Plains All American Pipeline (PAA) is a high-yield (11.4%) Master Limited Partnership (MLP) that has declined more than 50% in the last year. It trades for only slightly more than its book value, and a basic distribution discount model suggests the market is already pricing in a 40% distribution cut. However, we believe a distribution cut of this magnitude (or one at all) is unlikely given PAA’s high level of energy price agnostic fee business, the credit worthiness of its counterparties, and the fact that it is currently well capitalized. We also believe PAA has significant price appreciation potential, it will continue to pay attractive distributions, and it could be a valuable addition to the higher risk portion of a diversified, income-focused, investment portfolio.

Overview

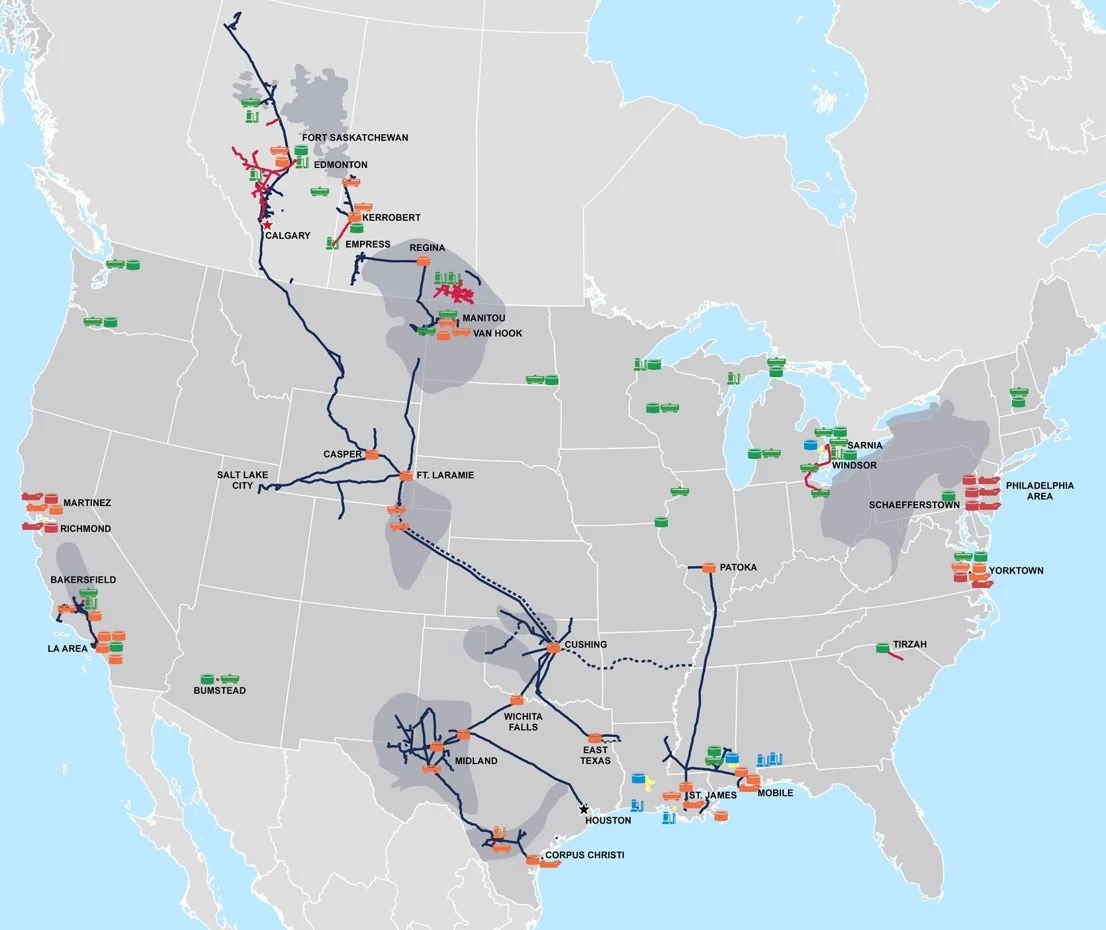

Plains is a publicly traded MLP that owns and operates midstream energy infrastructure and provides logistics services for crude oil and natural gas products. MLPs in general have sold off dramatically since energy prices began to decline in the second half of 2014. Not only do MLPs have varying degrees of direct exposure to energy prices, but they are also exposed to growing credit/default risks related to their energy industry counterparties. For example, cheap oil has already bankrupted more than 50 American producers, and more bankruptcies are expected. To make matters worse, fears related to rising interest rates have created additional headwinds for high-yield MLPs because it makes capital even more expensive and because investors may begin to find attractive yields elsewhere.

