has three operating segments exposed to fast-growing industries:

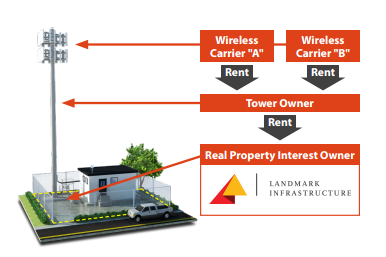

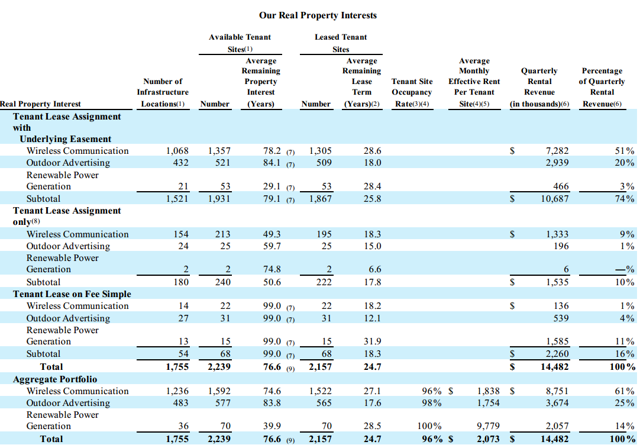

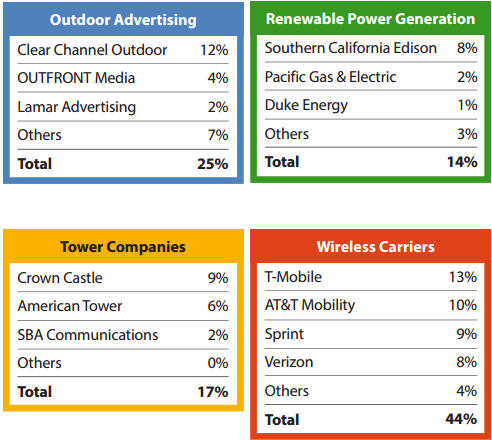

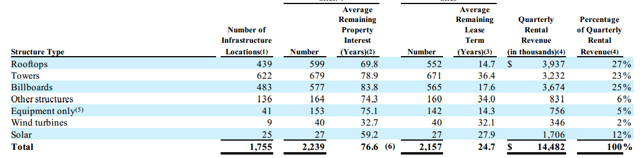

- Wireless Communication: These are tower assets that are owned by the major tower companies or directly by the wireless carriers. Combined, these two pieces account for 61% of company revenue. There are more than 153,000 locations worldwide. LMRK owns and operates 1,592 sites, 96% of which are currently leased. LRMK's portfolio contains less than 1% of those locations giving them significant capacity for expansion.

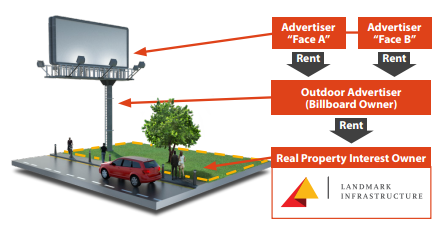

- Outdoor Advertising (billboards): With more than 165K locations, this is a large industry with growing revenue. It is estimated that by year 2026, outdoor advertising revenue will reach $11.3 billion. LMRK owns 565 sites, 98% of which are currently leased and amounting to 25% of quarterly revenue.

- Renewable Power Generation: This is their smallest segment but one that is growing rapidly. At 14% of revenue (and 3% of leased sites), the segment is not substantially material but they have just 70 locations today. There are 48K locations worldwide giving them a long and large runway.

Below is a table of their real property interests and the structure of the lease, quarterly revenue production, and occupacy rates:

(Source: 10-K Filing)

Managing a REIT should be thought of in the same vein as being a landlord. Owning property and renting it out to a tenant can be a difficult business. You have to find the right tenant and right income stream to make everything work correctly. We've seen how important this is recently with the retail REITs where tenant quality has become front-and-center the most important metric. Investors are shunning REITs with high concentrations of exposure to Sears (SHLD), J.C. Penney's (JCP), and even Macy's (M) among many others.

Fortunately for LMRK, they have over 85% of their revenue derived from tier one tenants.

(Source: Investor Presentation)

The business model and lease terms allow for very stable cash flows from long-lived assets. The average remaining life on their real asset interests are over 76 years! This allows them to have massive operating margins with little to no maintenance capex (its just raw land), essentially making them a triple net lease. The average remaining lease term is nearly 25 years.

