If you like your investments to pay you high income now—this report may be right for you. We countdown our top 25 big-yield Exchange Traded Funds (“ETFs”) and Closed-End Funds (“CEFs”) with yields of 6.0% to over 12.0%, and carefully highlighting the important nuances of these two distinct investment vehicles, while also avoiding the gimmicky yield traps that sadly dupe so many unsuspecting investors. We start with some high-level advantages and disadvantages of ETFs versus CEFs, then rank our top big-yield funds, starting with #25 and counting down to our top ideas.

ETFs Versus CEFs: Strengths and Weaknesses

Starting with ETFs, they are increasingly popular for good reasons, and for bad. Initially, many ETFs were positioned as passive index funds designed to give you diversified market exposure at a very low cost. For example, rather than painstakingly trying to select individual stocks, and rather than paying the very high fees of traditional mutual funds (which are often tax inefficient and struggle mightily to beat an index), an ETF could quickly get you the diversified market exposure you want and at a very low cost.

However, ETFs also have a couple big weaknesses that you need to look out for. First, an increasing number active and exotic ETFs have been released over the years. Active ETFs try to beat a specific benchmark (which is hard to do) and often charge dramatically higher fees. And exotic ETFs can have goofy and misleading strategies (we’ll review one popular example later in this report) and also can charge very high fees without actually delivering the results you’re looking for.

The other big ETF weakness you need to look out for is their distinct disadvantages versus CEFs, particularly in the big-yield space (i.e. the focus of this article). Specifically, ETF’s that try to produce big-yields often take on risks that can be avoided through a CEF vehicle. For instance:

Leverage (i.e. borrowing money) is dramatically LESS risky for most CEFs than it is for most ETFs because of the fund flows. Specifically, it’s a lot riskier for an ETF to use leverage (which can magnify income and returns) because uncontrollable fund outflows (from investors selling shares) can force an ETF management team to sell things when they don’t want to (and at “fire sale” prices) just to meet immediate liquidity needs and to stay within mandatory leverage limits. On the other hand, CEFs are closed-end, so they don’t have to worry about money flowing out of their fund (at exactly the wrong time) and messing up their liquidity and leverage levels. It’s a lot less risky to use leverage in a CEF than in an ETF, and this is a distinct advantage for a CEF versus an ETF (especially in the “big-yield” space, as we will review with specific examples later in this report).

Holdings Flexibility is another advantage CEFs have over ETFs. For example, it’s a lot less risky (again from a liquidity standpoint) for a CEF to own less liquid assets (for example, higher-yield bank loans—which don’t necessarily trade in the public markets) than it is for an ETF. This is because CEFs (i.e. “closed-end” funds) generally don’t have the same liquidity demands as ETFs (i.e. “open-end” funds) in terms of fund inflows and outflows, and this allows CEFs to own some attractive asset classes that are generally a lot harder (and riskier operationally) to own in the ETF structure. This is another distinct advantage for CEFs over ETFs in the big-yield space.

Discounts/Premiums versus NAV are another unique characteristic of CEFs versus ETFs, and this creates some important risks and opportunities. Specifically, because CEFs are “closed-end,” they trade based on supply and demand (sellers versus buyers) and there is no immediate mechanism in place to ensure CEF market prices stay tightly aligned with the value of their underlying holdings (i.e. net asset value or NAV). As such, CEF’s can trade a wide discounts or premiums to NAV (we’ll discuss specific examples later in this report), and this creates distinct opportunities and risks for CEFs versus ETFs (which typically trade at market prices extremely close to NAV due to “open-end” market mechanisms in place).

There are a lot more nuances to ETFs versus CEFs (that we’ll get into later in this report), but the ones listed above are very important as we get into our top 25 big-yield ETFs and CEFs in a later section of this report.

