100 High-Yield REITs, The Mass Exodus Continues

High-yield REITs continue to sell-off as investors exit in droves. And the resulting underperformance has been particularly acute for certain REIT subsectors including retail and certain healthcare properties (i.e. skilled nursing facilities). As a result, many income-focused investors are left wondering if it’s finally time to buy or if they should head for the hills. This article highlights performance (and more data) on over 100 high-yield REITs that have sold off significantly, and then reviews 10 specific high-yield REITs that we believe are increasingly compelling and worth considering.

100+ High-Yield REITs Selling Off:

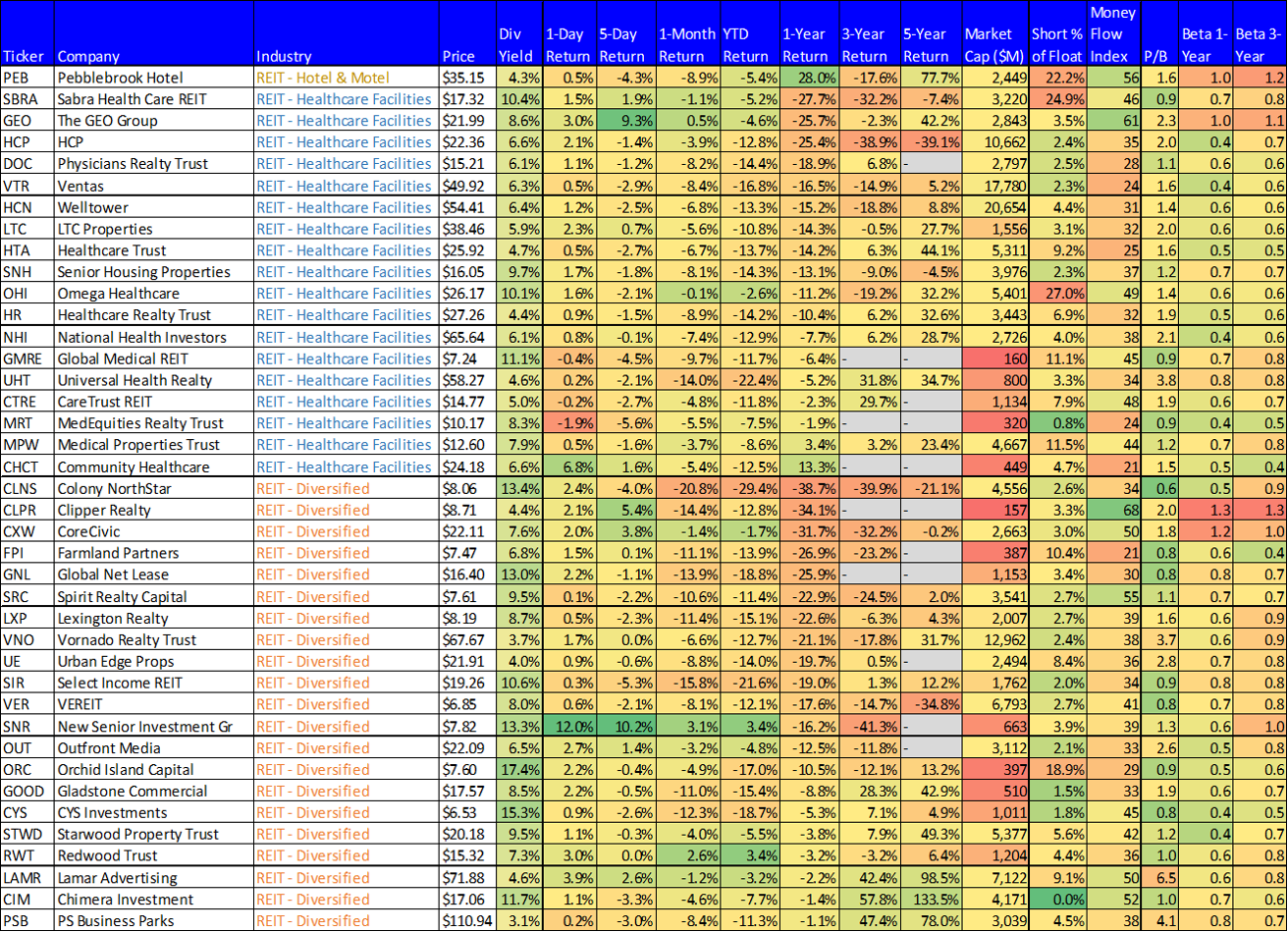

For starters, here is a look at the sputtering performance of over 100 high-yield REITs (in this case defined as those with yields of at least 3% and up to over 20%) organized by industry groups.

