High-Yield investments have been terrible over the last month. From Bond Closed-End Funds (CEFs) to Business Development Companies (BDCs) and Real Estate Investment Trusts (REITs), the carnage has been extreme. Many will not recover (there will be bankruptcies and dividend cuts). However, others will experience swift and powerful rebounds. This article surveys the damage, focusing on BDCs, Bond CEFs and REITs, and also shares three specific “Strong Buy” opportunities.

Overview:

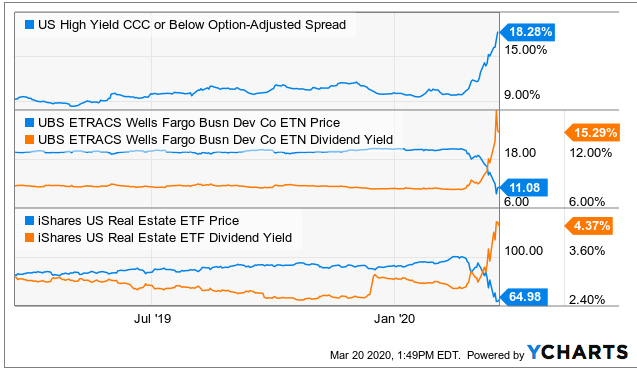

For a little perspective, before we get into the specifics of BDCs, Bond CEFs and High-Yield REITS, it’s worth considering where we are in terms of the high yield market. As you can see in the following chart, bond credit spreads have widened, BDC prices have plummeted and yields among REITs have risen, as we wait for more clarity (corporate earnings updates and Fed repo-market activity) on the fallout from this turmoil.

As you can see in the chart above, credit spreads (the difference in yield between risky bonds versus essentially US treasuries) have blown out, BDC prices (UBS ETRACS (BDCS)) have plummeted, and REIT yield have been mathematically driven higher as prices have fallen. For a little more perspective, here is what happened to credit spreads during the energy market distress of late 2015/early 2016, the financial crises (2008-2009) and the tech bubble bursting (the early 2000’s). As you can from the current credit spread magnitude, things are getting hairy right now, relatively speaking.

One of the big contributors to the current market distress (besides the coronavirus and low oil prices) is liquidity in the credit markets. Specifically, large investors are unable to unload big amounts of bonds (to raise cash) because there are no buyers. As a result, you can only sell at fire sale prices, credit spreads blow out (see chart above), and panic in the market increases. Fortunately, the Fed had been pumping mass liquidity into the system through the repo market (i.e. the fed has been buying huge amounts of bonds) and this will continue to relieve stress and eventually drive bond prices higher. This is a good thing (especially for certain bond CEFs) as we will cover in more detail later in this report.

Business Development Companies (BDCs):

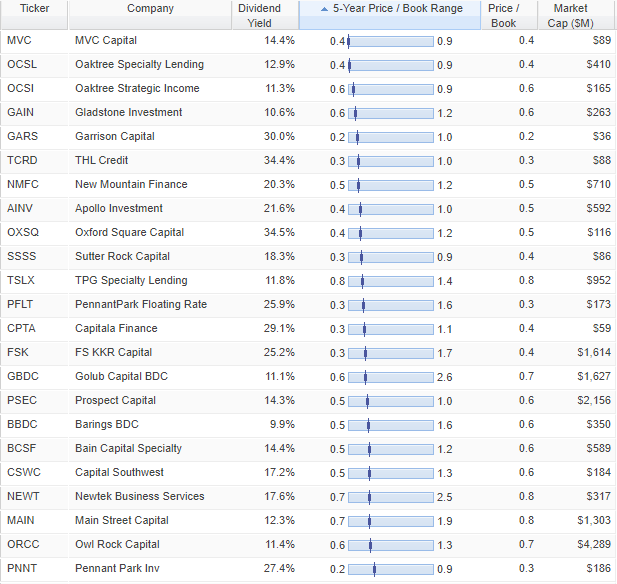

One area of the market that has been hit extremely hard is Business Development companies. Specifically, here is a look at the recent performance and yields of many BDCs. You’ll note the performance has been absolutely brutal and the yields have mathematically risen to abnormal levels.

