The following table shows the performance of 40 sector and industry ETFs sorted by year-to-date total returns. And not surprisingly, given the high political uncertainty this year, health care (and biopharmaceuticals, in particular) have performed very poorly, especially versus the S&P 500 which is up 13% this year. This article details five specific ETFs (across markets, sectors and industries) that we believe are particularly attractive headed into 2017.

Health Care SPDR ETF (XLV):

This health care ETF (XLV) is particularly attractive for a variety of reasons. For starters, it’s out of favor, and as contrarians, we like that (be greedy when others are fearful!). The health care sector has been clouded with uncertainty this year because of the US election. Specifically, companies have had little clarity with regards to the future of health care laws, and the market hates uncertainty (therefore prices are down). However, we may be about to get a lot of clarity with the soon-to-be aligned White House and Congress. Specifically, we’ll get more clarity with regards to Obamacare (i.e. how much of it will be repealed) and with taxes (can president-elect Trump follow through on promises to make taxes more fair for health care companies versus their international peers?).

Additionally, this ETF is very efficient because of its very low cost (0.14% annual management expense), and it’s broadly diversified exposure to health care stocks. We expect a rebound in health care stocks in 2017, and this ETF (XLV) should benefit handsomely. And if you are particularly aggressive, you may want to consider the Biotechnology (IBB) and Pharmaceutical (IHE) ETFs which are health care industries and they happen to be the two worst 2016 performers in our table above (thereby making them particularly attractive from a mean reversion standpoint).

iShares Core MSCI Total International Stock ETF (IXUS):

International markets have lagged US markets significantly in 2014, 2015 and 2016, and in our view they are due for a rebound. Specifically, as the US market continues to strengthen, so too will non-US markets (a rising tide raises all ships). US markets have led the world leading into, and coming out of, the financial crisis, and we expect this trend to continue. Specifically, aggressive US monetary policies have caused the US dollar to strengthen significantly in 2014, 2015, and 2016, and we expect this trend to abate (or even reverse slightly) which will help non-US markets perform better in US dollar terms. The global economy is interconnected, and Trump’s promise to “Make America Great Again,” may actually have a positive impact on the rest of the world too.

This particular ETF (IXUS) is an extremely efficient way to play non-US markets. For starters, it is extraordinarily inexpensive for an ETF with exposure to both developed and developing non-US markets (the expense ratio is only 0.11% annually), and it provides exposure to a highly diversified basket of large-, mid-, and small-cap non-US equities. This ETF should be a staple of many investors’ long-term equity portfolio, and we consider it particularly attractive heading into 2017.

Vanguard Total Stock Market ETF (VTI):

Speaking of highly efficient, low-cost, market exposure, the Vanguard Total Market ETF should also be a staple in many investors’ diversified long-term investment portfolios. This ETF seeks to track to US market (small-, mid-, and large-cap stocks), and its expense ratio is incredibly low at only 0.05% per year. Truth be told, many investors would be better off in the long-term by investing in this ETF instead of trying to outfox the market because in the end, high trading costs and bad decisions result in performance that is worse than VTI. Worth noting, we are starting to like VTI more than the uber-popular S&P 500 ETF (SPY) because VTI is slightly lower cost, and it offers exposure to a broader range of stocks besides simply the large S&P 500 stocks. It’s also grown to a very healthy critical mass in terms of market cap (there is $226 billion invested in the strategy which helps ensure there’s plenty of liquidity). VTI can be a very attractive cornerstone for many diversified, long-term, investment portfolios.

iShares MSCI United Kingdom ETF (EWU):

The market continues to be overly pessimistic with regards to the United Kingdom following last summer’s Brexit vote. And iShares MSCI United Kingdom ETF (EWU) is an attractive way to play a rebound. Both the currency (GBP) and UK stocks are due for some mean reversion (because the UK economy remains stroner than many investors realize). For perspective, the following chart shows the sector exposures within this well-diversified ETF

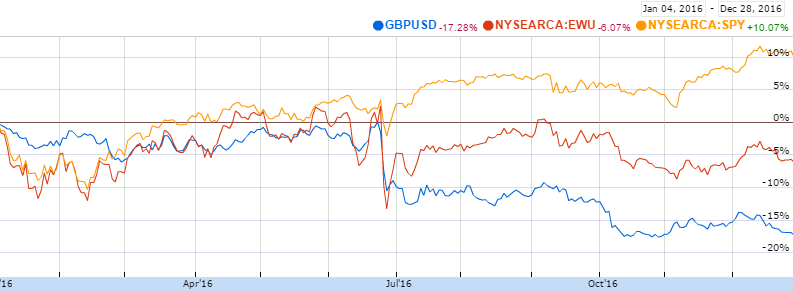

And worth noting, EWU’s expense ratio is only 0.48%, which is reasonable for a mid-term play on a rebound for the UK. For reference, this chart shows the 2016 year-to-date performance of the UK (EWU) versus the S&P 500 (SPY) and the British pound (which has weakened versus the USD).

For further reference, you can read our recent write-up on EWU here.

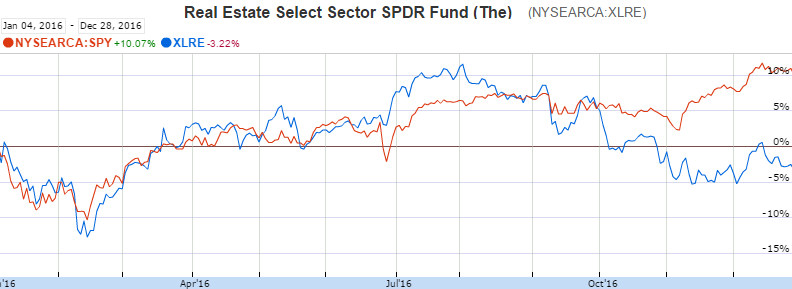

SPDR Real Estate Sector ETF (XLRE):

If you like big dividends and the possibility of price appreciation then this Real Estate ETF (XLRE) is worth considering. Its price has come down after the market’s infatuation with divided stocks earlier this year, and because investors are afraid rising interest rates will make Real Estate Investment Trusts (REITs) less profitable because they rely on heavy borrowing. However, most REIT management teams have been preparing for rising interest rates all along, and income-focused investors won’t allow this ETF to stay low for too long. Specifically, these attractive, safe, steady, dividend-payments are hard to pass up (especially considering the price appreciation potential of the sector).

And if you prefer to invest in individual REITs then Omega Healthcare (OHI) is one of our favorites. We own OHI in our Blue Harbinger Income Equity strategy, and we expect it to benefit from a rebound in both health care and REITs (you can read our recent OHI write-up here). However, if you prefer more diversification and less volatility, then this very low-cost (0.14% expense ratio), big dividend yield (4.3%), Real Estate sector ETF (XLRE) is certainly worth considering headed into 2017.