For reference, the iShares Real Estate ETF (IYR) in row 1 is has delivered a NEGATIVE total return (-2.9%) over the last year, while the S&P 500 and Nasdaq have gained +17.7% and +28.9%, respectively. And the REIT performance is even worse when you look across certain subsectors (e.g. retail) in our table above. Two additional metrics worth noting in the above table are the short interest column (a lot of investors are still betting against certain REITs by selling them short) and the Money Flow Index (a technical indicator that quantifies selling pressure--we’ll discuss this metric more later).

Five Reasons Why REITs Have Sold-Off?

To put the continuing REIT sector underperformance into perspective, we review five reason why they have been under pressure, starting with interest rates.

1. Interest Rates: REITs must pay out most of their earnings as dividends in order to avoid paying taxes. And this means they must borrow funds when they need capital for growth. And now that interest rates are finally rising again (and expected to keep rising) this puts pressure on REITs. Specifically, rising rates makes it more expensive to borrow money to grow. Now to be fair, as long as interest rates are rising, that means the economy is strengthening thereby making it easier for REITs to raise property leasing rates to offset the higher interest expense. However, it isn’t exactly that simple (for example, many longer-term leases are already in place at low rates), and certain REIT sectors are being forced to actually lower leasing rates (for example, B-class mall REITs at risk of losing tenants to Internet competition, and skilled nursing facility tenants who simply cannot afford to pay).

2. No Big Tax Benefits: REITs do NOT benefit from the recent corporate tax breaks to the same extent as other organizations. As mentioned previously, REITs avoid taxes by paying out most of their earnings as dividends, therefore the new lower tax rates recently signed into law by the President don’t provide nearly the same level of benefits to REITs as to other types of companies. This is another contributor to REITs continuing relative underperformance.

3. Sub-Sector Specific Challenges: As mentioned above, certain REIT sub-sectors are currently facing unique challenges that are making it increasingly difficult to support their dividends. One example is new competition for retail REITs from Internet retailers. According to a popular narrative, the Internet (e.g. Amazon (AMZN)) is going to put all “brick and mortar” retailers out of business. Now this is obviously not entirely true, but it is changing the retail REIT landscape. We wrote in more detail about this challenge in this report: Amazon Insurance: 5 Attractive High-Income Retail REITs. But the fact is that many less desirable location B-class retail REITs are going to be increasingly forced to lower rents for struggling retailers (or at least not able to raise them as much as they’d like) or risk losing them as tenants altogether.

Another sub-sector challenge pertains to “Skilled Nursing Facility” (“SNF”) operators within the healthcare REIT subsector. Most SNF operators have been struggling as insurers continue to put immense pressure on medical reimbursement rates. For example, popular big-dividend (+10.1%) healthcare REIT Omega Healthcare (OHI) has several large struggling tenants that are at risk of not making future rent payments simply because they don’t have the cash flow. Similarly, over a year ago, HCP was forced to spin-off it’s SNF business (HC ManorCare) into an entirely separate REIT (QCP) because it was becoming such an intense burden on the business. Pressure on SNF REITs and B-class retail REITs is another big reason the entire real estate (“REIT”) sector has been underperforming the rest of the market.

4. Increasing Yield Opportunities: As interest rates rise, so too do the yields on bonds that were once completely unattractive to investors. For example, the yield on a 5-year US treasury is over 2.6%. Still a far cry from the double digit yields of the early 1980’s, but better than the near zero percent yield just a few years ago. Granted, the value of your bonds will continue to fall as interest rates continue to rise, but if you hold them until maturity, you can essentially lock in the yield with practically no risk. Also, investment grade corporate bonds (held to maturity, or earliest call) also provide increasingly attractive yields (higher than treasuries). And if you’re willing to move out to high-yield bonds, the yield gets even better (grated with more risk) as we wrote about in last week’s Market Rover: 20 High-Yield Bonds Selling Off. The point is that as investors continue to search for yield, they have more options than REITs which were very popular before they started selling off last year and especially this year-to-date.

