Donald Trump Stocks tend to be large, blue chip companies that pay a dividend. We are basing this description on a US Office of Government Ethics filing that lists out his individual holdings. The list is from months ago, but we are revisiting it because Trump again bragged about it on Twitter within the last several days.

Additionally, it is likely Trump still owns a lot of Gilead considering it has been such a large position across several of his brokerage accounts. We believe Gilead is a Donald Trump stock that is worth considering for a variety of reasons including its ability to defend its big revenues and profit margins (on HIV/AIDS and Hepatitis C medications), its proven ability to generate new growth (from its pipeline and via acquisitions), its strong cash flows (which will enable continued share repurchases, increasing dividend payments, research & development, and potential future acquisitions), and its current valuation (the stock is down over 15% since it recently missed earnings expectations, and we believe the market has overreacted).

Overview

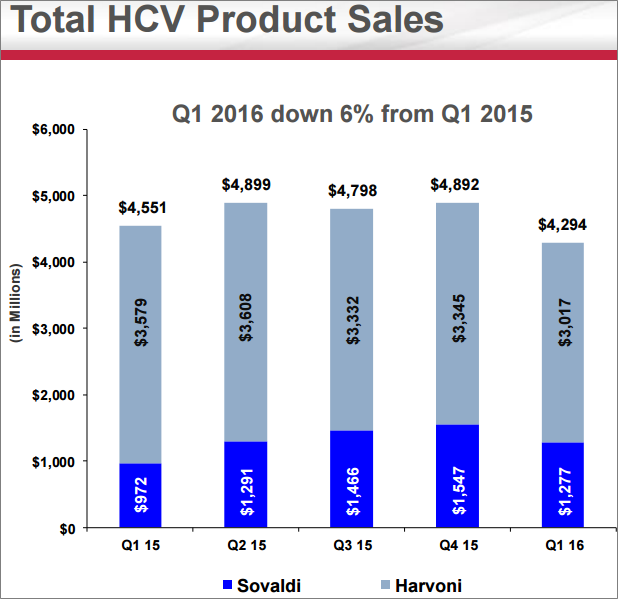

Gilead has several blockbuster drugs within its two largest product lines that treat hepatitis (Harvoni and Sovaldi) and HIV/AIDS (Truvada and Altripa). And even though the company’s net profit margins remain large (over 50% in 2015), growth is slowing and some competition is beginning to creep in (see the following chart for some perspective).

Gilead recently missed first quarter earnings expectations, and the stock sold off as many investors have bought into the narrative that it’s now a company in decline. However, the reality is that Gilead’s revenues and profit margins are still huge, and they’re going to stay that way for a while. Gilead’s profits are not going to disappear overnight, and we believe it’s working on new drugs that will slow the rate of decline and help it defend its market leadership position.

For some perspective, in 2015, Gilead’s HIV products were prescribed for more than 70 percent of newly-diagnosed HIV patients in the United States. And in Europe, 7 out of 10 patients started on a regimen with a Truvada® backbone (Annual Report, p.1). And even though competition is growing from GlaxoSmithKline (they’re rapidly expanding “Triumeq”) and Johnson & Johnson (they’re working on efforts to bypass Gilead drugs), Gilead is still the market leader. And we believe Gilead will defend its leadership position as it continues to make progress with new combo pills such as Genvoya (approved in 2015) and Odefsey and Descovy (approved in 2016).

Similarly, Gilead is the market leader in oral hepatitis C medicines. For example, more than 770,000 hepatitis C patients around the world have initiated treatment with a Gilead product since the company introduced its first treatment in late 2013. And today, Sovaldi is approved in 65 countries and Harvoni is approved in 50 countries. (Annual Report, p.1). And despite growing competition from AbbVie and Merck, we believe the low resistance potential of Gilead’s medicines combined with the company’s continued innovation of new drugs will help Gilead maintain its leadership position for many years to come.

Valuation

We believe Gilead’s valuation is too low right now. That’s not to say it can’t get lower, but we believe it should go higher, potentially much higher, in the future because of its existing and expanding profitable drug lineups, and because of its proven ability to develop and acquire successful new drugs. For some perspective, the following chart shows Gilead’s historical price-to-earnings ratios.

And currently just over seven times earnings, the market is giving Gilead very little credit for its future earnings potential. Especially considering Gilead’s proven track record of developing and acquiring new blockbuster drugs (more on this later).

Gilead’s Cash

Gilead generates a lot of cash (over $20 billion from operations in 2015) that can be used for future acquisitions (it has a proven ability to make smart acquisitions such as its early 2012 $11 billion Pharmasset acquisition which seemed expensive at the time, but proved amazingly profitable), to buy back more shares (it has repurchased over 17% of its shares outstanding since 2012, and its $12 billion January 2016 repurchase authorization remains outstanding), to increase its relatively new dividend again (it started paying the quarterly dividend in June of 2015, and it will already increase it in June of 2016; the current yield in a healthy 2.2%), to pay down its debt (Gilead debt to assets ratio is high near 50% but we are okay with that because it essentially levers this cash cow's returns for shareholders, and they have plenty of cash flow to pay it down in the future), or for continued strong research and development (Gilead spent over $3 billion on R&D in 2015, and they have a healthy pipeline as shown in the following table). Gilead is in an enviable cash position.

Risks

The first risk factor listed in Gilead’s annual report has to do with their concentrated portfolio. Specifically, according to Gilead:

A substantial portion of our revenues is derived from sales of products to treat HCV and HIV. If we are unable to maintain or continue increasing sales of these products, our results of operations may be adversely affected.

Gilead is less diversified than other drug companies, and this increases the risk. To address this risk, Gilead goes on to say:

If we fail to commercialize new products or expand the indications for existing products, our prospects for future revenues may be adversely affected.

And of course Gilead faces a variety significant competition, and other uniquely heightened risks associated with operating in the drug industry such as safety issues:

If significant safety issues arise for our marketed products or our product candidates, our future sales may be reduced, which would adversely affect our results of operations.

Gilead’s ability to defend its patents:

Our success will depend to a significant degree on our ability to defend our patents and other intellectual property rights both domestically and internationally.

And the company’s ability to not infringe on the patents of others:

Our success depends in large part on our ability to operate without infringing upon the patents or other proprietary rights of third parties.

And of course litigation is an issue. Recent examples include litigation with Idenix, Merck and AbbVie (see pages 36-38 of Gillead’s most recent annual report for details). Further, Gilead faces the risk of “significant liability resulting from our products that may not be covered by insurance and successful claims could materially reduce our earnings.”

Conclusion

We believe now is a good time for long-term investors to consider Gilead. We have ranked it #9 on our list of top Ten Donald Trump Stocks Worth Considering because it’s a large, blue chip company, with a decent dividend, and a very attractive valuation. Specifically, we believe the market has overreacted to the company’s recent earnings miss and the narrative has become too negative considering Gilead’s ability defend its big revenues and profit margins, its track record of generating new growth, its strong cash flows, and its discounted price.