If you’re looking for stable high income, Goldman Sachs BDC (GSBD) offers an interesting way to invest in private middle-market companies while paying you a healthy 9.1% dividend yield. This article reviews the business, the portfolio, net investment income, dividend coverage, and risks, before finally concluding with our opinion about who might want to consider investing in this high yield opportunity.

Overview: Goldman Sachs BDC, Inc. (GSBD)

GSBD seeks to generate current income and, to a lesser extent, capital appreciation primarily through direct originations of secured debt, including first lien, unitranche, including last-out portions of such loans, and second lien debt, and unsecured debt, including mezzanine debt, as well as through select equity investments.

The company primarily invests in US middle-market companies, which are underserved by traditional providers of capital such as banks and the public debt markets. GSBD defines middle market as companies with EBITDA between $5 million and $200 million (EBITDA = earnings before interest expense, income tax expense, depreciation and amortization).

The Middle-Market Opportunity:

Middle market companies present an interesting investment opportunity because the demand for financing exceeds the supply (i.e. a good thing for discerning investors like GSBD).

According to the National Center for the Middle Market and the CIA World Factbook, the US middle market is comprised of approximately 200,000 companies that represent approximately 33% of the private sector gross domestic product. This makes the US middle market equivalent to the world’s third largest global economy on a stand-alone basis. Collectively, the US middle market generates more than $6 trillion in annual revenue. The number of US private-equity companies is at its highest level since 2000. Conversely, the number of listed US domestic companies has dramatically declined over the same time period, yet the average market capitalization of listed companies has grown. This has resulted in a shift in the ownership of middle-market companies, thus creating a larger market opportunity within an attractive investment environment for BDSs (like GSBD) to provide loans to US middle market companies.

And while demand from middle market companies for capital is increasing, the supply remains relatively constrained. The trend of consolidation of regional banks into money center banks has reduced the focus on middle-market lending. Money center banks traditionally focus on lending and providing other services to large corporate clients to whom they can deploy larger amounts of capital more efficiently. While underwritten bond and syndicated loan markets have been robust in recent years, middle-market companies are rarely able to access these markets as participants are generally highly focused on the liquidity characteristics of the bond or loan being issued. This has resulted in fewer bank lenders to US to middle-market companies and reduced the availability of debt capital to the companies that GSBD targets.

Portfolio Characteristics:

GSBD’s portfolio consists of 101 companies across 37 industries. The origination strategy focuses on leading negotiations and structuring the loans in which it invests, and then holding them to maturity. In many cases, GSBD is the sole investor in the loan or security. Where there are multiple investors, GSBD seeks to control or obtain significant influence over the rights of the loan or security. GSBD targets investments that have maturities between three and ten years and range in size between $10 million and $75 million.

Management and Investment Criteria:

Goldman Sachs Asset Management (“GSAM”) serves as the company’s investment adviser. The Private Credit Group of GSAM is responsible for identifying investment opportunities, conducting research and due diligence on prospective investments, negotiating and structuring investments and monitoring and servicing investments. Per the management team, here are the high level considerations when selecting investments for GSBD’s portfolio:

Value orientation and positive cash flow: GSBD focuses on companies in which it can invest at relatively low multiples of operating cash flow and that are profitable at the time of investment on an operating cash flow basis. The target company must be able to provide a steady stream of cash flow to repay loans and reinvest in their respective businesses. Typically, it does not expect to invest in start-up companies or companies having speculative business plans.

Experienced management and established financial sponsor relationships: Portfolio companies must have an experienced management team and proper incentives in place to induce management to succeed and to act in concert with GSBD’s interests as investors. In addition, investments are focused in companies backed by strong financial sponsors that have a history of creating value and with whom members of the Investment Adviser have an established relationship.

Strong and defensible competitive market position: Targets companies that have developed leading market positions within their respective markets and are well-positioned to capitalize on growth opportunities. GSBD also seeks companies that demonstrate significant competitive advantages versus their competitors, which should help to protect their market position and profitability while enabling GSBD to protect the principal and avoid capital losses.

Viable exit strategy: Internally generated cash flow, leading to the payment of interest on, and the repayment of the principal of, the investments in portfolio companies is a key means by which GSBD targets its exit from investments over time. In addition, it invests in companies whose business models and expected future cash flows offer attractive exit possibilities. These companies include candidates for strategic acquisition by other industry participants and companies that may repay GSBD’s investments through an initial public offering of common stock or other capital markets transactions.

Stable Dividend Payout:

GSBD dividend payout has been consistent since its IPO in March 2015. Specifically, the company’s distributions have been $0.45 per share every quarter since its IPO.