5. Risk-On Market Conditions: Finally, it has been a “risk-on” pro-growth market since President Trump was elected, and this has fueled investors to move investments away from “flight to safety” investment (e.g. REITs, Utilities) and into growth assets (for example, the Nasdaq and FAANG stocks continue to perform very well). Remember, REITs tend to be low beta stocks (as shown in our table earlier in this report), and are thereby less impacted by a strong market rally as compared to higher beta stocks. This can be good for REITs when the market is selling off, but not great when the market is rallying. Overall, this change in preference has put increased pressures on REITs, thereby contributing to their continued underperformance.

Four Reasons Why Some REITs are Starting to Look Attractive

To be clear, there are some REITs we do NOT like at all (more on these later), but there are also some compelling reasons why certain REITs are increasingly attractive (not the least of which is their big yields).

1. Babies Being Thrown Out With the Bathwater: To some extent, there has been indiscriminate REIT selling as investors (and ETFs sellers) have moved the entire sector lower. However, there are some attractive opportunities that should not have sold off so much, in our view. For example, retail REITs have been among the worst performers, but not all retail REITs are created equally. Specifically, we agree with the sell-off in B-class mall REITs (they still have more pain to come—more on this later), but we don’t agree with the extent of the sell-off for some of the A-class retail REITs. Specifically, we believe some babies have been thrown out with the bathwater, such as GGP (GGP), for example.

2. Brookfield’s Failed GGP Acquisition Sends a Message: In November, Brookfield Asset Management reportedly made an offer to acquire high-end retail REIT GGP for a significant premium to its market price. For starters, Brookfield is known as a smart value investor, and their effort to acquire GGP sends the message that they see value in retail REITs (high end retail REITs in particular, such as GGP). Further, GGP’s decision to reject the premium offer sends another strong message (i.e. GGP believes their stock is undervalued by even more than Brookfield’s premium bid suggested). For more perspective, this recent Barron’s article (REITs Are Sending a Powerful Buy Signal) suggests higher quality retail REITs like SPG and TCO are undervalued by as much as 32% and 41%, respectively (more on these names later).

3. Valuation: According to the same Barron’s article referenced above:

“REITs are trading for 20 times projected 2018 AFFO, compared with an earnings multiple of 18 for the S&P 500. That gap is narrower than the typical five-multiple-point spread.”

And for more perspective, here is the price to forward FFO (funds from operations) for several interesting REIT opportunities.

In addition to the REIT ideas above, many additional REITs have continued to grow their FFO and increase their dividends, but have still seen their prices move lower. A good sign for contrarian income-focused value investors.

4. REITs Offer Low Betas and High Yields: Not to be forgotten, REITs are generally low-beta investments with high yields, and this can be extremely attractive for income-focused investors such as retirees. Beta is a measure of the extent to which the price of an asset (in this case a REIT) covaries with the overall market (e.g. the S&P 500). When an investment offers a low beta that is an attractive risk reducing quality. And when that low beta investment also offers a high yield (like many REITs do) that makes the investment that much more attractive. For these reasons, REITs are often a favorite for income-focused rertirees.

Three REITs We are Still Avoiding

Before getting into a few of the REITs we like, it’s worthwhile to consider a few that we do NOT like. We’re not saying these REITs don’t have the potential to increase dramatically in price (they do). It’s just that we believe the downside risks continue to outweigh the upside, and for this reason we are avoiding…

1. CBL & Associates (CBL), Yield: 16.6%

CBL is one of those battleground REITs that elicits strong responses from both buyers and sellers. To be as succinct as possible, we believe there are too many shopping malls, and those with lower sales and rent per square foot will be increasingly challenged considering growth in internet competition as well as their lack of experiential value to the same extent as some of the A-class properties.

Of course CBL may eventually be able to pick itself up by it’s bootstaps and deliver incredible price appreciation, but considering it recently announced terrible earnings, it has cut its dividend, and the short-interest is very high (33.5%), we’re simply avoiding CBL’s equity. However, if you are dead-set on investing in CBL, try the bonds NOT the equity. We wrote about CBL’s bonds here.

2. Washington Prime Group (WPG), Yield: 14.9%

We alluded to the risks of spinning off trouble assets into a separate REIT earlier when mentioning HCP and QCP as well as OHI, but Washington Prime is actually the result of such a spin-off. Wisely, Simon Property Group spun-off it’s less desirable assets into a separate REIT (WPG) before the heavy sell-off in REITs began. And as you can see in our earlier table of rent and sales per square foot, WPG properties are very low. Further, short interest is very high (23.2%), and we believe WPG will continue to struggle as the evolving marketplace thins out the REIT herd.

