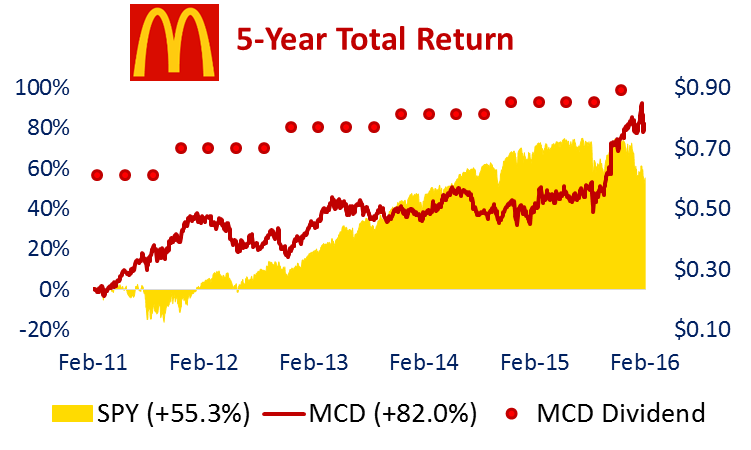

McDonald’s has outperformed the S&P 500 (SPY) by 37% over the last year. However, the company faces a variety of risks moving forward. In the week’s Blue Harbinger Weekly we weigh the risks ahead for McDonald’s, and provide our view on why it might be time to reduce your exposure to this blue chip stalwart.

For starters, McDonald’s has undertaken a variety of initiatives over the last year that have improved the strength of the company and improved its stock price significantly. However, these initiatives are now baked into the stock price, and it is unlikely for McDonald’s to generate the same level of big gains over the next year. We have described these initiatives below.

- Chinese supplier issues: Part of the reason McDonald’s has been able to generate outsize returns over the last year is because the stock was starting from a very low level. McDonald’s stock was still in the dog house (pun intended) due to Chinese supplier issues that caused customers in the region to lose faith in the company. Since then China has been able to rebuild trust from its customers, and this has contributed to stock price gains. And while McDonald’s hopes to maintain the traction they’ve built in China, it is unlikely they’ll experience the same types of gains considering they are starting from a much higher price now (more on valuation later).

- New CEO: Steve Eastbrook became CEO in March 2015, and the stock immediately gained 6% on the news. We believe the stock price will continue to demand a premium with Steve as CEO, but it’s not likely to experience a similar 6% pop in 2016 because there isn’t likely to be another new CEO that is perceived to be even better.

For added color, shareholders were unhappy with the old CEO and welcomed Steve’s previous experience as the Chief Brand Officer of McDonald’s. Not unlike other large global employers, McDonald’s constantly faces brand challenges (for example quality of food perceptions), and thus far Steve has done an excellent job addressing the challenge. For example, he changed some recipes to improve the quality of ingredients (e.g. using real butter in egg McMuffins).

- All Day breakfast: McDonald’s made breakfast items available all day and this had a positive impact on sales. We believe this will continue to be a positive impact going forward, but it’s already baked into the price (more on valuation later).

- Turnaround Plan Completion: McDonald’s has been in a multi-year turnaround plan whereby capital expenditures have been heighted. Turnaround initiatives included significant expenses around reimaging a variety of restaurants. These turnaround plans are largely competed, and as a result capital expenditures are expected to be significantly lower going forward. McDonald’s has been transparent with the progress of the turnaround plans, and the gains from lower future expected capex is largely baked into the price already.

Valuation:

We are raising our McDonald’s price target to $128 per share compared to our previous target of $122.69. To arrive at this valuation we used a discounted cash flow model. Our model assumes approximately $5.1 billion of free cash flow in 2016, a 5.82% weighted average cost of capital and a conservative 1.5% growth rate. Our price target is approximately 9% higher than McDonald’s current market price, and this is not unattractive, especially considering its 3% dividend yield and lower volatility versus the rest of the market. However, this is a lower expected return compared to many other stocks, and McDonald’s faces a variety of risks.

