If you are an income-focused investor, this company is worth considering. It doesn’t offer the flashy price returns (or downside risks) of the general stock market, but it does pay a safe 7% yield, its share price (what you pay) has recently decreased, and its value (what you get) has recently increased.

Golub Capital BDC (GBDC), Yield: 7.03%

Golub Capital (GBDC) is a healthy, well-managed, business development company (“BDC”) that makes loans to middle market companies (i.e. companies with annual revenues in the neighborhood of $10 million to $500 million). Golub continues to manage one of the lowest risk portfolios of any BDC, and its shares are currently trading at a very attractive price. This article reviews three reasons why Golub is attractive and worth considering, including:: (1) its healthy high yield, (2) its attractive low price, and (3) its relatively low risk profile.

Overview of Golub:

As mentioned above, Golub is a BDC that makes loans to middle market companies. Per the following graphic, Golub’s total investment portfolio consists of 185 investments with an average size of $8.6 million.

The largest type of investment is “one stop” loans at 79%, followed by senior secured loans at 11%. Also important, the loans are diversified across industries, as shown in this next graphic.

And also very importantly, 99.6% of the loans are floating rate (more on this later).

1. Attractive High Yield:

Golub currently offers investors an attractive high yield of just over 7%, paid quarterly. The first important thing to consider about these distribution payments to shareholders is that they are supported by a healthy net investment income (“NII”) distribution ratio, as shown in the following table.

Specifically, Golub has been has been paying out $0.32 per share per quarter, and that amount is supported by roughly $0.32 per share of NII. As a BDC, Golub has chosen to be treated as a regulated investment company, meaning it must distributed at least 90% of its income to shareholders in order to avoid paying corporate income tax. And as we’ll see later, Golub has a history of increasing that payout once per year with a “special dividend.”

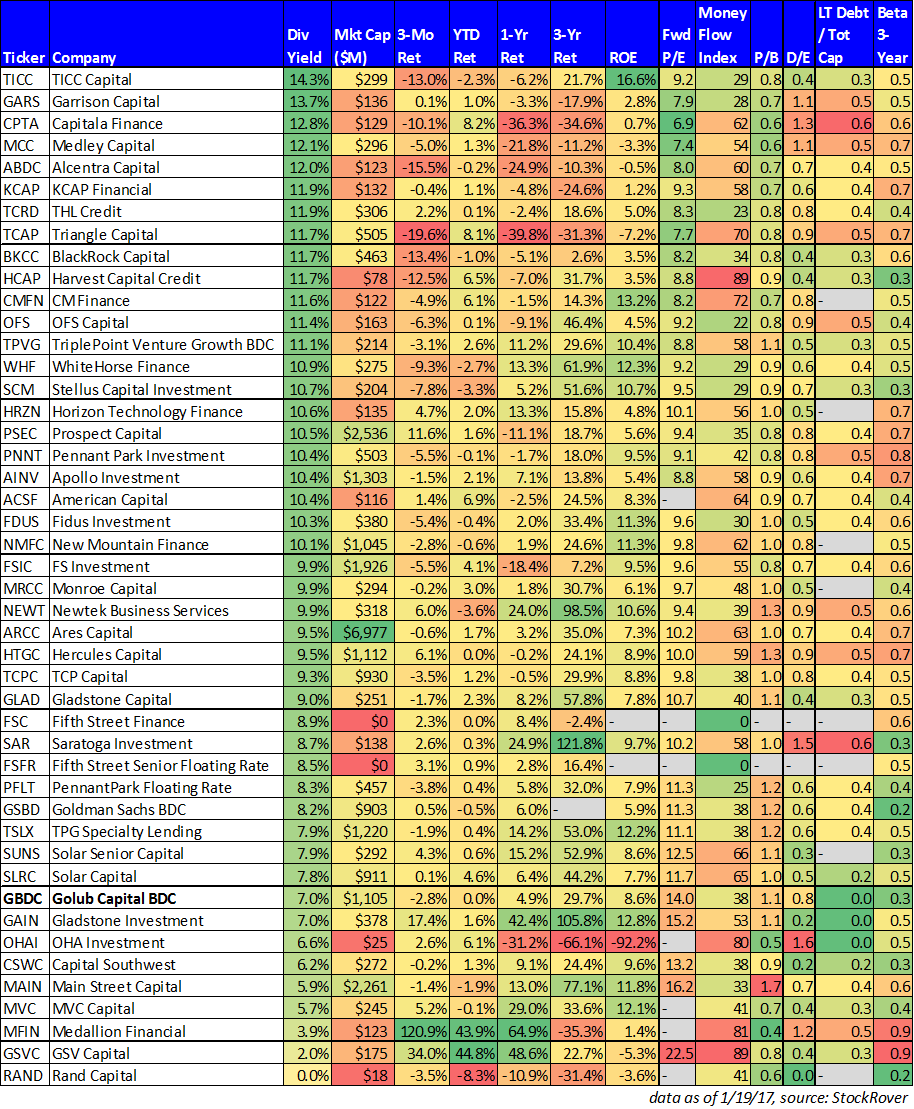

Important to note, Golub’s yield is actually low compared to other BDCs (as shown in the following table) and we view this as a good thing because it’s the result of Golub’s less risky investments compared to other BDCs.