3. Tanger Factory Outlet (SKT), Yield: 6.1%

Tanger Factory Outlet seems attractive when you look at backwards looking data, but on a go forward basis it seems likely this REIT will face a lot of pressure to offer rent concessions in order to avoid losing tenants. Yes, Tanger has a healthy FFO payout ratio (63.8%), and a low price to FFO ratio (10.65x), but these are backward looking metrics. We believe Tanger is among the weaker of the retail REIT herd (see rent and sales per square foot data in our table above), and apparently a lot of investors agree considering short interest is a whopping 38.9%. If you’re looking for a temporary short squeeze, or perhaps you’d like to roll the dice when the odds are stacked against you, consider Tanger. But if you’re a more risk averse long-term investor, consider putting your money elsewhere (we offer several ideas to consider later in this report).

Technical Trading Indicators:

In addition to fundamentals, we pay attention to short-term technical indicators when entering new positions. For example, the “Money Flow Index” in our earlier table is a technical measure of price and volume, or money flow over the past 14 trading days with a range from 0 to 100. An MFI value of 80 is generally considered overbought, or a value of 20 oversold. As shown by the MFI data in our earlier table, REITs continue to face selling pressure. And for more technical trading perspective, be sure to check out Jeff Miller’s Stock Exchange report from this week: Are You Out of Your Comfort Zone? We edit this weekly report for Jeff using data provided by his models, and it provides very good perspective on different ways to think about technicals when entering and exiting positions, ranging from near-term mean reversion to powerful momentum opportunities.

Ten (10) REITs We Like:

So we’ve provided our overview of the REIT sector, and shared our views on a few REITs to avoid. This section of the report reviews ten REITs we actually like.

1. EastGroup Properties (EGP), Yield: 3.1%

To all of the obnoxious “yield chasers” out there who want to believe “the higher the yield, the better the investment,” East Group Properties is NOT for you (if you don’t know what we’re talking about, check out #5 on our list of 7 Deadly Sins of Long-Term Investing). However, if you’re looking for a relatively safe, above average yield (+3.1%), with continued strong price appreciation potential, then EGP is worth considering. We have owned these shares in our Blue Harbinger Income Equity portfolio since January 2016 when they we trading at around $53 per share (they currently trade at $82.01). And the recent share price pullback is making for a very compelling entry point, in our view.

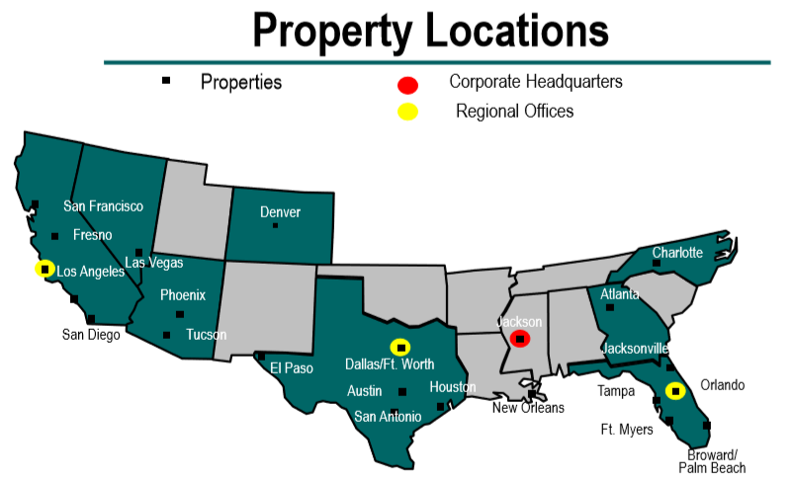

When it comes to real estate, it’s usually all about “location, location, location,” and in EGP’s case, they’ve got that covered. With industrial property locations across the southern “sunbelt” areas of the US, EGP properties are located in distribution “hub” areas that are convenient for multiple forms of transportation and also benefit from growth in online retail sales (rather than shipping to retail stores, internet retailers still use EGP properties as part of the distribution process).

As mentioned previously, we like to focus on potential future performance (not past performance), and based on continuing strength in the US economy we believe EGP can continue to put up very strong results (and keep paying healthy dividends).