Worth mentioning, the dividend yield has consistently been in the range of 7% to 10%, and currently sits near the higher end of the range at 9.1%. And very importantly, the dividend is consistently covered by net investment income, as shown in the following chart.

Risks:

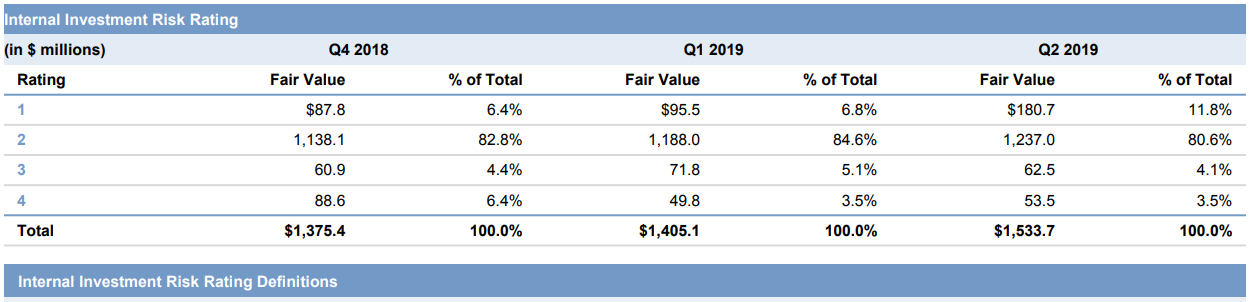

GSBD’s Portfolio Credit Quality is reasonably healthy. For example, as seen in the table below (from the latest quarterly investment presentation), only 7.6% of the investment portfolio has experienced an increase in risk (as measured by a 3 or a 4 rating) in the table below. And the percent of investments with an internal investment risk rating of 4 (deemed as non-accruals) has declined recently and currently represents only 3.5% of the total portfolio.

Worth noting, the company’s investment in NTS Communications was placed on non-accrual status during the quarter ended December 31, 2018 and it represents 3.2% and 3.5% of the total investment portfolio at fair value and amortized cost, respectively. Further, GSBD expects this investment will be repaid during the quarter ending September 30, 2019, in connection with the sale of NTS. However, the exact timing is dependent on the satisfaction of certain closing conditions, including receipt of Federal Communications Commission approval. Overall, however, the credit quality of the total portfolio remains quite healthy.

Valuation is another risk, however GSBD’s valuation is currently reasonable. Price to book value is a common valuation metric for BDCs, and as shown in the following table GSBD’s current price to book value is quite reasonable compared to its own history and as compared to other BDCs.

Recession Risk is another risk that can impact BDCs significantly, despite their hefty dividend payments. For example, considering BDCs are usually just a portfolio of high yield loans, they can trade with a high inverse correlation to credit spreads, as shown in the table below.

If credit spreads widen significantly, the price of BDCs can often decline. Considering where we are in the current market cycle can be helpful when you consider investing in BDCs such as GSBD, as well as when you are constructing your overall personal investment portfolio (i.e. prudent diversification generally proves extremely valuable, considering no one really knows when the market cycle will turn, and considering different investments perform differently at different points in the market cycle). Nonetheless, we have confidence in the portfolio and the management team in general and as compared to other BDCs.

Floating Interest Rates are another risk factor for GSBD. As noted in an earlier table, the overwhelming majority of the portfolio loans are floating rate. This can work both for and against the company. For example, if interest rates go too high then GSBD collects more income but defaults among borrowers can also increase (i.e. less income for GSBD). On the other hand, if rates fall that can mean less income for GSBD, but it can also mean a different default rate. Floating rates are a risk factor, however we get confidence from the diversified portfolio over over 100 investments as well as the experienced management team’s underwriting criteria.

Conclusion:

If you are looking for big steady income, Goldman Sachs BDC is worth considering. The dividend payments have remained consistent since its IPO in 2015, and the dividend yield is currently closer to the higher end of its historical range. The higher yield could be an indication of higher perceived risks (perhaps from NTS Communications, until it is resolved—expectedly soon, or perhaps from our currently slightly higher marketwide credit spreads). Nonetheless. GSBD has consistently generated net investment income to cover the dividend payment, and on a price-to-book valuation metric the shares are currently reasonably priced. There are risks to investing in GSBD, as described in this article; however, we view the potential rewards (including the big steady income payments) to outweigh the risks at this time, particularly if you’re owning GSBD within a well-diversified, goal-oriented, income-focused, long-term investment portfolio.