A lot of top growth stocks have sold off hard over the last month, and a select few of them provide extremely attractive entry points right now. In this report we share data on over 100 top growth stocks, briefly review macroeconomic conditions, discuss several massively disruptive secular trends, and then count down our top 10 growth stock rankings. We believe the names on this list have dramatic upside potential in the quarters and years ahead. However, if you are not a growth stock investor, this article is absolutely not for you.

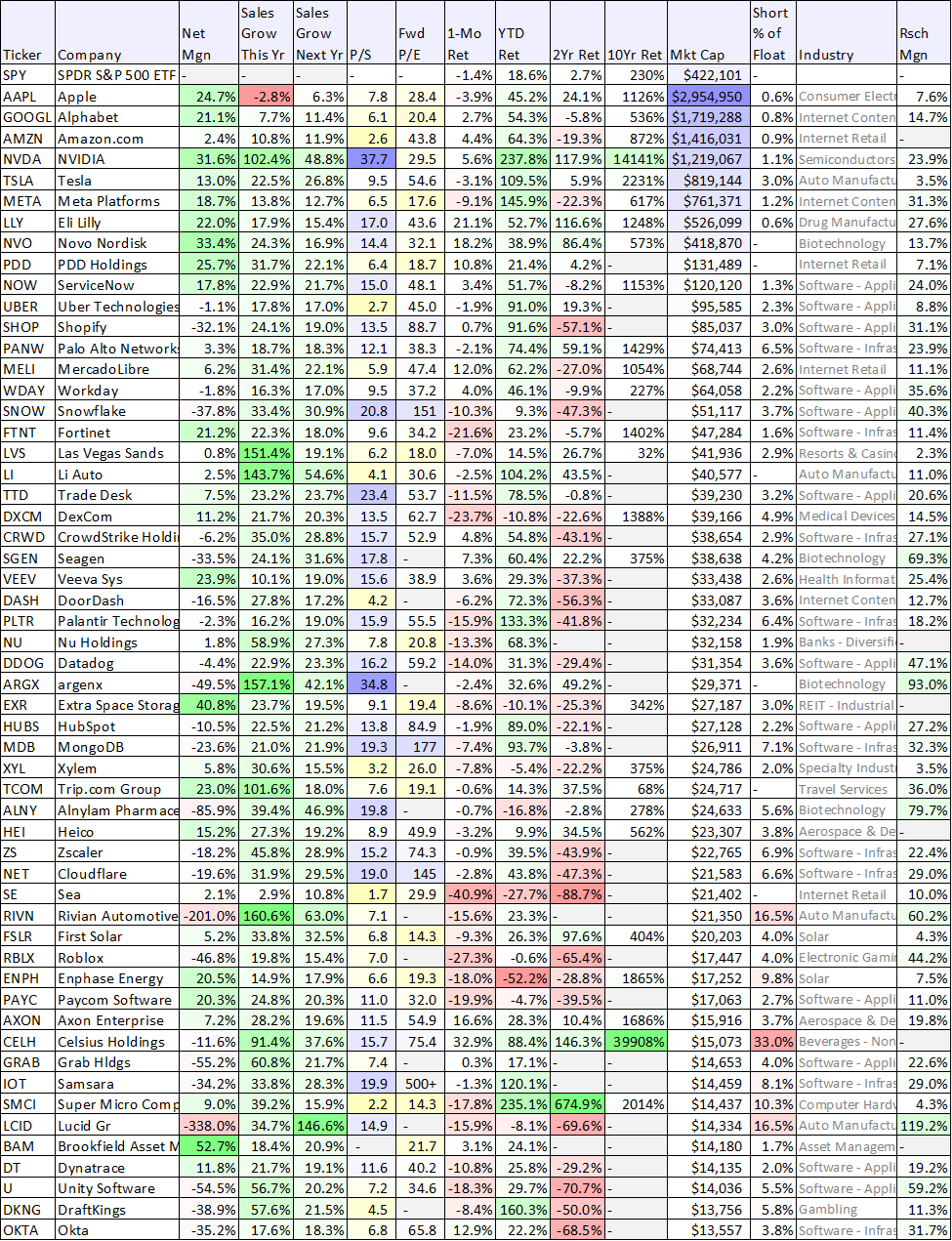

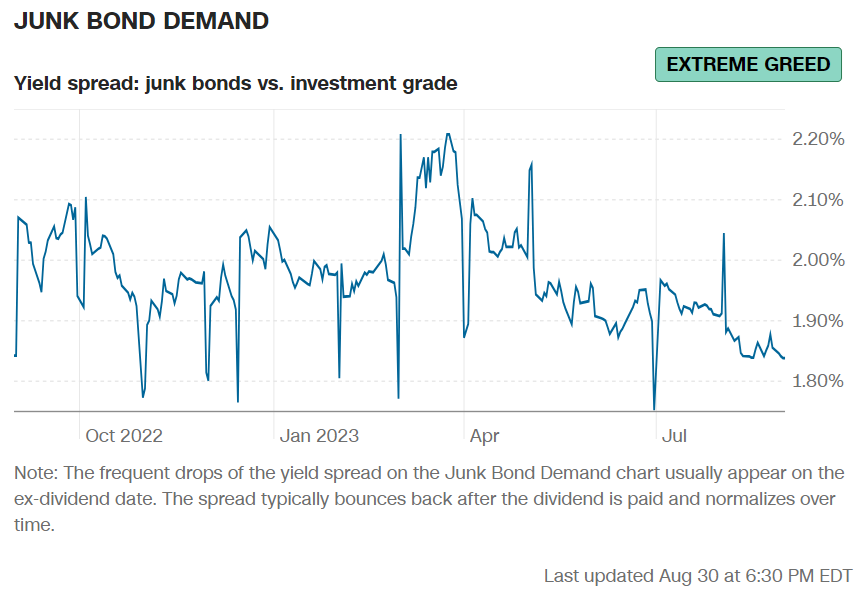

100+ Top Growth Stocks

The following table contains data on over 100 top growth stocks (i.e. those with high expected sales growth rates, this year and next). And as you can see, many of them have sold off hard over the last month (as this year’s growth stock rally has pulled back).

Also, many of these names are still down over the last two-years because that’s when the pandemic bubble first started to burst. However, over the last 10-years (for the companies that have traded publicly that long), especially the mega-caps, the returns are dramatically better than the overall market (as measured by the S&P 500). Rather than chasing mega-caps (many of which are very attractive, but have already experienced tremendous growth), we’re searching for non-mega-cap companies with dramatic upside in the years ahead.

data as of August 31, 2023.

The table is sorted by market cap, and you likely recognize many names you are familiar with (we included the “Super 7” mega-cap stocks at the top of the table, for comparison purposes). One thing you may notice, the Super 7 has very strong net profit margins, but many of the other names on the list do not yet (because they are spending heavily to generate high sales growth at this point in their life cycle as they capitalize on important secular themes—which we will cover later in this report).

