New Residential Investment Corp (NRZ) is a high dividend yield (+15.5%), Mortgage Real Estate Investment Trust (mREIT) that is currently trading at a discount. The company emerged in the mortgage servicing space following the financial crisis as banks had to shed risk and the mortgage markets became more complex. NRZ’s business currently nets very high yields, but questions remain with regards to the longevity of the business (eventually 2004-2007 vintage subprime related assets will roll-off NRZ’s books), and increasing home prices and interest rates have many investors concerned. We believe NRZ’s business can continue far into the future, concerns about asset prices and interest rates are largely baked into the price already, and investors may want to consider NRZ for the higher-risk allocation within their diversified income-focused portfolio.

What Does NRZ Do?

NRZ is a leading capital provider to the mortgage industry, including investments in three core business segments:

1) Excess Mortgage Servicing Rights: A mortgage servicing right (“MSR”) provides a mortgage servicer with the right to service a pool of mortgage loans in exchange for a fee. Banks currently own 74% of the $10 trillion MSR industry, and NRZ expects this percentage will decline as banks face pressure to reduce their MSR exposure as a result of heightened reserve requirements, regulations, and simply a more challenging servicing environment. This creates opportunity for NRZ. According to NRZ’s website:An MSR is made up of two components: a basic fee and an Excess MSR. The basic fee is the amount of compensation for the performance of servicing duties, and the Excess MSR is the amount that exceeds the basic fee. As the owner of an Excess MSR, we collect monthly cash flows from the MSR, but do not assume any servicing duties, advance obligations or liabilities associated with the portfolios underlying our investment.

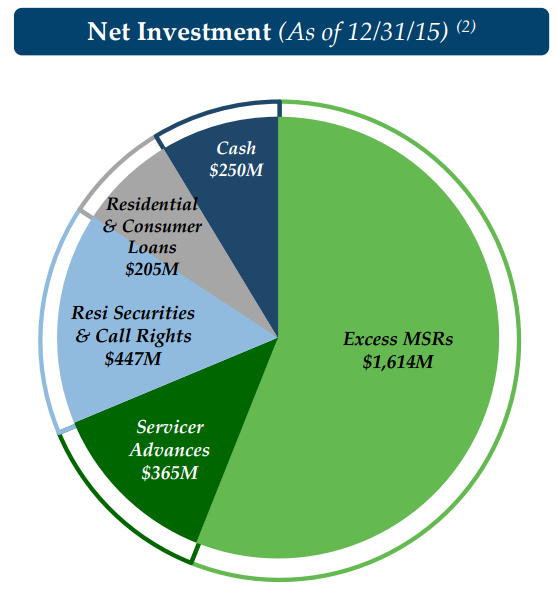

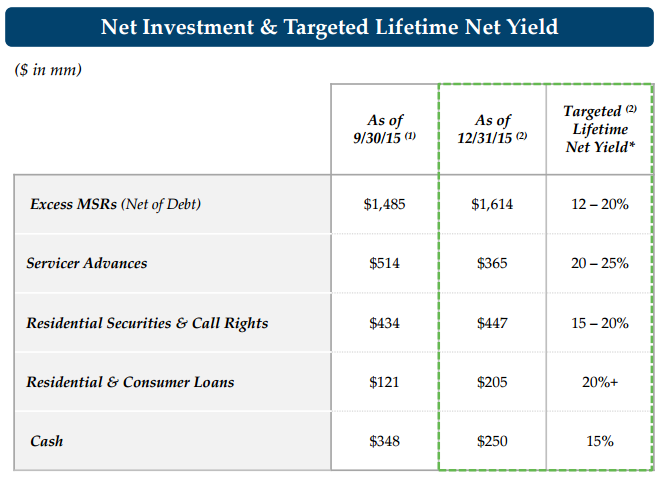

Investments in Excess MSR’s make up 56% of NRZ’s business, and the company believes these investments can provide 12-20% net yields.

2) Servicer Advances: Servicer advances are generally reimbursable cash payments made by a servicer (i) when the borrower fails to make scheduled payments due on a mortgage loan or (ii) to support the value of the collateral property. These investment are considered very safe, they make up 12.7% of NRZ’s total investment portfolio, and they believes they can provide 20-25% net yields.

3) Non-Agency Securities & Associated Call Rights: NRZ acquires and manages a diversified portfolio of credit sensitive real estate securities, including non-Agency Residential Mortgage Backed Securities (RMBS) and call rights on select RMBS. These investments make up 15.5% of NRZ’s total investments. NRZ believes these investments complement their excess MSRs.

All three of these business segments are high risk as evidenced by the banking industry being required to shed the first two from their balance sheets due to increased regulatory scrutiny, and the very high volatility of the third (RMBS) since the financial crisis. However, they all also offer high return opportunities as evidenced by NRZ’s high net yield expectations and NRZ’s high dividend yield.

Why will NRZ’s Business Persist?

Even though 2004-2007 vintage pre-financial-crisis assets will eventually roll-off NRZ’s books, and there will likely NOT be another housing crisis anytime soon (hopefully), a lot of business will still persist for NRZ for a variety of reasons. For example, there will always be some subprime mortgages that need servicing, banks will want this business off their books (due to de-risking regulations), and NRZ will be able to serve this need.

Another reason why NRZ’s business will persist is because they are expanding into new states. At the end of 2015, NRZ was qualified to own non-agency MSRs in 38 states and the company expects to obtain remaining state and agency approvals in 2016.

Also worth noting, NRZ completed a big $1.4 billion acquisition HLSS in 2015 which will help grow the business.

