In case you haven’t noticed, rising inflation has been dominating economic headlines lately. The big argument is whether the recent rise in inflation is transitory (and thereby simply a short-term phenomenon following the pandemic lockdowns), or whether it is long-term (thereby making it a much bigger risk to investors). Make no mistake, inflation is real (its the hidden thief in the night that reduces the buying power of your nest egg), and if you park your money in a savings account, its going to be worth less and less every year (thanks to our low interest rate environment and rising inflation).

We’re not going to make an argument about whether the current spike in inflation is transitory or long-term because we know long-term inflation is real on some level, and a much better strategy is to focus on attractive investment opportunities that can do well regardless of whether inflation is 1% or 5% per year.

Real Assets and Value During Inflation:

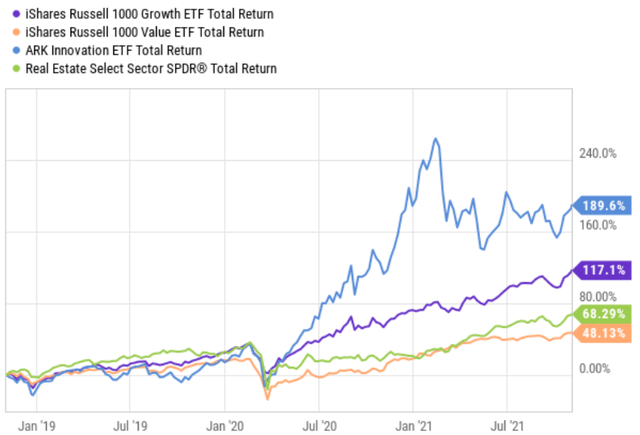

Generally speaking, real assets (such as the real estate owned by REITs) and value stocks (such as many select REITs) often do better in inflationary environments, whereas high-growth stocks face challenges. We saw high-growth stocks post incredible returns coming out of the onset of the pandemic in 2020 as rapidly lowered interest rates boosted the present value of their expected future earnings, and to the chagrin of value stocks (which were increasingly outcast by investors).

However, with interest rates and inflation expected to keep rising, current assets (such as real estate) are rising in value, especially considering they often pay high income now (instead of the hopes and wishes for high future income from popular growth stocks—many of which are yet to even turn a profit). What’s more, REITs arguably have a lot more room to run as inflation persists, and especially considering growth stocks may increasingly be shunned as interest rates rise and dovish monetary policy recedes (for example, the Fed is expected to announce an end to its bond buying program).