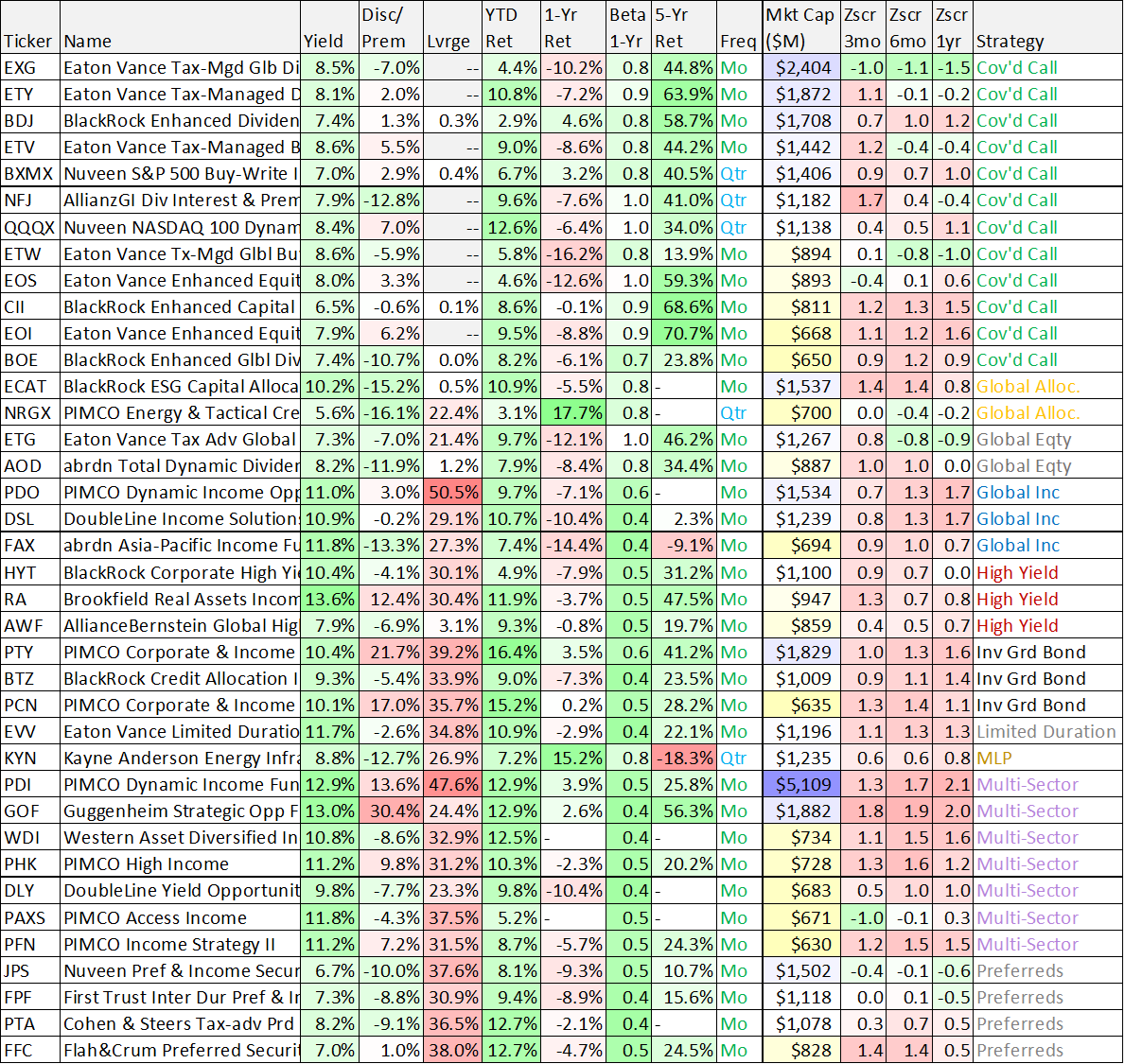

50+ Big-Yield ETFs:

Data as of Friday Close 17-Feb-23, Source: Stock Rover. *Note: A downloadable version of this data is available here.