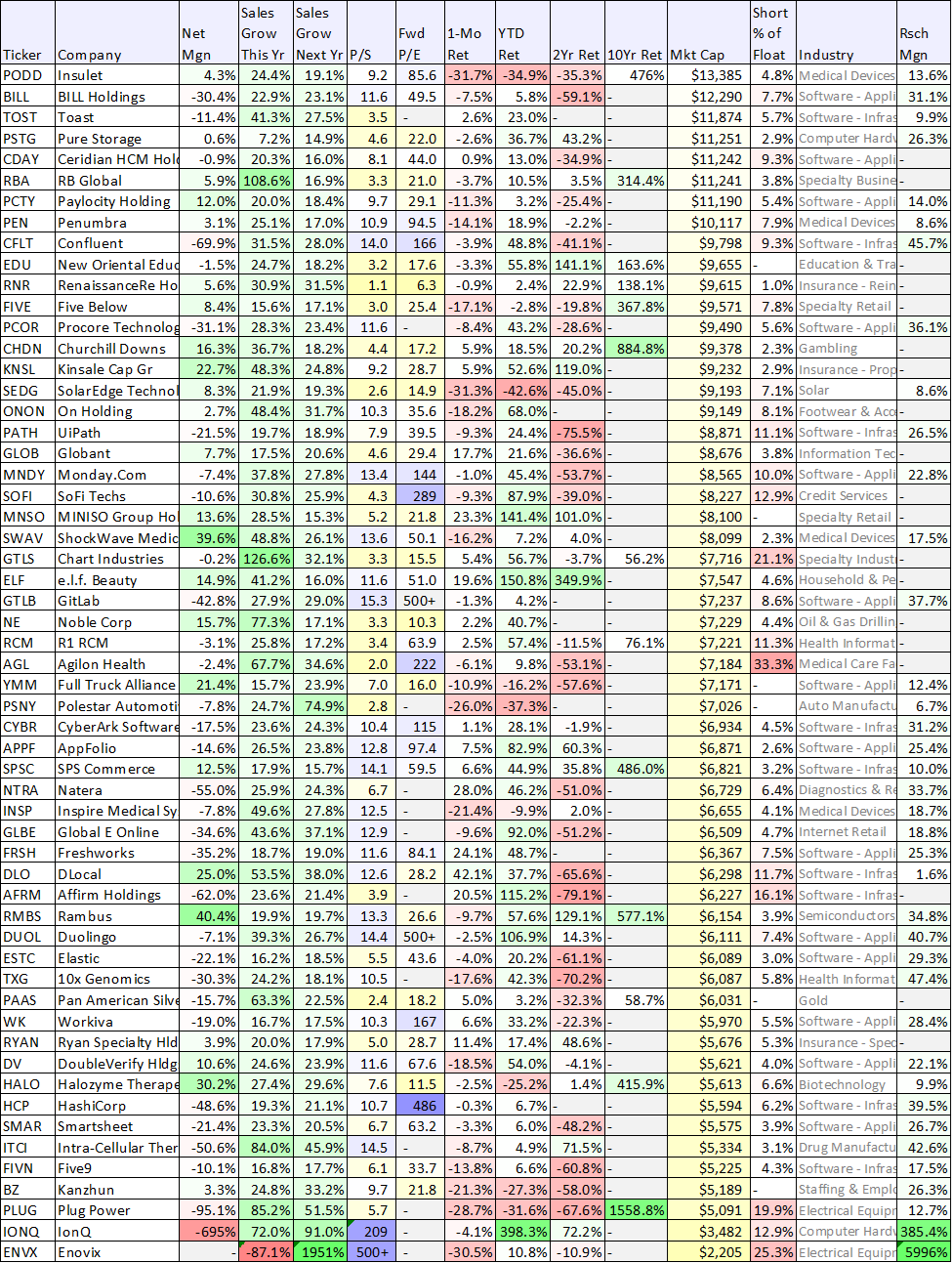

Macro: Market Greed Has Faded

As you can see in the following two “Market Greed” graphics, fear has fear has risen (and greed has faded) over the last month. This is consistent with the market pullback we have seen over the last one-month for many top growth stocks, and it has created some increasingly compelling entry points (as we will cover later in this report). And considering the market was up so strongly through the first 7 months of this year, the pullback in attractive and not surprising.

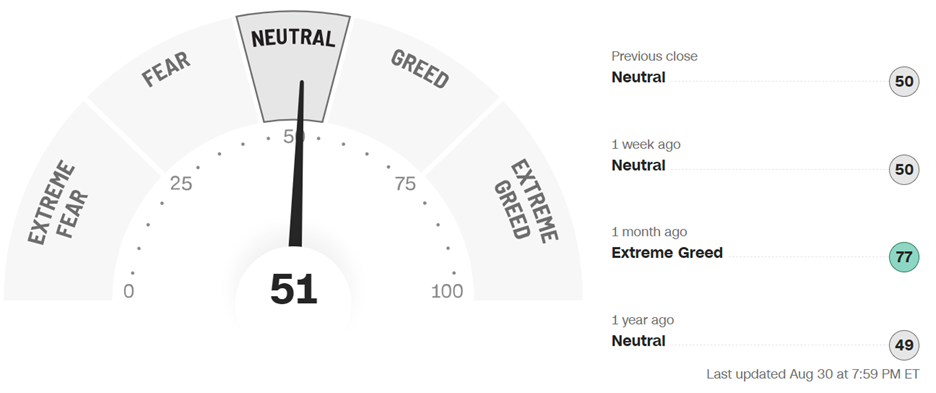