Another reason why NRZ’s business will persist is that they have other lines of business (and theoretically they have the ability to grow these other business lines). Specifically, NRZ owns a residential securities portfolio as well as some residential and commercial loans. As shown in the pie chart earlier in the report, Excess MSR’s make up the majority of NRZ’s business, but other segments are not insignificant.

Why has NRZ’s Price Declined?

In addition to overblown fears that NRZ’s business cannot persist far into the future, the stock has recently sold off because many investors fear the residential real estate market is overheating and interest rates are expected to rise. The following chart shows the US Case/Shiller Home Price Index since 2006:

Home prices have increased steadily following the financial crisis, and they are now approaching pre-financial crisis levels. This has many investors concerned that prices cannot continue to increase rapidly forever, and a slowdown in price appreciation could put pressure on the subprime industry that NRZ serves. Specifically, defaults could increase, which would decrease NRZ revenues. Additionally, prepayment speeds could change thus creating problems for NRZ’s hedging programs and income streams. On top of that, if interest rates increase significantly that could put further pressure on home prices by decreasing the amount of home buyers are able to afford.

We also believe NRZ has sold off more than it should have because it gets inappropriate lumped in with other mREITS. NRZ’s servicing business is unique from other mREITS, but the market has been indiscriminant in its recent selling. According to a recent Barron’s article, “mREITS aren’t trading on individual fundamentals… It’s all about the interest-rate outlook… A rapid rise in the 10-year Treasury’s yield would torpedo mREITs.” Worth noting, the same article goes on to optimistically say, “it’s hard to see how enough inflation could build to trigger that kind of rate rise… It’s going to be volatile… But when you can buy a dollar worth of financial assets for a considerable discount, that generally works to your advantage over time.” http://www.barrons.com/articles/the-allure-of-mortgage-reits-1441435125

Why is Now a Good Time to Consider NRZ?

Aside from NRZ’s big dividend, and discounted price, now may be a good time to buy because fears seem largely overblown. For starters, a dramatic decline in home prices seems unlikely given the more stringent underwriting requirements since the financial crisis. Additionally, a sharp increase in interest rates seems unlikely given the US Fed’s history and outlook, and because it’s hard for the US to raise when rates and economies around the world are still low and struggling.

Another reason why now is a good time to consider NRZ is because it has been able to grow its core earnings and its dividend. As the following chart shows, NRZ increased its dividend twice in 2015, and reserves a cushion by paying out less than 100% of its core earnings as dividends.

An additional reason to invest in NRZ is that it nets huge yields on its investments. As mentioned previously (and shown in the table earlier in this report), NRZ’s targeted lifetime net yield on its Excess MSRs is 12-20%, on Servicer Advances it’s 20-25%, and on Residential Securities and Call Rights it’s 15-20%. These are very attractive yields that NRZ has been able to deliver so far, and they expect to continue delivering similar yields going forward.

What are the Risks?

In addition to the risks we have described previously (i.e. interest rates, asset prices, and NRZ’s ability to maintain and grow its business), NRZ also faces a variety of additional noteworthy risks. For example, NRZ uses leverage to operate its business, and this increases the size of potential losses; it also may reduce future cash available for dividend payments.

Counterparty risk is another big risk. The majority of NRZ’s co-investments in Excess MSRs and servicer advances are related to loans serviced by Nationstar or Ocwen. If either of these two counterparties is terminated or files for bankruptcy, NRZ’s expected returns would be severely impacted.

Subprime mortgages pose another risk. As mentioned previously, many of NRZ’s investments are collateralized by subprime mortgage loans. “Subprime” mortgage loans refers to mortgage loans that have been originated using underwriting standards that are less restrictive than the underwriting requirements used as standards for other first and junior lien mortgage loan purchase programs, such as the programs of Fannie Mae and Freddie Mac. Subprime loans are generally higher risk.

Illiquidity is another significant risk. Many of NRZ’s investments are illiquid, and could significantly impair the company’s valuation if economic conditions were to change. For example, if NRZ needed to liquidate positions quickly the value of those position would likely be significantly reduced.

Management conflicts of interest pose another risk for NRZ. Specifically, NRZ is externally managed by an affiliate of Fortress Investment Group, and there are conflicts of interest in the relationship with the manager. According to NRZ’s annual report:

“Our Management Agreement with our Manager was not negotiated at arm’s-length, and its terms, including fees payable, may not be as favorable to us as if it had been negotiated with an unaffiliated third party. There are conflicts of interest inherent in our relationship with our Manager insofar as our Manager and its affiliates—including investment funds, private investment funds, or businesses managed by our Manager, including Newcastle, Nationstar and Springleaf —invest in real estate related securities, consumer loans and Excess MSRs and servicer advances and whose investment objectives overlap with our investment objectives.”

Qualifying as a REIT (or failure to qualify) is another risk for NRZ. For example, if the company fails to qualify as a REIT it would result in higher taxes and reduced cash available for distribution to shareholders. Additionally, complying with the REIT requirements may negatively impact investment returns by causing NRZ to forego otherwise attractive opportunities. Also, complying with the REIT requirements could limit NRZ’s ability to hedge effectively.

Conclusion

We like New Residential because of its big dividend and discounted price. We believe it’s a company that can be profitable for many years to come, and we’ve ranked it number 3 on our list of Three Huge Dividend Stocks Worth Considering. In our view, the market isn’t giving New Residential enough credit for its uniqueness, and it has indiscriminantly sold off with other mREITs. Barring another financial crisis-sized collapse of the residential real estate market, we believe this mREIT could be a valuable addition to the high-yield portion of a diversified income-focused portfolio.