The reason for this dramatic sell off is because BDCs provide financing (mainly loans) to small businesses, and small businesses will be hit the hardest during the current financial turmoil. Generally, small businesses have less financial flexibility and strength, and any disruption to their businesses highlights how fragile many of them were in the first place. The loans made by BDCs to small businesses were high in the first place because of the higher risk, and now they have become extraordinarily high because many of them will not be able to pay their debts. There will be big winners and big losers in the BDC space.

As we survey the BDC market, it is important for investors to not be fooled by price to book values. Specifically, price to book value is one common valuation metric used in the BDC space, and as you can see below, many of them (that were trading near 5-year highs just a few short weeks ago) are now dramatically less expensive.

source: StockRover

However, before you go blindly buying BDCs, keep in mind the prices update daily, whereas the book values generally update only quarterly. As such, the book values will likely be written down in dramatic fashion in the upcoming quarters, and a lot of BDCs’ businesses will be extremely challenged.

Saratoga Investment (SAR), Yield: 16.6%

Not all BDC are the same, and their businesses vary widely. Saratoga Investment (SAR) is one BDC that we like in this environment (especially relative to others) because of its multiple SBIC liceneses which give it access to significant capital at attractive rates (to invest in high yielding loans of small busineses). This is particuarly meaningful to Saratoga because it is relatively small compared to other BDCs which allows the SBIC licenses meaningfully move the needle for Saratoga. Essentially, the SBIC licenses will add support to Saratoga’s business. For reference, you can access of last full report on Saratoga here.

Bond Closed-End Funds (CEFs)

Bond CEFs are another high yield investment vehicle that has experienced an extraordinarily hard hit during the current market turmoil. Not only can these vehicles have exposure to riskier bonds (such as certain below investment grade and mortgage backed securities), but many of them are now trading at wide discounts to their net asset values as the selling pressure has been intense (large discounts and premiums to NAV are a unique characteristic of CEFs versus ETFs and most mutual funds because they trade off supply and demand, and there is no immediate mechanism to bring CEF prices back closer to NAV).

Amazingly however, as the fed works to pump enormous amounts of liquidity into the market (as part of its latest quantitative easing effort) it is actually going to pump the prices of some Bond CEFs back up to normal. Specifically, some Bond CEF will likely post 20% and 30% returns in a matter of months (as the Fed props up the bond market), and this is in addition to their big double-digit yields paid to investors monthly (more on the specifics of the Fed’s action in a moment).

PIMCO Dynamic Income Fund (PDI), Yield: 13.0%

PIMCO Dynamic Income Fund is a closed-end fund that invests in multiple fixed-income sectors, including agency mortgage-backed securities, among others. And the securities in this fund are among the exact securities the Fed is currently buying to prop up the market.

The price of this fund fell (and the premium evaporated into a discount) as panic froze the credit market. But as the fed unclogs the credit market pipes, they will essentially pump the prices of many securities in this fund back up to where there were previously. You may think the Fed is out of ammo with interest rates at near zero, but they have incredibly enormous fire power to buy more bonds in the repo market. And even though the Fed may be recently focused on purchasing agency MBS (which PDI does own), once liquidity is added to this assets class, it will flow through to all the other assets classes PIMCO holds in this fund.

A few months from now, PDI’s price will likely be dramatically higher that it is now (and back close to the level is was prior to this current market mess). PDI is a Strong Buy. We don’t currently own PDI, but as our members know, we own other Bonds CEFs that we like even more for essentially the same reason (i.e. the Fed is working to prop up bond market).