To add more perspective, this next chart shows the yield spread on junk bonds versus investment grade bonds is currently very low. This is an indication that the market is not panicking, and currently has some stability. Widening yield spreads can be an indication of high volatility and danger for investors. The chart is labeled “extreme greed,” suggesting the bond market may be too calm and comfortable, but we view it as a sign of current stability.

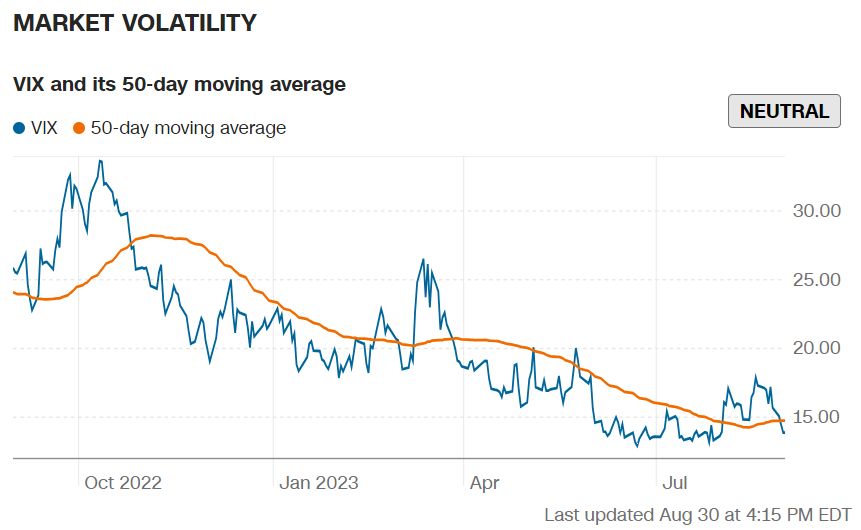

Further, the market “fear index” (the VIX) is currently low by historical standards, also suggesting the market is fairly calm and stable right now.