For perspective, here is an analysis of the current spreads on Golub’ loan portfolio.

These spreads are lower (because they’re safer) than other BDCs, and as we’ll see later, the high quality of Golub’s investments is usually recognized in the price of its shares.

As mentioned earlier, 99.6% of Golub’s loans are floating rate, which is a good thing for our current rising interest rate environment. However, around two-thirds of Golub’s own debt is also floating rate which offsets some of the benefits, but still not all (i.e. rising interest rates are attractive for Golub’s investment portfolio).

Also worth mentioning, Golub has a history of paying special distributions to shareholders, as shown in the following table.

The special distributions are due to taxable income exceeding distributions over the previous year (remember, as a BDC and RIC, Golub must pay out more than 90% of income to avoid corporate taxation).

2. Attractive Valuation and Low Price

When assessing a BDC, its price to tangible book value is an important consideration. As shown in the following chart, Golub’s price to tangible book value is currently closer to its all-time low that to its high (Golub is “GBDC” in the chart).

The fact that Golub trades at a higher price to book value than peer BDCs is a tribute to the higher quality of its investments. Investors are willing to pay a premium for Golub’s quality and safety. And for a little more perspective, here is a look at Golub’s historical price to tangible book value.

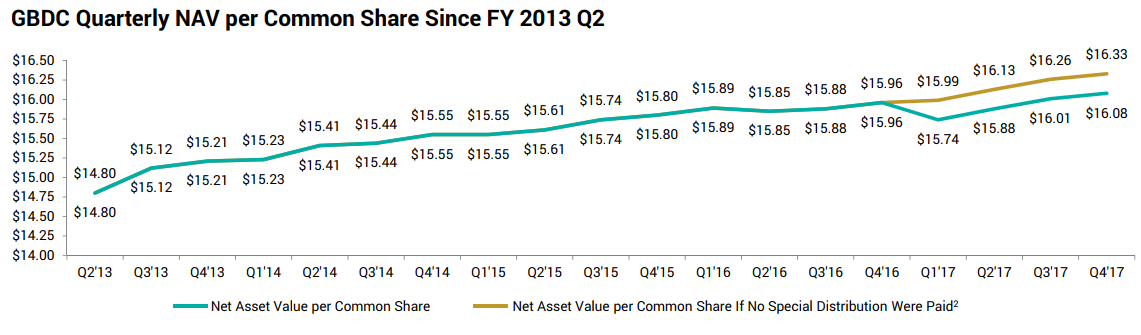

Another important valuation metric for investors to consider is Golub’s rising net asset value (“NAV”) per share, as shown in the following chart.

It can be a warning sign when NAV per share is chronically decreasing, but this is not the case for Golub.

As this next chart shows, investors should be aware that the price of Golub (and BDCs in general) don’t usually keep pace with the returns of the overall stock market (as measured by the S&P 500) because BDCs distribute their net income instead of reinvesting it.

However, when we look at total returns (price appreciation plus distributions to shareholders) Golub has generally kept pace with the market as shown in this next chart.

Also important to note, the total returns of Golub have sharply underperformed the broader market in recent months as investors have favored “growth” investments over “income” investments, and this has created an attractive contrarian buying opportunity, in our view. As we showed earlier, Golub’s NAV keeps rising, but its price and its price to book value have declined, thereby making for a more attractive entry point for contrarian income-focused investors.

3. Relatively Low Risk and Safe:

Golub is relatively low risk and safe for a variety of reasons. First, the quality of its investment portfolio is good. Specifically, the following table shows the very low level of non-accruals (i.e. troubled loans) in Golub’s book.

This is consistent with the reason for the small premium price for Golub relative to other BDCs and Golub’s relatively lower (but still high) yield—Golub is relatively very safe.

Next, Golub has a low 3-year beta of only 0.3 as shown in our earlier peer comparison table. The average market beta is one, and Golub’s low beta attractively signifies that it is less impacted by broad market moves than most other investments. This is a great investment characteristic for volatility reduction and diversification.

And with regards to diversification, we saw earlier that Golub’s loan book is well diversified across industries and borrowers. This is another attractive quality.

Lastly, as we mentioned earlier (and as shown in our earlier chart), Golub is taking prudent risks as measured by the low interest rate spreads (and low distribution payments) relative to other BDCs. We greatly prefer to invest in a BDC with a higher quality books of loans because we simply don’t want unnecessary risks.

Conclusion:

Golub is a low risk BDC, with an attractive dividend, and a price that has recently pulled back (due to noisy market sentiment) while its value (NAV per share) has continued to rise.

According to Warren Buffett:

“Price is what you pay, value is what you get.”

If you are an income-focused investor, Golub Capital is an attractively priced BDC that offers a compelling high yield and value. We believe it’s worth considering.