EGP beat consensus estimates on FFO and revenues per its January 31st earnings announcement, and according to CEO Marshal Loeb:

“Our fourth quarter results are a testament to the strength and resilience we are seeing across the industrial market. Our in-fill Sunbelt high growth market strategy is further positioning us to capitalize on the opportunity. The 5.6% increase in quarterly FFO over prior year represents the 26th increase in the past 27 quarters, truly a long-term trend. Other indicators of the strong market and our solid performance include being 97.0% leased, over 5% same store PNOI growth, and over 15% re-leasing spreads.”

The company has been consistently raising its dividend, and EGP is forecasting continued growth in FFO for 2018. And at a price of only 18.2 times 2018 FFO guidance ($82.07/4.50) EGP is attractive, especially considering its business is much safer and more consistent that many of its industrial REIT peers.

2. Simon Property Group (SPG), Yield: 5.0%

Like just about every single retail REIT, Simon Property Group has been under intense selling pressure over the last year for the 5 reasons we described earlier in this article. However, there is good reason to believe Simon is one of the babies that is incorrectly being thrown out with the bathwater (i.e. Simon is worth more than its share price suggests).

For starters, SPG’s properties are more desirable than the B-class retail REITs with high short interest as discussed earlier. For example, as mentioned, SPG got rid of many of its less desirable properties when it spun off WPG years ago. As shown in our earlier chart, SPG generates a lot more sales per square foot than WPG.

Also, at a time when other retail REITs are being forced to cut their dividends due to liquidity needs, Simon just recently raised its dividend again. According to some investors, the safest dividend is the one that has just been raised (technically, we’d have liked to see SPG focus more on share buybacks than raising the dividend, but it is what it is).

3. Omega Healthcare (OHI), Yield: 10.1%

Omega is one of the riskiest REITs on our list because of the mounting challenges with several of its large tenant/operators (i.e. mainly Orianna and Signature). Nonetheless, we continue to own these shares within our Blue Harbinger Income Equity portfolio, and some investors may want to consider purchasing shares after the recent price decline (keeping in mind these shares are among the riskiest on our list).

The recent price decline resulted from a disappointing earnings announcement whereby Omega met FFO expectations, but fell short compared to revenue estimates. Per the earnings release:

“Operating revenue for the quarter was approximately $221 million versus $235 million for the fourth quarter of 2016. The decrease was primarily a result of placing Orianna and Daybreak on a cash basis in the third quarter and therefore recording no Orianna or Daybreak revenue in the fourth quarter.”

And further still:

“from an accounting standpoint, we would note that Signature is currently paying approximately 75% of its monthly contractual rent, as a result its receivables balance continues to grow. As of December 31, we had approximately $21 million in contractual receivables outstanding, which is partially offset by $9.3 million letter of credit as well as significant personal guarantees.”

And while a few operators pose the challenge today, the larger issue is the continuing pressure on reimbursement rates for skilled nursing facilities operators, in general (i.e. Omega’s main tenants). Omega is working with several of its operators to restructure portfolios and operating terms, but the questions remains if these are the last operators to face challenges, or if they are just the first.

For perspective here is a look at Omega’s historical operating FFO and FAD data, and as you can see, things have taken a turn for the worse in recent quarters in terms of funds per share and payout ratios.

It seems Omega’s track record of raising its dividend may come to an end this year (considering its challenges with some operators), but if the company can successfully renegotiate the operator challenges then the existing dividend is still extremely safe and the shares trade at a very attractive price. We continue to own Omega, and watch the shares closely.

4. Taubman Centers (TCO), Yield: 4.1%

Taubman is one of the highly quality “A-class” retail REITs that has inappropriately sold off with the rest of the sector.

Not only do we like Taubman because it owns high quality properties, and it’s relatively cheap at only 16 times 2018 FFO guidance ($60.82/$3.79), but we also like it because with a market cap of only $3.76 billion, it’s increasingly likely to get bought out at a healthy premium by one of the larger retail REITs (similar to Brookfield’s recent attempt to purchase GGP).

For more information on Taubman is available in our recent retail REIT write-up here.

5. Stag Industrial (STAG), Yield: 6.0%

Last time we wrote about Stag, we encouraged readers to wait for a pullback.

And considering the economy remains strong, and the shares have recently pulled back, now is a much more attractive time to consider purchasing shares. Here’s what we wrote about Stag in our last article back in November:

“Our advice to investors is to understand what you own (i.e non-primary, non-secondary, but yes tertiary property locations), and understand how Stag’s price will likely react under different market conditions. More specifically, consider buying more Stag on market pullbacks (because it will likely have pulled back more than the rest of the market because of its high beta) as long as you don’t believe the pullback is the first leg into a larger market wide recession.”