50 Big-Dividend REITs (4.0% Yields and Up):

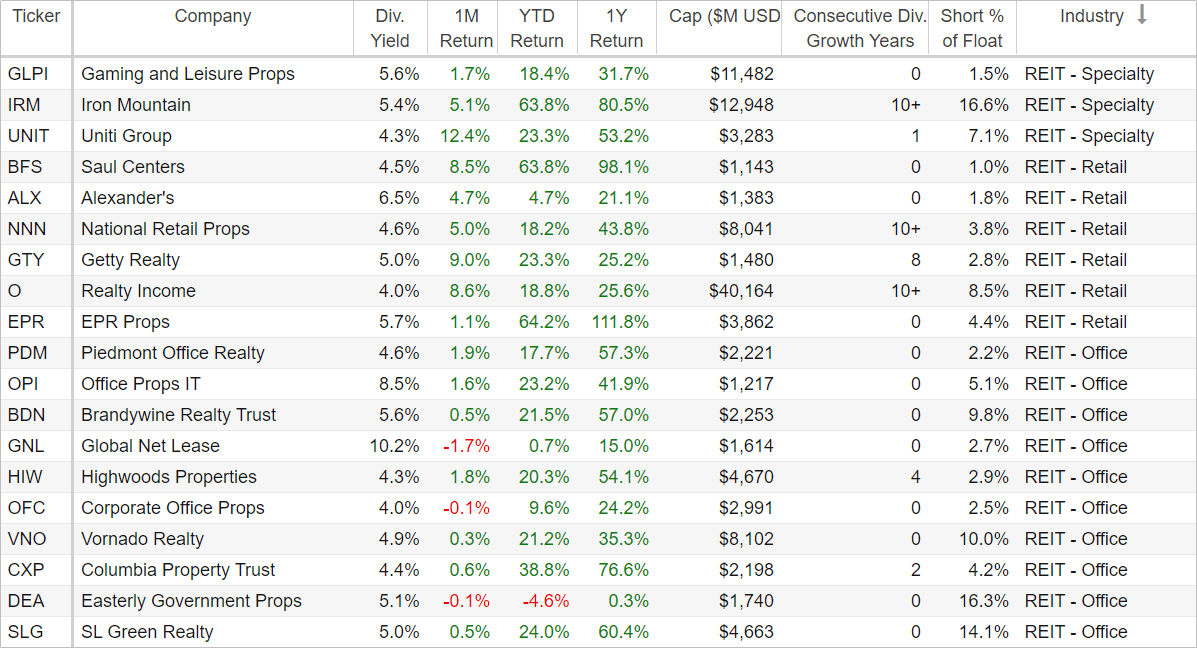

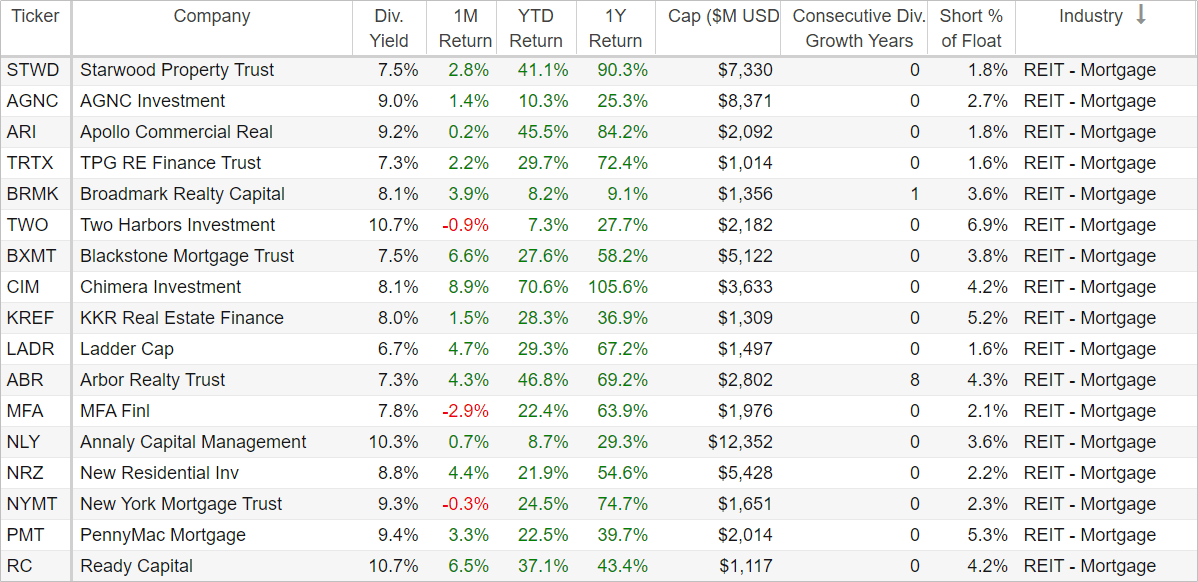

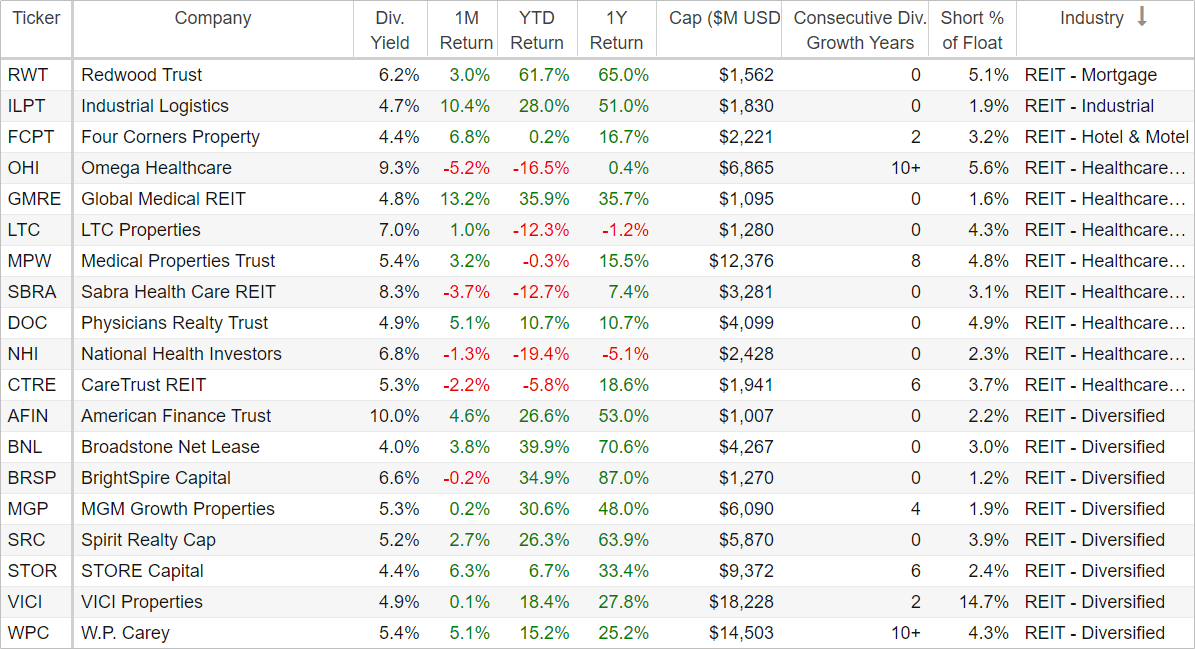

REITs are often an income-investor favorite because they can pay big, steady, cash dividends to investors, but also because the thought of owning long-term physical assets (such as real estate) gives many investors peace-of-mind that helps them sleep better at night. For perspective, here is a list of over 75 big-dividend REITs, including recent performance, current yield, dividend history and more.

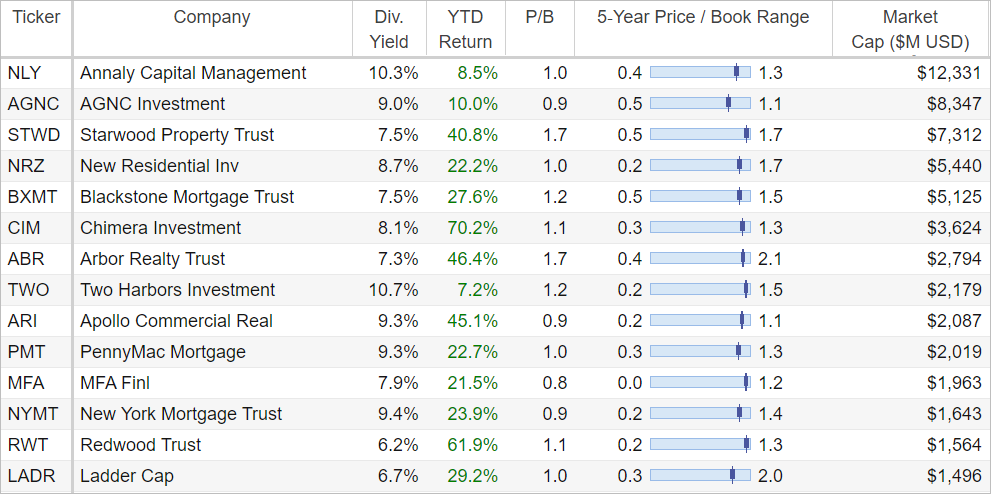

source: StockRover (data as of 11/4)

You may notice a few of your favorites on the list, as well as those with strong dividend history, and those with high short interest (such as (IRM) and (VICI)). This report focuses on attractive REITs that pay big dividends, ranging from 4% to over 10%.

Top 10 Big-Dividend REITs

With that backdrop in mind (i.e. higher inflation and rising interest rates), we next get into our top 10 big-dividend REIT ranking and countdown. But before we do, it is important to remind readers that different investors have different goals, and you should never lose sight of yours. Disciplined, goal-focused, long-term investing is a winning strategy. Without further ado, here is the ranking and countdown.