In most of their locations, the tenant leases were acquired together with an easement granted by the property owner. This allows LMRK the right to the tenant site occupied by the tenant under the lease terms.

- The lease terms also have rent escalators and lease modification clauses allowing rental income to increase over time. The rent escalators are on 93% of their leases with 7% tied to CPI and the other 86% containing fixed rate increases with an average annual escalation rate of approximately 2.5%.

- The modifications are primarily done in the wireless segment due to technology upgrades and the co-location of additional tenants to the same property. In the outdoor advertising space, the conversion to digital billboards is also a mechanism for a lease modification.

The key takeaway is that their cash flow is highly stable with margins above 90%. It is the envy of any business owner to have margins that high, with multi-year visibility to cash flows, and little-to-no operating expenses. Add on top of that, the high barriers to entry for the industry. It is not easy to replicate the property often located in dense population areas while netting the zoning necessary to build the infrastructure on top.

Approximately 78% of their total borrowings are fixed rate including their preferred stock issues, $195 million through swaps with a 4.19% blended rate, and $194 million of secured notes with a 4.18% fixed coupon.

The shift towards wireless infrastructure also makes the business less cyclical. Data towers and cell phones have become a need, not a want. Thus, people are likely to pay their wireless bills regardless of where we are in the business cycle. The only real exposure comes from the billboard business which can be cyclical. In that business segment, LMRK leases out to the main billboard advertising companies like Outfront Media- (OUT), Lamar Advertising- (LAMR), and Clear Channel- (CCO).

Drivers For Growth

- Organic growth via rent escalators, modifications, revenue sharing

- Lease renewals from below market leases

- Accretive drop-down acquisitions from the sponsor

- Third-party portfolio acquisitions

The business model is such that their organic growth will be relatively low and driven by rent escalators (approx. 2.5% per year), and lease modifications which require no capex. The modifications are primarily done in the wireless segment due to technology upgrades and the colocation of additional tenants to the same property. In the outdoor advertising space, the conversion to digital billboards is also a mechanism for a lease modification. Outside of those two items, they can realize higher income from renewals (and thus higher rental rates) and revenue sharing agreements.

Inorganic growth will be the primary avenue for above trend and market share capture. The assets under management with the sponsor and their affiliates alone would significantly increase the size and scale of their portfolio. There are about 900 available assets spread across all three business segments (67% wireless, 17% outdoor advertising, and 16% power generation). If they were to add all of these assets, their total properties would reach 3,268 (+38%).

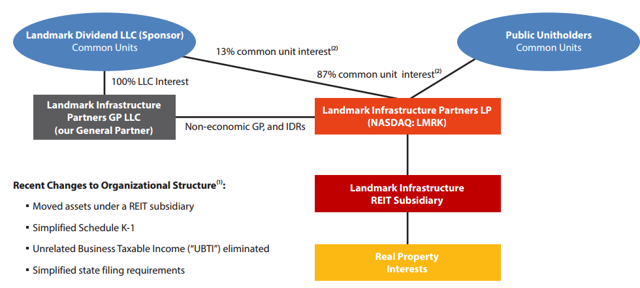

Change Of Structure

In the middle of last year, the partnership took a significant step to simplify their organizational and tax reporting structure. Most investors hate K-1s and avoid them like the plague. It's understandable. CEO Arthur Brazy said last year that they decided to change the legal structure to make it easier for investors. By moving substantially all of their operating assets to a controlled subsidiary which qualifies as a real estate investment trust.

From the release:

After the changes to the Partnership’s legal structure are implemented by the end of July 2017, the Partnership expects that the new structure will simplify tax reporting for unitholders and substantially eliminate unrelated business taxable income (“UBTI”) allocated by the Partnership to tax-exempt investors, including individuals investing through tax-deferred accounts such as individual retirement accounts (“IRAs”), ultimately broadening the Partnership’s investor base. The Partnership’s reporting on Schedule K-1 is expected to be simplified to include predominately dividends, other corporate distributions and related expenses, and is intended to eliminate the amount of state taxable income sourced to states other than the state of residence for most individual unitholders. These changes are expected to apply to both the common and preferred units and are not expected to impact the presentation of the Partnership’s financial results.

The move to simplify tax reporting and eliminate UBTI opens up the shares to a larger pool of investors. The ability to avoid unrelated business taxable income allowing unit holders to freely purchase LMRK units without having to worry about generating taxable income sourced to states outside their own state of residency is a substantial advantage.

The general partner (sponsor) is Landmark Dividend LLC who owns 13% common unit interest whereas public unitholders own the remaining 87%. The alignment of interests is a key consideration for investment and they are highly congruent with public unitholders.

