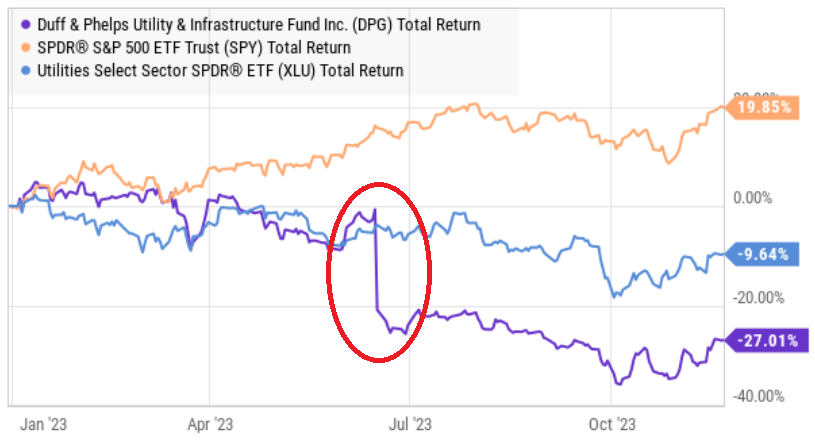

If you are a big-yield contrarian investor, the Duff & Phelps Utility and Infrastructure fund (DPG) stands out like a sore thumb. It’s down more than 25% this year (the worst performer among the top 25 CEFs we share in our table below) for two reasons. First, it invests in a low-volatility “safe” market sector that is significantly underperforming the market this year. And second, it trades at a massive (and very inappropriate) discount to its net asset value (“NAV”) following a distribution right-sizing a few months ago (emotional investors have dramatically overreacted). In this report, we compare the 9.2% yielding DPG to 25 other top big-yield CEFs, then review its strategy, current market conditions and valuation. We conclude with our strong opinion about investing in this very interesting “stand out” opportunity.

25 Top Big-Yield Closed-End Funds (CEFs):

For starters, here is a look at DPG versus 25 other top big-yield CEFs (see table below). And as you can see, it is the worst performer among this group so far this year.

You likely recognize a few of your favorite CEFs in the table above (it’s sorted by strategy and then by market cap). The table includes a variety of comparative metrics, ranging from distribution yield, to performance (over varying time periods), current leverage (i.e. borrowed money), size (market cap) and more.

And if you are a contrarian investor that likes to buy big-yield closed-end funds at a price discount versus their net asset value, then DPG stands out like a sore thumb. Let’s have a closer look.

Duff & Phelps Utility & Infrastructure Fund (DPG), Yield: 9.2%

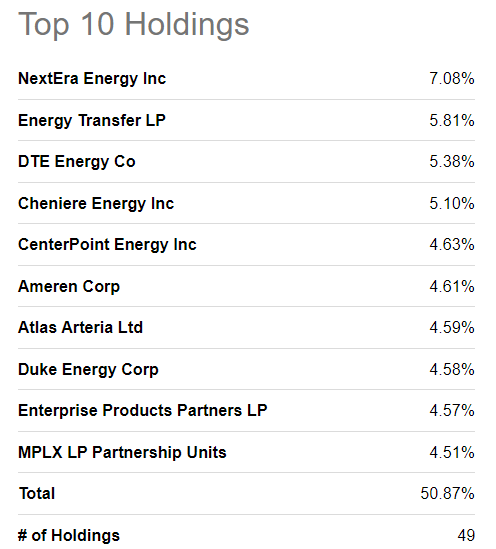

This $350 million dollar fund, managed by industry stalwart (Duff & Phelps) holds 49 positions, consisting mainly of utilities sector (63%) and energy sector stocks (25%). You likely recognize several of it’s top holdings in the table below.

It has long been an income-investor favorite, until this year (as utilities stocks have been the worst performing sector, and a related distribution rightsizing has driven investors away in hoards).

distribution cut date circled in red.

Utilities Sector Ugly

Utilities sector stocks are known for low volatility (because of the steady nature of their business and because market regulations often ensue a reasonable level of profits) and for the healthy growing dividend payments to investors. However, this year the sector has been under pressure (see chart above) for a couple reasons.

For starters, as interest rates have risen, many investors have moved money out of Utilities stocks and into CDs, money market accounts and bonds because the interest rates are now comparable to dividend yields.

Furthermore, as inflation has been on the rise, it takes time for utilities sector stocks to get regulatory approval to raise their rates to cover rising costs. These factors have put a lot of selling pressure on Utilities stocks, and created an attractive “buy low” contrarian opportunity, in our view.