10. Medical Properties Trust (MPW), Yield: 5.2%

Medical Properties Trust Inc. (MPW) is a healthcare REIT that owns hospital properties globally. Its portfolio consists of 446 properties and ~47,000 beds spread across 9 countries. It is the second-largest hospital bed owner in the US, with properties in 32 states.

MPW announced earnings at the end of October whereby it raised its Funds from Operations (“FFO”) annual run-rate guidance to $1.81 -$1.85, which means the shares now trade at around 11.6x forward FFO, attractive in our view.

We recently completed a detailed long-form report on MPW for our members, where we went into its attractive qualities and risks. Here is our conclusion from that report:

While MPW does face challenges, we are highly encouraged by the improving operating environment, strong investment trends and its solid track record of operations. MPW has increased its dividend eight years in a row, and it has solid liquidity and strong dividend coverage. Further, we believe the company’s acquisition strategy is prudent and the shares are attractive. We do not currently own shares of MPW, but it is high on our watchlist. And if you are a long-term income-focused investor, Medical Properties Trust is worth considering for a spot in your portfolio.

9. Omega Healthcare Investors (OHI), Yield 8.9%

Omega Healthcare Investors (OHI) is a big-dividend healthcare REIT that is facing very serious challenges. Specifically, the already significant challenges (that many of Omega’s Skilled Nursing Facility operators were already facing) have been exacerbated to the point where Omega’s dividend yield has inflated to 9.0% and its FFO multiples are depressed. We recently wrote a detailed members report on Omega, and we concluded it like this:

In our opinion, if you are looking for a safe income investment, Omega is not for you. Rather, if you are a deep contrarian willing to take on very significant risks, then you might consider investing in Omega… But most importantly, before you invest in anything, make sure you know your own personal goals and risk tolerance, and then select only opportunities that meet your specific needs. Disciplined, goal-focused, long-term investing is a winning strategy.

Honorable Mention:

*New Residential (NRZ), Yield: 8.7%

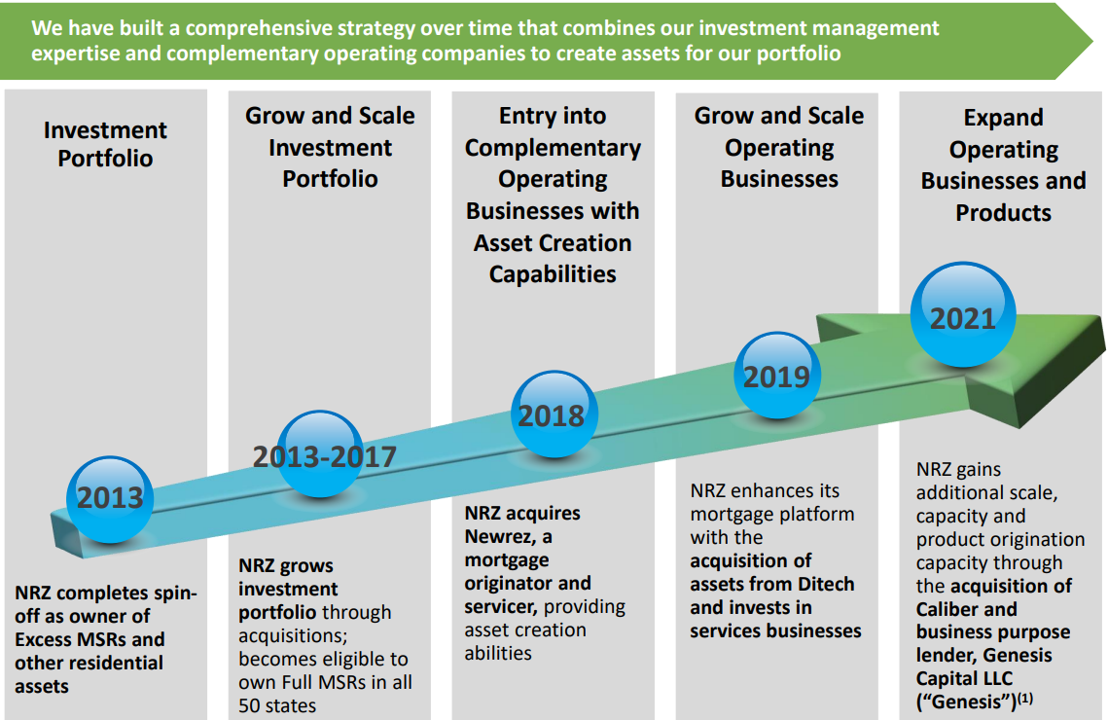

New Residential is a mortgage REIT, which means it generally invests in mortgage related financial assets (unlike property REITs that generally invest in physical real estate properties). NRZ is one of the most exotic and innovative mortgage REITs (for its history of being early and opportunistic in assets including mortgage servicing rights, for example).

The advantage of being innovative and opportunistic is that when times are good, returns (and dividend income) can be very good. However, being as aggressive as NRZ is can lead to big liquidity challenges and loses when unexpected market conditions strike (such as the freezing up of bond markets that we experienced around the full onset of covid in 2020).

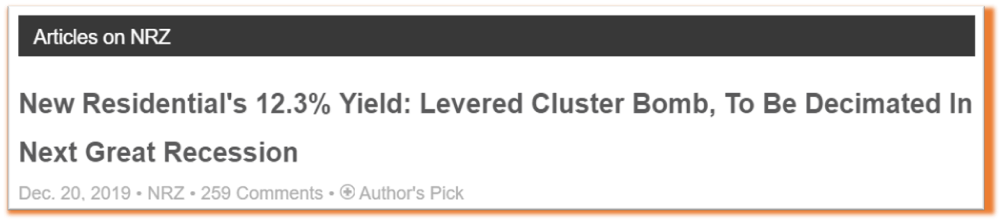

We warned investors about the dangerous growing risks of investing in NRZ in late 2019, in one of our most controversial headlines:

We received a ton a negative comments about that title, however the article proved somewhat prophetic as the shares crashed and the dividend was decimated (just a few months after the article was released). It was a really bad time if you were an NRZ investor.

source: YCharts

Since those extremely challenging times for NRZ, the share price hasn’t fully recovered (mainly due to the draconian fire sale cuts the company was forced to make just to stay afloat), however NRZ has cleaned up its balance sheet, rightsized its dividend (they’ve actually been increasing it, but its still well below pre-pandemic highs) and market conditions are significantly better (the US fed was extremely quick, decisive and far-reaching with its actions—apparently having learned from its slower response during the financial crisis of ‘08-’09).

New Residential recently announced earnings on November 2nd, and as you can see in the chart below, the mREIT is now invested in a wide variety of origination, servicing, MSR and Agency Security assets, which is quite different than 2015 when the company’s balance sheet was largely dominated by excess mortgage servicing rights (that they added in the aftermath of the ’08-’09 financial crisis).

In fact, the current investments are markedly different than the pre-covid balance sheet at the end of 2019. Specifically, NRZ has now opportunistically increased its originations exposure (through recent acquisitions, including Ditech in late 2019, Caliber in August of 2021 and a new agreement to acquire Genesis). Also, NRZ’s total assets to equity ratio

