Ford currently offers a big 4.5% dividend yield. And if you factor in the special dividend they paid earlier this year, the yield jumps to 6.4%. However, we believe there are better dividend paying opportunities than Ford because of the significant risk exposures the company faces such as the industry’s wide cyclical swings, Ford’s lack of competitive advantage, its expensive workforce, and its absurd pension assumptions. In this article, we review Ford’s dividend and risk exposures, and then provide details on five big dividend stocks that we like better than Ford.

Ford’s Dividend

The following chart shows Ford’s historical dividend payments.

The dividend has been increasing steadily since being cut to zero during the financial crisis. And this year’s $0.25 special dividend may become somewhat of a regular occurrence in the future because it gives Ford some flexibility to deal with the industry’s wide cyclical swings (i.e. they can skip the special dividend in challenging years, but still maintain the regular dividend).

The Auto Industry’s Wide Cyclical Swings

By nature, the auto industry is exposed to the risks of wide market swings. For example, we are just coming out of one of the worst where Ford had to cut its dividend to zero (and General Motors relied on a government bailout just to survive). Ford’s beta is over one (1.36 according to Google Finance) which means the stock price has a history of being more sensitive to market-wide swings than average. Specifically, Ford sells autos in North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and any downturns in these markets can stall the company’s growth plans, and there is very little they can do about it. Generally speaking, stocks with higher betas should compensate investors by offering higher long-term returns (assuming the overall market rises), but this may not be the case for Ford considering its lack of competitive advantage.

Ford’s Lack of Competitive Advantage

The auto industry is extremely competitive, and Ford has no significant competitive advantage versus many of its peers. For starters, the high capital costs of manufacturing autos once acted as a barrier to entry, but as efficiencies increase and foreign competition grows, Ford profits are increasingly pressured. Plus, new disruptive technologies (such as autonomous and electric vehicles) continue to put pressure on the company.

Ford has recently been able to increase profitability by increasing operating efficiency (for example, they’ve benefitted significantly from economies of scale by reducing the number of common vehicle manufacturing platforms over the last several years), but this effort can only go so far, and it’s unlikely they’ll be able to grow meaningfully by wrestling market share away from their competitors. For example, Ford’s attempts to grow its higher-margin luxury Lincoln brand could bear some fruit, but realistically not much because competition is already so intense in the industry.

Ford’s Expensive Workforce

Historically speaking, it seems many hard-working Ford people were able to build quality vehicles and lives with the help of collective bargaining. However, as competition grows at home and abroad, Ford’s workforce is relatively expensive and risky. For example, Ford acknowledges the risk on page 14 of their most recent annual report by saying:

“A work stoppage or other limitations on production at Ford or supplier facilities for any reason (including but not limited to labor disputes…) could have a substantial adverse effect on our financial condition and results of operations.”

And for reference:

“Substantially all of the hourly employees in [Ford’s] automotive operations are represented by unions and covered by collective bargaining agreements.”