With an attractive yield, and more room to run, we like Stag shares at the current price. You can read our previous full write-up on Stag here:

6. New Residential (NRZ), Yield: 12.1%

New Residential is an oddball in the REIT space because its strategy is unusual. Unlike traditional property REITs, NRZ is essentially a mortgage REIT that invests in unique financial assets (it still gets the same beneficial REIT tax treatment though). We like NRZ because its dividend is well-covered, and its business continues to have growth opportunities thanks to management’s constant smart decisions to evolve with the evolving industry. The shares have also pulled back recently providing for a more attractive entry point.

You can read our previous full write-up on NRZ here:

7. Ventas (VTR), Yield: 6.3%

Ventas is a blue-chip, hard hat, well-managed healthcare REIT that pays a big dividend and the shares are currently on sale, trading for only around 12.6 times 2018 FFO guidance.

We love that the shares have sold off significantly because it is creating a very attractive buying opportunity.

We’ve written about Ventas in the past (for example here), but one of the things we really like about it is that management wisely decided to exit the skilled nursing facilities businesses thereby dodging a bit of a bullet.

Nonetheless, the shares have been pulled lower partially due to broader industry REIT woes, but also as management provided conservative/Soft guidance for 2018 despite meeting FFO expectations and beating on revenues. The lower guidance was due mainly to disposition activity whereby the company shed less desirable assets, rather than allowing them to drag down the rest of the business with their potential challenges (smart move by management). We believe this is an outstanding time to pick up shares of this big safe dividend payer.

8. Macerich (MAC), Yield: 5.0%

Similar to our view on Taubman (TCO) we like Macerich because it is a high quality “A-class” retail REIT that has been inappropriately pulled lower by the rest of the REIT industry. We also especially like Macerich because of its relatively smaller market cap ($8.4 billion) which means it could be in the sweet spot as an acquisition target as larger players look to bootstrap growth with inorganic acquisition as industry valuations remain very low. We like Macerich many times more than the risky B-class property REITs like CBL, WPG and SKT. Short interest on Macerich is essentially zero.

We wrote in more detail about Macerich’s business (including “omni channel” sales, here.

9. Digital Realty (DLR), Yield: 3.6%

The sell-off continues for this data center REIT (as shown in the following chart), and we believe this continues to create a very attractive investment opportunity. Our basic thesis is that data center business still has an enormous runway for growth and DLR will continue to benefit.

We've written in detail about DLR recently in this report:

10. W.P. Carey REIT (WPC), Yield: 6.7%

High quality, big safe dividend, and an attractive price. Those are a few of the most important things to know about WP Carey. We continue to own this REIT in our Blue Harbinger CVI portfolio, and we continue to believe it has very attractive upside after its recent price pull-back.

At its last earnings announcement, WPC beat FFO estimates and provided 2018 guidance well above the street’s estimates, but the shares have still sold-off in a “baby with the bathwater” phenomenon as we described earlier.

For your reference, the following graphic shows WPC’s property-type and tenant industry diversification.

And here is a look at the geographic diversification.

And very impressively, here is a look at the historical occupancy.

WPC’s 2018 AFFO guidance is $5.40 per share, which means it currently trades at an extremely attractive 11.2 times forward AFFO. And important to note, WPC just recently raised its dividend again. If you’re looking for high quality safe yield at a discounted price, WP Carey REIT is absolutely worth considering. We continue to own shares of WPC.

More Perspective On The Market:

Outside of Blue Harbinger, we manage investment accounts for individuals and institutions. And these in-person interactions often provide very good perspective for the things we write about at Blue Harbinger. For example, this week we spoke with a private investor getting ready to retire, and he explained that he likes to corroborate ideas between multiple Seeking Alpha writers (when they cover the same securities). Please feel free to direct message us, or add comments/questions to this article, if we can ever be of assistance as you consider your investment options.

The Bottom Line:

With uncertainty, comes opportunity. We certainly believe that is true within the high-income REIT space which has been under significant selling pressure for much of the last year (and particularly year-to-date). Our view of the space is that REITs have sold off for the five reasons described in this article, but some of them are looking increasingly attractive for long-term income-focused investors, especially the ten highlighted in this article.

For reference, you can view all of our current Blue Harbinger holdings here.