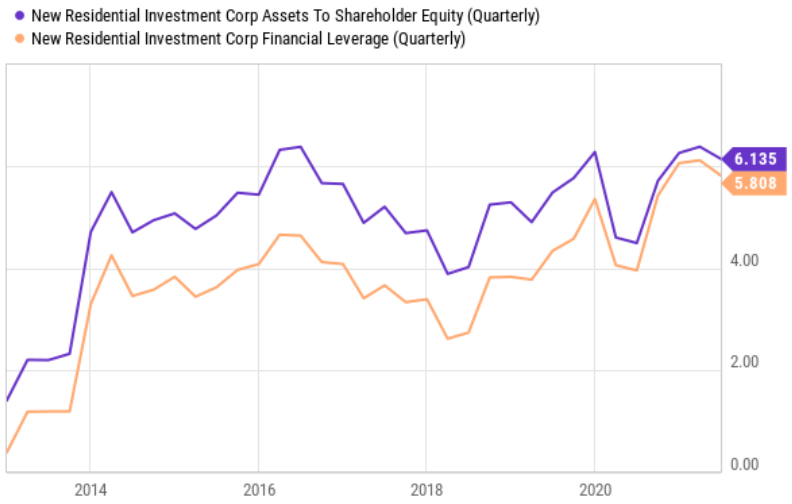

We’d like to say NRZ has learned its lesson from the distress on 2020, but realistically the same people are in charge (i.e. they didn’t lose their high-paying jobs), and there remains significant moral hazard (what’s to stop NRZ from dragging investors through a similar situation down the road). Further, leverage remains high (although it’s arguably less risky leverage as compared to the type of assets it now owns), as you can see in the following chart.

Nonetheless, based on where we’re at in the current market cycle, and NRZ’s improved balance sheet, this mREIT has more room to run; the share price and the dividend payments have upside from here. Caveat emptor.

8. Arbor Realty Trust (ABR), Yield: 7.4%

Arbor Realty Trust is a mortgage REIT (i.e. it provides real estate financing solutions—such as loans, instead of owning properties—like property REITs), and the shares are attractive. For example, ABR offers an attractive 7.4% dividend yield, the dividend has been increased 8 years in a row and the shares are attractively priced. Moreover, ABR just announced earnings at the end of October, whereby it beat revenue expectations and announced another dividend increase.

Mortgage REITs: (source: StockRover, data as of 11/4/21)

From a valuation standpoint, ABR shares continue to trade at a premium to book value (that is consistent with its own history) as would be expected for a company with such a steady history of performance. Moreover, the company announced the commencement of a (dilutive) common stock offering on November 1st (to take advantage of the premium), and the subsequent share price dip has created a more attractive opportunity (buying price) for new investors.

We recently completed a detailed report on ABR for our members, and here is how we concluded that report:

Mortgage REITs can be an attractive source of steady high income, but they come with risks. As we saw during the depths of the 2020 covid sell off, years of gains can be wiped out quickly as dividends were slashed and share prices plummeted. However, ABR faired much better than peers because of the relatively conservative and diversified nature of its balance sheet and its business. In particular, ABR was able to continue increasing its dividend when others were cutting, and ABR’s share price continues to be a long-term top performer. In our view, ABR is well positioned for share price strength and dividend growth in the years ahead, and if you don’t own shares they are worth considering—particularly if you are an income-focused investor.

7. VICI Properties (VICI), Yield: 4.9%

VICI owns properties in the gaming and entertainment industry (for example, its largest tenant is Caesars Palace in Las Vegas). And the shares are absolutely worth considering thanks to its triple net lease REIT status, its well-covered 4.9% dividend yield and its potential for ongoing share price appreciation. VICI has been largely unfazed by pandemic challenges, and has actually been wisely increasing the growth trajectory of its business (in a space with high barriers to entry).

The share price has recently pulled back a bit following an earnings announcement at the end of October whereby the company delivered revenue in line with expectations, but fell short on FFO and lowered guidance. However, from a long-term investment standpoint, the thesis (and attractiveness) remains intact.

We recently completed a detailed members-only report on VICI, whereby we reviewed the business, dividend safety, valuation and risks. We concluded that report like this:

VICI’s business and shares currently offer a number of attractive qualities, including enhanced scale, marquee S&P500 tenants, industry leading lease duration, an embedded growth pipeline, a strengthened credit profile, a well covered 5% dividend yield, and a compelling valuation. In our view, all of these things combine to make VICI an attractive opportunity for income-focused investors that also like share price appreciation potential. We do not yet own shares of VICI, but it is high on our watchlist, and we may purchase shares in the near future.

6. EPR Properties (EPR), Yield: 5.8%

EPR Properties is an experiential net lease REIT, and as such it got hit hard by the pandemic-related lockdowns. In fact, EPR’s share price plunged as it slashed its dividend to zero, thereby ending a previously growing track record of dividend hikes. However, with the economy reopening, EPR has reinstated a monthly dividend as the business continues to strengthen and has an active pipeline for growth.

