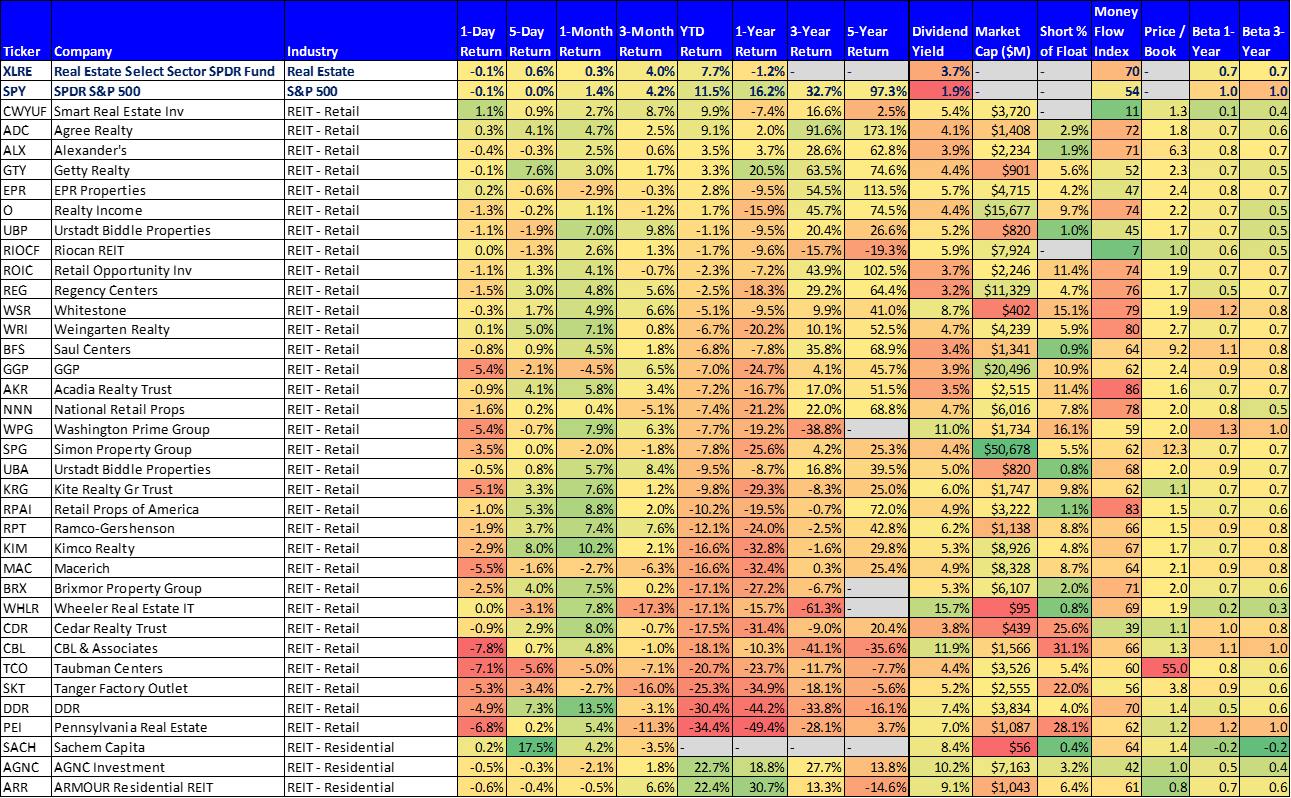

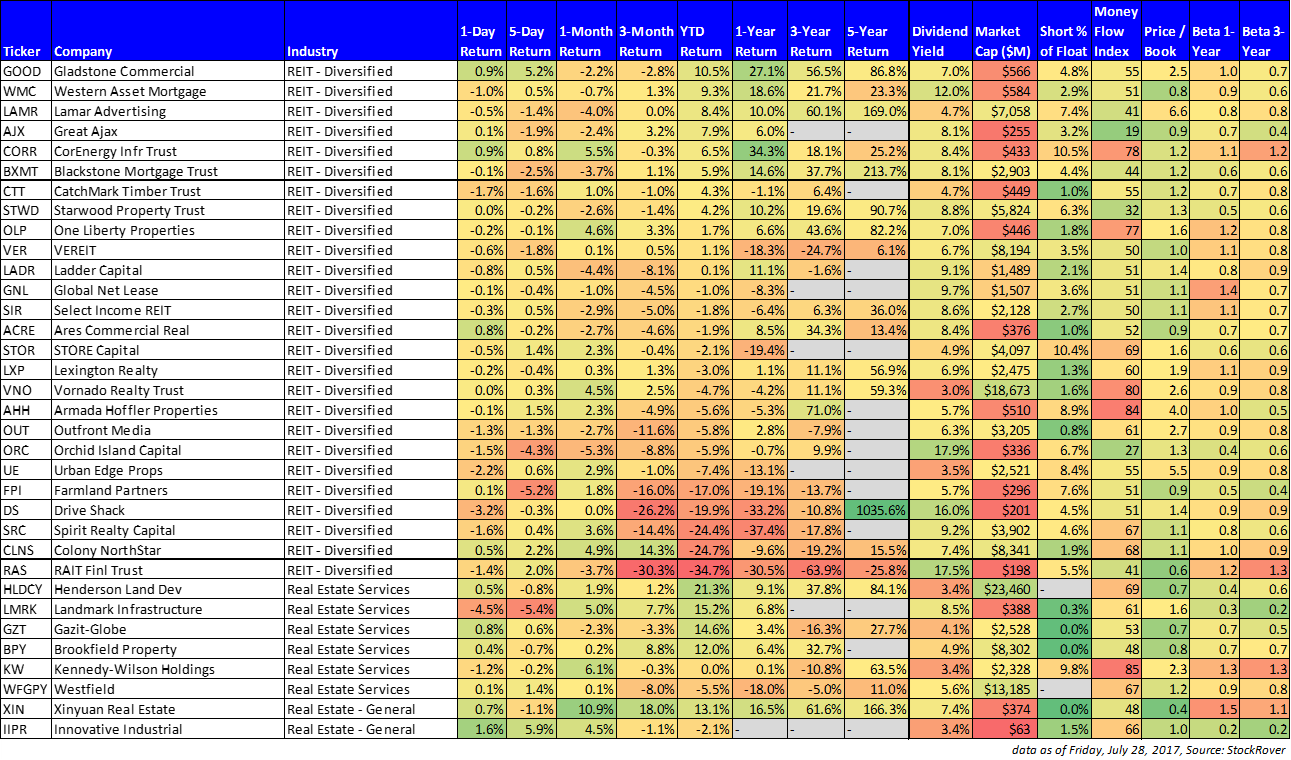

This article provides comparative data on nearly 200 high-yield REITs, and dives deeper into the three attractive REITS that we ccurrently own. For starters, here is a table with updated data on nearly 200 big-dividend REITs sorted by REIT sub-categories.

REIT Sub-Sector Data (as of Friday 7/28/17):

A couple observations about the data that is worth noting...

First, pubic real estate, as measure by XLRE (line 1 in our table) continues to struggle. It has now underperformed the S&P 500 (line 2 in our table) over the last 1-month, 3-months, year-to-date, and 1-year.

Notably, Retail REITs have significantly underperformed this year and over the last full year. This is due to three main things in our view: (1) fear of rising interest rates negative impact on REITs (because they rely on borrowing to grow), (2) The Trump rally has favored growth sectors like Technology and Financials and it has shunned less volatile sectors like REITs and Utilities, and (3) investors are afraid all retail stores are going to get “Amazoned” (i.e. put out of business by the Internet). To some extent, all three of the points have some merit, but to some extent they’re all an overblown “false narratives.” Specifically, we believe there will be specific winners and losers in the REIT space, and we’ve highlighted four of our favorite REITs below (i.e. WPC, OHI, NRZ, and EGP, with an “honorable mention” to SPG).

Simon Property Group (SPG): The price is compelling!

(Yield: 4.4%)

We’re including Simon Property Group in this write-up as an “honorable mention” because we do NOT currently own shares, but we have recently written about the attractiveness of the shares, as well as the attractiveness of selling SPG puts. You can read more about that in this article:

Also, we believe Simon Property Group will be one of the long-run winners in the retail REIT space because of its prime property locations (less likely to get Amazoned), it’s very strong cash flows (this gives it the financial wherewithal to redevelop space of any large retailers, like Sears, that may close stores), and because SPG is still trading at an attractive price because the market negativity is overblown, in our view (we are contrarians). You can learn more about our views on SPG here.

New Residential (NRZ): Earnings Announcement on Monday

(Yield: 12.5%)

NRZ is our highest risk REIT, and it’s also our highest yielding REIT. Further, it is essentially a mortgage REIT (unlike other REITs which are property REITS) and this gives it a very different risk profile. We own shares of NRZ within our Income Equity portfolio.

