The market has been ugly. But as they say, this too shall pass. And when it does, the most attractive buying opportunities will be gone. No one knows the exact timing of when the turmoil will end, but there are currently a lot of REITs trading at compelling prices (there is enormous fear baked in) and offering unusually attractive big dividend yields. And it’s those big dividends that can give you the steady income you need while you wait patiently for the long-term price gains to come to you. This report counts down our top 10 big-dividend REITs.

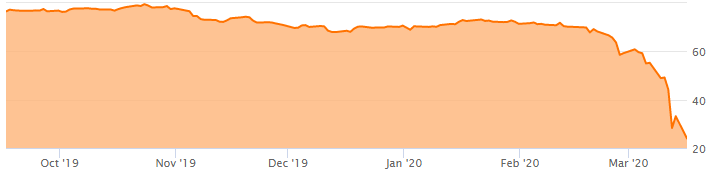

Before getting into the rankings, it’s worth considering what is happening in the market and how that is impacting REITs in multiple ways. The three big things spooking the market right now are (1) the coronavirus, (2) plummeting energy prices, and (3) the general notion that Mr. Market was getting frothy and looking for a reason to correct. The impact of lower interest rates on REITs is also worth considering.

The Coronavirus

The market’s reaction to the coronavirus is more than just fear. There are very real impacts to the economy that will impact all stocks in varying ways. For example, most major sporting events (e.g. the NBA, March Madness) have been cancelled. That’s a lot of tickets sales, concession sales and advertising dollars that have now vanished into thin air. Similarly, hoards of people are cancelling airline tickets and non-essential travel. With regards to REITs, there are specific cases of coronavirus outbreaks at senior living properties owned by popular REITs. Also, foot traffic at shopping malls (and shopping mall REITs) will be impacted as more people practice social distancing. Those are just a few examples, and the full list is extremely wide-ranging. The impacts of the cornavirus to the economy are no joke.

Energy Prices

You may think the plummeting price of oil has nothing to do with REITs. But it does. First of all, it has most certainly contributed to the market fear and selling that has impacted all stocks (including REITs). Further, it impacts certain geographical regions more than others (for example, the sub-economy of the Houston-area can be more impacted by the energy price slump because of the significant exposure to the energy sector in that region).

Market Valuation

The market hadn’t gone straight up for 10 years following the financial crisis, but it was fairly close, and valuations were getting very frothy by multiple valuation metrics. We’re not going to spend too much time on this one because frothy valuations can get frothier, and cheap valuations can get cheaper. Nonetheless, it almost seemed as if the market was just looking for an excuse to blow off some steam, and it certainly found it in the coronavirus and plummeting energy prices. However, we will say that disciplined long-term investing has proven to be a winning strategy over and over again throughout history, and there are a lot of attractive big-dividend REITs out there right now.

Interest Rates

Interest Rates are a huge factor for REITs. And in relatively short order, the market has gone from expecting rising rates, to the opposite. Rates were recently cut 50 basis points, and the US Twitter-In-Chief wants more (to make America more competitive around the globe). REITs rely heavily on the capital markets to fund growth, and lower rates makes funding that growth cheaper. Further, as investors are starved for yield (US treasuries certainly don’t yield what they used to), REITs can become relatively much more attractive for income-focused investors.

The Top 10 Big-Dividend REITs

The names on our list are wide-ranging. And in our view, they are very attractive if you are an income-focused investor that likes to “buy low.” However, it’s also important to remind investors of the importance of diversifying your investments across multiple big-dividend categories, as well as to focus on some long-term capital gain opportunities too. At Blue Harbinger, we do our best to write about attractive opportunities from across multiple categories because prudent diversification can help keep risks lower and returns higher.

Without further ado, here are our top 10 big-dividend REITs.

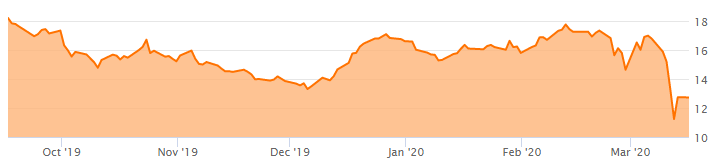

10. Brookfield Property REIT (BPYU), Yield: 11.6%

Like a lot of REITs right now, Brookfield is interesting because as the price has fallen (for mainly the reasons described earlier) the dividend yield has mathematically risen significantly (plus the company just recently boosted its dividend payment by a small amount too).

