Canadian Pacific Railway (CP) released earnings on Tuesday (they beat expectations), and the stock is trading at an attractive price for long-term investors. As railroad stocks have declined significantly over the last year, CP has declined right along with them. However, CP has also increased its operating efficiency and steadily grown its earnings, and now trades at a discount to its intrinsic value. Based on its highly diversified business segments, its attractive operating ratio, and its low stock price, we believe CP offers significant upside potential, more so than its railroad peers.

Canadian Pacific operates in the US and Canada with strategic access to both the east and west coasts via its direct links to eight major ports.

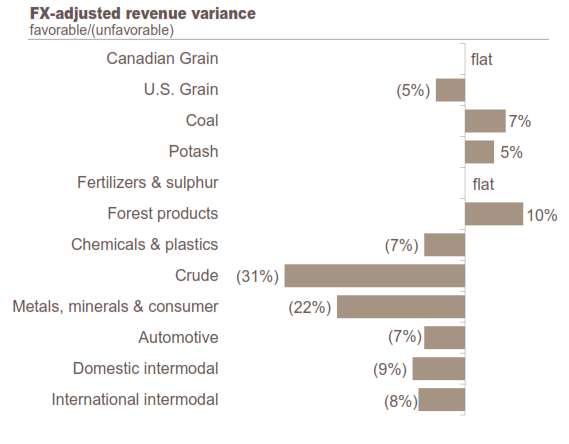

The company’s freight mix is more diversified than its peers, and this helps CP deliver strong earnings in varying market conditions, such as a reduced demand for coal and lower commodity prices in general.

As Chief Executive Officer Hunter Harrison said in his most recent annual letter to shareholders:

“We are not pinning our success as a railroad on the energy sector. Ours is a solid, highly diverse franchise, with a multitude of exciting growth opportunities… [and] when crude cycles back, we’re in a great position to benefit, but we are not dependent on it.”

And true to that statement, the company’s diversified earnings stream has continued to grow despite the challenging energy market conditions. A big part of the strategy to grow earnings has been the optimization of assets. For example, CP has been able to move increased volumes with fewer locomotives and cars via longer sidings and increased train lengths. For reference, the following table (from the company's Q3 2015 Earnings Review) shows the Q3 2015 versus Q3 2014 FX-adjusted revenue variance. It's worth noting that even though crude revenue was down 31%, crude only contributed 7% of total CP revenue in 2014 because the company is well-diversified. Said differently, crude is only a small part of CP's business.

Cash Flow:

The company continues to generate increasing free cash flow. During Tuesday’s conference call, Chief Financial Officer Mark Erceg noted that year-to-date CP has already “generated $979 million of free cash, that’s a 60% increase versus year ago.” However, despite growing free cash flow, CP’s dividend is considerably lower than peers. Rather than paying a high dividend, the company chooses to use its cash mainly for growth opportunities and share buybacks. For example, CP has been investing in strategic siding extensions and Centralized Traffic Control (CTC) technology; the objective is to increase network velocity, capacity and safety (2014 Annual Report, p16). Additionally, CP continues to heavily repurchase shares demonstrating their conviction for the long-term value of the company.

Valuation:

Canadian Pacific continues to generate growing profits, however it also continues to trade at a discount relative to its peers. For example, on a price to 2016 earnings basis, CP (12.7) is the best value among large-cap North American railroad stocks such as Norfolk Southern (13.3), CSX Corporation (13.2) and Canadian National (13.0), to name a few (2016 earnings estimates are taken from 20+ analysts covering the stocks per Yahoo Finance).

For background, CP was an industry laggard as recently as 2012 when a proxy battle led by hedge fund Pershing Square resulted in new leadership that has been working aggressively to turn the business around. For starters, CP has successfully reduced its operating ratio from over 83% in 2012 to under 60% in the most recent third quarter of 2015. And unlike peers, CP is now generating double-digit earnings growth.

As an additional indication of the stock’s upside potential, we discount expected future free cash flows and use a Benjamin Graham earnings growth formula (EPS x (8.5 + (2 x growth))). Both techniques are subject to a variety of assumptions (e.g. future cash flows, weighted average cost of capital, market risk premiums, earnings growth rates, etc.) but both also suggest Canadian Pacific is undervalued and is a better investment than its railroad peers. For reference, we value Canadian Pacific at $190 per share, giving it more than 20% upside.

Also worth noting, Canadian Pacific is helped by a strong US dollar. According to the company’s most recent annual report:

“On average, a $0.01 weakening (or strengthening) of the Canadian dollar increases (or reduces) EPS by approximately $0.07 per share. On an annualized basis, a $0.01 weakening (or strengthening) of the Canadian dollar positively (or negatively) impacts Freight revenues by approximately $35 million and negatively (or positively) impacts Operating expenses by approximately $16 million.”

For reference, the US dollar has strengthened more than 15% versus the Canadian dollar over the last year, and there is no strong indication that this will revert in the near future, especially considering the US dollar will likely be strengthened if/when the fed starts raising interest rates.

Conclusion:

Canadian Pacific is a diversified railroad company with strong and growing profit margins. There are also a variety of valuation metrics (such as P/E-16 ratios, discounted future cash flows, and Ben Graham’s earnings growth formula) that suggest the stock price is lower than it should be. Unless you are seeking a big dividend, Canadian Pacific is an outstanding investment opportunity.