NRZ faces a lot of big risks right now stemming most immediately from its servicers (they are in very challenging financial situations, and NRZ relies on them). NRZ shares pulled back 1.2% on Friday thereby creating a slightly more interesting entry point. The company is expected to announce earnings Monday morning (7/31) and we are expecting a lot of big news (about deals to help support its servicers) and potential price movement. Depending on the news and the price, investors could see an attractive opportunity to add shares. We recently did a detail write-up on NRZ, and you can read that here:

EastGroup Properties (EGP): Location, Location, Location!

(Yield 2.9%)

We’ve owned EastGroup Properties (EGP) for about a year and a half now, and the share price continues to climb. This is a high quality blue chip industrial REIT with prime industrial locations across the “sunbelt” in the southern US states. This REIT doesn’t get a lot of attention because its yield is only 2.9% (too low to be include in our 3% minimum yield table at the beginning of this report). In the industrial REIT space, a lot of attention is paid to STAG because it yields over 5%, but Stag invests in higher risk secondary and tertiary properties compared to EGP’s prime locations.

EGP has faced some concerns over the last year related to its Houston-area properties exposure to the volatile energy industry, but the EGP continues to manage through the challenges supported mainly by its financial strength and prime location properties. As the old real estate saying goes: Location, location, location!

You can read more about our views on EGP in this report.

W.P. Carey REIT (WPC): Internally Managed and Diversified

(Yield: 5.9%)

We consider W.P. Carey REIT to be attractive for a variety of reasons including the fact that it is internally managed, it has a large and growing dividend, and has a very diversified portfolio across geographies and property types, as shown in the following charts.

We’ve written about WP Carey recently in this report:

W.P. Carey REIT announces earnings this week on 8/4.

Omega Healthcare Investors (OHI): More Dividend Increases Ahead!

(Yield: 8.2%)

We continue to own shares of Omega Healthcare within our Blue Harbinger Income Equity portfolio, and we recently wrote a detailed article about the risks and potential rewards of this position here:

However, since the article, the company has released its most recent earnings results, and there are a few things worth considering.

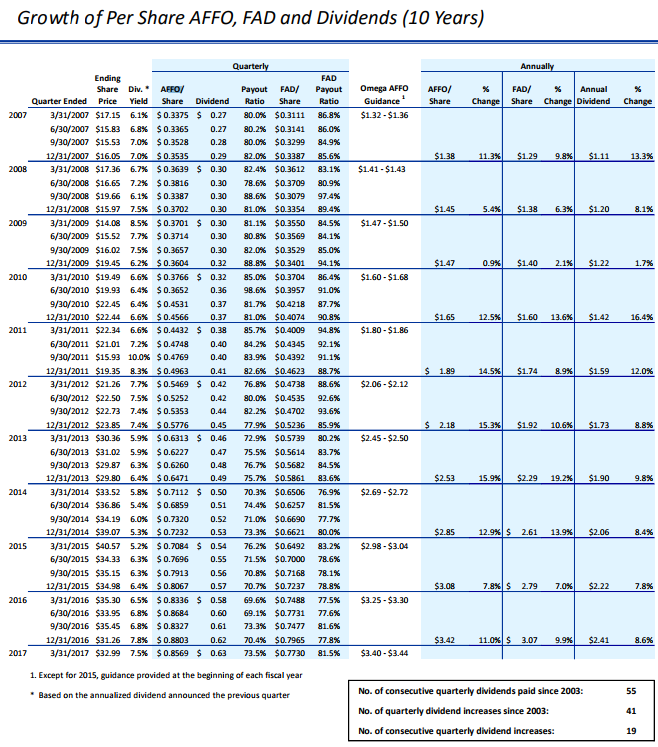

For example, the company reported Q2 FFO of $0.73, $0.08 worse than the analyst estimate of $0.81. And revenue for the quarter came in at $235.8 million versus the consensus estimate of $234.23 million (source). Omega’s earnings falling short of analyst estimates is concerning, however the company continues to maintain a healthy cushion on the amount it pays in dividends versus it’s adjusted funds from operations (“AFFO”) and its Funds Available for Distribution (“FAD”) as shown in the following table.

The company also announced that it will again raise its dividend by one penny to $0.64 per quarter, and we believe (barring any significant new tenant challenges, or big changes to the Affordable Care Act) Omega will be able to continue this trend of one cent quarterly increases in further into the future.

For reference, you can view all of our current holdings here.