Yahoo is looking to sell its core business, and the board is excluding CEO Marissa Mayer from the process. In this week’s Weekly, we consider who might actually buy Yahoo and what they’ll pay (spoiler alert: they’re not going to pay much, and they are going to cut costs to the bone). On a separate note, our new big dividend Blue Harbinger Income Equity strategy is off to a terrific start this year, outperforming the S&P 500 by 2.2% already.

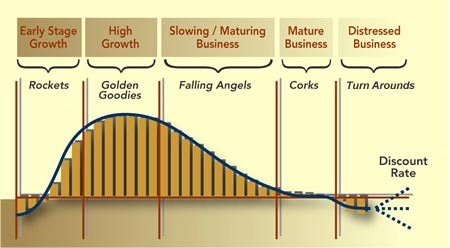

Yahoo is a dying growth company. It’s down 32% in the last year while Internet peers Facebook and Google are up 40% and 35%, respectively (note: we own Facebook in our Blue Harbinger Disciplined Growth strategy). As the following chart shows, companies often decline as the mature.

However, the question for Yahoo is what to do next. They need to cut costs first and foremost, but once that is complete then the company can either: 1) Try to resurrect itself with a newer leaner strategy, or 2) start paying a dividend, and become a value stock instead of shooting for big growth like Google and Facebook.

One potential buyer for Yahoo is perennial value stock and high dividend payer, Verizon. We believe Verizon will soon need a big acquisition (such as Yahoo) to offset its slowing telecommunications business and maintain its big dividend. In fact, this is exactly what Verizon competitor AT&T did with its recent purchase of DirectTV. As we wrote about extensively here, AT&T ventured outside its traditional telecommunications business to purchase the sputtering cash flows of DirectTV so it could avoid a potential dividend cut. Verizon’s cash flows are still a handful of quarters away from being too small to maintain the dividend, but that time is approaching steadily, and if they don’t start generating growth organically (which they likely won’t) they’re going to need inorganic growth in the form of a big acquisition like Yahoo.

One thing we can say about the potential acquisition of Yahoo by Verizon is that if it happens Verizon will absolutely cut Yahoo’s spending to the bone. The cultures of these two companies are night and day in terms of spending. Yahoo is used to spending big to try to generate growth (which they have been failing to do). On the other hand, Verizon has a culture of extreme cheapness in order to preserve cash flows and maintain its big dividend. Yahoo doesn’t currently pay a dividend, so if it is acquired then its cash flows may be just what the doctor ordered in terms of allowing Verizon to have more free cash flow from which it can pay/maintain its big dividend.

Another potential Yahoo buyer is a private equity firm such as TPG which has expressed interest in the last several months. For Yahoo’s sake, they better hope private equity firms are interested because they’ll pay far more than Verizon. A private equity firm would likely try to resurrect big long-term growth at Yahoo, and pay more, whereas Verizon would simply cut Yahoo costs to the bone and they’d likely pay very little for it. Our Stock of the Week this upcoming week will likely be Verizon/AT&T, so stay tuned for more information on the valuation of those two companies.

Tsakos call options:

On a separate note, we continue to own our June 2016 call options on Tsakos Energy Navigation (strike price: $5.00). Tsakos is up significantly over the last week, and trades at around $5.67 per share. This puts our calls $0.67 “in the money,” but we believe there is still A LOT more upside, and we continue to hold our call options. We wouldn’t be surprised to see Tsakos trading in the $8.00+ range before long, and making our call options significantly more profitable. You can read our thesis on Tsakos here.

Blue Harbinger Income Equity Strategy - Update:

Our Income Equity strategy was launched earlier this year, and is already outperforming the S&P 500 by 2.2%, and with a much higher dividend yield to boot! For reference, here is a list of the stocks in the strategy and their performance through Friday (2/19).

Paylocity Buying Opportunity:

Finally, Paylocity (PCTY) is one stock we own in our Disciplined Growth strategy that has declined significantly this year (for reference, the Disciplined Growth strategy as a whole is still outperforming the S&P 500 this year). And we still strongly believe in Paylocity going forward. Paylocity is a high beta, high volatility stock, and its year-to-date decline makes now an exceptional time to buy if you don’t already own it. You can read some of our most recent updates on Paylocity here.