As a follow-up to our recent report “Big Divided BDCs: Ranking the Best and Worst,” this article provides the details for our top 4 favorites Business Development Companies. Two of the four are internally managed, all have recently sold off creating a more attractive entry point for long-term investors, and they offer dividend yields of 10%, 7%, 13%, and 10%, respectively. Without further ado, here are our four favorites.

4. Ares Capital (ARCC): 9.9% Yield

Ares Capital (ARCC) is an attractive big-dividend (9.9%) Business Development Company (BDC) trading at a discounted price. As shown in our recent report, Big Dividend BDCs: Ranking the Best and Worst, Ares price has dropped 3.2% since the start of September, and it now trades at an 11% discount to its Net Asset Value (NAV). It just announced earnings a few days ago, and despite the risks, such as heightened short-interest, an increasingly hawkish fed, and management conflicts of interest, we believe Ares is an attractive long-term investment for income-focused investors because of its big dividend, recently discounted price, and attractive fundamentals. You can read our full report on Ares here.

3. Main Street Capital (MAIN): 6.8% Yield

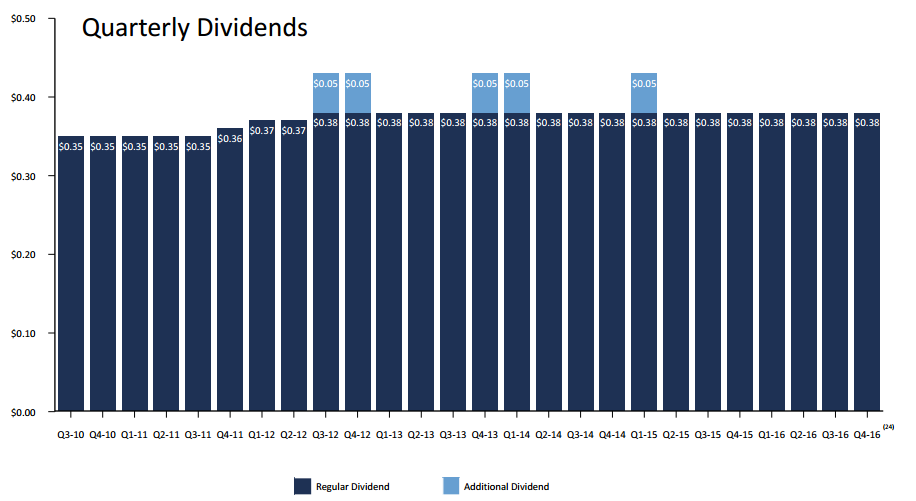

We first wrote about the attractiveness of Main Street Capital back in May (read that report here), and it has since increased modestly in price. It also raised its already big monthly dividend. And what makes it particularly attractive right now is its recent selloff in November as the Fed signaled higher rates are coming and high yield equities (like Main Street) sold off in general. We also like its internal management team, as well as the possibility (and track record) of additional supplemental dividends, above and beyond the standard 6.8% dividend yield. Main Street announced earnings last week, and exceeded street expectations by $0.03 per share.

Our Two Favorite Big-Dividend BDCs

This week’s Weekly covers our two favorite big-dividend Business Development Companies (BDCs). They yield 13% and 10%, respectively. And we own both of them in our Blue Harbinger Income Equity portfolio. They’ve both sold off modestly over the last two months as higher yielding equities in general have sold off, thereby creating a more attractive entry point for long-term income-hungry investors.