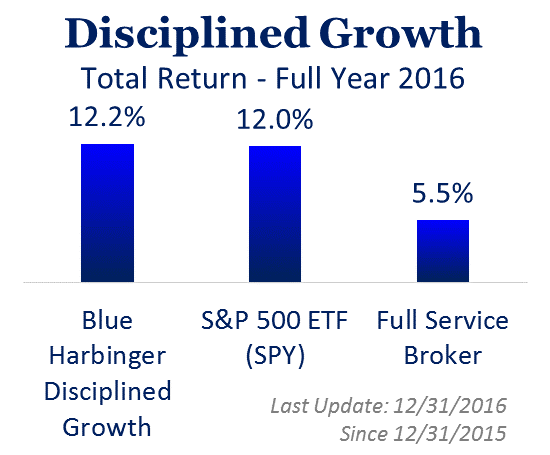

We finished the last trading-day of 2016 with two new purchases. We also finished the full-year with all three strategies (Income Equity, Disciplined Growth, and Smart Beta) beating the S&P 500. The two trades were in the Disciplined Growth and Smart Beta (ETF-only) portfolios, and we detail them in this report. We also believe all three strategies are well-positioned for continued out-performance in 2017.

2016 Performance:

First off, the following graphs show the 2016 performance for all three strategies. Please keep in mind, the Disciplined Growth Portfolio was launched in 2012, but the Income Equity and Smart Beta (ETF-only) strategies were launched on January 8th, 2016.

New Trades:

We purchased two new securities on the last day of the year. Specifically, we bought the Healthcare Sector ETF (XLV) in both the Disciplined Growth and Smart Beta strategies, and we swapped out the S&P 500 ETF (SPY) for the Vanguard Total Market ETF (VTI) in our Smart Beta strategy. Here are the holdings in each strategy as of year-end:

(Note: Smart Beta was rebalanced at year-end).

Healthcare Sector ETF (XLV):

The rationale for our healthcare sector ETF purchase is mainly that we expect the cloud of uncertainty that has been weighing down the sector to be lifted in 2017 as we get more clarify from the soon to be aligned White House and Congress. XLV was the worst performing sector in 2016, and we expect it to be one of the best in 2017. We also have exposure to the sector via our Johnson & Johnson (JNJ) holding and our Omega Healthcare REIT (OHI), but we are comfortable with an overweight to the sector based on our expectation of more clarity and better performance going forward.

Vanguard Total Market ETF (VTI):

Simply put, this is a better ETF than the S&P 500 ETF (SPY) that we sold to buy it. In addition to large cap stocks, VTI has broader diversification to small- and more mid-cap stocks that the S&P 500 does not hold, and these are also the stocks that tend to add a little extra outperformance over the long-term. Additionally, VTI is slightly cheaper than SPY (we’d expect nothing less from Vanguard- a company that’s built its name on low cost investments), and saving a small amount each year compounds and adds up to a bigger amount over the longer-term. You can read more about these ETFs (including their fees) in our recent write-up...

Income Equity Strategy Outlook:

The Blue Harbinger Income Equity strategy delivered very strong performance in 2016 (it beat the S&P 500 handily with a much higher dividend yield), and we believe it is well-positioned for continued outperformance in 2017. However, we continue to look for attractive new opportunities. We understand that many of our readers are focused on identifying lower-risk high-dividend opportunities, and we’ll be working hard to bring you more of these investment ideas in 2017...