To some extent, it makes sense that the stock price of shipping-container company, Triton International (TRTN), keeps getting whipped around by moving credit spreads. However, the market is not giving this company enough credit for improving conditions within its niche industry, nor is the stock price correctly reflecting improving company-specific fundamentals.

Overview:

If you don’t know, Triton operates and manages a fleet of intermodal marine dry, refrigerated, and cargo containers. These are the ubiquitous steel boxes used in trade. We’ve written about Triton previously in this article.

Credit Spreads: The Real Reason Triton Sold Off

Here is a look at what happened to the share price of Triton when credit spreads widened earlier this year (i.e. Triton’s shares sold off).

For more perspective, here is what happened to the share price of Triton peer, CAI International (CAI), each time credit spreads widened over the last ten years (we use CAI as a proxy since Triton’s share history only goes back to 2016, when it merged with TAL International).

Clearly, when credit spreads widen, Triton (and peer CAI) sell off. And this makes some sense considering Triton is a BB+ rated industrial company with a significant amount of debt on its balance sheet.

If you don’t know, a credit spread is the difference in yield between two bonds of similar maturity but different credit quality. For example, if the 10-year treasury note is trading at a yield of 3% and a 10-year corporate bond (such as Triton) is trading at a yield of 5%, the corporate bond is said to offer a 200-basis-point spread over the treasury. The riskier the debt, the higher the credit spread.

Triton likes to brag in its quarterly calls and marketing materials that 85% of its debt is fixed rate thereby suggesting they’re not impacted as much by our current rising interest rate environment. However, because Triton’s debt is higher yield (riskier) that means it can be impacted more by credit risks than by interest rates. And as we saw in our earlier chart, Triton’s equity price gets whipped around as BB credit spreads move. And for the record, the company does still have interest rate risk exposure, and here is a look at Triton’s upcoming debt maturities.

However, despite the strong relationship between credit spreads and Triton’s equity valuation, there are other factors that the market is not giving Triton enough credit for, such as improving conditions in Triton’s niche industry and Triton’s improving company-specific fundamentals.

Improving Industry Conditions:

Market conditions remain increasingly favorable for Triton. For example, both global GDP and container trade continue to grow and benefit Triton, as shown in the following graphic.

Further, worldwide leasing of containers continues to rise in both absolute terms and in terms of the percent of containers leased versus owned, as shown above. This benefits, Triton’s leasing business, as containers are leased under multi-year contracts. Further still, industry container inventory remains lower than in the past, which helps to support prices (more on this later).

Improving Company-Specific Fundamentals:

In addition to improving industry-wide conditions, Triton is doing well (and has some advantages) on a company-specific basis.

For starters, one of Triton’s competitive advantages is its economies of scale. Following the 2016 merger of Triton and TAL, Triton is the world's largest lessor of intermodal freight containers with a 25% market share. This helps customers trust the strength and stability of Triton (versus smaller peers), as well as allows Triton to reduce prices by further spreading fixed costs.

Regarding Triton’s earning, CEO Brian Sondey explained (via the most recent earnings release) that income is growing:

“We generated $84.9 million in Adjusted pre-tax income during the fourth quarter, an increase of 16.3% from the third quarter of 2017, and we achieved improvements across all of our key operating metrics.”

Further, he provided an encouraging outlook, as well:

“We expect market conditions will remain favorable in 2018. Our customers are indicating they expect trade growth will remain solidly positive, and the supply of containers remains well controlled, with a moderate amount of new container inventory and very limited inventories of available used containers. Container prices remain in the range of $2,150 - $2,200, and we expect many of our shipping line customers will continue to rely heavily on leased containers for new additions to their fleets.”

Further still, Triton “put their money where their mouth is” by issuing new equity shares in Q3 to finance growth which they believe will be very accretive to shareholders. Specifically, Triton raised $193 million in an equity offering, and has invested $300 million since the offering to finance new containers which are already coming on stream.