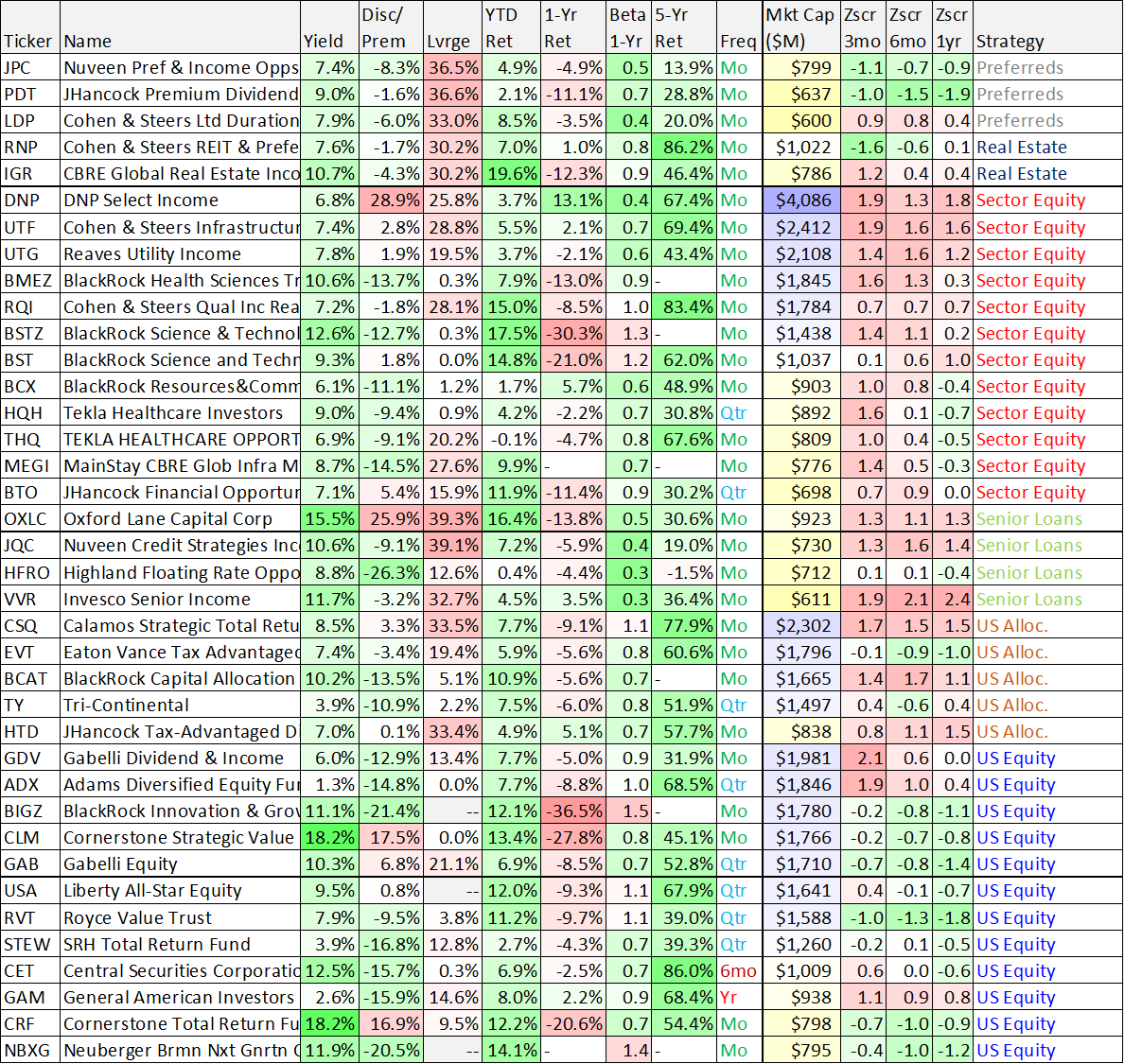

50+ Big-Yield CEFs:

Data as of Friday Close 17-Feb-23, Source: Stock Rover, CEF Connect. *Note: A downloadable version of this data is available here.

