We finished July with positive returns for all three of our Blue Harbinger strategies (Income Equity, Disciplined Growth, and Smart Beta), and all three strategies continue to outperform the S&P 500 since their inception. This report provides a brief update on each of our current positions. We believe there is significantly more upside ahead.

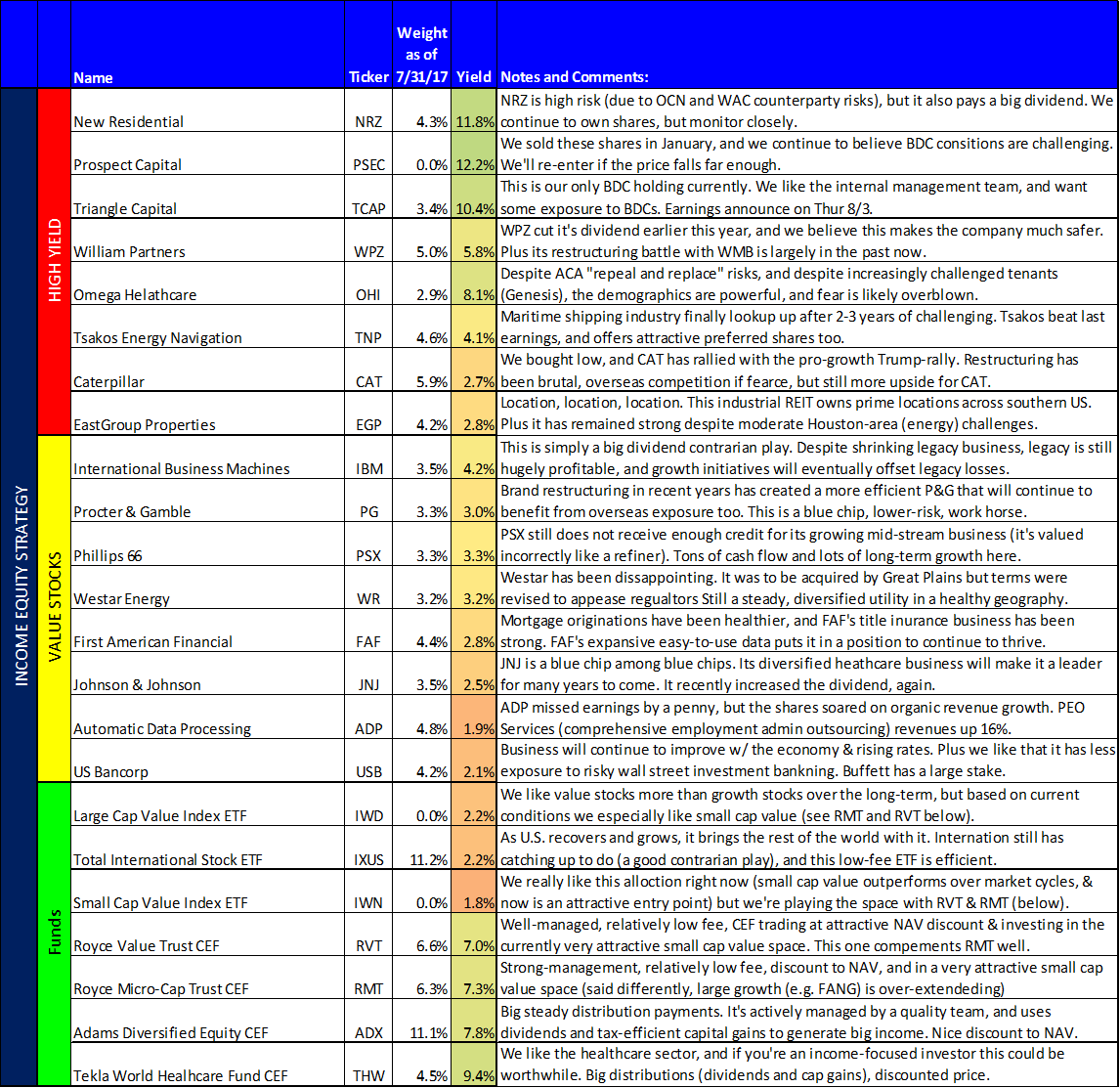

Income Equity Portfolio:

New Residential NRZ

NRZ is high risk (due to OCN and WAC counterparty risks), but it also pays a big dividend. We continue to own shares, but monitor closely.

Prospect Capital PSEC

We sold these shares in January, and we continue to believe BDC conditions are challenging. We'll re-enter if the price falls far enough.

Triangle Capital TCAP

This is our only BDC holding currently. We like the internal management team, and want some exposure to BDCs. Earnings announce on Thur 8/3.

William Partners WPZ

WPZ cut its dividend earlier this year, and we believe this makes the company much safer. Plus its restructuring battle with WMB is largely in the past now.

Omega Healthcare OHI

Despite ACA "repeal and replace" risks, and despite increasingly challenged tenants (Genesis), the demographics are powerful, and fear is likely overblown.

Tsakos Energy Navigation TNP

Maritime shipping industry finally lookup up after 2-3 years of challenging. Tsakos beat last earnings, and offers attractive preferred shares too.

Caterpillar CAT

We bought low, and CAT has rallied with the pro-growth Trump-rally. Restructuring has been brutal, overseas competition is fierce, but still more upside for CAT.

EastGroup Properties EGP

Location, location, location. This industrial REIT owns prime locations across southern US. Plus it has remained strong despite moderate Houston-area (energy) challenges.

International Business Machines IBM

This is simply a big dividend contrarian play. Despite shrinking legacy business, legacy is still hugely profitable, and growth initiatives will eventually offset legacy losses.