High-Yield REITs

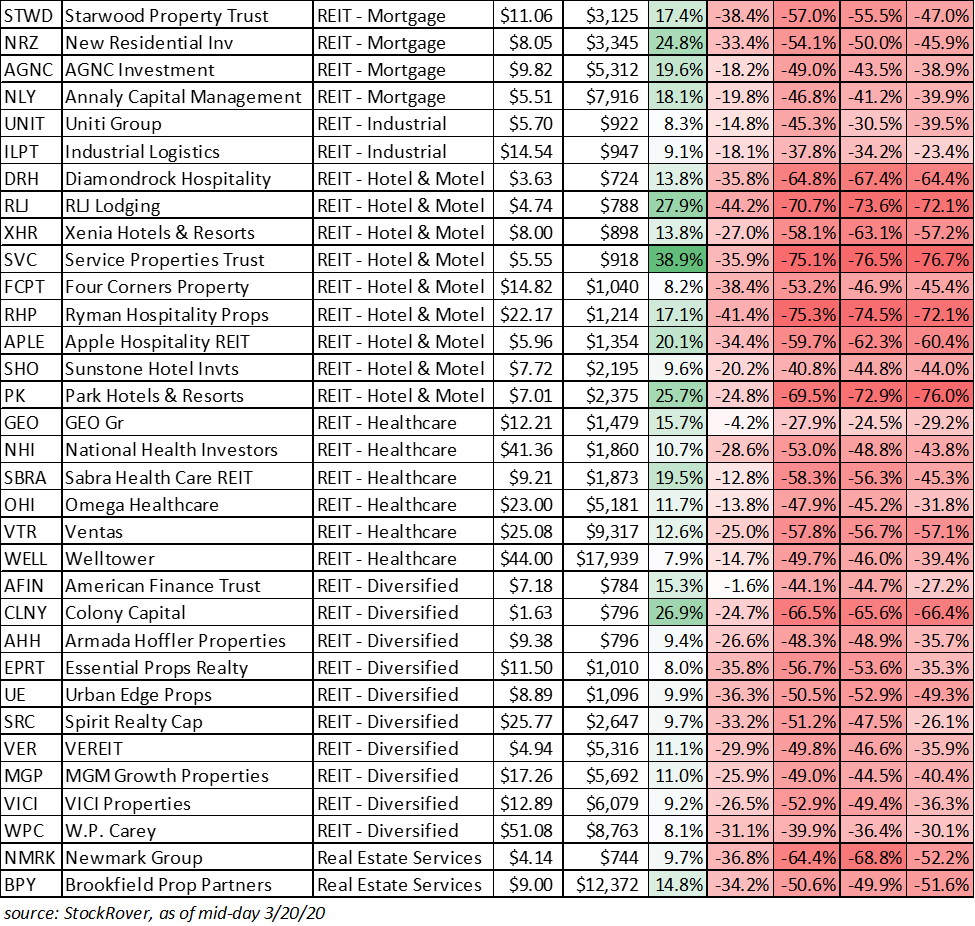

With the Fed’s emergency rate cuts you might think REITs would be doing well in this environment (because their businesses rely heavily on borrowing, and the cost of borrowing was just lowered for some REITs), but as you can see in the following table that has NOT been the case for high-yield REITs.

High-yield REIT are generally risky than others (that’s why they offered the higher yields in the first place—to offset for the risks).

With regards to specific REIT industries, retail REITs are getting hit extra hard (as “social distancing” dramatically reduces foot traffic), mortgage REIT are dealing with turmoil (as the fed’s new monetary policies have vast impacts), and REITs with simply weak balance sheets struggle more than others. We recently wrote in great detail about how the entire commercial real estate market has changed dramatically amongst the recent market turmoil, and you can access that report here: REITs: The Landscape Has Shifted. And if you are looking for more specific opportunities, you might consider our recent report on The Geo Group (GEO), as well as accessing our recent report “Top 10 Big Dividend REITs” here.

The Bottom Line:

The high-yield market has been hit extremely hard during the market turmoil in recent weeks. That includes high-yield REITs, high-yield BDCs and high-yield Bond CEFs, as described in this article. And when this all eventually ends, there will be losers (dividend cuts, defaults and significant loss of capital) and winners. In fact, current market conditions are creating some exceptional strong buying opportunities, such as those described in this article (including GEO, PDI and SAR). However, despite these select attractive opportunities, we want to remind investors to stick to their long-term investment goals and plans because (unfortunately) volatile market conditions (like right now) is a time when a lot of investors make unfortunate trading mistakes. Prudently-diversified, goal-focused, long-term investing has proven to be a winning strategy over and over again throughout history. It will this time too.