Early on in their public life, the company grew primarily through drop-down acquisitions. In 2015, they conducted 8 drop-down acquisitions of 761 tenant sites. In 2016, that fell to 5 drop-down acquisitions for 539 sites. Last year, they completed just 4 for 155 sites. Starting in 2017, they have started to shift away from that strategy and towards internally financed growth. The sponsor has an additional ~900 assets under management in Landmark Dividend for drop-downs and affiliates plus third-party acquisition opportunities.

In early 2016, they completed their first preferred stock offering- a $40 million deal for their series A units. In August of the same year, they completed their second preferred stock offering- a $46 million offering. In October of 2016, they conducted a $56 million secondary offering issuing equity.

Fourth Quarter Results

In mid-February, the company released their fourth quarter and fiscal 2017 results:

- Rental revenue growth was +27% yoy to $14.5 million, driven by the acquisitions completed in the prior twelve months.

- Ended Q4 with 2,157 leased tenant sites out of the total of 2,239 available sites, with an occupancy rate of 96%.

- Wireless carriers have started to upgrade equipment for 5G deployments giving way to significant tenant modification activity.

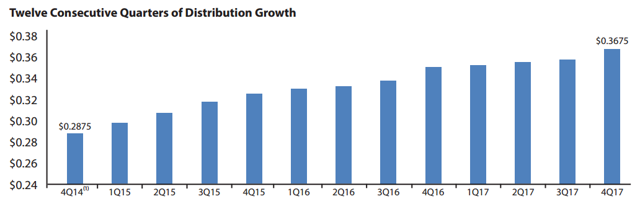

- Fourth quarter cash distribution of $0.3675 per common unit, the 12th consecutive quarterly increase, and a 5% improvement.

- Fiscal 2017 EBITDA rose to $51.75 million, up from $34.3 million in fiscal 2016.

- Distributable cash flow ("DCF") hit $28.8 million, a 34% increase from last year.

The company does have a lot of debt at $491 million or 9x adjusted EBITDA. But remember that their cash flows are extremely stable with little variation and reduced exposure to the business cycle. Hence, lenders are willing to extend and allow more debt than a more cyclical, cash flow volatile, business model.

Management laid out guidance for 2018 including acquisition volume and development spending in the range of $250 million to $300 million. New development spending is expected to be approximately $50 million as they push through their growth initiatives in the pipeline. Overall, management sees distribution growth of 10% over the fourth quarter of 2017 $0.3675 per unit payment.

DCF coverage was only 0.87x, down from 0.93x the year before. Management covered this shortfall by stating that drop-down H and other acquisitions should begin to meaningfully produce cash flow growth in 2018 and cover that variance in the payout.

(Source: Investor Presentation)

Valuation

We look at LMRK as a bond more than a growth stock. Over time, it is our expectation that we will earn the dividend yield on cost, plus or minus 1% from price movements. The price channel has been quite clear with the shares oscillating between $14 and $18. At $17, the shares yield just over 9% using the new payout annualized. Our target yield is 9.25% which is our cost of capital hurdle plus 50 bps. That would be reached at a price of $15.89. But we must adjust for the quarterly dividend.

The shares went ex-dividend on February 2, so we would expect the next dividend to be approximately May 2. Well, a stock on May 1 should be worth more (all else equal... and it never is) compared to March 1 as more of the dividend has accrued to the shareholder.

Risks

The two main risks are the complicated organizational structure and the debt load.

Complex Organizational Structure: There is a clear conflict of interest. The company and affiliates own a moderate-sized stake in the company and control the general partner. The unit-holders have only nominal voting power and cannot force change to management. So there's a degree of trust in management that has to go into this investment.

Debt Load: As we move into a rising rate environment for financing (short-end of the curve), the cost to fund acquisitions and existing operations will increase. Given the higher rates, we would expect the ability to acquire new assets could be curtailed unless prices adjust to reflect the new environment. Higher rates would also shrink the spread between their cash flow growth (from the rent escalators) and the cost of that capital (interest expense). Most of their debt today is fixed but that is likely to change as they need to increase/roll that existing debt.

Management understand that the company is highly levered. Instead of tapping additional debt revolvers, they have been issuing new preferred stock to fuel the growth. This is not a free lunch as the coupons for speculative, small company, preferred stock is very high, at 8%. The hurdle rate on acquisitions and new project development is therefore very high.