Risk Factors:

- Already Near Fair Value: For starters, we believe McDonald’s is not nearly as undervalued as it was in our last valuation report on July 27, 2015. At that time the price was $97 per share, and we believed the stock had over 26% upside due mainly to the initiatives we described above. Now that McDonald’s has executed on many of those initiatives, we believe the stock has less upside going forward. Our valuation (above) assumed only a 1.5% growth rate for McDonald’s, but if that growth rate falls to only 1% then our price target would fall to only $115 per share, which is $2 lower than its current market price. For reference, McDonald’s global comparable sales grew by 1.5% in 2015 (source: fourth quarter earnings announcement).

- Unattractive Growth Prospects: With many major initiatives now in the past, McDonald’s future growth prospects seem far less attractive.

- Value Menu Initiatives: One potential source of growth is the company’s expansion of “value initiatives.” For example, McDonald’s recent “Two for Two” menu offers may drive traffic in the near term, but eventually the effects of the promotion may wear off, traffic may decrease, and McDonald’s may be left with reduced traffic spending at lower price points.

- REIT Spinoff: Another potential source of growth is the possibility of a REIT spinoff. There has been some talk among McDonald’s board as to unlocking shareholder value by spinning off the company’s real estate into a real estate investment trust (REIT). We believe this could unlock a one-time valuation increase for shareholders, but this seems unlikely based on recent news as we have written about here. Further, we don’t believe it offers as much stock price appreciation potential as the company has achieved over the last year.

- Changing Consumer Preferences: There is a constant and evolving risk that consumer preferences could shift away from McDonald’s and more towards, smaller, healthier, more socially responsible restaurants. We believe there is some truth and some falseness to this perception. It is true that consumer preferences change, and may shift away from McDonald’s. However, McDonald’s has very significant socially responsible initiatives underway to address customer concerns. More information is available on the Sustainability section of the company’s website. In our view, McDonald’s often receives a disproportionately large amount of negative media attention simply because it is so large that it has become an easy target for a variety of activists and causes.

- Currency Risks: The impacts of foreign currency exchange rates are largely out of McDonald’s control, and they have had a significantly negative impact on the company’s recent earnings. For example, McDonald’s consolidated revenues decreased 7% in 2015, but would have actually increased 3% if it were not for the strong US dollar. We believe any strong currency moves in the opposite directions could cause a jump in McDonald’s earnings. However, this is not a long-term strategy, and we don’t expect it to significantly improve earnings on a sustainable basis. And in fact, it could continue to move against McDonald’s in the future.

Conclusion:

We rate McDonald’s a hold with a price target of $128.57. We are not yet selling our MCD holdings, but we are not adding to our position either. We are currently reinvesting all McDonald’s dividend payments into other stocks. We still believe McDonald’s stock has price appreciation potential, but simply not as much as it had a year ago due to its recent strong rally. We recognize the stock offers an attractive dividend yield (over 3%) and lower volatility. We believe the stock is still attractive to income investors (we own it in our Income Equity portfolio), and we continue to hold it in our Disciplined Growth strategy as well because it offers some price appreciation potential and it adds important diversification to the strategy.

Disney (a Blue Harbinger holding) announced earnings last week, and they beat estimates by a wide margin. Specifically, earnings per share (EPS) came in at $1.63, $0.18 better than expected, and revenues were $15.2 billion (the consensus estimate was only $14.75 billion).

According to Robert A. Iger, Chairman and Chief Executive Officer:

“Driven by the phenomenal success of Star Wars, we delivered the highest quarterly earnings in the history of our Company, marking our 10th consecutive quarter of double-digit EPS growth... We’re very pleased with our results, which continue to validate our strategic focus and investments in brands and franchises to drive long-term growth across the entire Company.”

We agree with Iger, we believe in Disney going forward. Our complete Disney thesis and recent updates are available here.