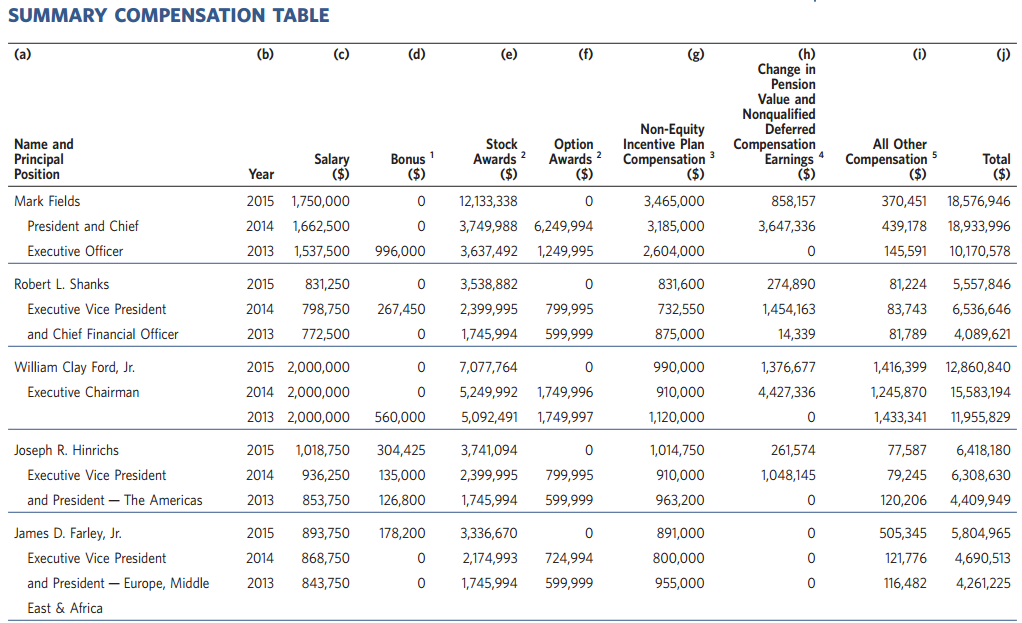

Also worth noting, it’s not just the automotive operations workers that are expensive. For example, the following table (from page 56 of Ford’s 2016 Proxy Statement) shows how much some of the big wigs are taking home:

For example, CEO Mark Fields took home $47.7 million in total compensation over the last three years. That’s no small amount.

Ford’s Absurd Pension Assumptions

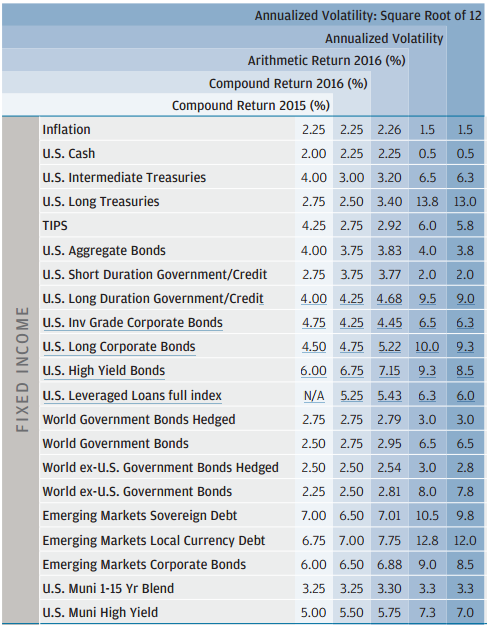

We’d be remiss not to point out the growing pension plan risks created by artificially low interest rates being set by central banks around the world. For example, according to page FS-36 of Ford’s most recent annual report, the long-term return assumption for Ford’s US Pension Plan is 6.75%. This assumption becomes totally absurd when you realize the US Pension Plan’s target allocation is 80% fixed income and 20% growth assets (primarily alternative investments which include hedge funds, real estate, and private equity, and public equity). There is virtually zero chance they will achieve this target return considering interest rates are at all-time lows. Realistically, they might achieve this target if they were invested in 80% growth assets.

For some perspective, according to JP Morgan’s long-term capital market assumptions (see table below), US large cap equities are only expected to return 7.0% over the long-term. On the other hand, the current yield on the 10-year US treasury is below 1.4%, and investment grade corporate bonds aren’t much better (according to the WSJ Disney, for example, just issued 10-year investment grade corporate bonds at 1.85%). And according to page FS-38, Ford’s US Pension Plan is invested mainly in government bonds and investment grade corporate debt as shown in the following table.

It’s simply absurd to believe Ford is going to meet its long-term return assumptions, and almost inevitable they will have to pony up more cash for those pensions, and that will be a drag on the stock price.

A Note on Ford’s Valuation

Valuing Ford based on its big dividend payments alone is not enough. For example, if we discount Ford’s dividend payments ($3.9 billion, including the special dividend) by its cost of equity (we use 11%, CAPM derived) and assign an optimistic growth rate of 2.5%, the company is still only worth $45.9 billion which is roughly 15% below the current market value of its equity. And if we ignore the special dividend then it’s worth only $27.5 billion using the same assumptions. Alternatively, if we discount 2015 free cash flow of $11.2 billion by an assumed weighted average cost of capital of 8.5%, the same 2.5% growth rate, and adjust for its outstanding debt, it’s still only worth $45.6 billion, which is roughly 15% lower than its current market value. These valuations are basic estimates meant only to be a guideline, and they’re highly sensitive to our assumptions. For example, if Ford can achieve a higher growth rate of only 3.0% then the discounted free cash flow valuation quickly changes from Ford being 15% overvalued to 16% undervalued. However, it seems unlikely for Ford to achieve a significantly higher growth rate given the high level of competition and risks that we’ve described previously.