Another Option - And A Hedge To Higher Rates

While waiting for a better opportunity to get into the common units (LMRK), we like the new preferred stock recently issued. The 7.00% Series C preferred units were issued on March 28, 2018 and started trading OTC under the ticker "LMMKP". Within 30 days, it will start trading on the Nasdaq under the ticker "LMRKN". This is the third preferred stock listing for the company behind their $40 million series A (LMRKP), and $46 million series B (LMRKO) from 2016.

- Series A: $2.00 annual payment, yield 8.00%

- Series B: $1.98 annual payment, yield 8.15%

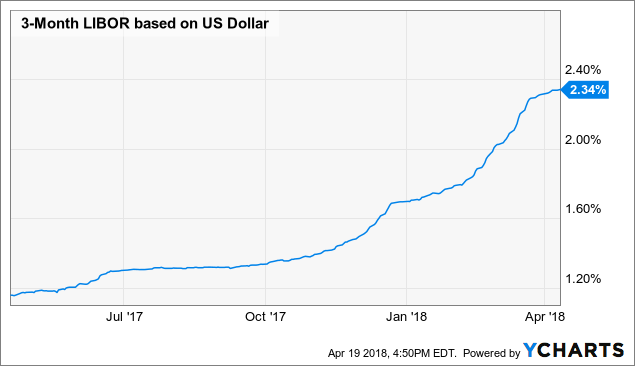

- Series C: 7.00% or 3-month Libor (2.36%) plus 4.698% = 7.06%

So why buy Series C which pays 1% less than the other two issues?

It is a fixed-to-floating rate preferred that while perpetual, has restrictions and clauses placed on it that essentially make it a ten-year bond. In May 2025, the interest rate adjusts to 9.0% ($2.25 per year paid quarterly).

The offering details:

- Ticker: LMRKN (currently LMMKP)

- Series: 7.00% Series C Fixed-To-Floating preferred

- Redeemable at the issuers option after May 20, 2025 at $25

- Quarterly distribution on the Feb, May, August, Nov. schedule

- Ex-date will be the first business day of the month of payable date

- Payment will be the greater of 7.00% per year or 4.698% + 3-month libor

- On or after May 20, 2025, the interest rate will adjust to 9.00%

- On May 15, 2028 (ten year anniversary) each holder will then have a redemption right to put back their units to the issuer at $25.

- In the event the issuer does not redeem the Units on the designated redemption date of holders properly electing to redeem such units then the issuer will increase the per annum distribution rate on all outstanding Units by an additional 3.00% per annum, to 12.00%.

- The unitholders have the option to convert their preferred to common above $19.21.

Often, the price of a preferred trades below par when trading on OTC but when it moves "on exchange" moves above par.

In the interim that interest rate paid on the series C is going higher. 3-month libor has run from 1.16% a year ago, to 2.34% today. With the Fed likely moving four times in 2018, and another 3 in 2019, you'll likely see libor move up in lock-step. If those hikes are to occur, libor would be approximately 3.75%-4.0%. Series C would then have to pay 8.45% - 8.70% as the forward annual coupon.

The preferred units are perpetual meaning they have no maturity date. However, they can be called by the company starting May 20, 2025. As we noted above, the coupon moves to 9.00% in May 2025 regardless of where Libor is located at the time. While it is impossible to know where interest rates will be in 7 years, the likelihood is that if the company has grown, they will be able to issue debt at a lower rate, which makes calling the units a high probability.

On the ten-year anniversary, May 2028, the unitholders will have a right to sell their preferreds back to LMRK at par ($25), plus accrued interest. In essence, this is a term preferred, not perpetual. This creates embedded value to the unitholders. If they do not redeem by 2025, the interest rate jumps to 12% so the yield to worst is nearly 8%.

In addition, you get a floating coupon, which given the interest rate environment, is another large value. At the same time, it has a 7.0% floor which is almost unheard of. You basically eliminate a large portion of the interest rate risk, especially to the downside, which when talking about perpetual preferreds, is a large value.

Lastly, there is a convertibility feature. While we think this is a call option, should the common shares rise about 15% in value, the conversion feature kicks in.

This is a very rare preferred security and we think the market is missing this value.

Conclusion

We added to the new preferred units to our Strategic Income Portfolio and think we have a relatively safe 7% yield with upside from higher rates. In general, we would wait on LMRK common units for a better price, preferably below $16 per share and opportunistically below $15.

Landmark is a speculative name, but one that is likely safer than other infrastructure REITs like UNITI Networks- (UNIT). We think the management team is highly skilled and, for the most part, aligned with unitholders.

Note: Thank you to Alpha Gen Capital for sharing this preferred stock idea.