The primary objective of most income-focused investors is to generate as much income as possible with very little risk. And there are smart ways to do this that are often overlooked because so much of the investment world is focused on maximizing total returns (instead of generating safe high income). This article highlights one such opportunity. Specifically, if you are an income-focused investor, this article explains why this particular 8.8% yield is attractive and worth considering.

PIMCO Dynamic Credit and Mortgage Income Fund (PCI), Yield: 8.8%

What’s Good About this Fund:

Safe 8.8% Yield: For starters, PCI offers a distribution yield of 8.8%. It is a “distribution yield” because PCI is a closed-end fund (“CEF”), and that’s how much investors get paid every month (it pays monthly, but 8.8% is an annualized yield number).

Discounted Price: Another good thing is that this fund currently trades at a discounted price relative to its Net Asset Value (“NAV”). Specifically, you can buy this fund at a 5.7% discount to the value of all the investments inside the fund. Discounts and premiums (in this case, a discount) is one of the unique characteristics of a closed-end fund. Because the fund does not create or buyback shares, the price moves based on supply and demand forces in the market, and the fund can thereby trade at a discount or premium to the value of its underlying assets. As value investors, we like to buy things on sale, such as PCI. And as income-focused investors, we especially like that we are buying yield at a discounted price (i.e. we’d have to pay a higher price for this much yield in the open market).

No Forced-Selling: As alluded to above, as closed-end fund, PCI doesn’t have to redeem or create shares like ETFs do. This drives the discount and premium prices (currently a discount), but it also prevents the management team of getting into a forced selling situation like other funds, such as mutual funds. Mutual funds are often forced to sell some of their holdings during bad market conditions (i.e. when things are trading too cheaply), whereas CEF’s like PCI have the luxury of being to able to sell only when management deems fit. This is a big advantage in terms of getting good buy and sell prices, but also in terms of not being forced to rack up expensive unnecessary trading costs all the time.

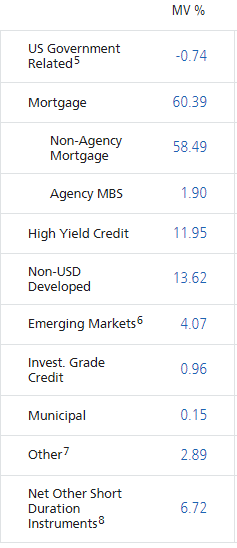

Wide-Range of Fixed-Income Holdings: We also like that this particular fund is actively managed by a highly qualified five-person team, and it invests across a wide variety of fixed income securities. For reference, you can see the management team here, and all of the holding here). And for further reference, here is a breakdown of the fund’s holdings by fixed income security type (more on the holdings "risks" later).

Income-Based Distributions: Since its inception, this fund has generated approximately 99% of its distributions from income on the securities it holds, and not based on a return of capital. This is a good thing because when funds returns capital just to make distribution payments, it can lower your cost basis in the fund, and result in you getting a big unexpected capital gains tax bill when you do financially decide to sell. We like that this fund generates distributions almost entirely from income on the investments it holds. In fact, the fund’s policy is stated as follows: “The Fund intends to make monthly cash distributions to Common Shareholders at rates that reflect the past and projected net income of the Fund.” This is a good thing.

Net Investment Income Coverage Ratio: Considering PCI makes distribution payments from the income it generates, it's important to monitor the income to make sure its enough to cover the distributions. Fortunately, PIMCO makes this easy by posting this report for all of its closed-end funds. There was some concern earlier in 2017 that PCI wasn't generating enough income to cover the distribution, but after a strong 126% coverage ratio in Q4, the fund ended 2017 with a 93.4% coverage ratio, and was able to meet the distribution payment. Realistically, management has the ability to control this ratio (and the amount of income it generates--to a large extent) by selecting different types of securities. We are comfortable with the funds current income-generation run rate.

Worth noting, in years when the fund has too much net investment income, a "special dividend" is often paid. In 2017, it seems that only PIMCO CEF that paid a special dividend was PCM (see this link for more information). We're still very comfortable with the big normal distributions paid by PCI, and we know there will be opportunities for more "special dividends" in the future.

Why the “Bad Things” about this fund are actually Good Things...

