As tax reform sets in, and expensive over-regulation is rolled-back, the market continues to set new record highs. However, not all stocks are particpating in the latest round of gains. This week's Weekly highlights a big-dividend REIT, that is very healthy, but the share price has pulled back, and the valuation is attractive. If you are an income-focused investor, this one is worth considering.

To get right to the point, the stock we like is a healthcare REIT, and there are actually TWO of them that are very attractive right now...

1. Ventas (VTR) Yield: 5.8%

2. Welltower (HCN) Yield: 5.9%

Ventas and Welltower are blue chip healthcare REITs, and here is a chart showing the total returns (dividends plus price appreciation) of Ventas and Welltower versus the S&P 500 (SPY) and the Nasdaq (QQQ) over the last year (and five years).

Why the Price Pullbacks?

The poor performance in recent months by the big-dividend REITs has been driven by investor “supply and demand” as well as a fear of rising interest rates. From a supply and demand standpoint, more aggressive growth stocks (such as the Nasdaq (QQQ)) have been preferred by investors, and safer stocks (such as VTR and HCN) have sold off because investors are “excited” about the growing economy. Compounding the problem, the threat of more rapidly rising interest rates has put selling pressure on REITs because they rely on borrowing to grow (and higher rates means higher borrowing costs). And because the yields offered by REITs may become less desired as higher interest rates means increasing yields on lower risks bonds that are preferred by many investors.

Both Companies Remain Healthy:

However, it’s important to recognize: (1) If rates are rising (thereby increasing borrowing costs for REITs) it also means the economy is doing well so Ventas and Welltower can raise rents (thereby offsetting higher interest rates), and (2) Ventas and Welltower both remain financially strong. Specifically, Welltower recently raised “funds from operations” (“FFO”) estimates (Welltower tops estimates, ups guidance), and Ventas is also growing FFO (Ventas Reports 2017 Third Quarter Results).

We wrote in more detail about the healthy fundamentals of these two companies in this report from several months ago. However, we didn’t purchase shares at that time because the price was high. However, the price has since come down significantly, and on a relative valuation basis, both of these REITs just got very attractive, in our view.

Attractive Valuations:

For perspective, here is the most recent and historical price to FFO ratio for both companies (as of 1/12/18).

Both companies are trading at very attractive low valuations (approaching 2008 financial crisis levels), especially given their strong current (and expected future) FFO.

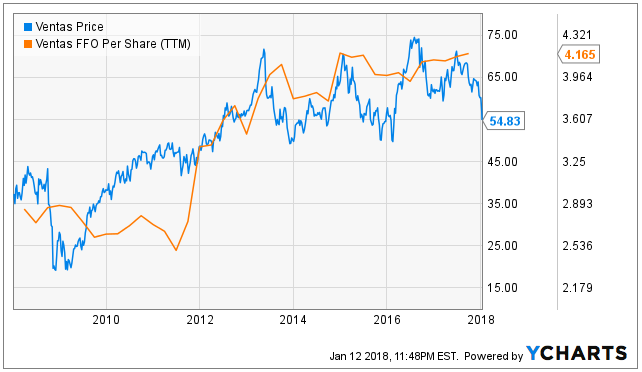

For added color, here is Ventas’ historical price versus FFO.

And here is Welltower’s historical price to FFO per share.

Again, both companies are inexpensive on a price to FFO basis, especially considering continuing growth expectations.

We wrote a detailed report comparing Ventas and Welltower a few months ago, and the comparison is still relevant today. For your reference, here is the report:

In that report we explained 10 reasons why the two companies are similar, and then 10 reasons why we believed Ventas was slightly more attractive. In reality, both were attractive companies then and now, but prices are even more attractive now considering the selloff over the last few months. Both companies are expected to announce earnings next month, and we expect more of the same… steady growth from these two high income-generating, safe, blue chip, healthcare REITs.

Conclusion:

Buy Low! It’s tempting to chase after the zero-dividend-paying Googles and Amazons of the world considering they’ve been putting up big price returns lately. But those are higher volatility, higher beta stocks, and when the market pulls back they will likely pullback a lot more. In the meantime, Ventas and Welltower are low beta stocks, offering big safe dividends, and their prices have already pulled back significantly despite the fact that their fundamentals remain strong.

We do NOT currently own shares of Welltower or Ventas, but they are both high on our watch list, and we may look to add shares as soon as this upcoming week. Members will be notified if/when we do purchase shares. For reference, you can view all of our current holdings here.