There are lots of additional attractive qualities about this one, such as its price discount versus NAV, portfolio diversification and demand for its core assets. We don’t own Brookfield (we own many other names on this list), but we like it (it’s on our watchlist). And the main reasons we haven’t ranked it higher on our list include its relatively high debt and ongoing potential bankruptcies of its many tenants (in addition to office properties, retail is Brookfield’s other main property type, and that faces challenges related to secular consumer shopping habit changes, mainly the growth of online shopping, plus the current dramatic aversion to the coronavirus). Overall, we view Brookfield as presenting a relatively attractive buying opportunity considering its current price and dividend yield. You can access our full report on Brookfield here.

9. Gladstone Preferred Shares (GOODM), Yield: 7.3%

If Brookfield is attractive, but one of the riskier names on our list, we’re offsetting it with a less risky opportunity in the form of REIT preferred shares. Specifically, the preferred shares of Gladstone have recently fallen only slightly amongst the market turmoil.

More specifically, they’re far less volatile than other opportunities because they’re preferred shares (higher than common shares in the capital structure). We also like them because they pay dividends Monthly and the company has been strengthening its balance sheet. Further we have less relative concern about Gladstone’s business as it is an office and industrial REIT (still commercial real estate, but not the big retail exposure of Brookfield and others). For more detail, be sure to check out our recent full report on Gladstone preferred shares here.

8. Iron Mountain (IRM), Yield: 10.0%

Some investors are afraid of Iron Mountain because its main business (it’s the market leader in physical storage and document retrieval REIT) seems outdated compared to other newer REITs (such as data center REITs, including the one we’ll cover in a moment). However, Iron Mountain’s legacy business isn’t going to disappear overnight (it’s mission critical for many of the tenants that use its properties), and Iron Mountain is making strong efforts to expand into newer growth business (including data centers to serve many of its existing legacy clients).

And considering the recent market wide plunge, the price and dividend yield of Iron Mountain have become significantly more compelling in our view. You can read our full detailed write up on Iron Mountain here.

*Honorable Mention: Digital Realty (DLR), Yield: 3.1%

We currently own shares of Digital Realty, but it only makes it onto our list as an honorable mention because its yield is too low to be considered a “big dividend” as compared to the other names on our list. And interestingly, DLR’s share price has actually Risen during the recent coronavirus panic as many investors view it as less susceptible to coronavirus risks.

If you don’t know, DLR is a data center REIT. A data center is a physical facility that organizations use to house their servers, critical applications and data. These facilities provide a highly reliable and secure environment, and are equipped with uninterruptable power supplies, air-cooled chillers and physical security. You can read our most recent full write up on DLR here.

7. The Geo Group (GEO), Yield: 15.1%

Without getting too philosophical or too political, sometimes things sell off for the wrong reasons. And in this case, we believe that The Geo Group (GEO) has been unfairly incarcerated by Mr. Market.

The GEO Group is a specialty REIT that owns, operates and manages correctional, detention and reentry facilities. And in some sense, the business is a prisoner to swings between the political left and right. However, in Geo’s case, it seems to have swung more than just a bit too far thereby making for a very attractive investment opportunity if you understand what you are getting into. You can read our full detailed report on The Geo Group here.

6. EPR Properties (EPR), Yield: 13.9%

In some regards, the coronavirus outbreak has removed the curtain on just how fragile some businesses are. For example, experiential property REIT EPR has been hit extremely hard. In particular, just last week the company withdrew its previous guidance and:

“announced the deferral of its anticipated gaming venue investment and all other uncommitted investment spending due to unfavorable current market conditions.”

If you don’t know, EPR is a triple-net lease specialty REIT focusing on property types such as theaters, eat and play, ski, attractions, experiential lodging, gaming, fitness and wellness, cultural and live venues. Yuck! Considering the coronavirus outbreak, who wants to go there!

However, if Wuhan China is any guideline (see tracker tool here), the coronavirus is being brought under control there, and with any luck it’ll be brought under control throughout the rest of the world sooner than later (President Trump suggested August). EPR’s business was attractive before the truly massive sell off, and we believe it’ll become attractive again. Only time will tell just how truly draconian the impacts will be, but it you are an optimist, the market will recover, and eventually EPR will too. You can read our previous full write-up on EPR here.

The Top 5 Big-Dividend REIT

The Top 5 Big-Dividend REITs are reserved for members only. We currently own most of the top 5, and they range from healthcare REITs, to industrial, specialty and more. You can access the top 5 here.

Want instant Access?

The Bottom Line

The recent market sell off has been extreme. And no one knows with certainty when it will end. But what we do know is that despite the very real impacts of the coronavirus, long-term investing has repeatedly paid off throughout history. Dividend yields are extraordinarily attractive right now (as share prices are pricing in the worst), and it’s highly likely that in the months and years ahead, investors will look back at the current market conditions now, and wish they took advantage.