Leverage: This fund currently has a leverage ratio of 44%. The leverage ratio is the amount of money this fund has borrowed (so it can investment in more securities). And for many investor, a leverage ratio this high is a deal-breaker (i.e. they simply won’t invest). However, we don’t believe this should be a deal-breaker, and here’s why. First, leverage isn’t inherently bad. People borrow money to buy homes, companies borrow money to operate their businesses. Also relative to the levels of leverage “big banks” used leading into the financial crisis (e.g. 1600%) 44% really isn’t much, especially considering PCI is using the leverage to purchase fixed-income securities (as described earlier), and these particular fixed income securities are far less risky that stocks, for example. Even though leverage alarms some investors, in this case we believe it is prudent and attractive. Also worth mentioning, this fund gets to borrow at very low interest rates—much lower than any individual investor could ever borrow at (this fund has over $3 billion of assets).

Expense Ratio: This fund has an expense ratio of 2.09%. To some investors, this is simply way too high. However, there are a few important things to consider. First, if you are an income-focused investor, this fund pays you an 8.8% yield (and it pays monthly), and you probably cannot achieve this type of yield with this low of risk on your own (i.e. you likely don’t have access to these types and denominations of bonds, you likely don’t have the sophistication and resources of this management team, and you probably cannot borrow money at as low of a rate as PIMCO). As an income-focused investor, you goal is likely high-income with very low risk, and that’s what this fund delivers.

Interest Rate and Credit Risk: There are two big risks to this fund (interest rate risk and credit risk), but neither is “all that risky” in this case, in our view. For example, Regarding interest rate risk, if interest rates rise then the value of bonds fall. And interest rates are expected to keep rising in the coming years as the economy remains strong and the Fed normalizes rates. However, the duration (a measure of interest rate risk) of this fund is only 4.27, and in the grand scheme of things, that isn’t that much. Especially considering, as a closed-end fund, PCI will never be forced to sell anything, and they can simply hold to maturity (at par) and collect the big dividend payments while they wait. As an income-focused investor, it’s the steady income payments that matter (which are safe in this case) not the daily price fluctuations of the underlying holdings (which will likely mature at full-price par anyway).

For more perspective on interest rate risk, here is a blurb from the fund’s most recently available quarterly commentary:

“The portfolio maintains moderate exposure to U.S. interest rates, where we continue to emphasize the intermediate portion of the yield curve.”

Regarding credit risk (the risk that the underlying bond issuers default), it’s slim. For example, given the strong economy, combined with the relatively short duration of the holdings, not to mention the high level of diversification across many holdings, it would take another financial crisis to make the value of this fund sell off dramatically. And as was the case during the last financial crisis, most CEFs (like this one) kept paying their big steady distribution payments (which could be reinvested at very low prices, if desired) and then recovered dramatically in price quickly anyway.

However, there is some risk that credit spreads will widen (given they’re currently very narrow as the market is strong and investors are confident) as shown in the following graph:

If market conditions change, and credit spreads widen, the underlying holding of this fund would decrease in value temporarily, but they’d still be expected to recover in full at par. And If you’re an income-focused investor, it’s the steady income payments that matter most anyway, and they’ll very likely stay very strong even if spreads widen. Overall, this fund may generate only flat to slightly positive price returns over time, but the distribution payments (currently 8.8% yield) will remain big, strong and steady.

Conclusion:

If you are an income-focused investor, the “PIMCO Dynamic Credit and Mortgage Income Fund (PCI)” offers a safe 8.8% yield that is worth considering. The “drawbacks” about this fund that may scare away some investors (such as the expense ratio, the leverage ratio, and the interest rate and credit risks) are actually prudent and attractive, in our view. Specifically, the expense ratio gets you a highly qualified management team with extensive resources, the leverage is prudent, and the interest rate risks and credit risks actually work to your advantage because they are prudent and they allow for the higher yield that is available on this fund. Further, this fund has many attractive attributes, such as the big 8.8% yield that is paid monthly, the discounted price, the advantage of no forced selling, the actively managed highly diversified portfolio, and the income-based distributions. Overall, this fund has many benefits for income-focused investors, and we believe it is worth considering if you are looking for high yield with low risk.