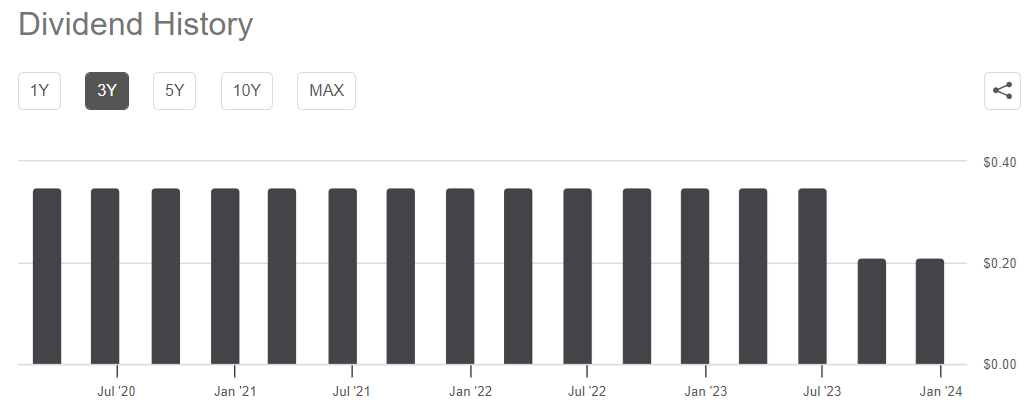

Distribution Right-Sizing

DPG reduced its distribution several months ago because it was becoming increasingly difficult to support. Specifically, because the NAV was down, the fund was also using a significant portion of “return of capital” (“ROC”) to support the distribution.

Basically, the fund was returning investors some of their own original investment dollars just to support the distribution. This is not a long-term sustainable strategy, and the distribution reduction was necessary. In fact, the distribution reduction makes the fund stronger going forward, and even after the reduction the distribution is still very large and quite attractive (currently offering a 9.2% distribution yield).

Investors’ Emotional Overreaction

Past performance is not indicative of future results. That’s the general phrase that is repeated over and over to investors, largely because investors have a very ugly tendency to chase past returns instead of focusing on what will likely happen in the future.

Here is a look at DPG’s price to net asset value (below). And as you can see, NAV has been ugly this year, and the price performance has been even worse!

Specifically, the NAV has fallen as utilities stock share prices have fallen. And then the market price of this fund has fallen even harder as investors flee from the double whammy of poor utility stocks performance and the distribution cut.

And as ridiculous as the market reaction has been to DPG’s situation, we are grateful because it has created an attractive contrarian investment opportunity for big-income investors that like to “buy low.” We believe the utilities sector will recover relative to the rest of the market, and we believe the big discount to NAV will also decrease overtime. Both factors make DPG an attractive contrarian opportunity.

Other Factors to Consider

Before investing in any closed-end fund, there are a variety of factors we like to consider, as described in the image below.

You can access most of this information on the fund’s website and through internet sources like CEF Connect. But to briefly address the points above:

Yes, a CEF that owns utilities sector stocks and pays a big quarterly distribution does match many investors goals.

No, the distribution has not been consistent (it was just reduced), but on a go-forward basis the fund is in a much healthier position to support the distribution.

The distributions were sourced with a significant amount of ROC, but going forward we expect that to be much less of an issue.

Yes, the fund does use leverage (recently 30.3%) which is a significant amount for a mostly equity fund, but still relatively prudent (depending on your goals) because of the lower volatility nature of utility sector stocks. DPG’s leverage will help keep the distribution high going forward.

DPG trades at a large discount of -13.2% (an attractive contrarian opportunity, in our view) relative to its own history as you can see in the chart above.

The total expense ratio was recently 2.51%, which is a lot for an equity fund. However, a large portion of that expense is the cost of leverage (borrowed money) and as interest rates have risen that cost goes up.

Duff & Phelps is an industry stalwart. They manage multiple funds and have ample resources to support the strategy.

Conclusion:

We recently added shares of DPG to our High Income NOW portfolio. We took advantage of the large discount to NAV and the contrarian opportunity currently offered by the utilities sector (and DPG shares in particular).

We understand that some investors are not comfortable buying a fund that has performed so terribly over the last 12 months. However, past performance is not indicative of future success, and from a contrarian standpoint, we believe DPG offers an exceptional opportunity for income-focused investors. We own DPG within a prudently-concentrated high-income portfolio, and we look forward to big distributions and price appreciation in the quarters and years ahead.