And things are healthy on the supply side of the business as well. For example, utilization remains high (it inched up to 98% last quarter). Also, according to the earnings release, Triton believes:

“Higher steel prices are leading to higher container prices. Triton International is seeing strong demand for containers, while supply is constrained and is likely to remain constrained. As a result, we believe new and used container prices will trend higher.”

If you don’t know, Triton not only leases containers, but also sells new and used containers too.

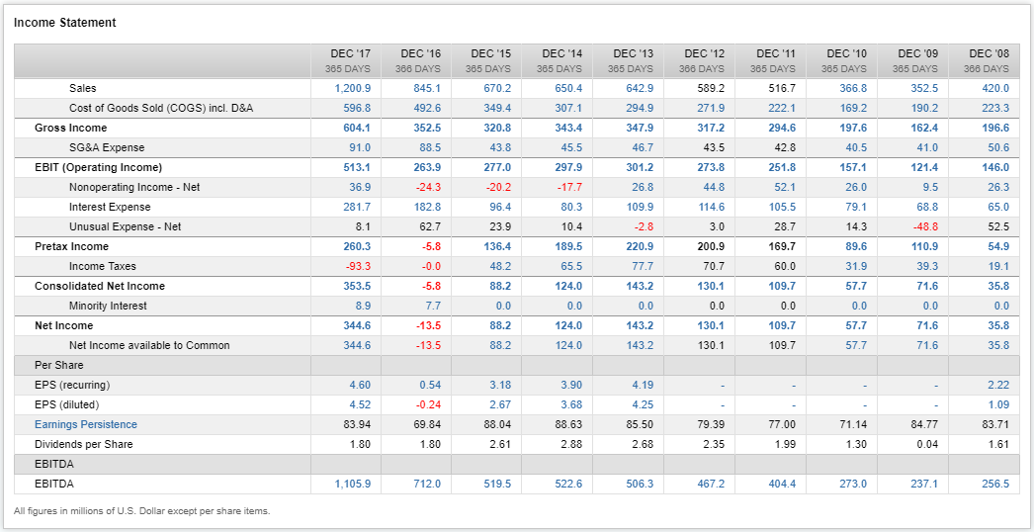

Also, here is a look at Triton’s improving sales and earnings per share.

Valuation:

From a valuation standpoint, Triton is attractive. For example (and for what it’s worth), the average analyst rating is a “buy,” and the average price target is $44.20, thereby giving the shares over 30% upside, and that’s in addition to the 5.9% dividend yield.

For some perspective, here is a look at EV/EBIT valuation versus its peers (despite being the industry leader, Triton is relatively inexpensive on this metric).

Here’s a look at forward EV-to-EBITDA, as well:

Risks:

Of course Triton’s business does face risks.

Risk-On versus Risk-Off: As described earlier, despite the recent uptick in volatility, we’re still in a “risk-on” market environment. However, if sentiment changes to “risk-off” and credit spread blow out, Triton shares could sell off further. For perspective, here is a look at historical credit spreads.

The reason for showing historical spreads is to show that they are currently relatively low. If spreads “get bad” Triton could feel some pain. However, the good news is that the economy remains strong, and GDP continues to grow at a healthy rate, as shown in our earlier chart.

Steel Prices: The price of steel poses another risk for Triton (steel is the main material in the shipping containers). If steel prices rise (or fall) this could squeeze margins (or increase competition).

Significant steel price moves could essentially disrupt the supply and demand balance across the entire industry.

Dividend Classification: Also important, Triton’s dividend is not a qualified dividend eligible for the lower capital gains tax rate. It has historically been classified as a return of capital. This can impact your cost basis, and impact your long-term capital gains taxes if/when you do eventually sell. Here is what Triton has to say about the dividend classification.

Conclusion:

Overall, we believe Triton is an attractive opportunity that is worth considering if you are an income-focused investor that appreciates some capital appreciation potential too. Triton has been more volatile than other income investments, but we believe it currently presents an attractive entry point for investors. We believe industry and company-specific dynamics should cause these shares to decouple further from trading simply on credit spreads, and cause the share price to go higher, perhaps significantly so.