Big Disruptive Secular Trends

Before getting into our top 10 rankings and countdown, it’s worth considering a few major market secular trends because they are a big part of the thesis behind most of the names on our top 10 list.

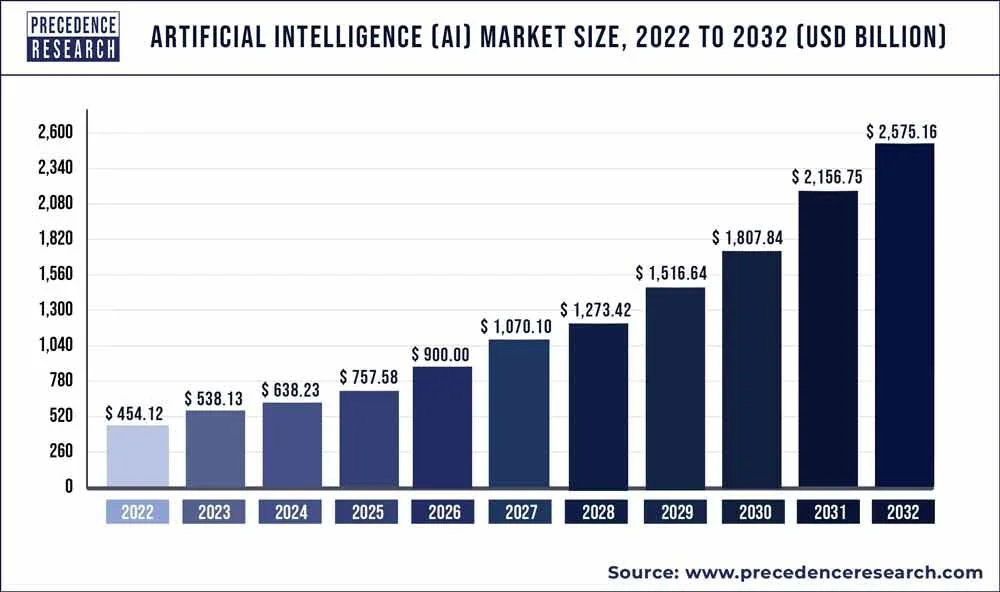

1. Artificial Intelligence: Unless you’ve been living under a rock, you’ve likely heard of the massive market disruption being caused by artificial intelligence this year. Artificial intelligence is basically “a machine’s ability to perform the cognitive functions we usually associate with human minds.” And generative AI is “describes algorithms (such as ChatGPT) that can be used to create new content, including audio, code, images, text, simulations, and videos.” AI has been a big part of the reason certain stock prices have shot up this year (such as Nvidia (NVDA) in our earlier table). And you can see in the following graphic just how big the AI market is expected to grow in the years ahead.

2. Fintech: “Fintech” (or financial technology) is another secular trend with the ability to massively disrupt markets. The space is wide ranging, but a major component is online payment processing companies with the ability to efficiently (and very profitably) process large amounts of financial transactions online and thereby eliminating the need for physical currencies. The opportunities in this space are very large and potentially extremely lucrative.

3. The Great Cloud Migration: In case you’ve been living under a rock, the world has been moving to digitize practically everything and then store it in the cloud. This not only makes things dramatically more efficient for organizations, but it also unlocks new highly valuable insights that become apparent from having such easy access to extensive data. As such, there is massive explosive demand for companies that can support the great cloud migration, especially considering it is still in its early innings and has many years of high growth for many years into the future. There are lots of attractive opportunities in this space if you know where and how to look.

Our Top 10 Growth Stocks:

So with that backdrop in mind, let’s get into our rankings, starting with #10 and counting down to our top ideas. All of the names on the list benefit from at least one of the secular trends described above, they are all attractive fundamentally (including the metrics included in our earlier table) and they all have powerful price appreciation potential (especially after the stock market softness over the last month) in the quarters and years ahead.