The Bottom Line on Ford and its Dividend

The bottom line is that Ford’s bottom line will continue to be challenged going forward due to the industry’s wide cyclical swings (automakers tend to have higher betas), Ford’s lack of competitive advantage (competition in the industry is fierce and growing), its expensive workforce (operations people and the big wigs), and its absurd pension plan assumptions (artificially low interest rates will cause pension plan returns to fall short of assumptions). Realistically, Ford’s basic dividend (not including the special dividend) is safe, and the stock will likely experience moderate long-term price appreciation. However, given the risks, we believe there are better investment opportunities elsewhere.

Five Big Dividend Stocks We Like More Than Ford

EPR Properties (4.7% Yield)

If you are an income-focused investor, EPR Properties (EPR) stands out, and we like it better than Ford. It’s a real estate investment trust (REIT) that offers a big, safe, growing, monthly dividend. It invests in properties such as megaplex theatres, entertainment retail centers, public charter schools, waterparks, and golf entertainment complexes. In addition to the nice dividend payments, it also offers attractive diversification benefits and it has exhibited very low volatility. And even though its price has already been performing well this year, we believe it has the growth prospects to support continued long-term price appreciation.

AmeriGas Partners (7.9% Yield)

AmeriGas is the largest propane distributor in the US (with about 15% retail market share), it’s organized as a master limited partnership (MLP), and it currently pays a big safe growing distribution yield. It also offers low volatility, a low beta, and an exceptionally attractive return on invested capital. Further, we believe AmeriGas is uniquely positioned to successfully execute on its growth-through-acquisitions strategy, and fears of a declining propane market are largely overblown. For income-focused investors, we believe AmeriGas is a better option than Ford.

HCP Inc. (6.3% Yield)

HCP Inc. (HCP) is a big dividend healthcare real estate investment trust (REIT) that is also a dividend aristocrat (i.e. it’s increased its dividend more than 25 years in a row). The company has recently faced challenges related to its largest tenant, HCR ManorCare, and we believe HCP’s decision to spinoff HCR ManorCare into a separate company is a smart move that will unlock value for shareholders. And we also view yesterday’s press release regarding the new interim CEO to be a positive part of the corporate restructuring process. http://ir.hcpi.com/2016-07-11-HCP-Announces-CEO-Transition If you are a long-term income-focused investor, we like HCP’s dividend and growth prospects significantly more than Ford’s.

Frontier Communications (8.5% Yield)

Frontier Communications (FTR) is a big dividend telecom company that is currently trading at an attractive price. Frontier paid out $576 million in dividends last year, and it also received $500 million in government subsidies (Annual Report, p.22). Said differently, Uncle Sam pays 87% of Frontier’s dividend. Frontier has created a niche for itself by operating in regions that are heavily subsidized, and they deepened their foothold in that space with their April 1st $10.5 billion acquisition of assets from Verizon. We believe Frontier’s niche is attractive, the company easily covers its dividend payments, and its current valuation is compelling.

Main Street Capital (6.6% Yield)

Main Street Capital is an internally managed Business Development Company, and we like it more than Ford because of its bigger dividend and relatively low volatility. Additionally, its investment income consistently exceeds its dividend payments, and its net asset value continues to enable additional supplemental dividend payments. We believe it is worth significantly more than its current market price, and if you are a long-term investor, Main Street Capital could be a valuable addition to your diversified income-focused portfolio.

Conclusion:

Even though Ford offers a big dividend, and its price has declined in recent years (declining prices are often attractive to value investors), we believe it does not have enough long-term return potential (it has some, just not enough), and there are better investments opportunities elsewhere. As described above, we like EPR Properties, AmeriGas, HCP Inc, Frontier Communications and Main Street Capital to deliver better long-term returns and dividends than Ford.