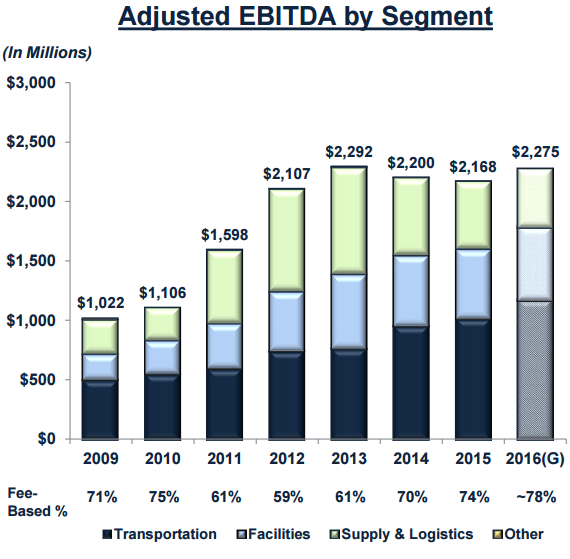

As the above chart shows, Plains sold off right along with other MLPs, but we believe this is somewhat inappropriate for several reasons. First, as the following chart shows, nearly 80% of Plains EBITDA is fee-based.

Fee-based earnings are less exposed to the volatility of energy prices, and this gives Plains an advantage over many of its peers. Secondly, the vast majority of Plains credit exposure is with investment grade entities (investment presentation, pp.19-20). This is not true for all of Plains peers (for example, Williams Partners has huge exposure to Chesapeake Energy which may soon go belly-up), and it makes Plains significantly less risky. Additionally, Plains is currently well capitalized. They recently completed a $1.6 billion preferred equity offering, they appear well-capitalized through most of 2017, and they don’t have material capital commitment beyond 2017 (investor presentation, p.8). This is important because even though Plains’ cost of capital has theoretically increased recently (see table below) they won’t necessarily need to raise capital in the near term at these costs.

Dividend History

As the following chart shows, Plains has a strong history of paying (and increasing) its dividend.

However, Plains has halted dividend increases so far in 2016, and this has many investors concerned. As fear ramps up, investors point to Plains high dividend payout ratio (1.13x) as a sign of distress. Specifically, Plains distributable cash flow was only $1.475 billion in 2015, but the company paid out $1.671 in distributions. A payout ratio greater than one is not sustainable over the long-term, however Plains has taken actions to address this. For starters, they’ve been cutting costs, and have provided guidance for a significant EBITDA increase in 2016 (see adjusted EBITDA by sector chart provided earlier). Additionally, they have access to plenty of capital as described above. And further, even if they do cut the dividend, the stock is still dramatically undervalued.

What is Plains Worth?

We believe Plains is worth significantly more than its current $9.9 billion market cap. For starters, Plains book value of $7.9 billion ($22.3 billion in assets minus $14.4 billion in liabilities) is almost as much as its market cap, and it gives the company very little credit for its future earnings power. And considering the company has already provided 2016 net income guidance of $1.3 billion (investor presentation, p.5), the $9.9 billion market value is a little ridiculous (it’s way too low).

Another way to look at Plains’ value is to discount its distribution payments by its cost of equity. Specifically, Plains paid out $1.671 billion in distributions in 2015, and its cost of equity is 9.59%. If we discount the $1.671 billion by the 9.59% cost of equity, and assume a 0% growth rate, then Plains is worth $17.4 billion, 76% more than its current market value. And to arrive at the $9.9 billion market cap, we’d have to assume the distribution gets cut by approximately 43%. A 43% distribution cut seems unrealistic (way too big) considering the company’s high level of energy price agnostic fee business, the credit worthiness of its counterparties, and the fact that it is currently well capitalized. It seems more likely that the market has greatly overreacted to current conditions, and Plains is very undervalued.

What are the Risks?

Plains is exposed to a variety of significant risk factors. For starters, it maintains a higher level of debt than many other industries, and changing capital market conditions could impair its ability to grow. For example, rising interest rates, debt levels, and credit concerns all pose a risk. Unlike a corporation, Plains is not able to retain cash (it must pay, quarterly, 100% of available cash to unitholders) and for this reason Plains may be required to raise additional cash (for growth) when capital market conditions are not ideal.

Plains is also exposed to growing counterparty risks. As energy prices stay low, more of Plains energy producing counterparties face financial challenges. As mentioned earlier, an increasing number of producers are filing for bankruptcy and this increases the chance that Plains may not be able to collect revenues per their agreements with these counterparties. Even though Plains has reduced their exposure to energy prices by increasing fee-based revenues, they will still receive far less revenue if counterparties file for bankruptcy.

Regulations pose another risk for Plains. Plains operates in a regulatory-sensitive industry, and new rules related to environmental protection, safety, and financial security may reduce Plains ability to be profitable. Because Plains operates in the US and Canada, they are exposed to regulatory risks from both countries. Additionally, they are exposed to currency exchange rate risks. Further, Plains is exposed to the risk of tax law changes. For example, the income tax treatment of publicly traded partnerships could change causing significant expense for Plains and its unitholders.

Another risk is that Plains may issue new units without unitholder approval. New common units may be dilutive to existing ownership interest. Plains has a history of issuing new shares (for example, they’ve issued over $3 billion worth in the last four years).

Conclusion

There is no question that Plains is facing a variety of very significant challenges. However, we believe fear has caused the market to overreact to these challenges. We’ve ranked Plains second on our list of Three High Yield MLPs Worth Considering because of its significantly discounted price and its ability to continue paying large distributions to unitholders for many years to come. If you are an income-focused investor, we believe Plains could be a valuable addition to the higher risk portion of your diversified, long-term portfolio.