10. Enovix (ENVX)

This is the most speculative idea in the top 10, and potentially the most lucrative (if things continue to progress for the company). Enovix shares are very volatile, and the share price has recently pulled back signficantly over the last month (it’s the last row in our earlier 100+ stock table).

Enovix is a manufacturer of advanced lithium-ion batteries. And this early-stage public company is well-positioned to benefit from growing demand, including mobile, Internet of Things (related to the great cloud migration) and electric vehicles. What sets Enovix apart (versus the competition) is its energy density advantage (achieved through design and architecture choices) and silicon anode technology (learn more in our full report linked below). Importantly, Enovix also addresses key safety concerns.

Enovix continues to position itself for wide scale production (for example, its recent manufacturing agreement in Malaysia), and it is also lining up battery cell orders (for example, this one from the US Army). Here (below) is our full report, whereby we review the business model, market opportunity, financials, valuation and risks. If you can handle this stock’s very high risk-reward profile, the shares are absolutely worth considering, especially after the recent pullback. We are long Enovix.

*Honorable Mention: IonQ Inc. (IONQ):

IonQ harnesses the power of atomic ions found in nature to develop quantum computing systems that are widely regarded as surpassing traditional computer technologies in both quality and scalability. Founded in 2015 and first trading publicly in late 2021, the company is relatively small, but growing rapidly and supported by very large long-term secular disruption opportunities.

We’re including IonQ as an “honorable mention” because we don’t yet own shares (as the technology’s uses are still nascent) however the upside is potentially enormous if this superior technology becomes more viable and catches on (which it appears on track to eventually do so). IonQ investors include Google Ventures and Amazon Web Services.

IonQ shares are tempting as the price has pulled back over the last month. You can read our new full report on IonQ here:

9. SoFi Technologies: (SOFI):

SoFi is a “fintech” company. More specifically, it is an online financial services company and bank that targets younger high-income customers. And SoFi has a lot of good things going for it. For starters, the recent end (this month) to the federal student loan forbearance program means more business for SoFi as federal loans are again refinanced (now that there is a need again) through SoFi’s private loans business. However, while student loans had slowed in recent years, SoFi’s personal loans business continues to accelerate (and is now much larger than student loans). Furthermore, the company picked up a bank charter recently, and is now benefiting from higher interest rates (i.e. higher net interest margins as rates rise).

SoFi shares are down nearly 10% over the last month, but the business continues to get better (it’s on track for GAAP profitability in Q4), and you can read our latest new SoFi report using the link below.

8. Palantir (PLTR)

Palantir is basically a software company, and it is positioned to benefit dramatically in the years ahead from the massive secular growth in Artificial Intelligence (“AI”) and Machine Learning (“ML”) (especially thanks to the company’s leading solutions, innovation, sticky customer base and very strong balance sheet).

Palantir’s recently announced quarterly earnings, whereby it raised forward guidance and announced a $1 billion share repurchase plan (both good things). However, it is growth in demand for the company’s Artificial Intelligence platform that is most interesting. Here is what CEO Alex Karp had to say about AI.

Shares of Panatir have been volatile since its pandemic-era IPO, but the business has continued to grow and expand. The shares are down more that 15% over the last month, and this is creating an increasingly compelling entry point. In the following report, we review the business, the growth, the opportunity, the valuation and the risks. We are currently long shares of Palantir with no intention of selling.

7. Super Micro Computer: (SMCI):

If you like to invest in powerful secular growth opportunities, Super Micro Computer (SMCI) has likely caught your eye. This developer and manufacturer of high-performance servers and storage systems is benefitting dramatically from explosive secular growth in artificial intelligence (“AI”) and high-powered computing (including its special relationship with Nvidia). The total addressable market opportunity is enormous. We recently wrote this one up in detail (see link below), and the shares have pulled back more than 17% over the last month (making for a significantly better entry point). We recently purchased shares of SMCI (on the pullback). Here is our full report:

The Top 6:

The top 6 growth ideas are reserved for members-only, and the remainder of this report is available here. We currently own all 6 of the top ideas, and the group includes an attractive mix of companies benefiting from AI, fintech and the cloud migration secular trends. We believe all of the top ideas have the potential to be trading dramatically higher in the quarters and years ahead.

The Bottom Line:

Growth stock investing is not for everyone because the volatility can be high. However, if you have a long-term horizon, growth investing can be extremely lucrative. Many top growth stocks have pulled back over the last month, and some of them (such as those described in this report) are extremely attractive.

The long-term viability of a business is much more important than any short-term price pullback. However, the recent pullbacks do add some additional margin of safety. We believe the top names listed in this report are all attractive long-term growth businesses, and they will likely be trading significantly higher in the quarters and years ahead.