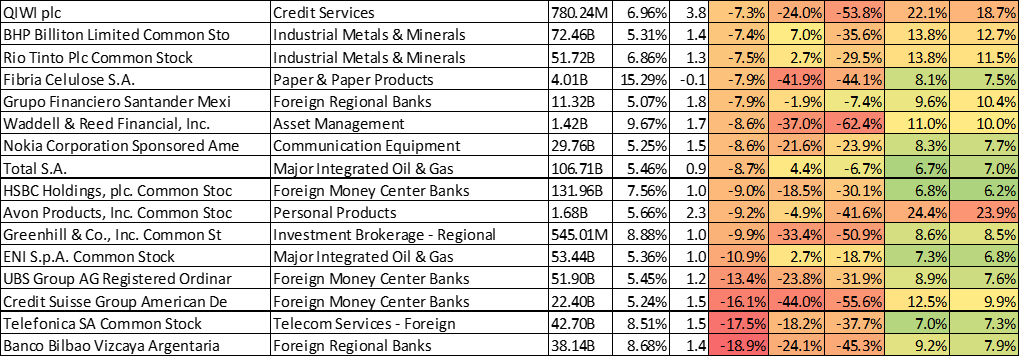

With central banks around the world holding interest rates artificially low, income-hungry investors are often drawn to the big dividends and low volatility provided by many real estate investment trusts (REITs). For some perspective, the following table shows the volatility of a variety of big yield securities, and REITS are clustered near the top (i.e. low volatility).

The full version of this chart is available here.

As the table show, high-yield REITs tend to deliver much lower volatility than other high-yield investments. Of course investing based only on yield and historical volatility would be an injustice to the idiosyncrasies of the market. Therefore, we have identified and ranked seven big dividend REITS that we believe are worth considering. We’ve also provided links to detailed reports for each REIT on our list. Without further ado, here is the list:

7. EPR Properties (5.0% Yield)

If you are an income-focused investor, EPR Properties (EPR) stands out. It’s a REIT that offers a big growing monthly dividend (5.0%, annualized), it has exhibited low volatility and attractive diversification benefits, and the market is expecting the business to grow. The company’s investment portfolio includes megaplex movie theaters, TopGolf recreation centers, and a variety of educational centers, to name a few. EPR proved to be a “safe haven” trade (+2.4%) during Friday’s Brexit turmoil, and despite its strong year-to-date performance, its valuation and dividend are both still attractive. You can read our full EPR Properties reports here:

6. American Capital Agency (12.3% Yield)

American Capital Agency (AGNC) is a REIT with a huge 12.3% dividend yield. It trades for less than its book value, and we agree with management’s view of “lower for longer” interest rates. The company’s 7.3x leverage ratio is reasonable and manageable, barring any extreme market events (such as another housing crisis or a rapid rise in interest rates). During Friday’s Brexit turmoil, AGNC actually gained in value (+1.0%), suggesting it’s not as risky as many of the other high-yield investments that sold off. If you can get comfortable with the tail risks, American Capital is worth considering for income-focused investors. You can read our full American Capital here:

5. HCP, Inc. (6.7% Yield)

HCP Inc. (HCP) is a big dividend (+6.7%) healthcare REIT that is also a dividend aristocrat (i.e. it’s increased its dividend more than 25 years in a row). HCP has recently faced challenges related to its HCR ManorCare business, and has decided to spin it off (into a separate company) later this year. We believe the spin-off decision is smart because it will help HCP maintain its dividend aristocrat status, and it will unlock value by expanding the potential investor base. Our full report on HCP is available here:

4. New Residential Investment Corp. (14.1% Yield)

New Residential Investment Corp (NRZ) is a high dividend yield (+14.1%), Mortgage Real Estate Investment Trust (mREIT) that is currently trading at a discount. The company emerged in the mortgage servicing space following the financial crisis as banks had to shed risk and the mortgage markets became more complex. We believe NRZ’s business can continue to deliver big dividend payments far into the future, and concerns about asset prices and interest rates are largely baked into the price already. If you are searching for yield, NRZ is worth considering for the higher-risk allocation within your diversified income-focused portfolio. You can read our full NRZ report here:

The top 3 Big Dividend REITS are reserved for members only, and they are available in this week’s Blue Harbinger Weekly. If you are not currently a member, consider a subscription.