Top 25 Big-Yield ETFs, CEFs, Ranked

You’ll notice there are a lot more CEFs than ETFs in our top 25 (for the reasons described above). Nonetheless, several big-yield ETFs did make the list. But before getting into the top 25, we’re starting with an also-ran (e.g. a big-yield ETF that is extremely popular, but wasn’t good enough to make it into our top 25).

*JP Morgan Equity Premium ETF (JEPI), Yield: 11.7%

JEPI is an extremely popular big-yield ETF, but it’s not good enough to make it into our top 25. From a “sales and marketing” standpoint, JEPI is a dream; it has a huge yield (paid monthly) and it’s beaten the S&P 500 over the last year (and with less volatility).

However, a look under the hood reveals that its yield is set to fall (as the income it generates from its ELN covered call strategy will fall as volatility passes) and it will likely underperform the S&P 500 dramatically in the years ahead (as that same ELN covered call strategy will cause investors to miss out on long-term market gains at an astounding (costly) compounding rate).

We recently wrote up JEPI in more detail for our members (you can access that report here), but if you are a long-term income-focused investor, JEPI simply isn’t good enough. There are other funds (and combinations of funds) that will deliver dramatically superior high-income results over the next decade.

25. Reaves Utility Income Fund (UTG), Yield: 7.7%

The Reaves Utility Income Fund is a closed-end fund ("CEF") that invests in securities (mostly stocks) operating mainly in the Utilities sector (a sector known for lower volatility and higher dividend income). And despite its higher management fees and expense ratio, it will likely handily outperform JEPI (mentioned above) over the next decade (higher returns and comparable monthly income payments) for the reasons described below.

First, UTG's holdings naturally have lower volatility than the typical S&P 500 stock (this is a general characteristic of Utilities stocks), but unlike JEPI, UTG will benefit more fully from the stock market's long-term gains. Specifically, JEPI limits its upside by only participating in around 65% of the market’s long-term gains (due to its covered call ELN strategy), whereas UTG uses a prudent amount of leverage (i.e. borrowed money) to more fully participate in the market's long-term gains (UTG recently employed ~19.3% leverage). Said differently, JEPI's long-term gains are hamstrung whereas UTG's long-term gains are prudently enhanced. Not only does the UTG leverage improve long-term returns, but it does so enough to offset the strategy's higher management fee and expense ratio, especially as compared to JEPI.

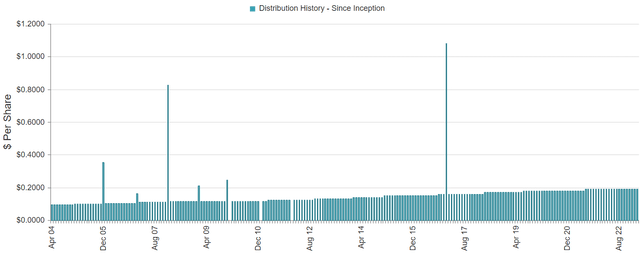

Further, both fund's pay monthly income, but JEPI's yield is set to fall, whereas UTG's yield is set to remain strong (see UTG's since-inception distribution payments in the chart below).

If you are seeking a high-monthly-income fund and strong returns, UTG's total returns will likely beat JEPI's very significantly over the next decade and beyond. Especially considering we like the Utility Sector right now (it's been relatively weak year-to-date in a bit of short-term mean reversion as compared to growthier sectors which have been whipsawed by unusually strong year-end tax loss selling followed by early 2023 strong gains).

24. PIMCO High Income (PHK), Yield: 11.2%

As the name suggests, the primary investment objective of the PIMCO High Income fund (a CEF) is to seek high current income. The secondary objective is capital appreciation. And with an 11.2% yield, paid monthly, there is a lot to like about this fund. For starters, it’s managed by PIMCO—a firm considered by many to be the clear leader in the fixed income space (and it has massive resources and expertise to support its leadership position).