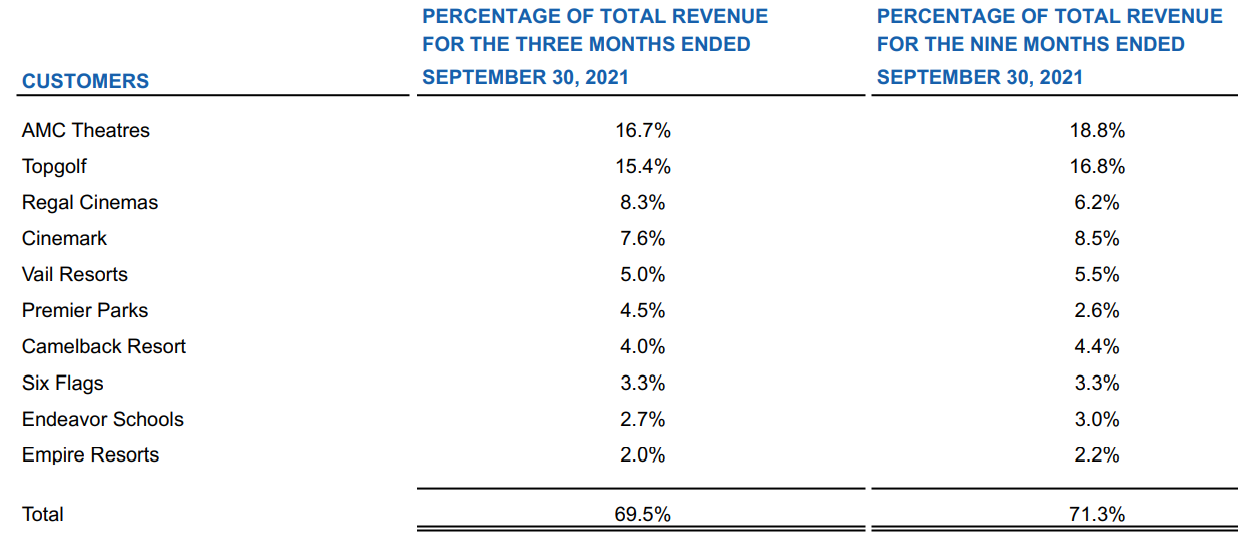

For perspective, here is a look at EPR’s top customers (by percent of total revenue):

There remains significant risk with many of these property types as social distancing remains in place. Additionally, theaters (i.e. AMC, Regal and Cinemark) face the added challenge of viewers increasingly switching to streaming from home.

However, EPR announced encouraging earnings this past week, whereby the company exceeded expectation for revenue and FFO, and boosted forward guidance as collection rates rise. Furthermore, has been successfully refinancing debt and received “an investment grade rating from S&P on its unsecured debt with a stable outlook.” And per CEO Greg Silvers (from Wednesday’s earnings release):

“With an active pipeline, we are well-positioned to reaccelerate our growth and expand our portfolio with diversified experiential properties."

Our thesis on EPR is simply that the market has over-reacted to the negative side, despite the very real challenges the company faces (such as movie theater properties versus people watching movies at home).

EPR currently trades at just under 18.0x 2021 FFOAA guidance (a non-GAAP measure), which is not high, especially as compared to the company’s reaccelerating growth.

The Top 5

The remainder of this report (including our Top 5 Big-Dividend REITs) is reserved for members only, and it can be accessed here. If you are not already a member, we are currently offering a limited-time 10% Off discount for all new members if you use the following code at checkout:

BH10We currently own all 5 of the top 5 within our 38-stock Income Equity portfolio (which also includes big-dividend BDCs, MLPs, CEFs and more dividend stocks).

The Bottom Line:

REITs can be attractive during times of inflation, especially select deep-value REITs. However, not all REITs are created equally. In this report, we have highlighted our top 10 "big-dividend" REITs (those with yields of 4.0% and up). However, it's important to understand your own personal goals before investing, and then to select opportunities appropriately.

Disciplined, goal-focused, long-term investing is a winning strategy. For your reference, you can view all the current holdings within our Income Equity Portfolio here.