If you’d have been invested in 100% “aggressive growth” stocks over the last two months (for example, young software companies with very high sales growth), you’d have gotten absolutely slaughtered. A bloodbath. Whether you call it a “rotation” or a long overdue “correction,” is irrelevant. The mistake we are talking about is, of course, the failure to prudently diversify your portfolio. We’re not suggesting anyone be a “closet index fund,” but for goodness sake, don’t put all your eggs in one basket. In fact, don’t even put most of them in one basket. You’re too darned old for that crap. And if you don’t know what we’re talking about, for your reference, check out these 7 Deadly Sins of Long-Term Investing (too many eggs in one basket is on the list).

This report is our monthly performance Update. But before getting into the performance details for our three portfolios, here is a list of some timely top investment ideas that we put together:

Performance Update:

Now on to performance. All three of our strategies continue to perform extremely well over the long-term, and the important takeaway this month (at least one of them) is don’t put all your eggs in one basket (you’ll see why in a moment, but it’s basically the mistake you’re too old to make).

Without further ado, here is the update for our investment strategies:

As you can see, our big-dividend (currently a 6.2% yield), 25-stock, Income Equity Portfolio continues to outperform the S&P 500 since inception back in 2016, and it continues to yield roughly 3 times the yield of the S&P 500. To put up those types of numbers with that type of yield is very impressive (yes, we are tooting our own horn). And as you can see in the following table, the strategy was up 3.2% in September (while the S&P 500 was up only approximately 1.7%).

We will share the recent performance of every single position in this portfolio later (in the members-only section) of this report.

Next up is our Income Via Growth strategy which also continues to crush the S&P 500 over the long-term.

And as a reminder, this strategy is designed to generate income for us through long-term capital gains (the strategy’s dividend yield is less than that of the S&P 500). As another reminder, we allocate some of our investment dollars to this strategy because we don’t want to put all of our investment eggs into the higher yielding Income Equity strategy because there are times (e.g. months, or longer) when that strategy does not do well, and we like to have the diversification benefits of owning some Income Via Growth Stocks too.

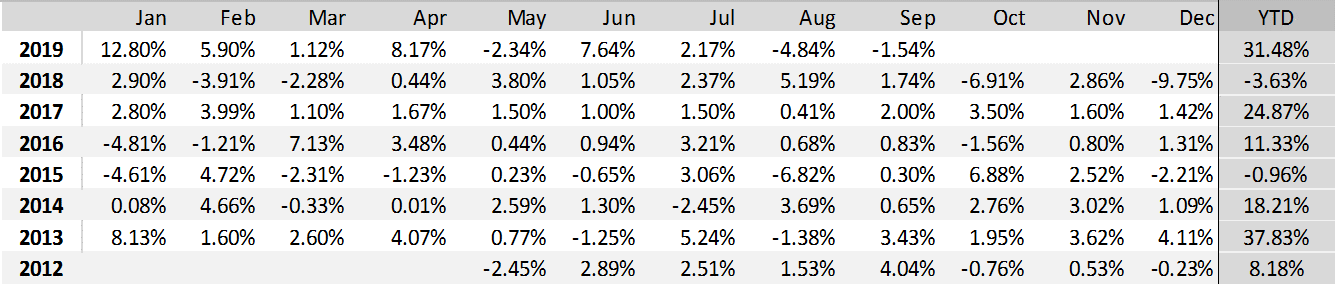

And even though the Income Via Growth strategy continues to “beat the pants off” the S&P 500 over the long-term (it’s inception is 2012, and yes we are bragging—again), it had a weak month last month, as you can see in its long-term monthly performance table, below.

In fact, the lagging performance over last month is because we do hold a few aggressive growth stocks (the kind that can do extremely well over the long-term, but happened to get crushed last month) for diversification and long-term return purposes. And obviously (it goes without saying, but we’ll say it anyway) you can invest your own money in whatever the heck you want—we just share our investment holdings to give you some ideas as you manage your own darned investments!).

Alternative Fixed Income:

Next, our Alternative Fixed Income portfolio ended the month with a 7.7% yield. It holds 15 “non-stock-market) securities (they’re preferred stocks and fixed income Closed End Funds). And the strategy was up 1.2% over the last month (September). Members can see all of the holdings in this strategy, as well as the performance over a variety of time periods in a downloadable spreadsheet (we also share our target weights and actual weights for each position in each of the three portfolios).

Bottom Line (Part 1)

Before we get into the members-only part 2 version of this report (where we share performance for each of our holdings--and a few additional insights that we hope are helpful), we want to share an important takeaway. And that takeaway is simply that you’re too darned old to NOT be prudently diversified. And we know you’re too old because if you’re old enough to be investing in the market, you’re old enough to know better. And this is an especially important point if you are already retired or near retirement. Because can you really afford to get a significant portion of your next egg wiped out by a market rotation or an overdue pullback? And just as it happened to aggressive growth stocks (e.g. software stocks with high growth rates), it can happen to other sectors that you don’t expect. For example, big-dividend REITs have been one of the best performing sectors so far this year, and they are not immune to a potential big sell off. We could say a ton more about REITs here (in fact, we have in recent past reports, and we will again in new reports in the near future), but the bottom line is simply that you’re too darned old for your investment portfolio to NOT be prudently diversified. Be smart.

Part 2: Individual Portfolio Holdings Updates

To get right to it, here is a look at the holdings and recent performance of every position in each of our three strategies (including downloadable spreadsheets)…

The complete report is reserved for members-only. If you are a member, you may access it here. If you are not a member, you may learn more here.