PHK’s income has recently been entirely from income on the underlying holdings, and not from capital gains or return of capital. The income payments have had some downward volatility in recent years, but have always remained large and could also be set to rise as interest rates are up and the fund’s duration (interest rare risk) was recently around 3.8 years. PHK also has a healthy distribution coverage ratio as compared to other PIMCO Funds. Further, PHK holds a high dose of high yield credit, which could be positioned for gains as somewhat elevated credit spreads could soon narrow as the economic risks of high inflation fade.

Further, this fund trades at a 9.8% premium to NAV, which is not too large for a PIMCO fund, and low by the fund’s own historical standards. Further, it recently had 31.2% leverage (or borrowed money) to magnify income and returns, and we view this as prudent (and even slightly conservative for a PIMCO bond fund). If you are looking for a well-positioned high-income fund that pays monthly and is managed by an industry leader, the PIMCO High Income Fund is worth considering.

23. iShares Preferred & Income ETF (PFF), Yield: 5.7%

Owning preferred stocks can be an important part of an income-focused investment portfolio because the asset class adds volatility-reducing diversification while keeping income strong. And the iShares preferred stock ETF (PFF) is an efficient and effective way to do this. Specifically, PFF seeks to track the investment results of an index composed of U.S. dollar-denominated preferred and hybrid securities.

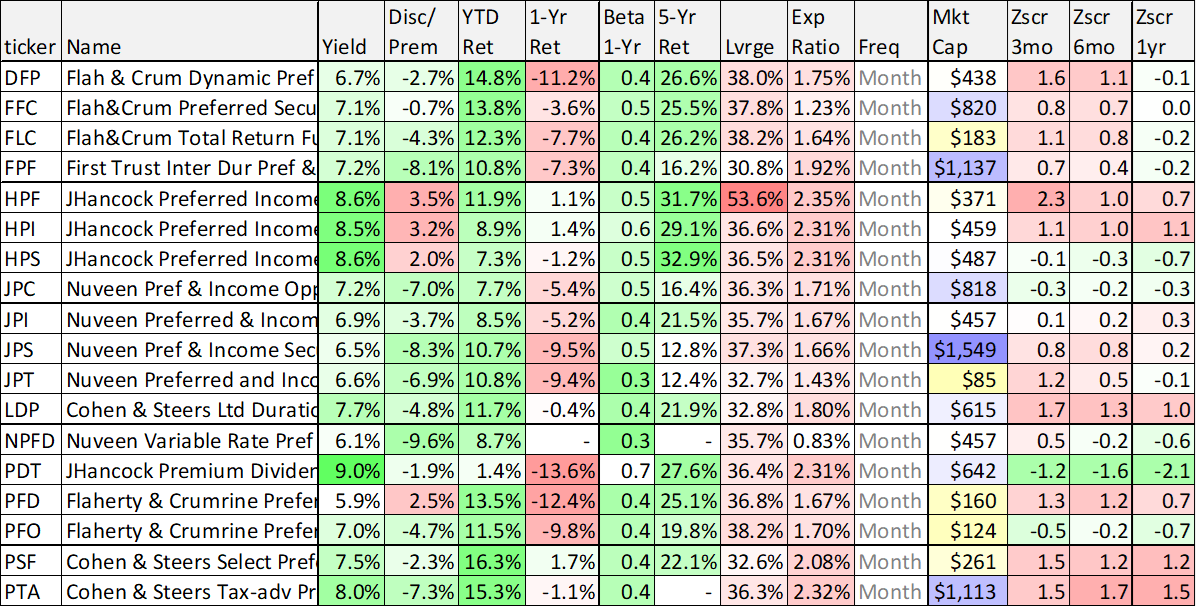

Rather than trying to pick individual preferred stocks, a lot of investors prefer to own preferred stocks funds. And for some perspective, here is some recent data on preferred stock ETFs (including PFF) and preferred stock CEFs, in the following two tables, respectively.