Procter & Gamble PG

Brand restructuring in recent years has created a more efficient P&G that will continue to benefit from overseas exposure too. This is a blue chip, lower-risk, work horse.

Phillips 66 PSX

PSX still does not receive enough credit for its growing mid-stream business (it's valued incorrectly like a refiner). Tons of cash flow and lots of long-term growth here.

Westar Energy WR

Westar has been disappointing. It was to be acquired by Great Plains but terms were revised to appease regulators. Still a steady, diversified utility in a healthy geography.

First American Financial FAF

Mortgage originations have been healthier, and FAF's title insurance business has been strong. FAF's expansive easy-to-use data puts it in a position to continue to thrive.

Johnson & Johnson JNJ

JNJ is a blue chip among blue chips. Its diversified healthcare business will make it a leader for many years to come. It recently increased the dividend, again.

Automatic Data Processing ADP

ADP missed earnings by a penny, but the shares soared on organic revenue growth. PEO Services (comprehensive employment admin outsourcing) revenues up 16%.

US Bancorp USB

Business will continue to improve w/ the economy & rising rates. Plus we like that it has less exposure to risky wall street investment banking. Buffett has a large stake.

Large Cap Value Index ETF IWD

We like value stocks more than growth stocks over the long-term, but based on current conditions we especially like small cap value (see RMT and RVT below).

Total International Stock ETF IXUS

As U.S. recovers and grows, it brings the rest of the world with it. International still has catching up to do (a good contrarian play), and this low-fee ETF is efficient.

Small Cap Value Index ETF IWN

We really like this allocation right now (small cap value outperforms over market cycles, & now is an attractive entry point) but we're playing the space with RVT & RMT (below).

Royce Value Trust CEF RVT

Well-managed, relatively low fee, CEF trading at attractive NAV discount & investing in the currently very attractive small cap value space. This one complements RMT well.

Royce Micro-Cap Trust CEF RMT

Strong-management, relatively low fee, discount to NAV, and in a very attractive small cap value space (said differently, large growth (e.g. FANG) is over-extended)

Adams Diversified Equity CEF ADX

Big steady distribution payments. It's actively managed by a quality team, and uses dividends and tax-efficient capital gains to generate big income. Nice discount to NAV.

Tekla World Healthcare Fund CEF THW

We like the healthcare sector, and if you're an income-focused investor this could be worthwhile. Big distributions (dividends and cap gains), discounted price.

Disciplined Growth Portfolio:

Westar Energy WR

Westar has been disappointing. It was to be acquired by Great Plains but terms were revised to appease regulators. Still a steady, diversified utility in a healthy geography.

Emerson Electric EMR

EMR is down on earnings, but also raised its full year forecast on strong demand. We like the price and dividend track record of this made in the USA manufacturing co.

American Express AXP

AXP finally got some traction w/ the Trump rally, but is still underperforming the market over the last 3-yrs. Rising interest rates and economic growth help this "big bank" CC co.

Disney DIS

DIS faces challenges with ESPN and people cutting cable TV, but the brands simply have too much global power to ignore. Earnings are coming on Aug 8th.

Paylocity PCTY

This company's cloud-based payroll processing and HR business is growing rapidly, and the price has recently pulled back. More upside potential ahead. Potential buyout target.

Procter & Gamble PG

Brand restructuring in recent years has created a more efficient P&G that will continue to benefit from overseas exposure too. This is a blue chip, lower-risk, work horse.

Johnson & Johnson JNJ

JNJ is a blue chip among blue chips. Its diversified healthcare business will make it a leader for many years to come. It recently increased the dividend, again.

US Bank USB

Business will continue to improve w/ the economy & rising rates. Plus we like that it has less exposure to risky wall street investment banking. Buffett has a large stake.

Union Pacific UNP

UNP was beat-up in 2015 (due to economic cycle, + west-coast port issues), but has shown life in recent Trump rally. July earnings pullback creates an attractive entry point.

International Business Machines IBM

This is simply a big dividend contrarian play. Despite shrinking legacy business, legacy is still hugely profitable, and growth initiatives will eventually offset legacy losses.

Accenture ACN

High-quality workforce & global opportunities. B/c its business (mainly tech consulting) is hard for some to understand, this blue chip gets inappropriately overlooked.

Facebook FB

High margin mobile advertising revenues continue to exceed expectations. We may trim this position soon as it has grown quite large.

Small Company Value ETF IWN

We really like this allocation right now (small cap value outperforms over market cycles, & now is an attractive entry point).

Large Company Value ETF IWD

We like value stocks more than growth stocks over the long-term, but based on current conditions we especially like small cap value (see IWN, RMT and RVT).

Healthcare Sector ETF XLV

Healthcare faces challenges and uncertainty (e.g. ACA repeal and replace), but the fear is overblown and the long-term demographics are powerful.

International ETF IXUS

As U.S. recovers and grows, it brings the rest of the world with it. International still has catching up to do (a good contrarian play), and this low-fee ETF is efficient.

Smart Beta Portfolio:

Small Company Value ETF IWN

We really like this allocation right now (small cap value outperforms over market cycles, & now is an attractive entry point).

Large Company Value ETF IWD

We like value stocks more than growth stocks over the long-term, and this allocation provides low-cost diversified exposure to this market.

Healthcare Sector ETF XLV

Healthcare faces challenges and uncertainty (e.g. ACA repeal and replace), but the fear is overblown and the long-term demographics are powerful.

Vanguard Total Stock Market ETF VTI

This fund is cheaper (lower fees), better (includes small cap in addition to large) and has higher long-term expected returns than the popular SPY.

International ETF IXUS

As U.S. recovers and grows, it brings the rest of the world with it. International still has catching up to do (a good contrarian play), and this low-fee ETF is efficient.