We like PFF in particular for its relatively low expense ratio, its big yield and its low-turnover passive approach. It also doesn’t use any leverage (which is common among CEFs). We’ll have more to say about a particular preferred stock CEF later in this report. However overall, PFF is an efficient and effective way to get broad exposure to high-income preferred stocks. We recently wrote up PFF in great detail, and you can view that report here.

*Honorable Mention:

*Schwab US Dividend Equity ETF (SCHD), Yield: 3.3%

SCHD is an okay fund, and frankly we have no huge problems with it, except for the fact that its yield isn’t big enough to make it onto this list and there are significantly better ways to achieve the goals it has set out to accomplish. For example, SCHD is biased in the types of stocks it buys, it omits REITs altogether, and we believe some of its holdings are much more attractive than others. We recently wrote up SCHD in detail here, and we shared better dividend-growth ideas in this report: Top 20 Dividend-Growth Stocks, Ranked.

22. Global X MLP ETF (MLPA), Yield: 7.1%

Master Limited Partnerships (or “MLPs”), especially those in the midstream energy sector, are often an income-focused investor favorite because of their big distribution yields (which are often supported by steady fee-based income generated by the underlying business). For example, midstream energy MLPs like Energy Transfer (ET) and Enterprise Products Partners (EPD) are frequently revered (we actually like them both). However, the problem with MLPs is they send out K-1 statement at tax time (instead of the typical 1099’s that investors are used to). And the K-1s are not only often a pain for investors, they are simply not allowed by some brokers in non-taxable accounts (such as IRAs). For this reason, many investors that want to invest in MLP’s simply cannot.

However, MLPA offers an attractive mix of 21 different individual MLPs in one ETF (Energy Transfer and Enterprise Products Partners are top holdings). And very importantly, MLPA doesn’t generate a K-1, rather it sends investors a 1099 at tax time. This makes it possible for many investors to invest in MLPs in situations where they otherwise would not be able to. And if you’re trying to get exposure to this attractive segment of the market MLPA is a great way to do it. MLPA is one of the few ETFs that actually cracked our top 25 list, and it’s worth noting that MLPA has a lower expense ratio than more popular MLP ETF (AMLP) (0.45% versus 0.87%). MLPA is absolutely worth considering for investors that want this unique MLP exposure (and high income) without the annual K-1 statement.

21. Guggenheim Strategic Opps (GOF), Yield: 12.9%

This largely fixed-income (bond) CEF is widely popular among income-focused investors because its big monthly distributions (it currently yields 12.9%) have never been reduced, only increased. And while its big premium to NAV (+30.4%) is a turnoff to some investors, it’s not as unattractive as some investors think (because of its ongoing “at-the-market” offerings and its well executed DRIP program). It recently had 24.4% leverage (which we view as prudent for the assets it owns) and its expense ratio (including leverage) is reasonable (recently at 1.83%). The fund’s investment objective is to maximize total return through a combination of current income and capital appreciation, and it has a long history of achieving that goal. We view GOF as attractive, and we previously wrote it up in extensive detail here.

The Top 20:

The top 20 big-yield ETFs and CEFs are available to members-only, and they can be accessed here. The top 20 includes a wide variety of very attractive big-yield opportunities, and we currently own almost all of them (in our newly-released High Income NOW portfolio).

Conclusion:

ETFs and CEFs provide a wide variety of opportunities for high-income investors, but they also offer risky pitfalls (i.e. opportunities that look good, but are actually quite gimmicky and weak in the long-term). Also important, big-yield funds offer opportunities to diversify away some of the risks by constructing a portfolio that works to meet your specific needs. At the end of the day, you need to determine a strategy that is right for you. We believe disciplined goal-focused long-term investing will continue to be a winning strategy.